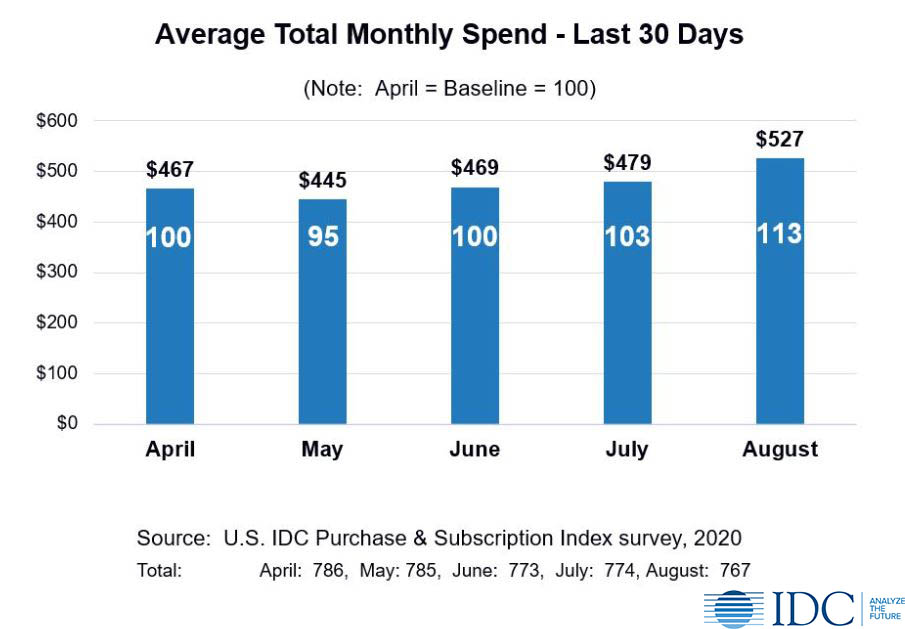

Despite the uncertainty expressed at the end of July, consumers’ self-reported tech spending expanded significantly according to August interviewing. In the latest round of results from IDC’s Consumer Purchase & Subscription Index survey, consumer tech spending blew past the April benchmark as COVID-19 concern stabilized and optimism won out.

Devices Spend Showed Big Growth, Services Also Gained

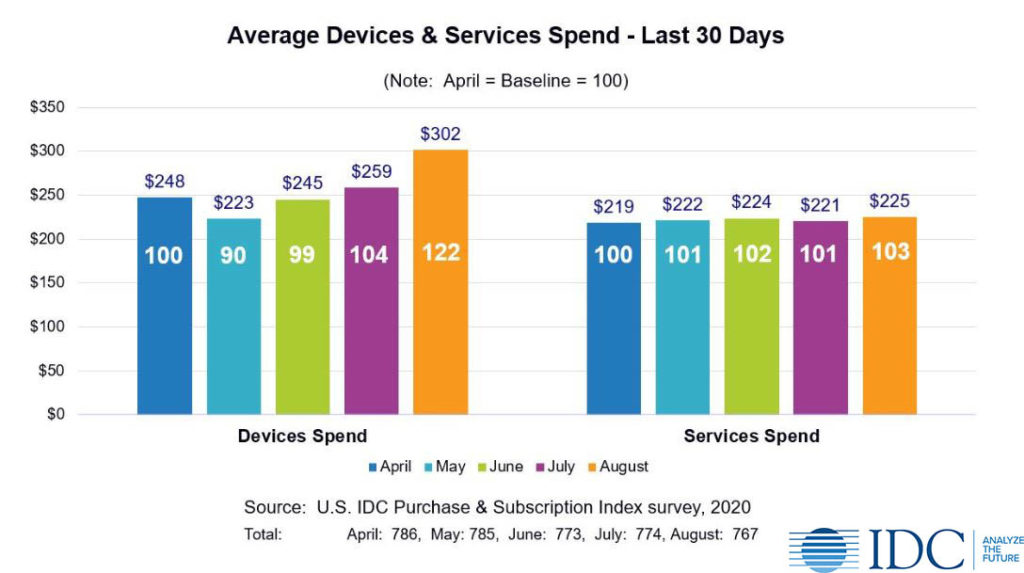

Once again, consumer spend on devices led the way as respondents reported a 17% increase in their device expenditures, up 22% over the April baseline. Outlays with services rose 2%.

Most devices saw gains, with video game consoles, phone accessories, and PCs/tablets as particularly strong performers. Though down slightly month over month, smart home expenditures remain at a high level (28% above the April baseline) with strong spend across almost all smart home sub-categories. Smart TVs are the most notable exception.

Mobile phones are a new bright spot as consumers reported spending more than they spent in April – the first time this has occurred. No doubt, this will be welcome news as the year-end holiday season approaches and Apple and others prepare to launch their new phones.

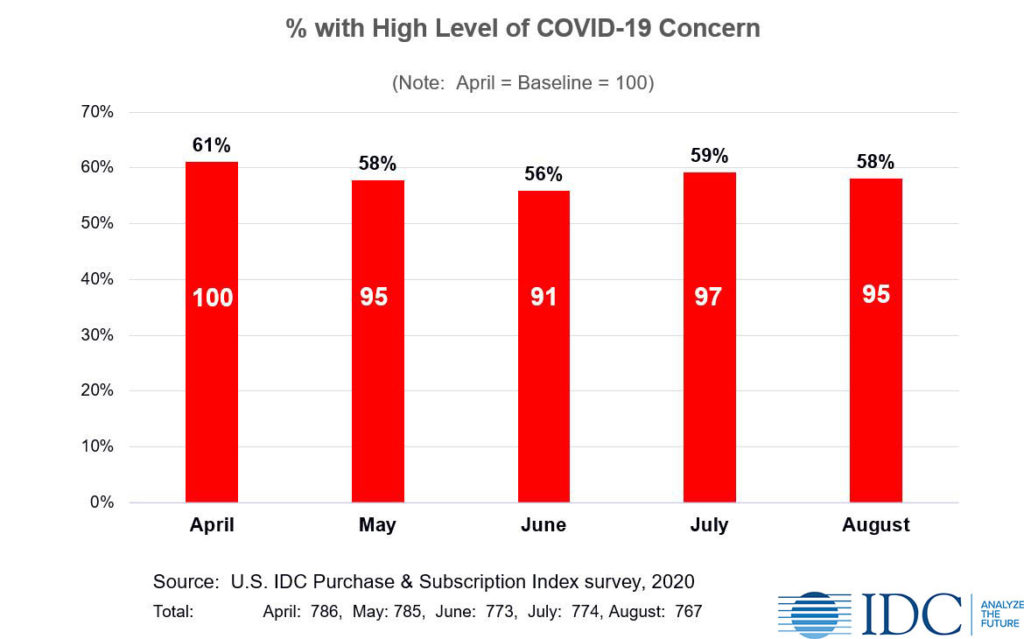

COVID-19 Concern Stabilized, Spending Optimism Returned

After jumping 3 points in July, COVID-19 concern stabilized. Consumers’ worst fears about the size and scale of COVID-19’s impact on their economic lives did not come to fruition.

