According to new consumer research from IDC, 2020 growth in self-reported consumer tech spend was highest among those who under-invested or lagged in technology adoption previously relative to their peers. Companies that understand this will find more success, rather than targeting just the usual suspects.

High-Paced Change

2020 was a year of fascinating change in the tech space as COVID-19 catalyzed a perfect storm of events that benefitted tech at every turn, driving an overall increase of 12% in self-reported consumer spending. In a year of such accelerated change, marketers, product planners, strategists, ad agencies, and analysts have been agile, working overtime to keep pace and understand what’s going on below the surface.

As the Dust Settles a Clearer Picture of the Impact Emerges

Fortunately, not everything is tactical and urgent. Tried and true methodologies with robust sampling provide robust measurement which make clear the impact of all that happened in 2020.

We can clearly see the impact of digital transformation at work in the 2020 results from IDC’s Consumer Tech Landscape Survey. Over 3,000 U.S. consumers were interviewed in December about the devices and tech-enabled services purchased and used by their households.

While spend increased broadly, growth rates varied widely by demographics, including generational cohorts. Growth was highest among those who under-invested or lagged in technology adoption previously relative to their peers.

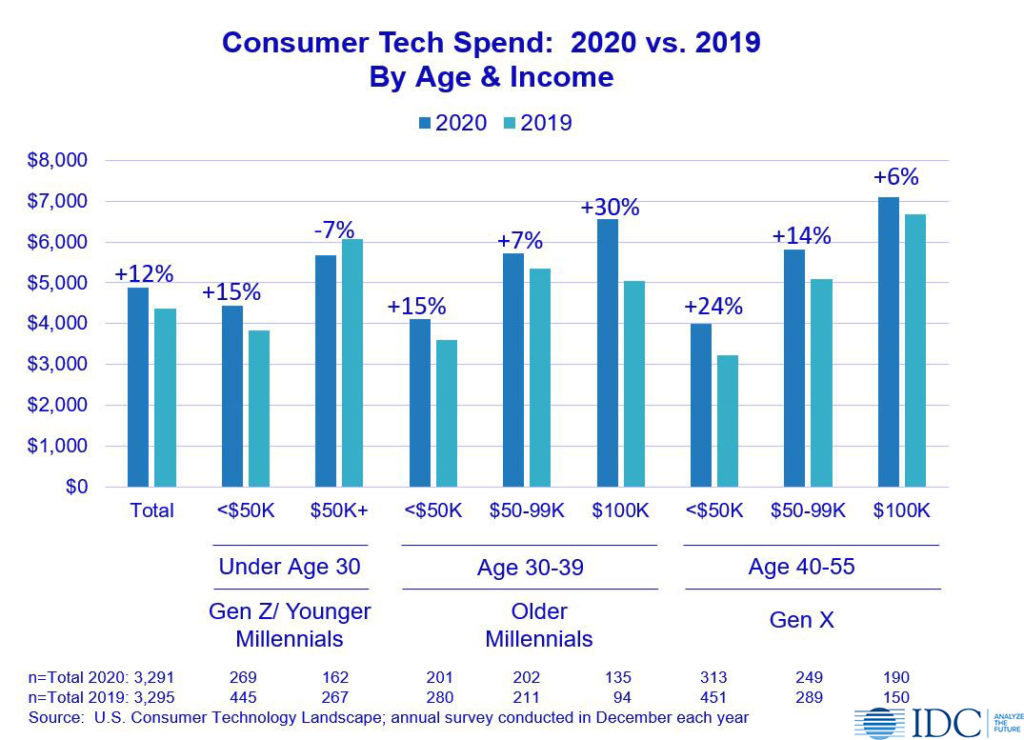

You can see this in the chart below. Sure, Older Millennials with incomes of $100K+ had the highest growth rate at 30%, even though they had a high level of spend in 2019. They are the exception. The more common pattern for these three generational cohorts is this: growth was highest among those earning $50K or less. These consumers spent less in the past, including in 2019 and needed to spend comparatively more in 2020, as they responded to the circumstances surrounding COVID-19.

Those with higher incomes did not feel the need to expand their spending much, with some even pulling back on their level of spend.

A Similar Pattern Plays Out with Seniors

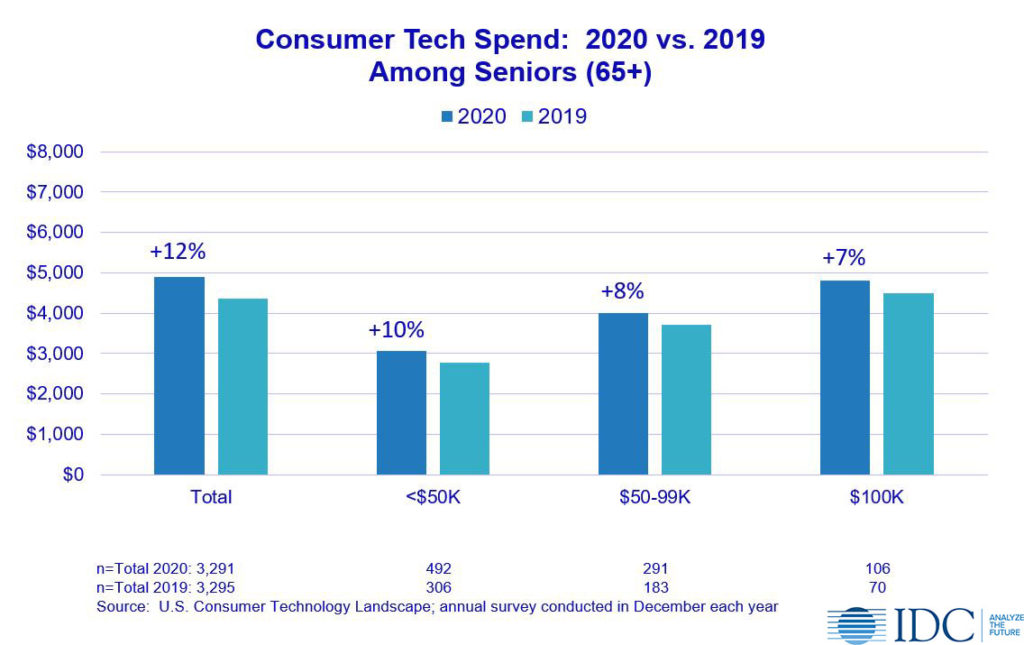

Interestingly, a similar pattern is seen with those 65 and older, though less pronounced. While seniors spend comparatively less than other cohorts, the same principle applies, with those earning less than $50K increasing their spending at a faster clip than those with higher incomes.

Very Different Dynamics Among a Portion of Boomers

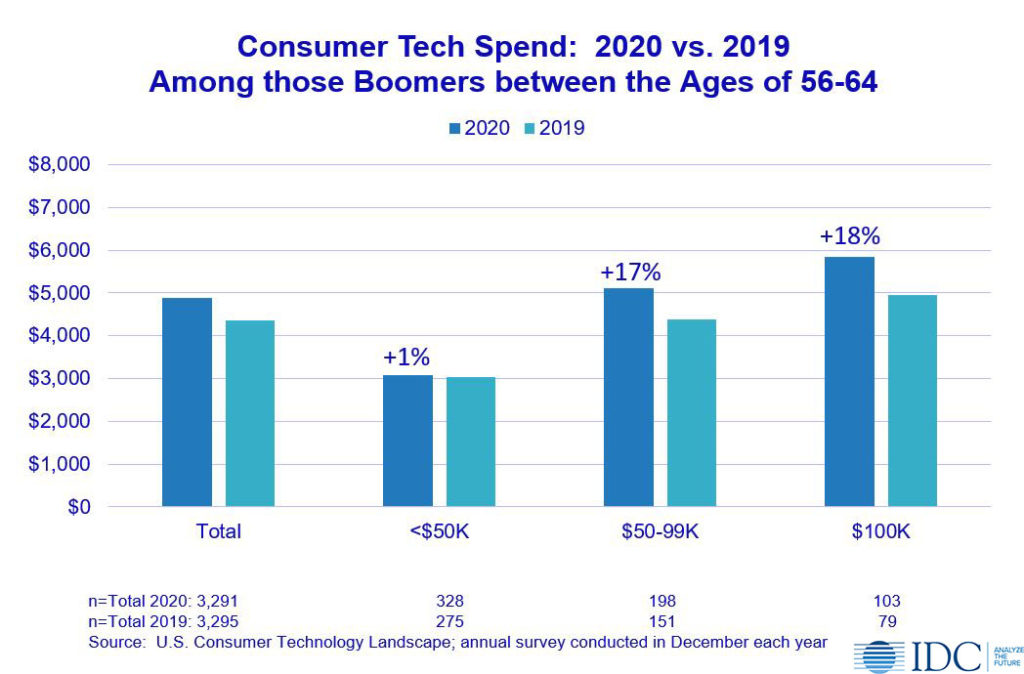

The trend among those in the last ten years before retirement is starkly different. Here, those with incomes under $50K did not budge on their tech spend, with a lack of disposable income the most likely cause. Similar-aged consumers with higher incomes had high double digit growth rates, reflecting their intensified sense of need for new tech amid the pandemic.

Those with Incomes Under $75K Drove Growth in Service Spend

Spending on services increased just 3% over 2019. This growth was not evenly distributed. Those with incomes of $75K increased spend almost twice that. Those with higher incomes merely maintained their spend, while those with incomes above $150K actually pulled back their service spend by 3%.

Key Takeaways & Actionability for Product Developers, Marketers & Strategists

- Digital transformation catalyzed the highest growth rates in spend among those with incomes of <$50K who had spent less than their peers in the past and felt a more pressing need to spend on tech with the pandemic.

- It is important to understand this group’s potential, not just focus on high-income, tech-savvy individuals.

- Less experienced and category involved than their peers, they need information to help them in the purchase process.

- Consumer reviews, expert reviews, online chat advisors, and in-store personnel are likely to be seen as reliable sources and should be cultivated by marketers.

- If implemented, a new stimulus plan is likely to continue to fuel this kind of “catch-up” spend, turning this group of consumers into an even more valuable target.

- Device makers and service providers would do well to be prepared for this, with appropriately featured and priced offerings.

- Accessories, warranties, set-up and installation all offer upsell opportunities for this target.

IDC’s Consumer Technology Strategy Service (CTSS) leverages a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes measuring brand trust and helping companies to understand how to cultivate it.

In addition to my syndicated service, I work closely with clients on custom research projects and consulting. Find out more here.