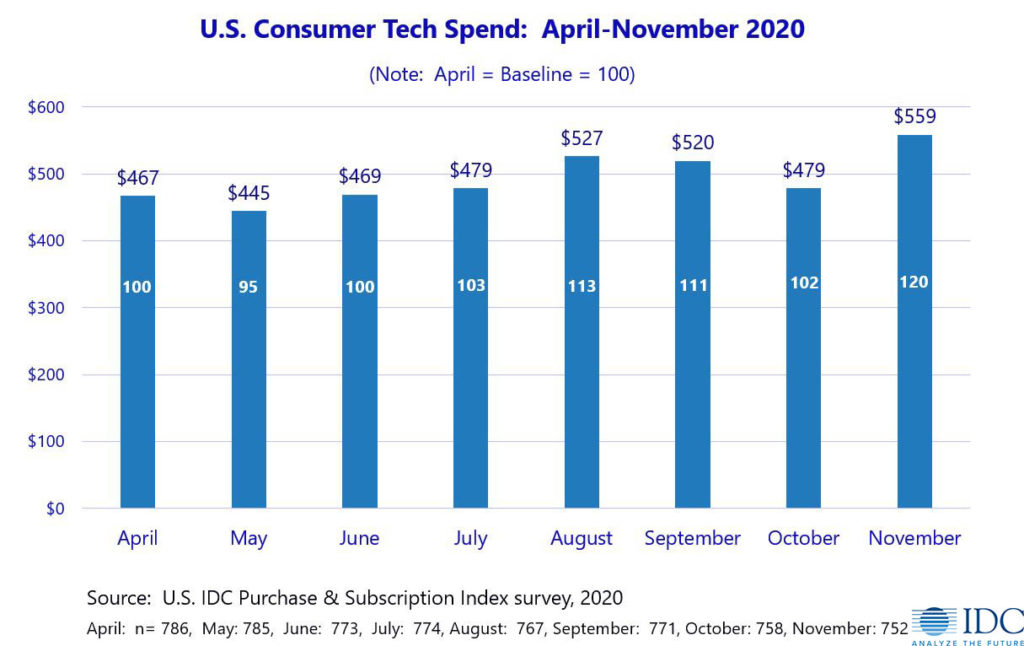

Self-reported consumer tech spending expanded 17% in the month of November, rebounding from October’s low as consumers began year-end holiday spending in earnest. According to IDC’s November Purchase & Subscription Index survey, which measures consumer expenditures on devices and tech-enabled services, the growth in spending was fueled by two consumer groups – those with incomes below $50,000 and those with incomes of $100,000-$150,000. Read on to find out more.

Month Over Month Increase is Positive Yet Timid for Year-End

After weak spending in October, consumers’ spending in November rebounded, reaching its highest monthly level since IDC began measurement in April. While the increase is a welcome change in trajectory given the sharp dip we saw in October, it is not yet clear what this will mean for the 4th quarter as a whole.

In reality it represents a rather timid expansion in overall consumer tech spend. A normal year-end cycle would see an even higher month-over-month gain. High levels of tech spend earlier this year (to deal with the reality of COVID-19 and being sequestered at home) and ongoing economic uncertainty are the primary factors driving this less-than-normal gain.

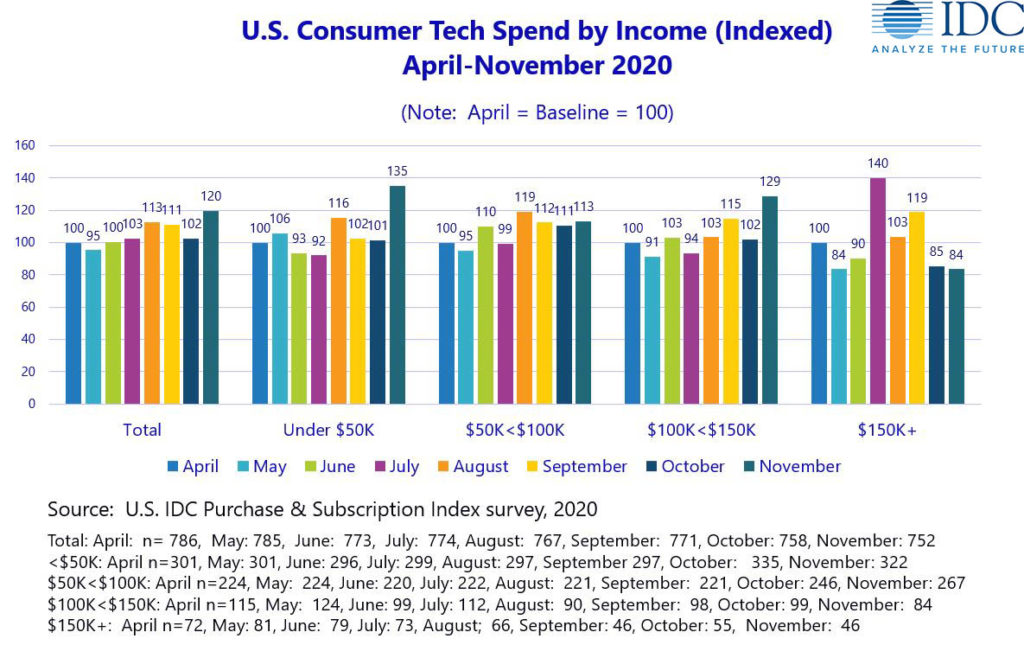

Dissecting Spend – The Consumer Groups Behind the Growth

Expenditures were especially strong for households with incomes under $50,000 as well as those with incomes between $100,000 and $150,000, where month-over-month growth in device spend was 77% and 47% respectively.

In the heart of the market, among buyers with incomes between $50,000 and $100,000, spend was steady, sustaining a similar level for the third straight month. That’s 13% ahead of the April benchmark but down from the high in August.

Tech spending among those with the most disposable income (the $150K+ income group) fell 2% in November as their device spending expanded a meager 2% and they cut back service expenditures by 6%. After spending heavily in July, it seems many in this group have the tech they need.

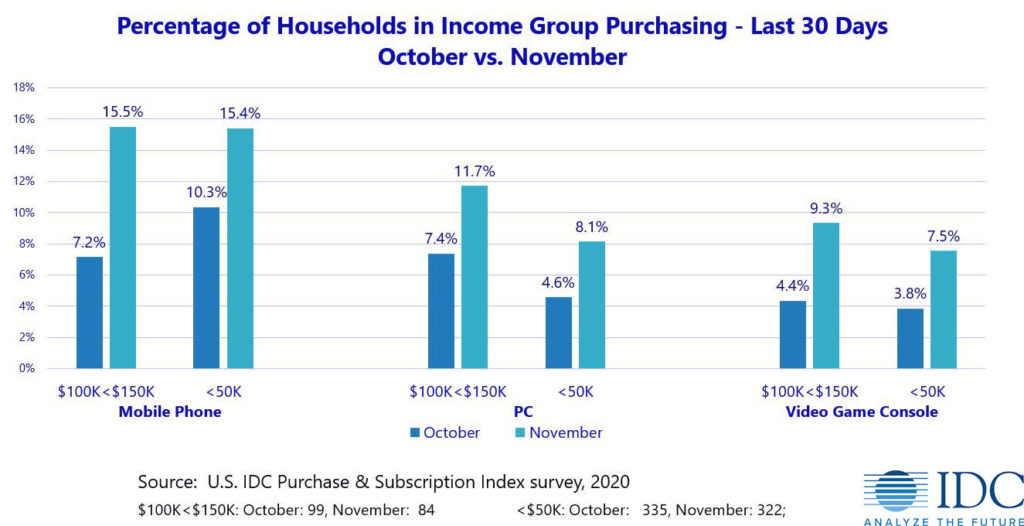

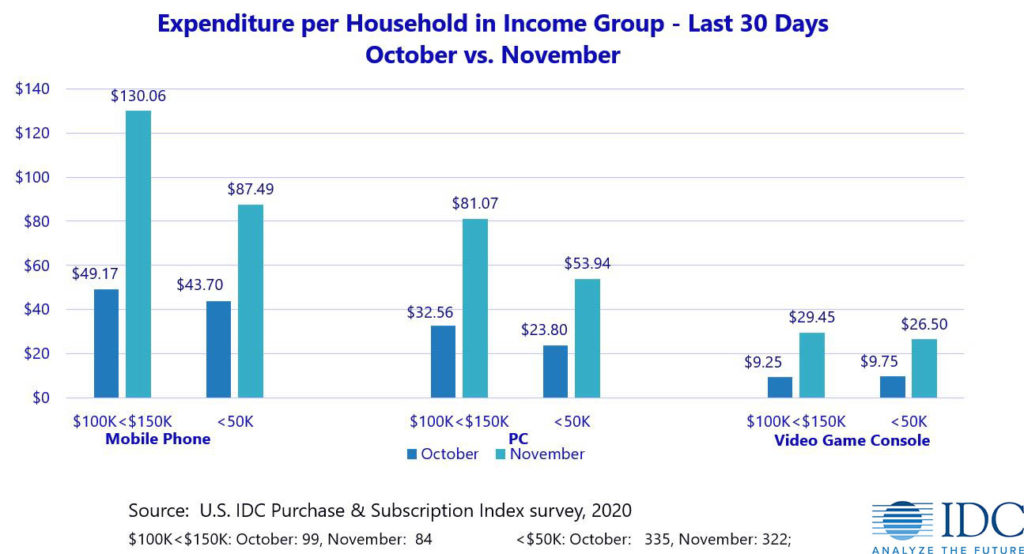

Phones, PCs, and Video Game Consoles Drove Growth for Both Groups

For both groups of households that increased their spending, mobile phones, PCs, and video game consoles were key drivers of their increased spend. The percentage of households purchasing each type of device increased significantly.

With that, the spend on each of these device categories more than doubled for each of these consumer groups.

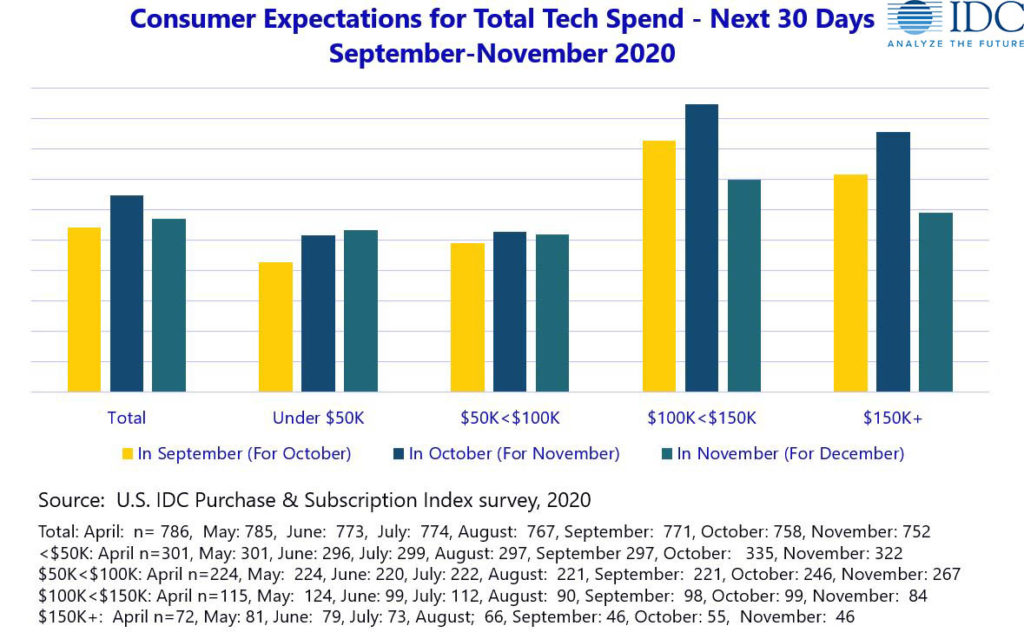

Consumer Expectations for December Signal Softening at the Top

Consumer expectations in November for the next 30 days suggest softening in consumer spend. This would suggest that December spend will be somewhat softer than that observed in November.

Experience has shown that these future metrics are directional and more qualitative in nature, so that’s how I am presenting them.

Indications are that spend among those with incomes under $100,000 will be relatively stable. However, among those with incomes over $100,000, spend is expected to drop relatively sharply. Those in the $100K-$150K group increasingly feel they’re spending too much on tech, while many in the higher income group spent earlier in the year, already meeting the tech needs they had.

Overall, consumer sentiment about holiday spending remains similar to October, with 51% indicating they will spend less overall this year, with a smaller share spending on tech.

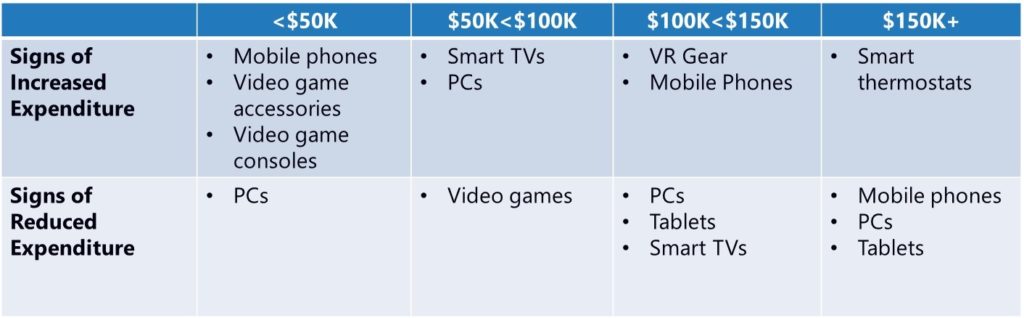

Areas of Opportunity with Each Consumer Group

Despite differences in how much they plan to spend overall, there are areas of planned increased expenditure for each consumer group.

Mobile phones remain an area of growth for both those with incomes under $50K and those between $100K and $150K. The former are also likely to spend more on gaming consoles and related accessories while the latter is unique for its interest in VR gear.

The best target for PC marketers is made up of households with incomes between $50,000 and $100,000. These middle-class households – mostly suburban young couples and small families – are also the prime target for Smart TVs.

Smart thermostats and other smart home devices are of particular interest for the highest income group.

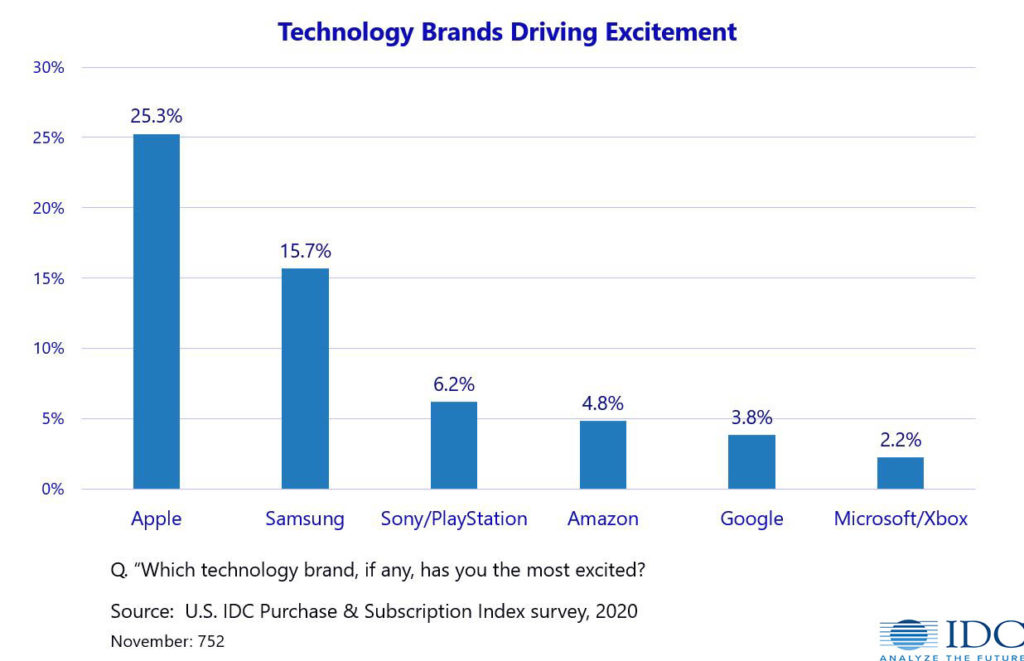

Apple and Samsung Lead the Tech Brands Driving Excitement

Given the broad return to interest in smartphones, it’s no surprise that Apple and Samsung top the list of brands which have grabbed consumers’ attention, with Apple leading.

In November, Sony/Playstation had greater mindshare than Microsoft/Xbox, even though both launched new consoles during the month. Meanwhile both Amazon and Google are driving some excitement, perhaps due to the popularity of their smart speakers and displays as gift items.

Key Takeaways & Actionability for Consumer Marketers

- Staying in tune with each consumer group’s sentiment and catering to their interests is key to success, especially as the holiday season progresses.

- Consumer interest in smartphones has energized the market and will continue to drive demand through year’s end.

- After a slower than expected year, interest has blossomed and spend has increased. This includes an increasing interest in 5G.

- Two groups of consumers remain very interested in phone purchases: those with incomes of <$50,000 and those making between $100K and $150K (where interest in 5G is highest).

- PC marketers should tightly focus their efforts on those with incomes between $50,000 and $100,000.

- Other consumer groups have spent on PCs and are signaling plans to cut back.

- Gaming continues to have strong relevance, particularly among those at the low end of the income continuum, where gaming consoles and accessories are planned purchases.

- Among those with higher incomes, VR gear is more salient.

- Cater offerings appropriately.

- Given the overall economy and consumer preferences, smart home device marketers should target high-end consumers.

- While smart thermostats are the most obvious area of interest, displaying them with other energy-saving devices (outlets, bulbs, switches) may help drive increased revenue per customer.

- Video monitoring cameras, including doorbells, have performed well throughout the year and would likely see a good response, as well.

IDC’s Consumer Technology Strategy Service (CTSS) leverages a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes robust monthly data, timely insights, quarterly webinars, and ongoing analyst access.

In addition to my syndicated service, I work closely with clients on custom research projects and consulting. Find out more here: