I was on the phone this morning with Ben Munroe, Sr. Director, Security Product Marketing at Cisco talking about Trust – an abstract yet implicit concept – that drives decisions at all levels. Ben astutely remarked that a breach of personal information could lead an individual to cancel that lesser-known credit card, with the possibility that such reactions at a larger scale can lead to the company suffering greater consequences. On the flip side, it is true that customers are more likely to continue to do business with a major credit card company, having been a victim of breach and fraud multiple times.

IDC defines “Trust” as a condition that enables decisions between two or more entities that reflects a level of confidence (risk and reputation) between parties.

So going back to the credit card example. Has this happened to you? Have you wondered what enabled the decisions to continue or discontinue your credit card? Let’s think this through.

Having been a victim of fraud, I can share that I value my credit card company’s ability to predictively detect fraud, suspicious transactions, or account takeover; proactively informing me about its findings and recommending next steps. These small things have led me to believe that I am well protected to the extent that the credit card company is able and willing and therefore I continue to Trust and do business with them.

As the global lead analyst for IDC’s Future of Trust research practice, this got me thinking about what it is that an organization (like the credit card company) is investing in to improve and maintain its trustworthy perception in the marketplace. I was certain security and compliance would top the list. But was curious about the next 3 areas of investments.

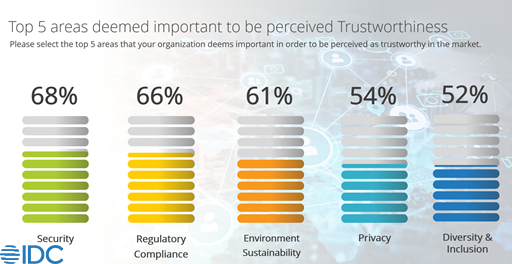

I decided to take the opportunity and survey nearly 800 respondents from 20 countries through IDC’s Critical Metrics to Measure Trust in RFPs: What Resonates Where?, IDC, July 2021. The survey asked to identify 5 top investment areas to improve Trust perceptions. The top two investments areas were bang on target with security at #1 and compliance at #2. But the next three are a unique mix of investment areas that include Environment & Sustainability, Privacy and Diversity & Inclusion.

In thinking and researching further about why Environment & Sustainability, Privacy and Diversity & are among the top 5 investments areas, I can share the following:

Environment Sustainability: IDC’s Consumer Experiences Survey from September 2020 indicated that 39% of U.S. consumers say a brand’s sustainability program has a “large” or “very large” impact on their decision to do business with them. Organizations can influence customer consumption patterns with commitment to and delivery of promises to positively impact people, planet, and resources through Environment Social Governance (ESG) initiatives.

Privacy: New privacy laws such as the Chinese Cybersecurity Law and upcoming India’s Personal Data Protection Bill are causing organizations to re-evaluate the data gathering, retention, and access policies. Data minimization is becoming the new norm wherein organizations mandate limits on collecting customer and consumer data while ensuring high profitability. Maintaining strict privacy and confidentiality of sensitive personal information in accordance with regulation also enables cross-border data sharing internally. Externally, this inherently protects customers and consumers. This approach not just limits the possibility of regulatory non-compliance fines but also defines an organization’s core values and promotes the commitment to customers.

Diversity & Inclusion: This is a softer initiative – not in terms of investment but in terms of feelings. In the words of an anonymous head of culture and people, “think of diversity as being invited to a party, and inclusion as actually being asked to dance when you get there.” IDC’s Technology for Social Good Survey, August 2020 indicates that the primary driver for organizations to invest in D&I is because employees require D&I to remain competitive and it is seen as a business imperative for sustaining or growing. Investment in good governance through policy/process creation, appropriate training, and adoption transparency enabling platforms will help guide towards a more inclusive culture.

In the future, I believe that transparency and ethical use of data will somehow find their space in the top 5. When? Time will tell.

Do you agree? I would love to hear from you. Do reach out to me at apotnis@idc.com.

For more research on the Future of Trust, click the button below.

If you would like to learn more about the Future of Trust or other IDC’s “Future of X” practices, visit our website at https://www.idc.com/FoX.