Organizations rely on SaaS and SaaS applications to introduce new capabilities to the business, accelerate time to value, and efficiently provide mobile workers with ubiquitous access to applications and information. IDC recently completed its world-wide survey of 3000 SaaS buyers, spanning 14 countries and several dozen industries. This survey product, known as IDC’s SaaSPath, is designed to:

- Understand the Mind of the SaaS Buyer, including their wants, needs, fears, and priorities.

- Capture the SaaS Buyer Journey, including the processes, channels and metrics they use to make purchasing decisions.

- Evaluate the Performance and Reputation of SaaS Vendors, through extensive ratings of vendor effectiveness, advocacy, and customer loyalty by SaaS users around the world.

Insights from SaaSPath are used regularly in strategic planning and competitive intelligence groups at SaaS, PaaS, and IaaS vendors around the globe. Looking at this year’s SaaSPath results, 3 trends about SaaS applications rose to the top:

Organizations are Looking to SaaS to Enhance Business Processes

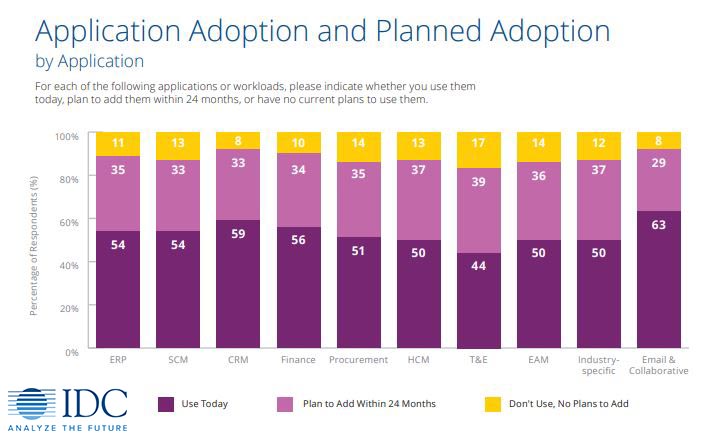

Enterprise organizations largely recognize the value that SaaS-based applications can bring into their organizations. It comes as no surprise that Email & Collaboration, a more mature business process, is the highest adopted.

Interestingly, Travel & Expense, while currently the lowest adopted application, has the highest rate of planned adoption, signaling how Digital Transformation (DX) is changing every facet of modern business, as employees take advantage of mobile devices and cloud-based applications to capture expense reports quickly and effortlessly.

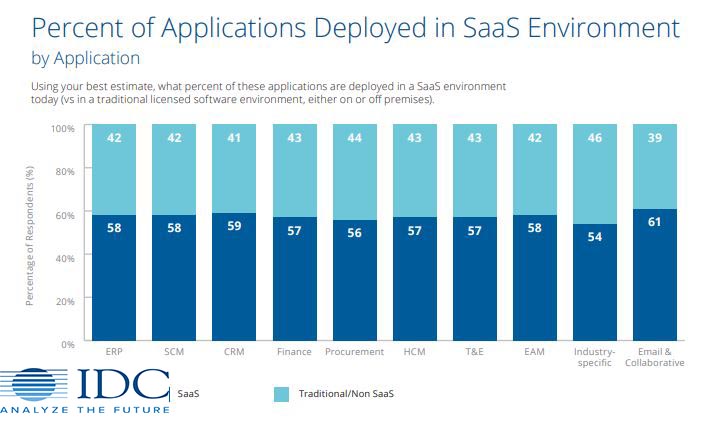

SaaS Deployment is Relatively Equal Across Applications

When it comes to deploying applications in SaaS environments, no one application type dominates. One trend of note is that repatriates in general have a smaller percentage of applications deployed as SaaS than non-repatriates do. For example, ERP deployment rates for repatriates skew 55% SaaS to 64% non-SaaS/traditional.

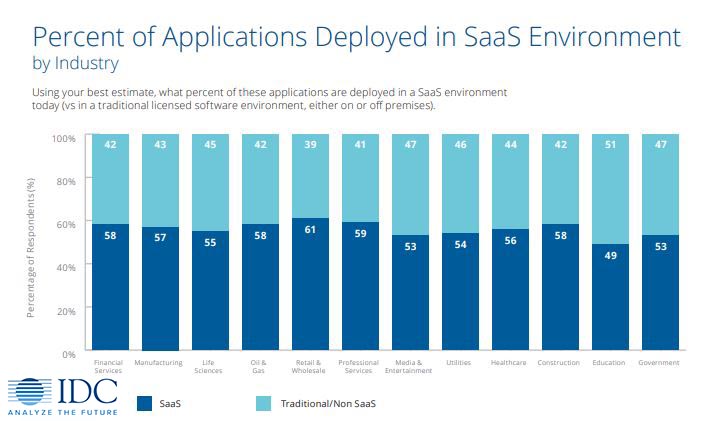

SaaS Deployment by Industry Varies

While SaaS deployments may not vary widely by application, they do differ when measured in terms of industry. Retail and Wholesale leads in SaaS deployment, taking advantage of cloud-based technologies to connect supply chains and dispersed workforces. Education lags behind other industries; privacy concerns and budget are factors to consider.

SaaS applications represent a lucrative but competitive market. Vendors need to understand what SaaS buyers are looking for – and looking to avoid – in their SaaS applications to differentiate from the competition. Learn what factors SaaS buyers consider their biggest obstacles to purchasing in IDC’s eBook, “The 5 Factors that Scare Away SaaS Buyers”.