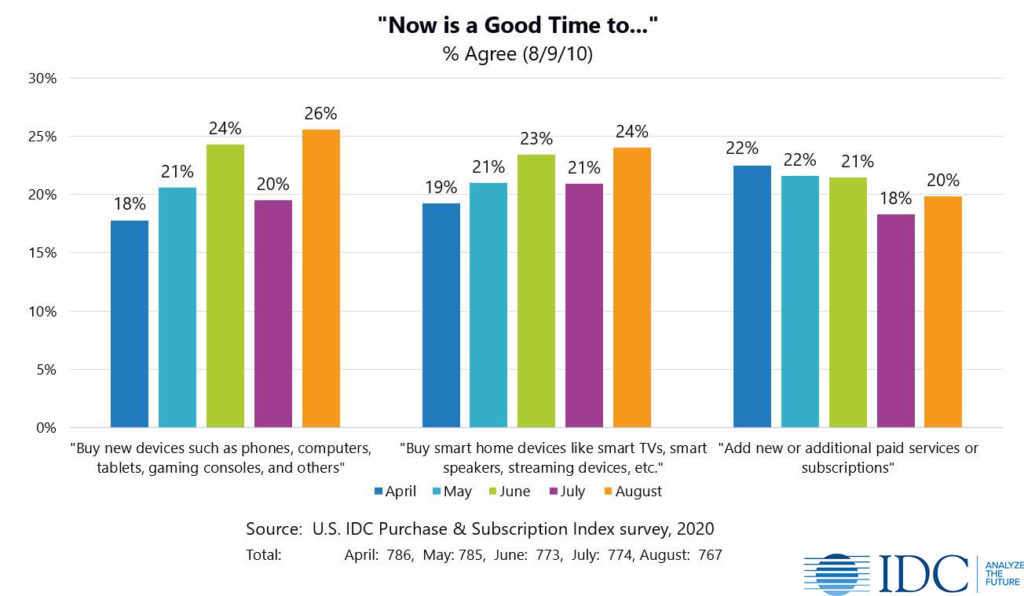

As a result, consumer optimism about the environment for spending on technology rebounded strongly after a sharp dip in July. The recovery in optimism was particularly robust for devices, where the level of agreement that “the time is ripe” now surpasses previous highs.

Less Job Loss, Wage Reduction, and Business Closings

As time has gone by, a smaller and smaller percentage of consumers mention new negative life events, also contributing to a more optimistic environment. In April, when COVID-19 hit with massive impact, massive job loss, reductions in pay and permanent or temporary business closings, nearly 1 in 4 households reported a negative life event like these. By August, this had fallen to 1 in 8.

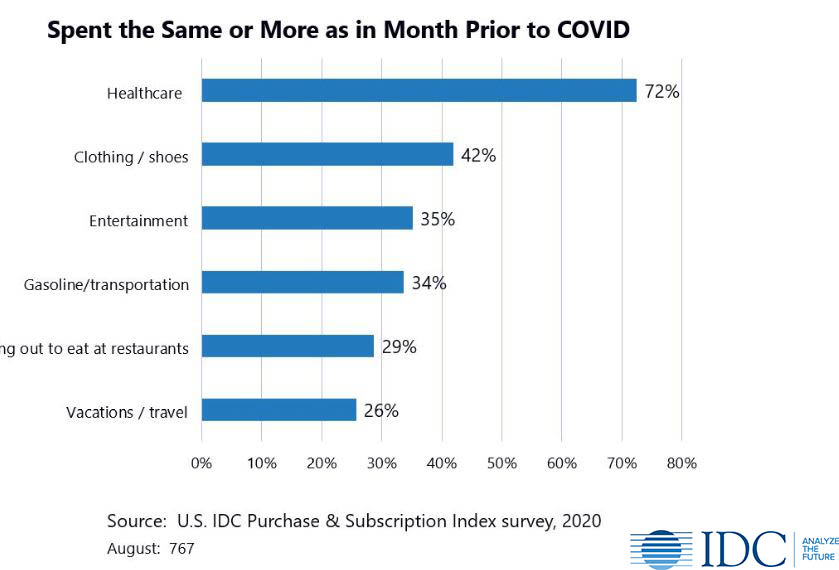

Consumer Spending on Other Categories has Not Returned to Normal

When asked about their expenditures in six significant categories, consumers only reported spending the same or more than pre-COVID-19 in one category – healthcare. In the other five, a large majority of consumers report spending less than they spent in the month prior to COVID-19’s onset.

This brings to life the reality that consumers generally have money to spend. July data released on August 28th by the U.S. Bureau of Economic Analysis (BEA) shows that the personal savings rate remains high at 17.8%, more than twice the level in February of this year (8.3%).

