Pandemic-accelerated change is combining with the unique habits of Gen Z and Millennials to drive massive changes in the consumer technology marketplace. Those who anticipate and understand these changes will find opportunity and growth; those who fail to do so will be blindsided and left for dead. There is no middle ground.

Now that the COVID Pandemic is Behind Us, Not All Boats are Rising

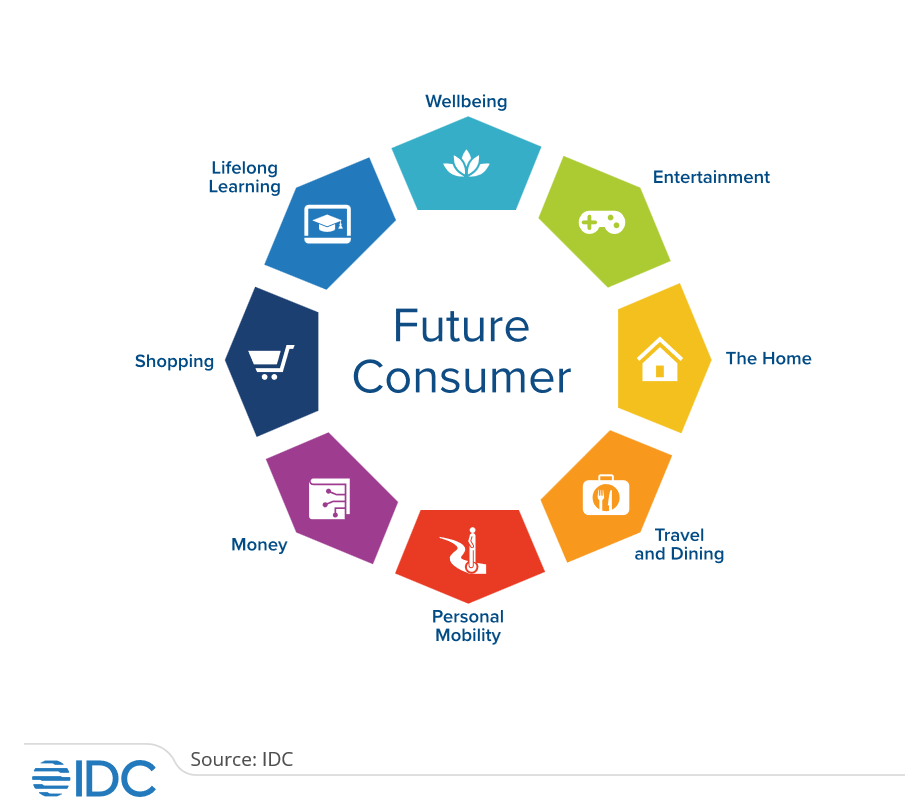

With the high level of consumer spending provoked by the pandemic, firms across the board were able to show revenue and profit growth – even those that lost share. Not anymore. Now is the time to make sure you understand where the market is headed and how you will drive growth for the future. If you are in a legacy business with a customer base largely made up of Gen X and Boomers, buckle up! Even companies who already resonate with Older Millennials must understand the unique attitudes and behaviors of Gen Z and Younger Millennials. IDC’s Consumer Pulse uses quarterly surveys in seven countries to identify the ways technology intersects with the life of the Future Consumer.

The Home: The Versatile Center for Everything

Forced to stay at home, consumers came to have a new view of their homes and lives. Their homes became the center where they do everything: work, play, learn, exercise, and more. 6 in 10 said they were ready for the tech demands of working and learning from home, with predictable differences by income. Connectivity was the area consumers reported the highest degree of readiness. Devices and accessories were areas of felt need.

Consumers had LOTS of time on their hands and were forced to use technology, engaging more deeply. Time spent on entertainment increased by 30% from pre- to peak pandemic. With little to do or nowhere to go during their free time, they upped their engagement with social media and online entertainment. They gamed and posted more frequently, putting out TikTok videos for all the world to see. Some even found they could make money at these new endeavors – doing what they wanted to do.

Re-thinking Work & Life More Broadly

An increasing percentage of workers found themselves aware of the choices they had. With newfound control over their time, broader market acceptance of work from home, and alternative income sources at their disposal, a growing share of workers redefined what was best for themselves and their view of success.

No longer would it be necessary to think of a corporate job in an office and a promotion as the means to success. In this new world, they reasoned, “I can work as much or as little as I want, when I want, doing what I like.” Energized by their opportunity to be their own bosses, workers resigned in droves, pursuing their own gigs or gravitating to employers willing to work under a new, different work framework. Others simply cut back on their work hours.

Content Creation: The Race to Empower and Enable Creators

Content creation and gaming, once considered niche activities, are now mainstream, fueled by the energy and ambition of Millennials and Gen Z. More and more, “everyone” is a content creator. In fact, 78% of consumers create and post content at least monthly, led by videos (62%). 1 in 6 report earning at least some amount of money with their content.

Those who earn money use 3 to 4 devices including real cameras and have a much more sophisticated content creation process requiring a seamless experience across form factors. Amateurs use only 1.3 devices on average, with most relying almost exclusively on their smartphones. The opportunity is ripe for companies across the marketplace to provide devices, software, and platforms which offer a seamless experience and empower content creators to do what they most want to do – build a following and make money. This means helping them to move along the continuum from amateur, to prosumer, and beyond. It also means understanding the dynamic, ever-changing environment. What role will generative AI play? Will short-form video continue to be the rage? What about long-form? Stills?

Tech-enabled Income-generating Activities Drive a Larger Tech-enabled Lifestyle

It’s not just content creation. Tech-enabled side hustles are on the rise. Half of households report engaging in at least one source of tech-enabled income-generation. Besides content creation, peer-to-peer commerce and rideshare driving top the list. Over 60% of households headed by Gen Z or Millennials report such online income. This trend, seen worldwide, was corroborated by a recent U.S. study by Lending Tree.

Importantly, engagement in online income-generating activities is a powerful catalyst to broader adoption of a tech-enabled lifestyle – a tipping point in individuals’ lives. The opportunity to earn income drives initial openness to the usage of tech-enabled apps and services. Successfully earning income then produces confidence to adopt tech-enabled approaches in other areas of their lives. This is true across all demographics. Online income-earners more intensely use digital payments platforms, spend more on devices, and subscribe to a wider breadth of tech-enabled services. Consumer-facing companies with tech-driven solutions would do well to target them.

An Online First Mentality is Predominant

When it comes to shopping, consumers have clearly embraced an “online first” mentality, leading online purchases (50%) to overtake in-person purchases (43%) for the first time; phone purchases remain at 7%. Usage of online grocery shopping has broadened dramatically – 72% now report they buy at least some of their groceries online, even if just occasionally. Home delivery is driving the biggest part of this growth – expanding its share from 25% of purchases (pre-COVID) to 35% of purchases (now). Gen Z and Younger Millennials drove this growth – along with Boomers, demonstrating how the habits of these younger cohorts are impacting the broader marketplace.

Interesting “Crossover” Activities are Emerging

There is an interesting mash-up happening between social media, gaming, and e-commerce. Enabled by technology, consumers are connecting areas of their lives previously seen as separate. Gamers are posting videos of their gameplay on Twitch and Instagram. Shoppers are using TikTok to discover where to eat or which supplements to take. Business opportunity exists wherever consumers want to connect previously disconnected areas of their lives. A future Metaverse is a potential place for that.

Two-thirds of consumers have heard the term Metaverse, but familiarity and knowledge with the concept behind the term is very low. Roughly 1 in 4 consumers are highly interested in the concept of the Metaverse. They prefer immersive experiences and are more willing to spend on tech, including smartwatches and AR/VR headsets.

Re-shaping Meals and Dining

When it comes to meals and dining, the attitudes of Gen Z and Millennials increasingly point to a very different lifestyle from previous generations. They have a much more positive view of the quality of delivered food and a much less negative opinion of its value for money. Their habits are re-shaping the marketplace, giving rise to a flurry of drive-through only restaurants and ghost kitchens. As Gen Z and Younger Millennials age and reach the family stage, the implications will be even more dramatic, as their “practical and convenient” orientation gives rise to the opportunity for alternative business models, including combined meals and groceries subscriptions.

Travel Rewards Opportunity with Gen Z and Millennials

Travel suffered significantly during the first year of the pandemic. Over the past 6 to 9 months, travel exploded! But travel is the ultimate discretionary expense and inflation pressures are now weighing on consumers’ disposition to travel, particularly among those with lower and middle incomes. Consumers have already widely adopted the internet for planning and booking travel and these habits have been stable for the past 3 years. Still there is opportunity for disruption here. While 29% of Gen Z and Millennials have dining-related rewards programs, only about 15% are active in an airlines or hotel rewards program. This clearly signals an opportunity to gain a footing early with these consumers, with a long lifetime ahead of them.

Multi-mode Personal Mobility & Gen Z

71% of consumers use at least two modes of mobility for a significant portion (10% or more) of their monthly mobility time. With their proclivity for urban living, more than any other generation, Gen Z use public transport, bikes, scooters, rideshare, and mobility services. The Future Consumer will have a broader, multi-mode mobility strategy using multiple modes alongside the continued use of personal cars which remain consumers’ strong preference. Battery electric vehicles continue to face barriers; but new more affordable entries are coming to market. This will reduce Tesla’s first mover advantage.

Lifelong Learning is Nearly Universal in Reach; Opportunity Remains

Online Learning is increasingly ubiquitous, used by 6 in 10 consumers overall, 70%+ of Millennials, and 80% of Gen Z. Online learning is a perfect fit for Gen Z and Millennials who are digitally self-sufficient and motivated to achieve. Online Learning continues to offer strong growth opportunity; the breadth of possible learning topics is tremendous, with many consumers pursuing topic after topic. While consumers see paid content as more trustworthy than free content, YouTube remains a dominant, free source and Gen Z has become more skeptical of the value for money of paid online learning offerings.

Wellbeing is Ripe with Opportunity

With COVID, at home’s share of consumer workout time grew from 36% to 56%. With the end of the pandemic, this has fallen but remains well above the pre-COVID benchmark at 44%. The pandemic had a big impact on mental health. The younger the consumer the worse the impact. Due to its perceived mental health benefits, more people are exercising now than before the pandemic. Millennials have shifted most strongly to working out at home due to their busy lives and their purchase of home workout equipment. At home, self-developed routines are most prominent as consumers leverage online workouts (free and paid) and companion apps. A segment of consumers is open to using AR/VR for their workouts. All these factors make wellbeing ripe for activity and change.

On top of that, consumers are nearly universally dissatisfied with the bureaucratic, manual nature of healthcare systems and providers in their country. Healthcare operations and logistics are ripe for disruption and can be a point of provider differentiation. Consumers are widely receptive to tech-driven change in all aspects from scheduling, to prescriptions, and related price research, medical records, and alternative tech-focused insurers and providers.

Near-term Consumer Digital Transformation Opportunity Momentum

Consumer-facing Brands that Fail to Prepare for the Future Consumer are Dead

Gen Z and Millennials embrace technology across a wide swath of their lives. Their unique habits offer opportunity, their attitudes signal their future interest. Firms which truly understand and meet their needs and expectations will cultivate their trust and build increasing relevance. Those that do not will find themselves increasingly ignored as stagnant or irrelevant. Business as usual is not an option.