Inflation is forcing tech leaders to make difficult choices in 2023. CIO’s and their teams must choose between delaying some technology investments to keep budgets under control or increasing budgets more than required based purely on business growth or transformation. The second choice is even less palatable today, as most IT leaders anticipate a recession in the coming year that may force even more aggressive cuts.

Inflation and Currency Fluctuations Alter IT Budget Decisions

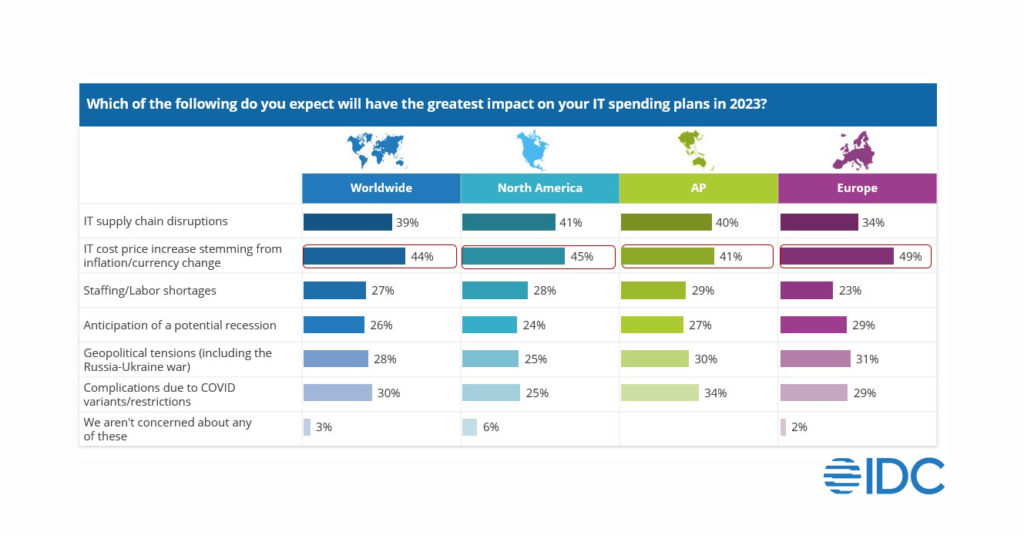

IT leaders around the world faced many disruptive challenges in 2022, from IT supply chain issues to continued difficulties securing skilled people required to support new digital business initiatives. IDC tracked how all of these “storms of disruption” were influencing organization’s IT spending plans in our monthly Future Enterprise Resiliency & Spending surveys of ̴850 IT decision makers around the world. Top concerns changed over time, but at the end of last year, concerns about the rising cost of technology due to inflation and “extra cost bumps” due to currency fluctuations topped the list for organizations across regions.

In challenging economic times, Chief Information Officers (CIOs) and Chief Financial Officers (CFOs) tend to scrutinize the largest and fastest growing parts of their budgets in anticipation of a need to pare spending. The technology investment areas where surveyed IT leaders most expect inflation/currency fluctuations to affect budget decisions were SaaS, infrastructure hardware/software, IaaS, PaaS. All, however, are also important investment areas to support ongoing digital business transformation. They are at the core of enterprises’ automation and data analytics projects that can improve a business’s ability to navigate economic disruptions.

Aligning IT Spending with Business Conditions in an Inflationary Environment

When working with CIOs on their technology investment plans for 2023 and 2024, IDC recommends that organizations adopt a two-track approach.

- Sustain momentum in technology projects that help the overall business navigate and even take advantage of this period of economic instability.

- Adopt cloud optimization (FinOps) practices and processes that eliminate waste in current cloud investments while also resetting long term cloud cost metrics (Cloud Economics).

In both tracks, it’s also important to adopt a phased approach that delivers short term savings, mid-term gains that protect the business if conditions worsen more than expected, and long-term architectural choices that ensure sustainably lower operating costs as business conditions improve.

Adopt a Tech Project Prioritization Strategy that Aligns with the Strengths of Cloud

Cloud Services, as well as the growing number of as-a-Service solutions for infrastructure hardware and software, deliver several benefits.

- The broad portfolio of cloud services offered by leading providers makes it possible to use the optimum cost/performance service without increasing administrative costs or business risk.

- SaaS solutions provide the earliest access to innovation in collaborative applications, customer experience, AI/automation, data integration, and security that can be directly tied to critical business priorities.

- The increasingly intelligent governance capabilities in cloud platforms make it possible to observe and automate reactions to actual changes in compute, storage, data, and process resource requirements in near real time as business conditions change.

