In today’s news cycle dominated by the pandemic, an important story is going untold. Flying largely under the radar is the fact that a segment of consumers is increasingly conscious of what their tech says about them. Read more to learn how this is driving tech spend and what it means for your brand.

Self-Reported Device Spend Rose 30% in 2020

U.S. consumer spending on devices rose sharply in 2020, up 30% from 2019, turbo-charged by the COVID-19 pandemic. We’re all familiar with the impact of work and school at home, the massive growth in gaming and streaming, and a host of other trends observed over the course of the year and what they will mean for 2021 and beyond.

Important Shift in Consumers’ Attitudes

Below the surface, we have noticed an important shift in consumers’ attitudes.

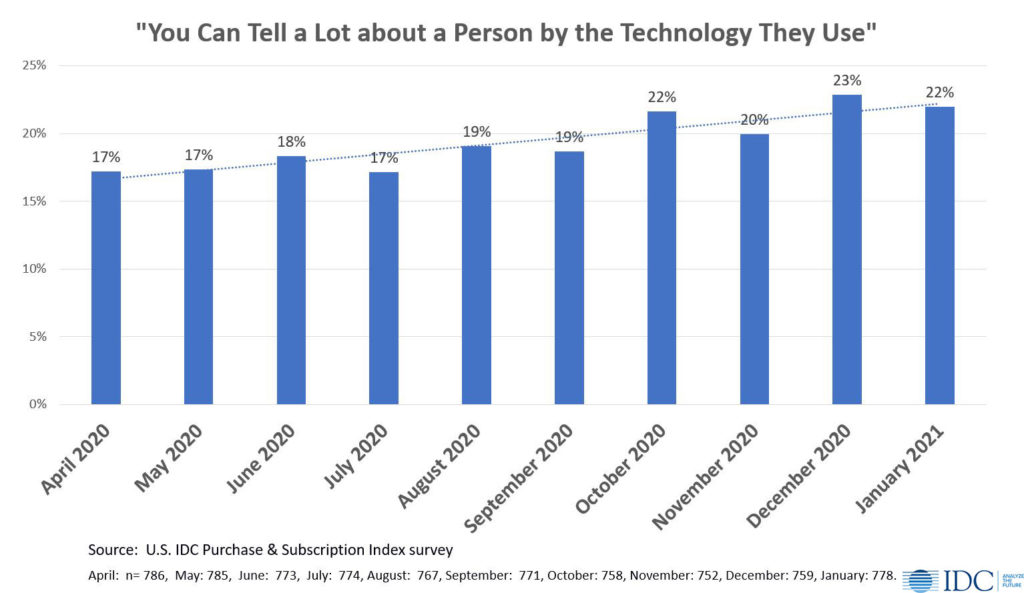

January research from IDC’s Consumer Tech Strategy Service shows consumers increasingly agree with the statement “You can tell a lot about a person by the technology they use.” This is very important, because consumers who agree with this statement embrace its social ramifications. They know that tech very much differentiates people, and they seek out the best tech for themselves – both for its usefulness and for the status and image it projects.

Who are These Social-Signaling Consumers?

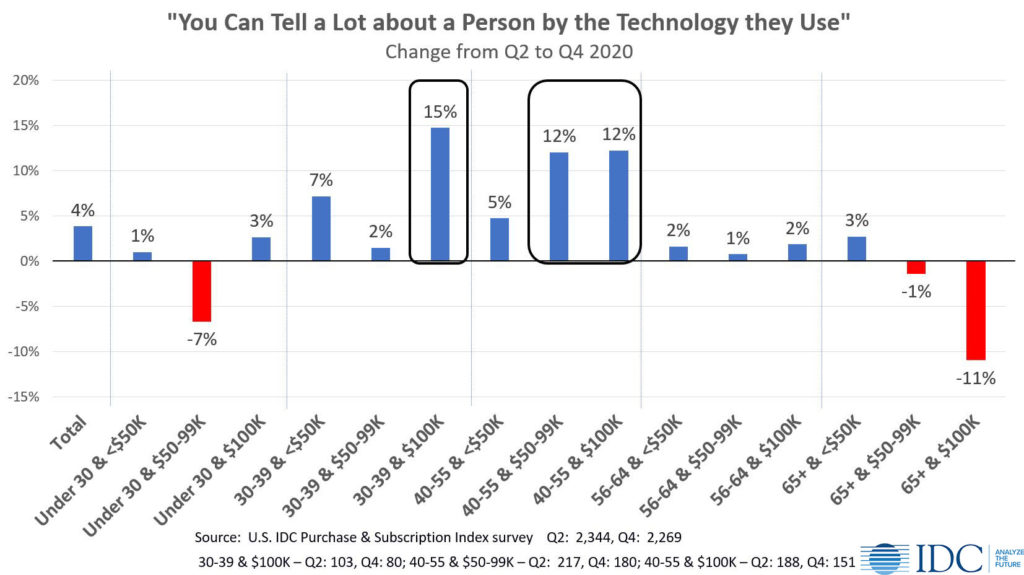

The biggest shifts in this attitude are found among those ages 30-39 with incomes above $100K and those ages 40-55, whether middle or high income. They want to be associated with the latest, greatest tech, unlike others with a similar demographic profile.

Within these groups, particularly the 40-55 age group, there are stark differences in the level of adoption of technology between one consumer and another. No doubt consumers noticed these differences as they became even more prominent over the past several months, brought to light as people reacted to the pandemic, some thriving with technology, some lagging far behind.

This group of social-signaling consumers already embraced technology before the pandemic and has further intensified its usage as a result, with corresponding impact on their tech spend. The lack of change in most young people’s attitudes is best explained by the fact that tech is more universally embraced among those under 30, producing less noticeable differences from one consumer to the next.

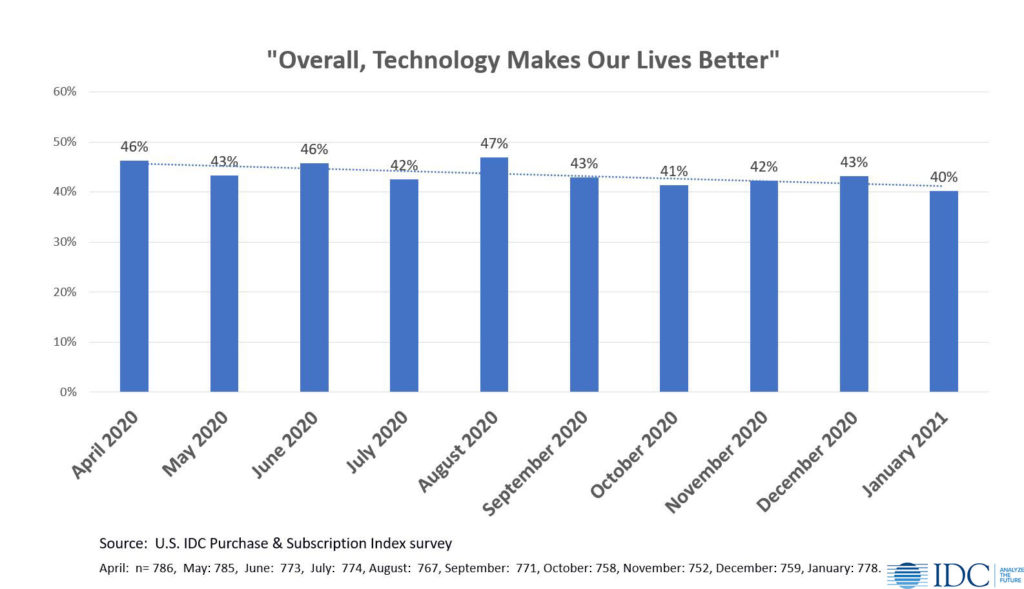

This self-expressive group stands out for its unwavering belief in technology’s benefit. The two groups of consumers with incomes above $100K share an increasing belief that “overall, technology makes our lives better.” This is in sharp contrast to the total market. Overall, consumers are less inclined to see tech as making life better, the combined impact of pandemic fatigue and being forced to use tech so much of the time – the longing for a return to normalcy that we all feel.

Empathy is Embracing the Consumer’s View and Needs – Including Signaling

At IDC, we are strong advocates of empathy at scale, making sure that every arm of an organization has a keen understanding of consumers’ experience, through their eyes and mindset. In a world where technology is so prominent and other forms of self-expression (ex. a stylish new car or the latest fashion in clothes, shoes, hairstyles, etc.) have shrunk in relevance, consumers are longing for a way to show their personality.

This need for self-expression explains the manicured lawns cultivated by so many this past summer and prominently displayed on social media. It also explains at least some of why both Samsung and Apple have seen the higher priced models of their latest phones do so well.

Key Takeaways & Actionability for Product Developers, Marketers & Strategists

- Consumers are longing for self-expression. Embrace this trend.

- This emotional connection can help drive purchases, even where consumers are suffering from an excess of screen time and tech fatigue.

- Although we’re in the middle of the pandemic, it’s okay to acknowledge consumers’ intangible needs and appeal to them.

- Consumers ages 30-55 with incomes of $100K+ are the best target.

- Make sure you include top-of-the line premium models in your line-up, as these make the strongest social statement.

- Provide more opportunities for personalization

- Ensure social media sharing from your site or app is easy so consumers can share in the moment

- Brand and consumer fit are important.

- This approach isn’t for every brand. Evaluate the appropriateness of such an approach for your brand and any possible fallout with other consumers before moving ahead.

- This approach isn’t for every brand. Evaluate the appropriateness of such an approach for your brand and any possible fallout with other consumers before moving ahead.

- It’s time to broaden the view of empathy.

- Empathy is not a tactical consideration whereby companies feign care and concern with what’s going on in consumers’ lives amidst a pandemic, only to move on to their next messaging topic.

- Companies that have empathy and demonstrate it do so out of an ongoing commitment to customer-centricity.

- Empathy is a company’s ability to understand and appreciate the consumer’s point of view and cater to it, meeting their needs (of all high kinds) through the products, services, and experience delivered.

- This includes understanding consumers’ need for social signaling and self-expression.

IDC’s Consumer Technology Strategy Service (CTSS) leverages a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes measuring brand trust and helping companies to understand how to cultivate it.

In addition to my syndicated service, I work closely with clients on custom research projects and consulting. Find out more here.