Strike the Right Balance of Direct and Indirect Channels To Maximize Potential in North America

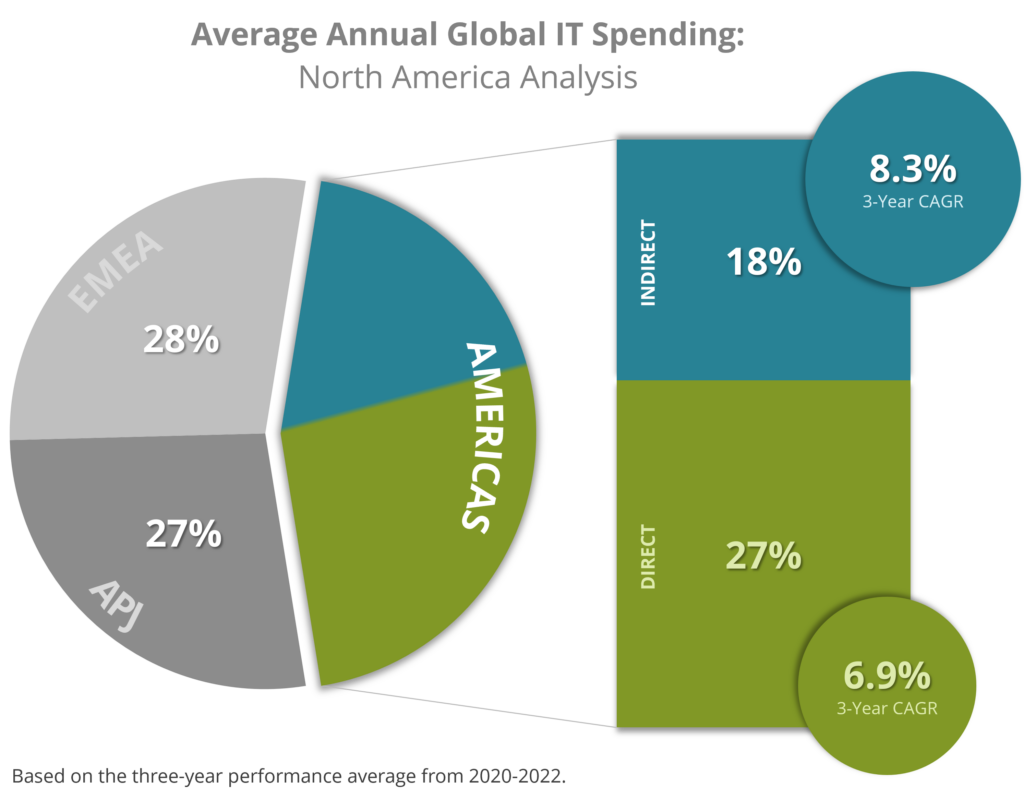

As the region with the largest share of global tech spend, North America—including the United States and Canada—is a critical geo for tech vendors to nail down. Competing in this region means you must operate at economies of scale to afford competitive price points and offer solutions that meet needs both broad and niche. With nearly 20 cents of every global dollar spent on tech moving through North America’s indirect channels, achieving and maintaining desired performance levels here requires a balance of vendor-direct and ecosystem sales.

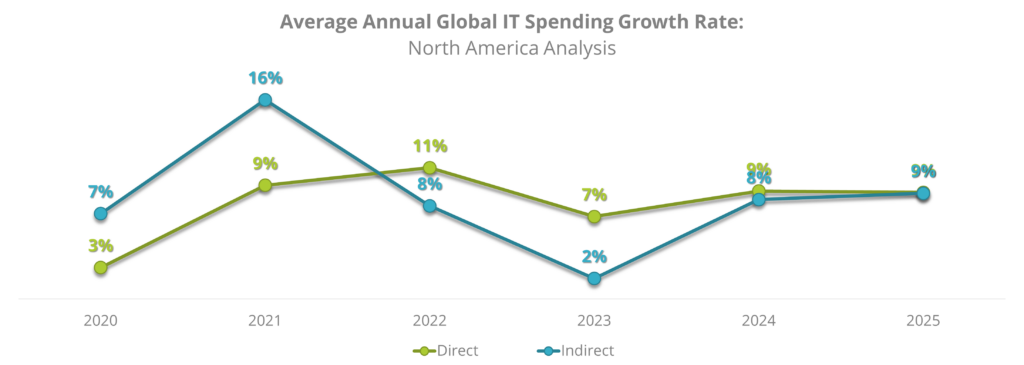

Looking at the 2022 calendar year, of the more than USD $2.9 trillion spent on technology in North America, over 40% was facilitated through indirect channels including dealers and VARs, retailers/e-tailers, service providers, system integrators, and distributors. In the three years from 2020 – 2022, indirect channels revenues also grew at a faster CAGR than direct channels.

