It’s a question that doesn’t get a lot of attention – but it should! I mean, when you really look at it, there are far too many brands that fail to develop deeper relationships with consumers, content to make the occasional transaction every two to three years. They believe that the best technology or the best product wins. But it often doesn’t. They fail to understand the many other factors at play, including the role of frictionless user experiences. Far too many are “one-trick ponies” with little relevance in consumers’ lives. They lack a clear understanding of how to build a brand – how to build from strength – and underestimate the impact of brand loyalty and brand advocacy have on the cost of customer acquisition.

The U.S. Consumer Device Market: A Picture is Worth a Thousand Words

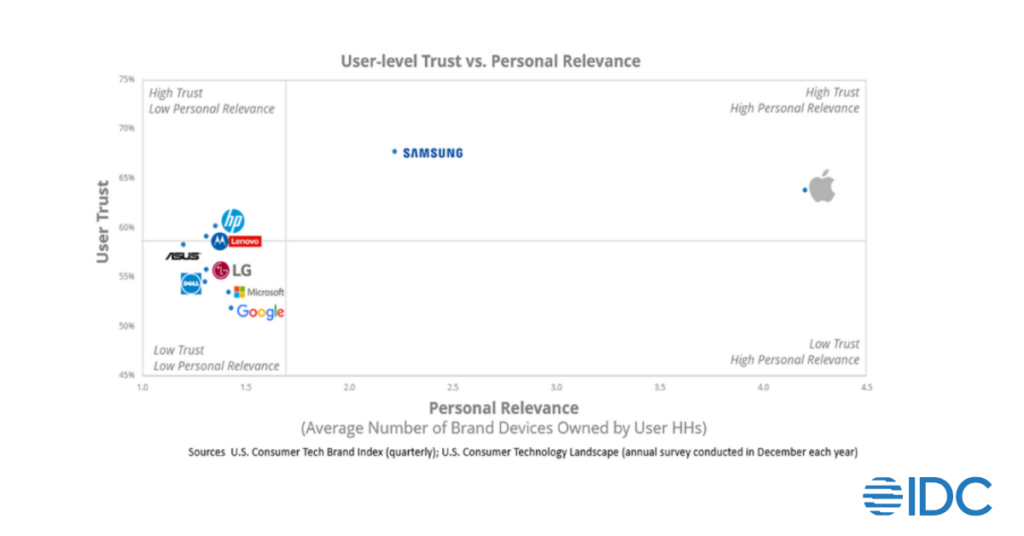

The brand map below captures the factors behind each brand’s performance.

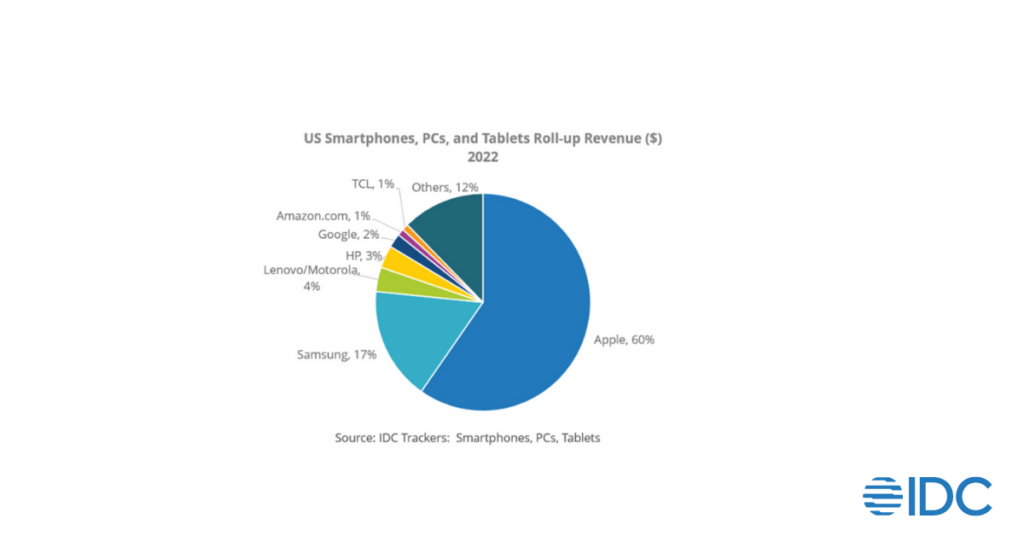

Although Samsung users trust the Samsung brand more than Apple users trust the Apple brand, Apple has successfully developed deep relationships in a much more profound way than Samsung, enabling it to outperform Samsung in revenue. Each brand’s position correlates strongly with its share of the U.S. consumer device market, which was worth more than $600 billion in 2022.

However, the news is not all bad for Samsung, which far outperforms all other brands in depth of relationship and revenue. The large group of low trust, low relevance brands is vulnerable; they must expand their relevance or suffer the consequences of their shallow, transactional relationships.

Trust is Essential for Successful Relationships with Consumers

The level of trust in your brand determines its ceiling – its potential. Trusted brands get bought, used, and recommended more. They eventually end up with a higher proportion of loyal customers and are more profitable.

As important as trust is, relevance is essential for developing deeper relationships with consumers. A high level of trust that does not translate into greater relevance is unfulfilled potential – the problem that plagues Samsung.

Deepening the Relationship – Building Increased Relevance

The process of deepening the relationship comes from empathetically asking questions like: What needs are we currently meeting? How well are we meeting them? What are their pain points? How could we solve them? What things would they like to do that they cannot do very well or at all today?

Contrast that with the selfish mindset of the inwardly focused company (e.g., how can we convince consumers our offering is still relevant?) Rather than starting with the needs of the consumer, this approach starts with the company’s need to find nails to hit with its hammer.

This does not apply only to device markets. It applies to subscriptions and services too. Take the example of the market for wireless service, broadband internet, and entertainment services like audio and video streaming services. The right questions include:

- What is changing about the way consumers communicate and entertain themselves?

- What would deliver a better experience?”

The answers require an understanding of the user journey, identification of pain points, and solutions that users find truly intuitive and helpful. It does not necessarily mean offering a bundle. Based on the needs and expectations of consumers today, it may very well mean offering excellent services, with great support, without a contract at prices that consumers consider a fair value (not cheap, but not exorbitant, and without built-in prices increases).

Charging a premium for a no contract relationship or forcing consumers to take on a two-year contracts to get the best price cuts against the grain, making consumers predisposed to change at the first chance to get the treatment they really want. Capturing new customers is much more costly than servicing them well and keeping them.

Two Kinds of Relevance

Relevance is all about a brand’s ability to meet consumers’ needs. There are two main kinds of relevance – market relevance and personal relevance. The more needs a brand meets, the greater its relevance. The more consumer spend that you compete for, the greater your market reach, and the greater your company’s market relevance. Brands with high market reach have a larger audience and the greatest market potential.

At the same time, not every brand is designed to play in the entire marketplace. Brands like TikTok and Tesla target specific subsets of consumers and drive dynamic and healthy businesses as a result. The more relationships consumers have with you, and the deeper those relationships, the greater your personal relevance to them. The deeper a consumer’s relationship with your brand, the more time or money they spend with you.

Trust That Does Not Translate into Relevance is Unfulfilled Potential: A surprising number of brands have a high degree of trust but fail to develop greater relevance, limiting their growth potential. There are many reasons for this.

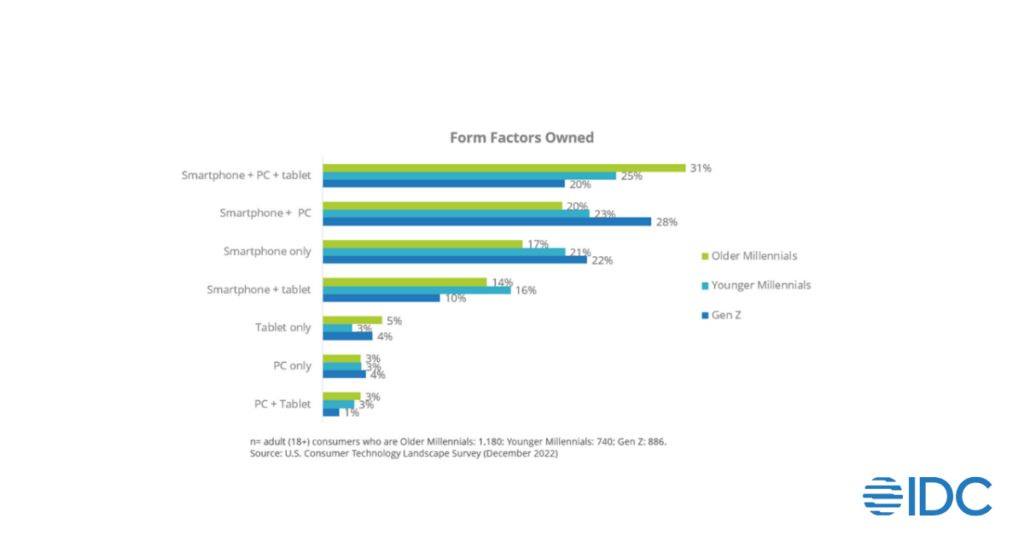

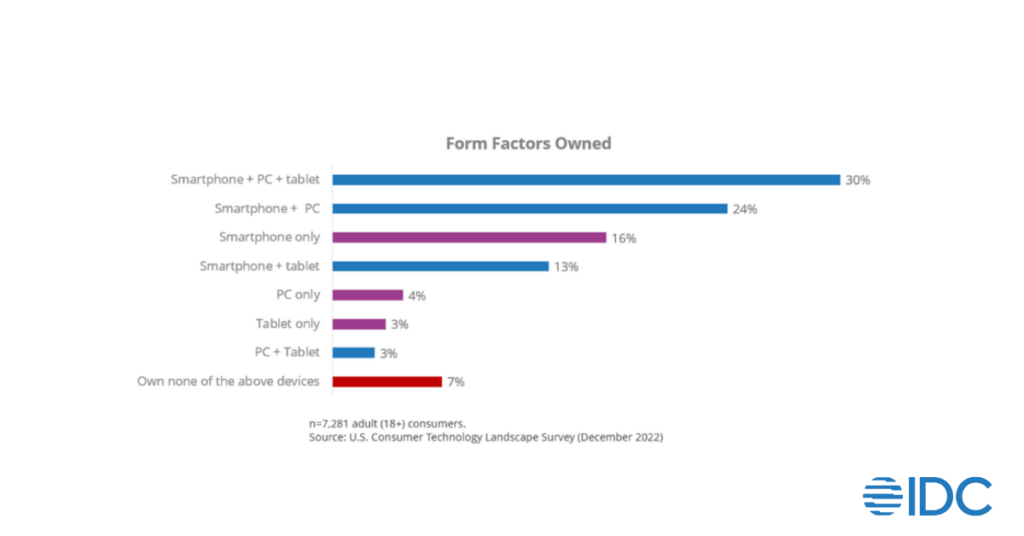

Too Many Companies Focus Too Narrowly on One Set of Consumer Needs: Consumers use multiple form factors, moving easily from one device type to another, as they create content, shop online, or game. Since consumers own multiple form factors, brands that offer the form factors they own or intend to buy have much greater relevance than those who do not.

Perhaps there’s a fear that younger consumers, who’ll define the future market, are different. After all, to ensure your brand thrives going forward, it’s important to align with the needs of Millennials and Gen Z. The data is clear. These generations are also multi-device, with Gen Z especially driving the trend towards smartphones and PCs.

Merely Marking a Presence Does Not Establish Relevance: It’s not enough to mark your brand’s presence in a segment. Consumers must see sufficient acceptance by other users to merit their consideration. They need to see people they know using a product or service. They need to be able to ask someone they trust about their experience. Word of mouth is important. Two to three percent market or segment shares are insufficient.

Samsung, Google, and Microsoft are among the many brands guilty of “marking a presence” in certain device segments without playing to win. They do not spend enough money on marketing to generate sufficient awareness, sales, and a big enough user base to snowball into something bigger. Take the example of Samsung in the PC market. They have small single-digit share, yet their tiny user base is extremely satisfied demonstrating its upside potential. They are the only brand other than Apple to offer smartphones, tablets, and PCs giving it the opportunity to make a compelling counter case to Apple. But few consumers are aware of this fact.

Too Many Companies have a “White Space” Mentality: The statement “we need to find white space” is more often a reflection of a company’s desire to find a place in the market where there is less competition and higher profit margins than it is a desire to truly meet consumer needs. True white space opportunities are extremely rare and cannot be the core focus of building a brand.

Companies that are successful at finding white spaces are more often those that have a strong presence in the market and see a convergence of consumer needs that produces a white space opportunity. In other words, white space opportunities are born from an understanding of current needs, pain points, and an understanding of how to address those needs in a uniquely new way. When that is missing, the white space can best be described as a black hole.

Take Microsoft Duo as an example – a device that’s too big and unwieldy to be a phone (despite the company’s positioning to the contrary) and too small to be an effective tablet. A device whose killer use case was never apparent. With the same resources, Microsoft could have invested in the marketing necessary to make Surface a household name with universal awareness. Or, if it were willing to commit to the development of another form factor, it could have developed a true smartphone, especially given LG’s exit from smartphones.

Past Failures Lead Brands to Refuse to Embrace Obvious Opportunities: The reason is clear. Microsoft obviously thought, “We’ve tried making ‘traditional’ smartphones before. We’ve tried and failed terribly. We can’t do that again.” Certainly, there is no clamor to bring back Windows Phones. Now let me ask you… does Microsoft’s past smartphone failure preclude it from developing a compelling, even premium Android smartphone now or in the future? Consumers have a high level of trust in Microsoft. The smartphone is not going away any time soon. A move to Android would be a powerful message. Superior functionality that allowed for smoothly going from a Microsoft smartphone to a Windows PC and an Android tablet would be welcome.

Apple’s Consumer Dominance: Deep Relationships

Now, I’ll be the first one to tell you – there is no reason for Apple to dominate the worldwide consumer tech marketplace as much as it does. In 2022, Apple accounted for 41% of worldwide smartphone, PC, and tablet revenue. The explanation is twofold. Apple has developed deep relationships with consumers and the other brands are largely conceding the market to them, focusing primarily on the enterprise market and unwilling to do the slow, hard work of building a consumer brand and business over time.

By far the most interesting part of Apple’s recent earnings call was the company’s spontaneous mention of the enterprise market and the increasing role of BYOD devices. Apple’s Consumer momentum results in “pull” for its devices, as small business owners and ITDMs are also consumers who bring their experiences to work with them each day. One way or another, it’s time to pay more attention to the consumer market. It may be the best way to slow the potential impact on the small business and enterprise markets.

Interested in learning more about IDC’s Future Consumer research and how it can help your business?