Overall consumer tech spending rose 10% in July up from June and well ahead of July 2020 – according to IDC’s Consumer Tech Purchase Index survey. The growth was propelled by an increase of 17% in devices spend month-over-month. Keep reading for more on this important finding.

Drivers of July’s Growth

While growth in device spending propelled the July result, tech-enabled services sustained their continued strong performance after a very strong first half of 2021. Although consumer expenditures grew just 1% from June, they are up 5% in the year-over-year comparison.

It’s important to point out that results are not uniform across the devices and services categories. For example, on the devices side of the house, consumer spending on tablets and smartphones is up sharply in the year-over-year, same-month (July) comparisons. Self-reported spending on personal computers, on the other hand, is down in that same comparison. On the services side of the house, bundled services are down from last year while standalone services are up.

Much Awaited News – A Sigh of Relief for Now!

The resiliency of consumer tech spending in the face of resumed expenditures on other categories is welcome news to tech companies who have been on pins and needles wondering what would happen as consumers seek a return to normalcy. Many have been wondering out loud “What will happen?” After posting record Q2 profits, a number of tech companies recently managed investors’ forward-looking expectations downward, fearing a cliff, of sorts.

Has the Base Level of Consumer Tech Spending Changed?

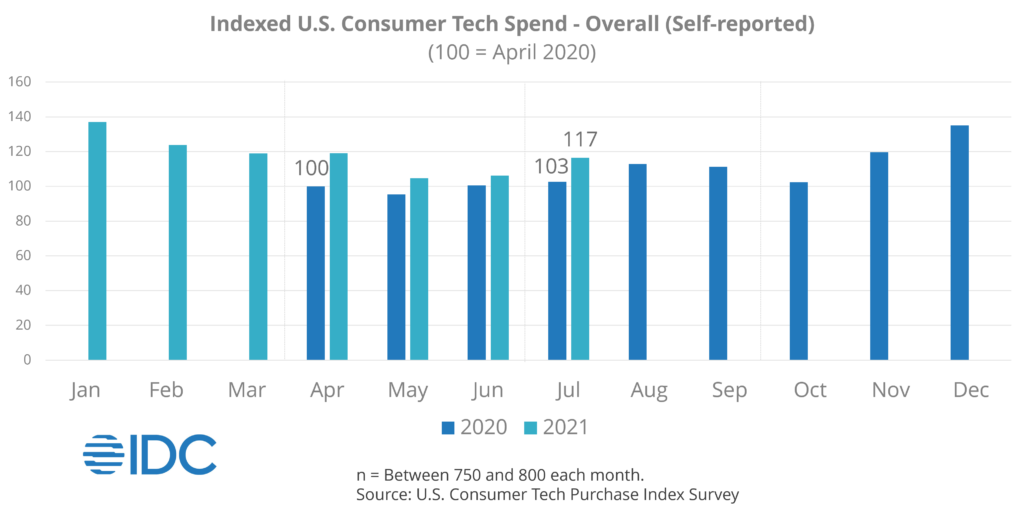

Overall consumer tech expenditures clocked in at an index of 117, or seventeen percent higher than the April 2020 benchmark, and 14% ahead of July last year.

Perhaps most importantly, July was the fourth straight month in which overall spend outperformed the matching month from pandemic-propelled 2020. Given the consistency of this pattern, it could indeed indicate that the increased level of engagement with the tech category has taken spend to a new base level.

However, it’s too early to make that affirmation; more data is needed and for a longer period. However, this possibility is reinforced by the fact that the spending increase is broad-based, up across all income groups. The one exception is among households making $150,000 or more, but they are a small portion of consumers.

Resumption of Non-Tech Expenditures Has Not Threated Tech – At Least Not Yet

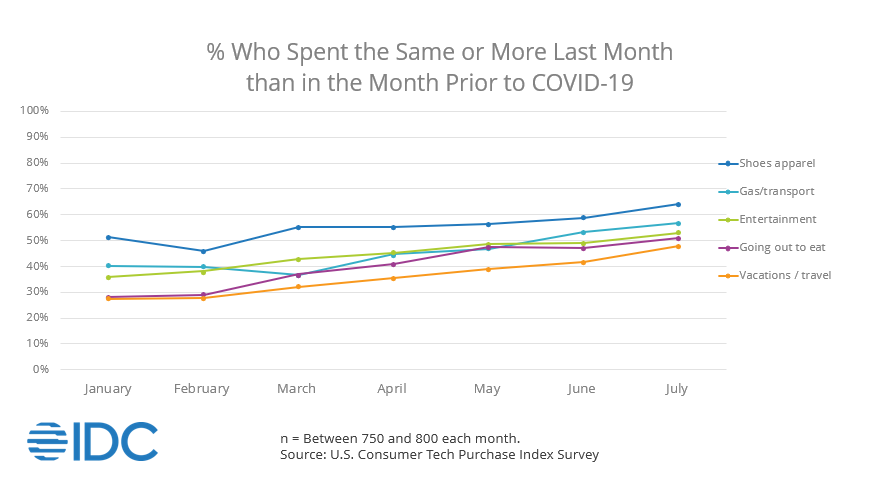

A cataclysmic drop-off in consumer tech spending does not appear imminent, even though consumers continue to ramp up expenditures on other non-tech categories, particularly services. This ramp-up has proven gradual so far, with little to indicate that it is directly impacting consumer tech spend.

It’s worth pointing out that, for each category, only 45% to 65% of people report having returned to their pre-COVID level of expenditure. This means that more spend will be coming.

But it also suggests that some consumers may not go back to the same level of spending – or may take quite some time to do so. As an example, take spending on gasoline/transportation. To the degree that companies adopt hybrid work policies or continue to let employees work from home, it is likely that this spend will not fully return to its prior level. For a portion of the population highly concerned with their health, reduced frequency of going out to eat or to entertainment venues, relative to pre-COVID, is also a real possibility.

To the degree that consumers do not resume non-tech spending all at once to prior levels, it preserves space for tech-spending, fortifying consumers’ habits and involvement with the category. It will be important to continue to monitor the pace of non-tech spending and the changing level of available disposable income.

Consumer Savings is Falling, Returning to Pre-COVID Levels

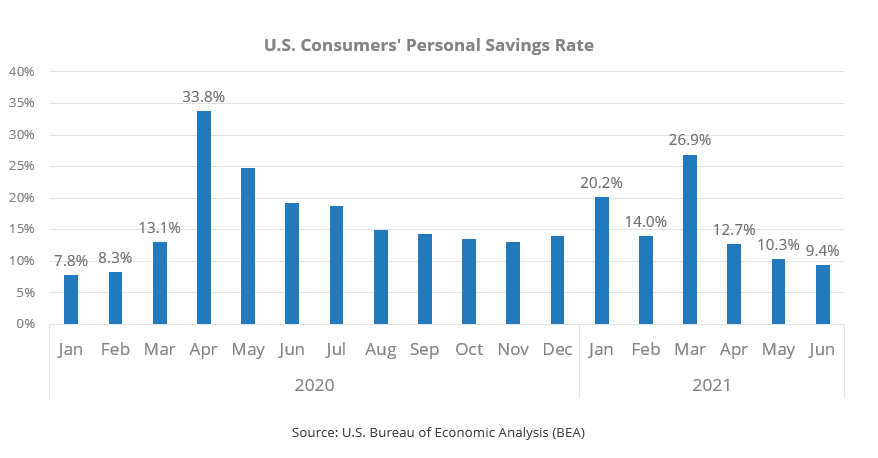

Savings is unspent disposable income. In June, the U.S. Bureau of Economic Analysis (BEA) reported that the personal savings rate has continued to drop, down from its most recent peak (March 2021), when the final wave of stimulus was issued. It’s reasonable to expect that it will settle at levels comparable to pre-COVID (around eight percent).

This is extremely salient, because it represents an important change from the pandemic period in which consumers (as a whole) had more money on their hands. Consumers may feel increasing pressure to choose between tech and other things, reinforcing the importance of monitoring the return of spend in other categories. The fact that consumer tech spend has remained strong so far – while the savings rate has continued to normalize – bodes well for tech spending. The next few months will be telling.

What about the Delta Variant?

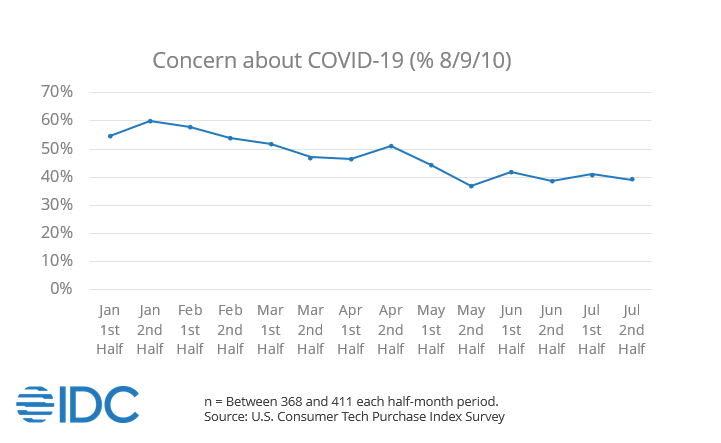

News of the Delta variant has been in the marketplace for some time, with reports of growing numbers of cases and hospitalizations. Despite this, consumer concern about COVID-19 dropped from January to the end of May and has been stable throughout June and July, even looking at the second half of July. We will be keeping a close eye on the August results.

To What Degree Has Life Returned to “Normal?”

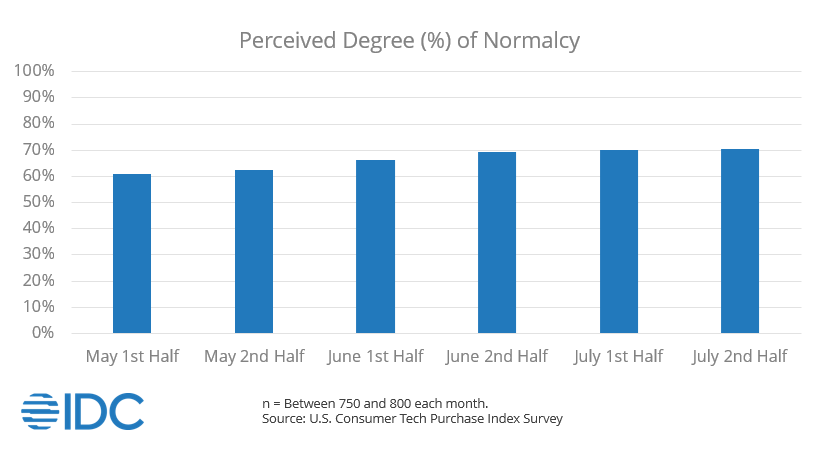

Asked directly, on average, consumers say life has returned to about 70% normal. Consumer sentiment sustained at this level throughout the second half of June and all of July, even with the growing news cycle around the Delta variant.

Vaccine Reluctance Means COVID-19 Will Likely Remain Part of “New Normal”

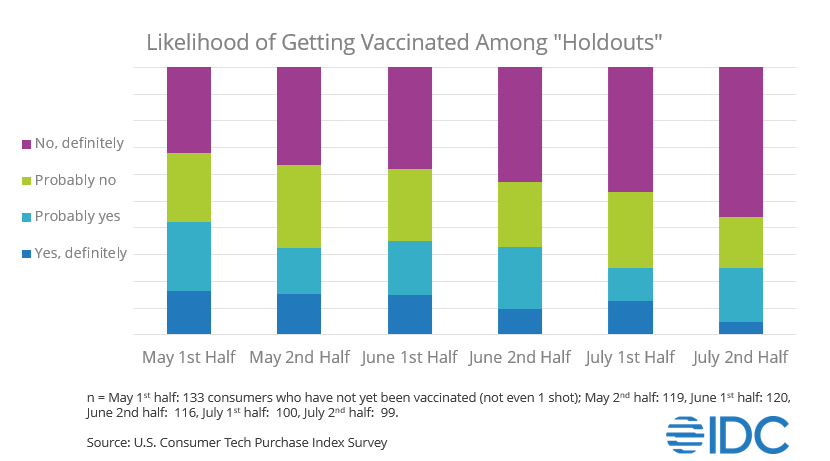

Data from the highly respected Mayo Clinic shows that 60.4% of the U.S. population had received at least one dose of a COVID-19 vaccine as of August 19th. This is progress from June 21st when it was 53.6%.

However, our data shows that the remaining group of unvaccinated consumers is increasingly made up of those entrenched against getting the vaccine. To the degree that this holds back the arrival at herd immunity, it ensures that COVID-19 and its variants will remain part of our day-to-day lives, further reinforcing consumers’ need for technology.

Key Takeaways & Actionability for Product Developers, Marketers & Strategists

- Consumer tech spending has proven very resilient and is unlikely to “fall of a cliff” over the next few months.

- It’s too early to tell if this will be a “new water level,” but the signs so far are promising.

- We will be closely watching the pace and level of consumer spending on non-tech categories and whether this begins to impact consumer tech spending.

- Given the current environment, we will likely see very strong tech expenditures for the August/September back-to-school season and for tech spending as a whole.

- With the year-end holiday season just months after that, it is important to be prepared for continued strong spend (although an October lull would fit last year’s pattern).

- Given continued vaccine resistance and the ongoing presence of COVID-19 as part of the “new normal,” brands must continue to exercise the “muscles” they developed during the height of the pandemic (ex. contactless purchase, etc.).

- Recognize that different consumers have different expectations given their view on COVID-19 and the associated risks.

- An omni-channel approach which gives consumers choices about how they buy and whether they go into a store is important.

IDC’s Consumer Technology Strategy Service (CTSS) utilizes a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes measuring brand trust and helping companies to understand how to cultivate it.

In addition to my syndicated service, I work closely with clients on custom research projects and consulting. Find out more here: