At IDC, we have been talking about the micro and macro-economic environment and classifying them as the winds of change. We talk about the headwinds associated with the pandemic, skills shortages and supply chain constraints coming at organizations. What we saw only one year ago, however, is that these headwinds were offset by tailwinds, which we saw as consumer demand, government stimulus and the drive to become a digital business. This is not what we see today.

When the winds of change become storms of disruption

Today, we are faced with record inflation, a tumbling stock market and an economy teetering on the brink of a global recession. These winds of change are coalescing into one big storm of disruption. Given this storm, it is critical for you to think about your planning in three periods, this year.

- Near term. Tech vendors need to help your customers slice through the storms of disruption, especially since their traditional IT cost cutting playbook is a lot different in as “as a service economy”.

- Mid-term. We believe companies will continue to invest in digital throughout the recession, but there will be a shift in what they invest in as they focus on scaling their digital business.

- Long term. We are seeing a fundamental change to the way the global economy is being shaped and the way technology is being used to support the digital economy. It is critical for tech vendors to understand this future and navigate your customers through it.

Near term planning: slicing through the storms of disruption

The big question on everyone’s mind is the economy. The US economy shrank in the first half of the year. However, we are at a 50-year low for unemployment. But, purchasing power of those wages has decreased as inflation hits a 40-year high.

During this time, we have been tracking enterprise buyer sentiment globally, especially as it relates to IT spending. IDC’s latest global Future Enteprrise Resiliency Survey (FERS) shows 72% of tech buyers and decision makers believe there will be a recession in the coming year; the majority believe the recession is beginning now or will take place in the first half of 2023, with many tech leaders in North America believing we are in a recession right now.

It does not matter whether or not the National Bureau of Economic Research declares a recession, because the perception of tech buyers becomes our reality. If tech buyers believe a recession is coming, they will act rationally to adjust their tech spending to align with an anticipated drop in revenue.

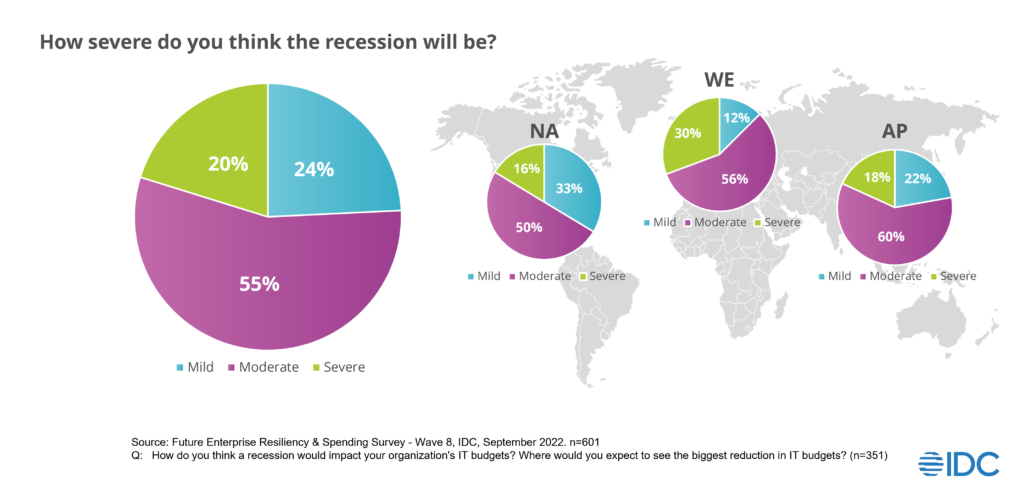

The extent to which tech buyers decrease their IT spending will depend on how severe they perceive the recession will be. According to IDC’s latest FERS data, 55% of enterprise tech buyers believe there will be a moderate recession that will last 6-9 months. But this sentiment varies by region:

- North American buyers tend to be most optimistic with one third anticipating a mild recession

- Asia Pacific buyers tend to be in the middle of road with 60% anticipating a moderate recession

- Western Europe buyers are most pessimistic with 30% anticipating a severe recession

Based on this current outlook, we have run a downside scenario for Worldwide IT Spending in 2023. In this scenario, IT spending is expected to grow 4% in 2023, compared to our current forecast of 6.3%. Our research shows buyers are not planning to make wholesale cuts across all tech categories. Rather they will be selective about where they cut.

We believe previous recession playbooks will not be as effective as technology increasingly becomes sold and delivered “as a service” and used to drive digital business models.

In the past, the playbook consisted of 3 key maneuvers:

- Delay capital expenditures by extended PC and infrastructure upgrades

- Cut labor costs, especially contract staff

- Delay the launch of new IT projects by a year

Why won’t these maneuvers have the same impact in an “as a service” and digital economy?

- While enterprise will delay capital expenditures, it will not have as much of an impact as more of the IT budget is made up of operating expenses via “as a service” contracts. In fact, a recession could drive organizations towards more OPEX-based infrastructure expenditures sooner than they had planned, as they seek alternatives to potential CAPEX budget cuts.

- Organizations are less likely to cut labor as there continues to be a skills shortage, especially around security and digital skills. Our research shows 42% of organizations increased their use of contract labor to address shortages in labor.

- Delay the launch of new IT projects by a year. As technology is more closely tied to digital business goals like new revenue streams, organizations will only cut those projects with the lowest business impact. For example, a manufacturer may keep their connected products project because it is tied to 2023 revenue stream. But they may delay a project to experiment with the metaverse in their augmented maintenance program because the business impact is not clearly defined.

What tech suppliers can expect in 2023:

- Enterprises will increasingly set up and utilize IT FinOps teams to optimize cloud spend. According to our Cloud Pulse survey, 2/3rds of organizations report they are overspending on cloud by 30% or more.

- They will renegotiate XaaS contracts to embed price certainty. For example, they may negotiate a 4-year contract, as opposed to 3 years, to lock in the price or the price increase.

- They will eliminate SaaS tools that provide redundant functionality. For example, if they have both Zoom and Teams, they may eliminate one.

- They will reprioritize their open projects with the lens of short-term business impact.

Don’t miss similar blogs, where we discuss the recession on tech markets, planning and how to scale digital business.

Related Reading:

- Technology Strategy Research and Insights: Ms. Whalen’s international team of 1,100 analysts leverage research and advisory services to empower business transformation for the Global 2000, and counsel technology suppliers on creating effective offerings for the digital economy. Meredith Whalen (idc.com)

- IDC’s Guide to market sizing in an overheated economy: Download our free guide to help you build a resilient strategic plan that helps you respond faster to change.