All these benefits are about “speed”. Less upfront costs. More flexibility. Pay only for what you need when you need it. Companies that prioritize application modernization and data augmentation technology projects can quickly realize reduction in budget pressure. Businesses should gravitate towards those technologies that can deliver meaningful short term (in 2023) business benefits through greater use of cloud capabilities.

IDC also advises that CIOs adopt a mid-term strategy that reallocates funds from “run” projects that mostly just push out the elimination of technical debt. We recommend companies focus on “new” projects that can boost revenue or productivity by early 2024. This approach ensures the organization can recover faster if conditions improve or respond more quickly if conditions worsen.

It’s also important to start thinking early about priorities for 2024 and beyond. Regardless of how inflation and currency conditions change, IT organizations will remain sensitive to potential future cost shocks associated with people and processes. Technology suppliers are embedding more automation and AI into all their products and services. 2024 will be the year that forward thinking businesses identify and execute the right IT automation mix to deliver long term operational improvements. IDC finds that IT Automation projects can yield consistent paybacks in less than 12 months based on post-implementation reviews.

Adopt a FinOps and Cloud Economics Strategy to Minimize the Risks of Cloud

While “speed is a Cloud benefit which can contribute to lower costs for many workloads, speed also creates new risks. After numerous conversations with CIOs and surveys of IT leaders in 2022, it became clear to IDC that many technology leaders feel their companies are overspending on cloud resources.

To achieve the full benefits of a cloud-centric project prioritization strategy, CIOs must ensure that they are reducing current ” waste” in cloud and other IT resources. In the short-term, they must empower existing vendor/product procurement and service management teams to more aggressively pursue cost optimization strategies. These include:

- Scrutinizing duplicate SaaS contracts

- Assessing actual usage of existing service levels, particularly for SaaS applications that use graduated per user pricing.

- Leveraging and maximizing volume-based discounts with leading cloud providers by selecting complimentary products/services from within their marketplaces.

In the mid-term, cloud operations teams need to adopt a wide range of standard processes that continually prune spending on unused resources. These teams also need to identify and accelerate adoption of new, lower cost options (e.g., new compute instances, storage tiers, tiered per-user pricing) as they become available. One significant opportunity to consider use of an emerging group of SaaS optimization solutions that provide greater visibility into actual SaaS use across the company. IDC has heard from IT leaders who noted that use of these solutions allowed them to get a clearer picture of current SaaS use and make changes that delivered major (up to 50%) reductions in recurring spend very quickly.

Both the of these short and mid-term efforts fall under what is commonly referred to as FinOps, today. While many CIO’s note that they already have staff dedicated to these tasks, what many lack is a unified view of actual cloud usage that is critical for achieving sustained rather than just one-time cost savings. Finding the right partner that can help create the visibility required to achieve this as well as establish sustainable processes can show paybacks tied to less over-provisioning in just a few months.

In the long-term, CIOs must also start laying a foundation for long term governance and cost optimization guardrails in their organizations’ future cloud use. The end goal of FinOps is to enable sustained assessment, reassessment, and future projection of cloud operating costs. IDC calls this Cloud Economics.

Businesses around the world are building entirely new business models based on smart connected things, AI-enhanced operations, and continuous customer engagement. As a result, the effective use of cloud services will require timely and accurate implementation, scale out, and long-term costs forecasts for vital digital business systems and will be less focused on simply cutting the cost of running back-end business systems.

What If Everyone is Overreacting?

As 2023 progresses, industry observers quickly began asking IDC if this is all an overreaction. In some countries, inflation showed signs of cooling down in early 2023, and the US dollar lost some of its strength. Others wonder if we may all be calling this the “GODOT recession of 2023” next year. Is all this “cost optimization” and “project prioritization” wasted energy?

The simple answer is, “No!”

Regardless of where the shifting winds of the economics take global businesses over the next 12 months, the factors that triggered technology cost concerns are already locked in. They include the long-term price increases that many SaaS providers initiated in 2022. They also include the reset in energy prices that corporate datacenters, colocation operators, and cloud providers will be grappling with thorough 2023 and 2024 at a minimum. SaaS providers that run their own infrastructure or leverage IaaS from leading cloud providers will be dealing with cost increases, forcing them to weigh the costs of expansion/innovation against profit margins. CIO’s need to keep a close eye on how this develops.

In the long term, focusing on prudent and methodical cost optimization after several years of accelerated technology investment driven by radical, pandemic-driven disruptions is the right strategy no matter how the economic situation evolves in 2023. Tech investment is no longer about supporting the business. Tech is at the core of competing as a digital business. Using Cloud Economics to invest wisely and ensure maximum returns on those technology investments is the key to long term success.