While IDC predicts a slight reversal in this growth rate trend, particularly as the PC market goes through a difficult year, it is still expected that more than USD $578 billion in North American tech spending will move through indirect channels in 2023, compared to USD $874 billion in direct business. Therefore, vendors must avoid the temptation to over-rotate on direct channels at the expense of indirect routes-to-market. In fact, it is expected that the slowing growth rate will drive increased competition within indirect markets as vendors take offensive and protective measures to ensure nominal financial metrics are reached and growth is maintained. The most successful tech businesses will be those that master both channels in their North American play.

Use the Classic 4 Ps of Marketing To Frame Your Go-To-Market Roadmap for North America

To set and achieve realistic go-to-market goals for their North American businesses, tech vendors must start with clear market understanding. The degree to which vendors can accurately identify, track, and meet market demands, set baselines against which to measure performance, and predict buyer and market responses relative to competitors, will determine the quality of market insight decision-makers have at their disposal. However, not all go-to-market decision-making domains are created equal – some, like the 4 Ps of marketing, have a greater impact than others.

First proposed by Edmund Jerome McCarthy in his 1960 book “Basic Marketing: A Managerial Approach” and popularized by professors like Philip Kotler of the Kellogg School of Management in the decades since, the “4 Ps” presents a mix of elements for consideration when developing go-to-market plans. This generally agreed upon model looks comprehensively at the four domains contained within, including:

- Product

- Price

- Place

- Promotion

The product domain considers the total value proposition offered to both those buying and those consuming the solutions in question. Here, vendors must look beyond the sum of their components and think about the whole benefit they deliver – from technology, services, and partnerships to pre- and post-sales consulting, engineering, and support and other ancillary considerations, like financial, process, and personal gains and pain relievers.

The price domain considers the amount of money, time, and effort required by the customer to effectively gain the benefits promised by the product. By reflecting upon not just the selling price and available pricing models, but the total cost of ownership and the people, process, and technology required to support the product on an ongoing basis, vendors can better justify their own price upfront, and become a strategic partner for customers in the long run.

The place domain considers the channels and formats in which the customer can access the benefits of product. Within their often vast and complex technology ecosystems, vendors must build out reliable supply and value chains across various routes-to-market to meet the expectations of modern tech customers. This long-tail marketing approach goes further than internal competencies to consider synergistic value offered through a robust partnership model.

The promotion domain considers all factors related to creating and maintaining a products’ “position” in the minds of customers – i.e., the unique standing or reputation one vendor occupies relative to competitors in the same market. In this domain, vendors need to think through the full experience they deliver across the entire buyer journey as customers become aware of, show interest in, drive sales for, and use a product, including their messaging, communications, events, and product-led strategies.

Modern incarnations of the 4 Ps have expanded the model, breaking down certain domains to provide a more granular decision-making model. Whether the classic marketing mix is followed, or an expanded version, the goal is the same – to develop a plan that comprehensively addresses all relevant considerations. Smart vendors will do this early and often in their process, while those less experienced vendors will find themselves with the implications of other vendors’ decisions thrust upon them.

Even though the 4 P marketing mix model is straight-forward, knowing which considerations are relevant and performing proper assessments can be anything but. To help, the IDC Data & Analytics team has developed a guide to assessing the 4 Ps of marketing for technology vendors. Read on to learn more about this template and how you can access it for free.

Give Your GTM Roadmap for North America a North Star with Insights from IDC

To get the most out of their North American play, tech suppliers must look beyond internal capabilities and work with other vendors and providers in the greater tech supply ecosystem. Without a partnership model, vendors risk losing out on a significant portion of the market—the indirect channel accounts for an average of over 40% of tech sales in North America.

Historically, indirect tech channels tend to grow faster than direct-to-buyer channels. However, recent market shifts have seen a slight reversal in this trend begin to emerge. Even if this is a temporary phenomenon, it could be enough pressure to disrupt the order of things in North America for years to come. Regardless of their ecosystem orientation, vendors and providers must pay attention to both sides of the tech spending coin to properly contextualize and strategize for their businesses.

Setting and achieving realistic goals starts with accurate market understanding. Tech suppliers must give themselves a clear baseline against which to measure performance, an understanding of what is possible given various market conditions, and an ability to predict likely buyer and competitor behaviours for both direct and indirect channels. Once this is confidently assessed, effective go-to-market actions for both channels can be planned across each of the classic “4 Ps” of marketing – product, price, place, and promotion.

To make it easy, IDC is giving away a go-to-market research and strategy template specifically designed for strategists within corporate, product, channels, marketing, and sales strategy teams for technology suppliers. Use this template to guide your high-level North American analysis and serve as an input to your strategic plans. To access the form, please fill-out the form available on this page.

Need a little inspiration? Read the Eaton customer success story to find out how the power management giant leverages data from IDC’s North America Distribution Tracker product to inform activities ranging from emergent trend analysis and market sizing to price skimming and acquisition evaluations. To get instant access to the story, please visit this page.

You can also learn more about IDC’s flagship market intelligence products that include coverage for North America by visiting our product pages, reading overview documents, and scheduling live demos with analysts and experts through our Data & Analytics site.

For more information on IDC’s North America Distribution Tracker, please visit this page.

For more information on IDC’s Black Book solutions coverage in North America, you can get started here.