Last month consumers reported that they planned to cut back on device spending in the coming 30 days. Our May survey results show that they have begun to slow their spending on devices, but not nearly as much as they said they would – at least not yet. Let’s take a closer look at what our latest survey results tell us.

In normal times, consumers have an easier time telling us what they have done recently than what they will do in the future. It is amazingly difficult, even for consumers, to predict their future behavior. This is doubly true in today’s turbulent world.

Slower than Expected Reduction in Spending

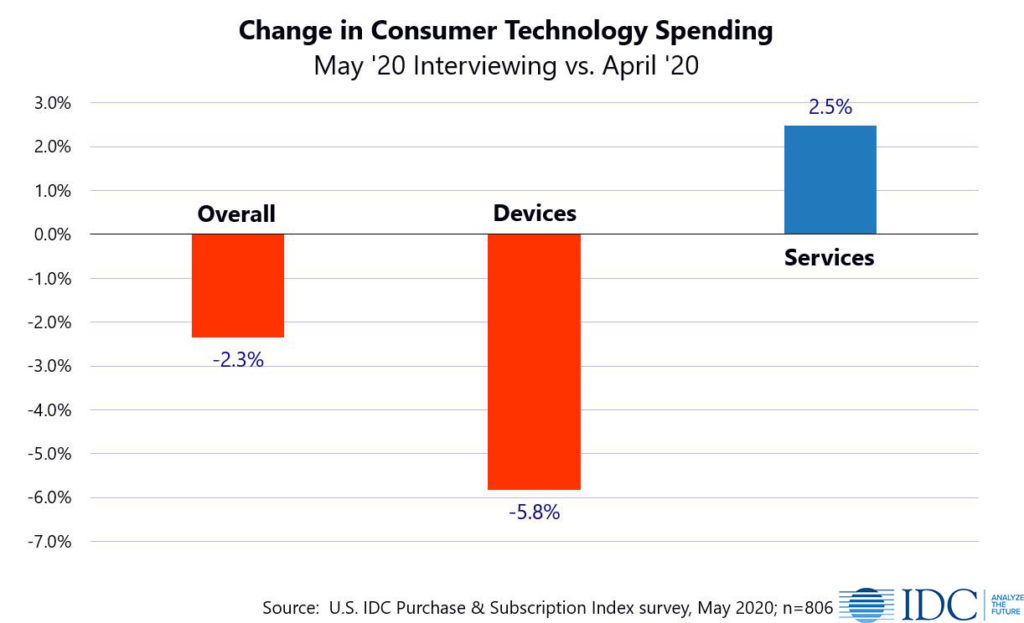

In the latest wave of IDC’s continuous monthly Purchase and Subscription Index survey, fielded between May 1st and May 28th, consumers reported spending 2.3% less overall. The result was far less negative than expected.

The decline was driven by a reduction of 5.8% in spending on devices last month. A meaningful drop, for sure, but far less than the 59% decline consumers had estimated for the period when interviewed in April.

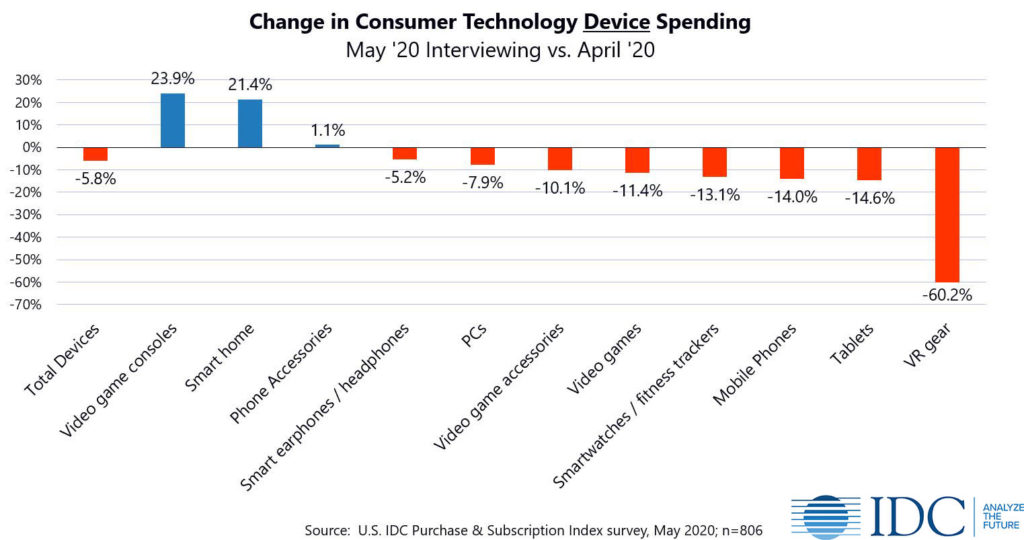

Virtual reality gear had the largest drop at 60%, likely the result of repeated sold out status for popular headsets like Facebook’s Oculus Quest. Demand for devices for work and school from home show signs of softening, with tablets down 15% and PCs 8%.

Video game consoles and smart home devices (particularly smart TVs) bucked the general trend, growing by more than 20% month over month. Without these two entertainment categories (fueled by people with excess time on their hands), the drop in device spending would have been a full 2 points worse at -7.8%.

Services Surprise with Growth

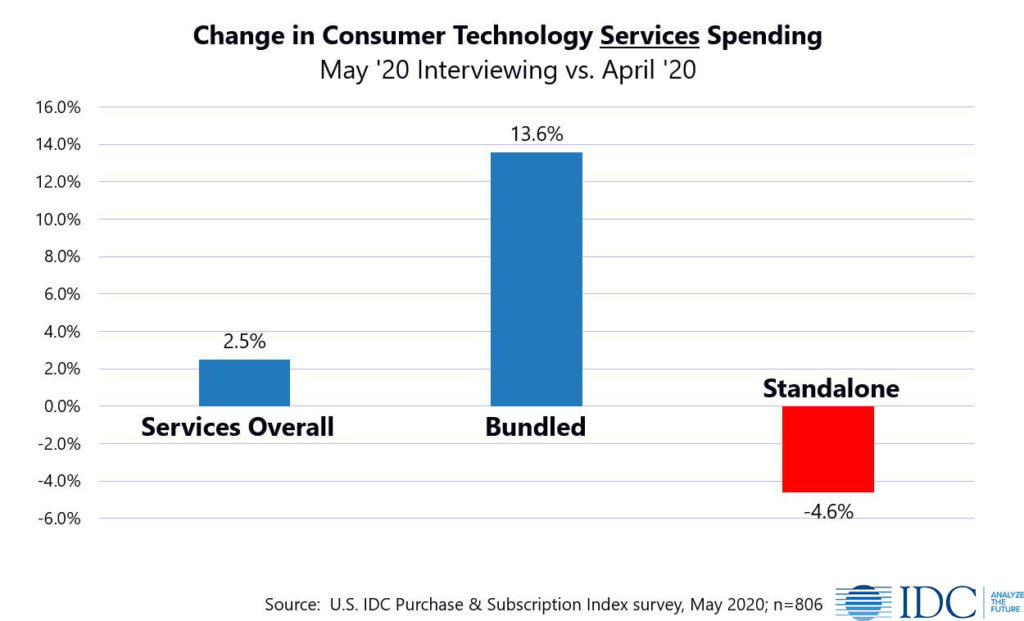

Expected to be flat, services grew by 2.5%, as consumers increased their bundled services and cut back on standalone services. The growth in bundled services came as consumers felt pressured to add services while trying to contain costs.

Among standalone services, PC gaming, audio streaming, landline phone service, and video streaming all suffered double digit losses. Unplanned spend for things like wireless device insurance contributed to the growth of services, serving as a bright spot.

Looking Forward

Consumers continue to communicate their intent to reduce their level of spending, signaling their plans to cut device spending. Based on this, I expect device spending will continue to decelerate, although at this point, I won’t put a number on it. Consumers expect to increase service spending by about 1% over the next month.

Consumer Concern Shows Small Signs of Initial Easing

Consumer concern about COVID-19 is largely stable. But there are small, directional indications that concern is beginning to ease slightly. The percentage of consumers reporting a “high” level of concern about COVID-19 has eased from 62% to 58%.

While shopping online and technology use remain much higher than before COVID-19, there is some movement towards normality, with consumers reporting a little less online shopping and a little less use of technology. With many states re-opening and the impending arrival of summer, this trend can be expected to continue as long as the virus does not see an uncontrolled resurgence.

Key Takeaways & Actionability for Consumer Marketers

- Consumers are likely to continue to cut their technology spending, with the pace of cuts accelerating over the next couple of months.

- Consumers have spent heavily over the past few months; they simply cannot keep this up forever.

- Consumers are consistent in their insistence that they will cut.

- With the re-opening of the economy, the end of school, and the impending arrival of summer, consumers can be expected to rebalance life as “cabin fever” sets in.

- Given the level of technology fatigue, device manufacturers might do well to let consumers have some time over the summer.

- “Back to school” may offer an excellent opportunity to re-engage consumers around their device needs.

- Consumers have shown renewed interest in bundled services, as consumers are more concerned about the value for the money of the services they subscribe to than the number.

- Consider creative bundles which encourage service expansion, but don’t penalize consumers for short-term stays or shifting the mix of their services.

- Consumer needs and behavior will continue to shift in this dynamic environment.

- Keep listening.

IDC’s Consumer Technology Strategy Service (CTSS) leverages a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes robust monthly data (including on interest in 5G devices and service), timely insights, quarterly webinars, and ongoing analyst access. Find out more here: