Business leaders are increasingly focused on technology to thrive, so much so that “technology” is the word of the year for CEOs in 2022. But beyond words, we’re seeing deliberate action being taken by CEOs to create a vision and strategy for the digital business era and to create new value. Insights from IDC’s 2022 Worldwide CEO Survey, a flagship study of 389 top executives from around the globe, will help tech vendors understand the priorities, investments and key success factors of CEOs in 2022, and will be discussed in an upcoming webinar.

The study reveals that CEOs have 5 key priorities in the context of the digital-first world.

1. Building New Skills to Lead Digital-First: Every CEO Must Become a “Tech CEO”

As CEOs look ahead to build the sustainable digital business, a new set of skills will need to be developed. Our global survey revealed that CEOs have a juggling act in terms of skills needed to lead the organization going forward. Traditional CEO skillsets are being displaced because of changing market dynamics and internal organizational needs. When asked about skills critical to CEO success, “digital know-how” topped the overall list, just ahead of business strategy acumen and people leadership. This reflects the recognition in the c-suite of technology as a way to compete. However, in the CEO role, the “know-how” is not about the bits and bytes, rather it’s about developing the digital vision and strategy, and executing on that strategy, in an informed way, with the right teams and technologies in place.

2. Balancing Technology Spending to Thrive… with Cost Management

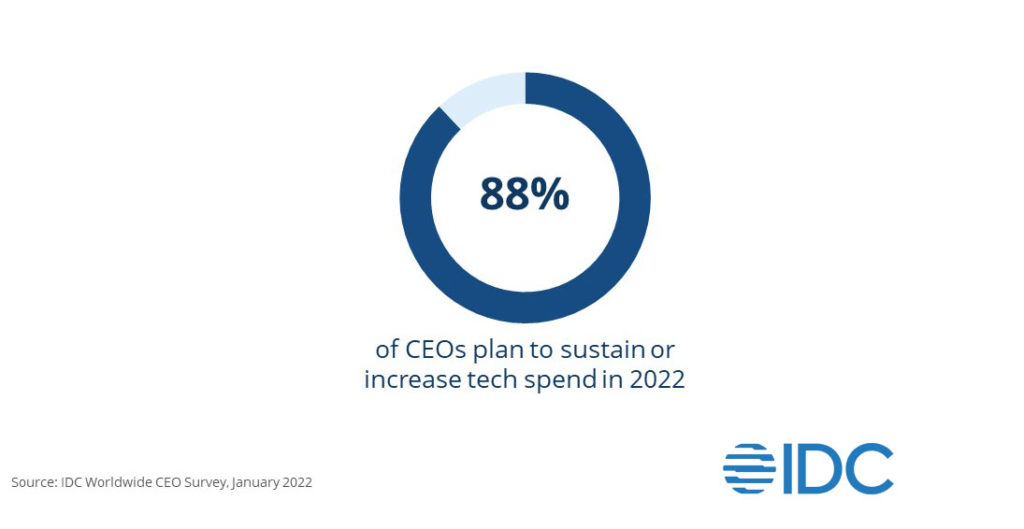

CEOs told us loud and clear that technology spending continues: 88% of CEOs are planning to sustain or increase tech spend according to our global survey.

The investment in new technology has ramped up to meet the accelerated demand for digital capabilities, particularly over the past two years. And CEOs are optimistic about future digital revenue streams, as the average proportion of revenue from digital products, services and experiences is projected to increase 11 percentage points from 2022 to 2027.

Digital is a major part of our strategy. We are going to be investing approximately €1 billion over the next five years, approximately 200 million per year in digital.

Miguel Stilwell D’ Andrade, Chief Executive Officer, EDP

With the big bets being placed now on digital, the focus on financial returns will intensify particularly with inflation clouding the picture. This is putting increased pressure on cost management. One line item getting attention is workplace technology enhancements, as 47% of CEOs indicated they are planning to reduce spending in this area.

3. Managing an Ever-Evolving Set of Risks

What keeps CEOs up at night? When asked what political, social, and economic risks CEOs expected would have the greatest impact on their business in 2022 and in 2024, topping the list for both years was cybersecurity threats & regulations. This comes as no surprise given the rising threat levels and frequency of attacks experienced by businesses over the past couple of years. What’s more concerning to all businesses and governments is the increasing degree and frequency of cyber threats arising since the beginning of the Russia-Ukraine conflict. That was emphasized on March 21st, when The White House Briefing Room of the U.S. Government released to the business community an urgently worded fact sheet entitled “Act Now to Protect Against Potential Cyberattacks”. This came on the same day that the European Commission proposed new rules to boost cybersecurity and information security in EU institutions, bodies, offices and agencies. Despite concerns about high levels of spend, our survey showed that CEOs are not likely to reduce expenditures on security. An issue adjacent to cybersecurity is digital sovereignty, which tied for top spot with cybersecurity threats when IDC asked CEOs about board priorities. Moreover, addressing new data sharing and compliance regimes was also a rising risk for CEOs looking ahead to 2024. The viewpoints on risk, particularly digital sovereignty, varied by region around the globe. It’s clear that balancing revenue generation and risk linked to tech investments is top of mind for CEO… and will have implications for tech suppliers. This balancing act needs to be managed very carefully.

4. Developing the Technology Leadership Function

It is the time for technology leadership – and more specifically the CIO – to shine. CEOs are increasingly seeing the importance of having the right technology leadership to succeed in a digital-first world. In fact, 89% see it as ‘absolutely critical’ or ‘very important’ to have the right technology leader in place to drive digital transformation in 2022. The CEO needs to develop a more direct relationship with the technology leader. IDC believes this role should have a seat at the leadership table. Although there is a current leaning towards having the CIO focus on risk management to deliver digital resiliency, over the next two years CEOs are expecting that CIOs will focus more business outcomes, agility and delivering new revenue streams.

55% of CEOs believe that it’s very important or critical to restructure their IT organizations in 2022.

IDC 2022 Worldwide CEO Survey

With that change, technology architectures need to evolve from focusing on managing IT, to building tech capabilities with a more external focus, that drives new value for the enterprise. IDC’s view is that CIO metrics should be updated accordingly.

5. Establishing New Engagement Models with Tech Vendors

As CEOs within enterprises develop new mandates, new skills and new teams, this will have a corresponding effect on their technology vendor relationships. CEOs will need to complement the skills of the CIO and team and look outward for guidance, resources, experience – and the ability to scale – in the digital-first world. This becomes an opportunity for vendors to play a trusted advisor role as nearly 1 in 2 CEOs need help building out a digital-first strategy. For vendors, this is the time to capture mindshare with CEOs. They are mapping out their new digital business strategies in a post-pandemic world – new ideas and insights are likely to be welcome today. Business outcomes and value will be the differentiators as technology vendors look to drive visibility and relevance with the CEO.

Learn More: Attend IDC’s Webinar on April 28th

Join IDC’s Phil Carter and Tony Olvet as they dig deeper into IDC’s Worldwide CEO Survey findings and share highlights of innovative digital-first case studies from around the globe.