Looking Ahead

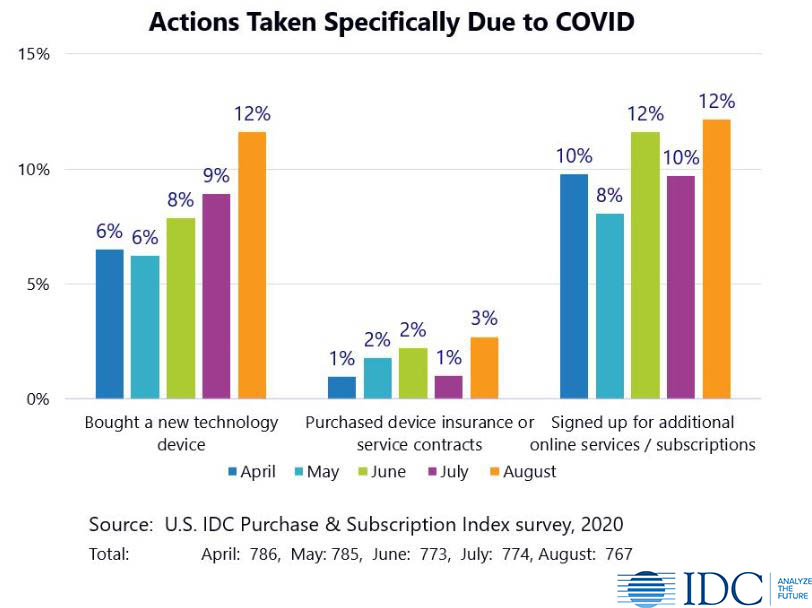

With COVID-19, consumers are using technology more than previously. While a tiny minority have backed away, the vast majority have not.

In fact, a growing percentage of consumers report COVID-19 has directly led them to purchase new devices, add services, or purchase device insurance or service contracts.

Key Takeaways & Actionability for Consumer Marketers

- Consumer tech spending continues to build momentum, as new devices remain the “go-to” choice.

- The level of sustained consumer demand and expenditure since April continues to impress.

- LOTS of uncertainty remains, with the presidential election at hand, social unrest still bubbling, and the ultimate impact of COVID-19 and its timing, still unclear.

- Hedge your bets upwards.

- Device manufacturers and marketers should embrace the current moment as a unique moment and situation in people’s lives and a unique opportunity to drive sales.

- Inventory matters, but so does customer experience.

- Just because demand is strong and some products are hard to find, that does not mean that customer experience does not matter.

- It does – and consumers will let you know if they are not happy by walking away and by telling others.

- Make a special effort to ensure that your online and offline marketing, sales, and fulfillment are seamlessly integrated.

- Map out the consumer journey, how they are feeling at each step, and their ideal outcome at each point along the way.

- Deliver on this. Doing so will enable you to build trust and make someone a customer for life.

- Map out the consumer journey, how they are feeling at each step, and their ideal outcome at each point along the way.

- Inventory matters, but so does customer experience.

- Consumer emotions and aspirations matter. Cater (don’t pander) to them. There are two sides to this.

- Most people are fatigued with COVID-19 and all that is going on.

- They could use something positive or light-hearted. Use your creativity to provide it.

- Many technology purchases are aspirational – part of consumers’ hopes and dreams.

- Whether it’s that smartphone they’ve always wanted to be able to afford, that cool new detachable tablet, or that massive TV – treat their purchase with the importance it has for them – not as a mere transaction.

- Tune your marketing messaging and sales process to this.

- Whether it’s that smartphone they’ve always wanted to be able to afford, that cool new detachable tablet, or that massive TV – treat their purchase with the importance it has for them – not as a mere transaction.

- Most people are fatigued with COVID-19 and all that is going on.

IDC’s Consumer Technology Strategy Service (CTSS) leverages a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes robust monthly data, timely insights, quarterly webinars, and ongoing analyst access.

In addition to my syndicated service, I work closely with client on custom research projects and consulting. Find out more: