Privacy concerns have begun to drive consumers’ tech brand choices, becoming an increasingly mainstream consideration. What’s more, a “Privacy First” segment is emerging, with important implications for marketers, product developers, and strategists, according to IDC’s U.S. Consumer Privacy study, conducted in September.

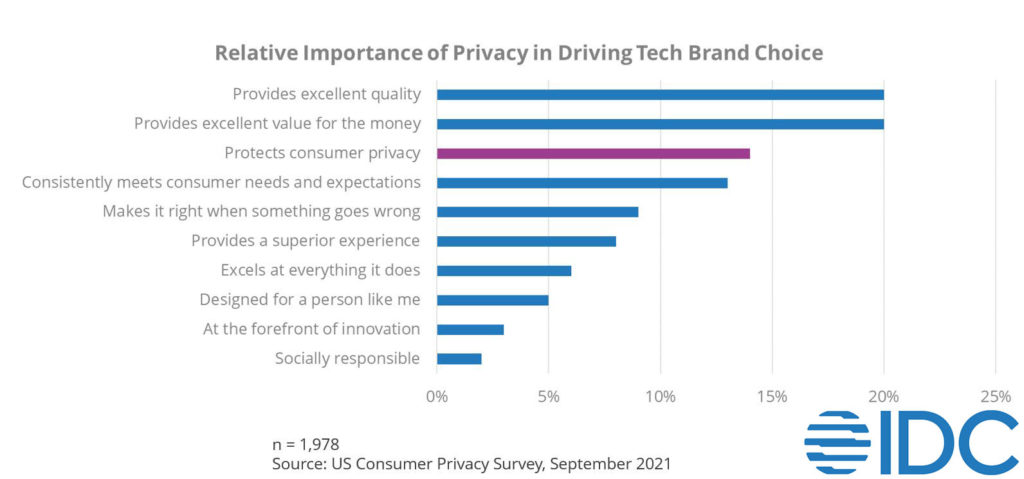

Privacy is an Increasingly Important Driver of Brand Choice

Privacy ranks highly, trailing only quality and value as key drivers as privacy attitudes intensify across the marketplace. Methodologically, this result is the product of a series of trade-offs, not a rating or ranking exercise. That means that it much more closely approximates the real-life choices people are faced to make in their daily lives.

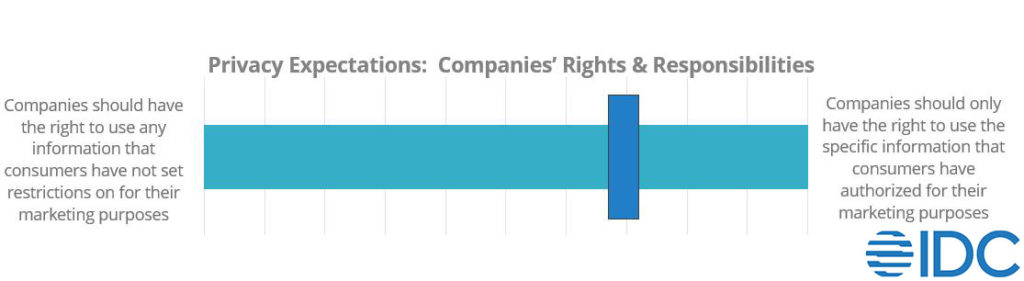

Consumers Believe the Onus for Privacy Should be on Companies

Overall, consumers say the onus should be on companies to respect and protect their privacy. Among other things, this means the “default” position should be that companies only use the info consumers explicitly authorized for the company’s use – not the other way around (i.e. not that companies should be able to use all data except that which consumers have prohibited).

Two types of data are comparatively less concerning for consumers:

- information about their purchase habits

- their affiliation with different organizations

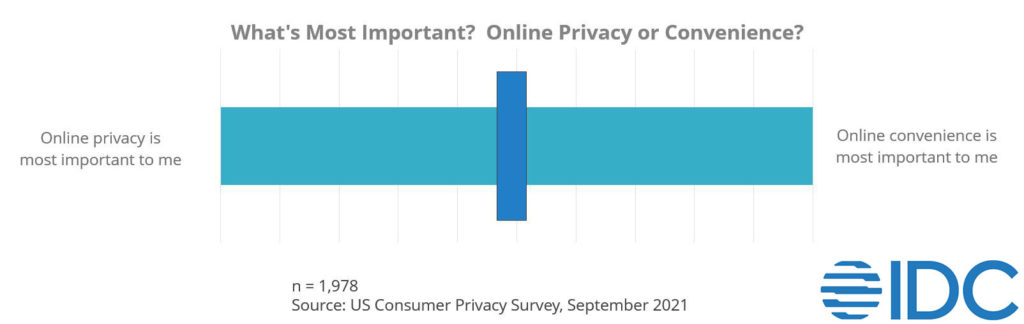

Consumers are Torn By the Trade-off Between Privacy & Convenience

When asked to directly choose between online privacy and convenience, consumers are clearly torn – stuck in the middle, unable to choose one or the other. Results couldn’t be clearer. Consumers want both. Companies that get this message and help consumers get “the best of both worlds” will be rewarded.

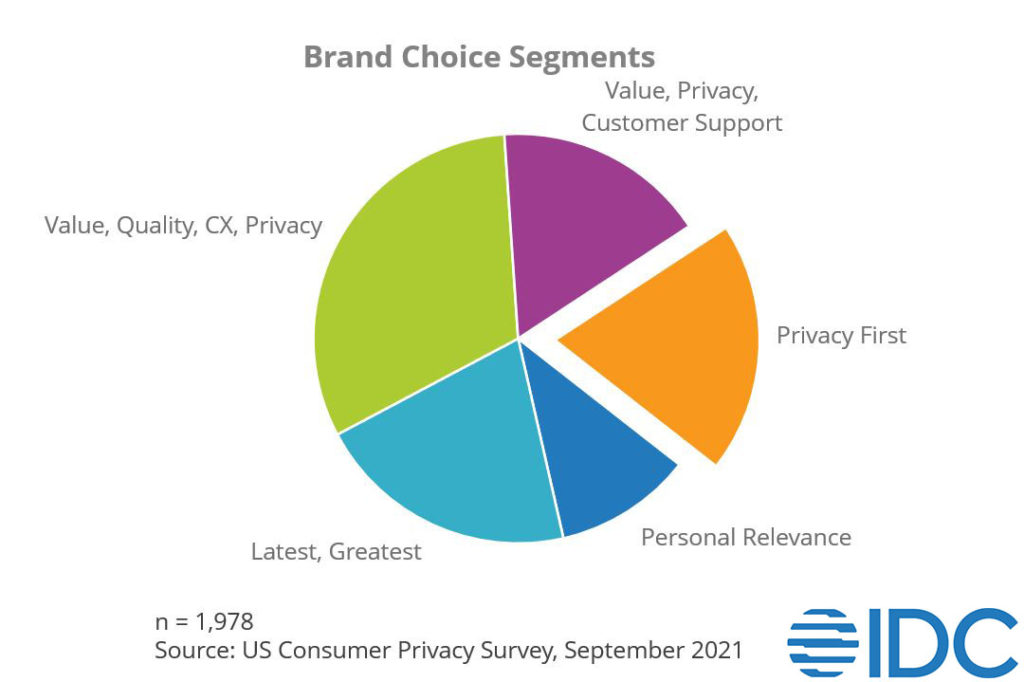

Consumer Segments

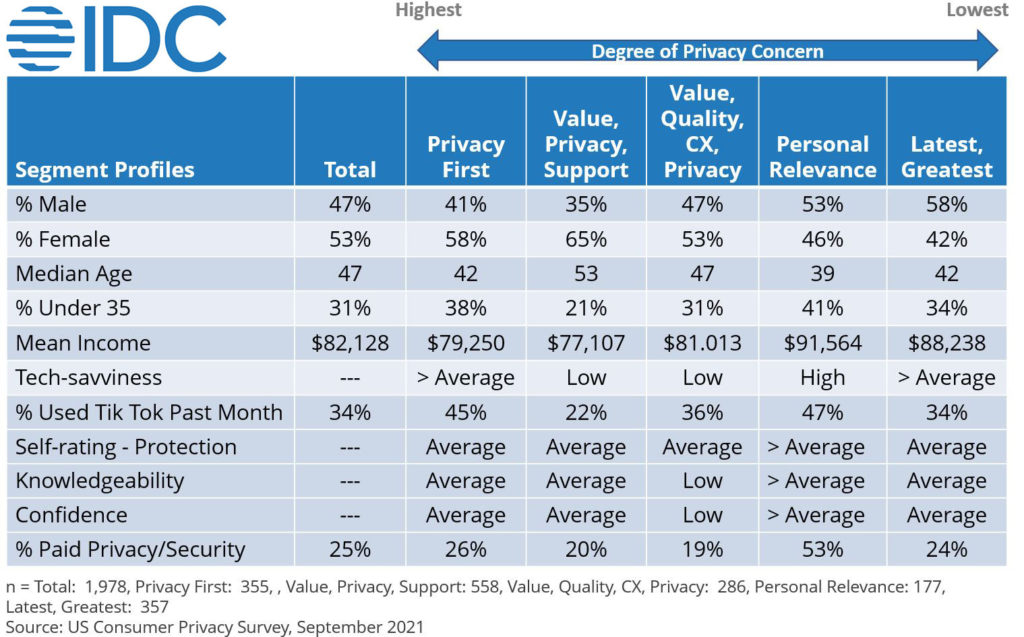

We identified five unique consumer segments based on the patterns in their choices in our tradeoffs. Privacy plays an important in the brand choices of 3 of the 5 segments, as evidenced by their names, demonstrating just how important privacy has become as a purchase criterion when choosing a device or tech-enabled service.

Privacy First

The “Privacy First” segment is of particular interest, both for its size and its profile. 1 in 5 consumers fall into this group, so it is significant.

The “Privacy First” segment is a younger, tech-engaged, tech-savvy group that is concerned about privacy and expresses a willingnessto pay for online privacy. This is backed up, in part, by a higher level of paid purchases of privacy or security services and tools as compared to the other two segments concerned about privacy. They have a heightened level of concern about all kinds of information: their phone number, email address, home address, and physical location.

When it comes to privacy, older people tend to be more concerned. This can be seen in the two value-oriented segments which are concerned about privacy. This means that to find a younger segment that is concerned about privacy is a meaningful finding. The “Privacy First” segment skews strongly female and has a strong social media presence, with 45% reporting they used Tik Tok in the past month.

They rate themselves average in protecting their own online privacy. They report having only average knowledgeability of the privacy tools their providers offer and average confidence in their ability to protect their own data privacy. This makes them an interesting target for further education. They are engaging online and demonstrate a degree of tech-savvy but clearly could use greater knowledge to build their confidence in their ability to manage their data privacy.

Personal Relevance

This segment is the smallest consumer group, but the youngest and most tech-savvy. Focused on high quality, innovative devices and services that cater to their lifestyle, they embrace convenience more than any other segment. Even more notable, they currently do more to protect their own data privacy than any other segment.

Rather than worrying about their privacy, they put their knowledge to work to protect their privacy. They are more than twice as likely (53%) as consumers on the whole (25%) to pay for a privacy or security-related service (whether a VPN, ad blocker, or password manager).

Like the “Privacy First” segment, they have a strong social media presence. 47% report using Tik Tok in the last month. They over-index for their use of Twitter and Snapchat as well as blogging, publishing, and social shopping networks. They have a much more positive view of artificial intelligence than other segments and see a much broader set of use cases as appropriate.

This group has a large contingent making between $100,000 and $150,000, with the highest percentage working full-time. It also over-indexes sharply on males between the ages of 25 and 45.

This segment shows a strong Apple affinity, with 56% owning an iPhone versus 44% in the market as a whole. They have high praise for Apple’s recent privacy changes and are 2.5 times more likely to opt into sharing their personal information across the board than other iPhone users.

Ultimately, what sets this group apart is their greater willingness to see consumers as having a role to play in protecting their own privacy, their acknowledgement that companies provide tools to make it easy to protect your privacy, and their willingness to use them, even pay for them. They have found a way to embrace the convenience provided by technology while taking steps to protect their online privacy and security.

Will the Emerging “Privacy First” Segment Follow Suit?

Attitudes eventually impact behavior. It’s clear consumer attitudes about privacy are intensifying, making privacy a mainstream concern which is having a growing impact on the brand choices made by tech consumers.

As the emerging “Privacy First” segment becomes more knowledgeable of their choices and the tools available to help them manage their privacy, they are likely to confidently engage further, following the path of the “Personal Relevance” segment embracing both the convenience of technology and the privacy tools which enable them to make smart choices and manage their privacy.

In this context, it’s easy to understand Apple’s approach and how it best fits consumers’ needs. By embracing consumers’ right to choose, and prompting consumers at every stop along the way, the strategy makes consumers aware of their choices and builds their confidence.

Key Takeaways & Actionability for Product Developers, Marketers & Strategists

- The emerging “Privacy First” segment presents tech marketers, strategists, and product developers with a unique opportunity to empower consumers to simultaneously embrace both convenience and privacy protection.

- By providing consumers with clear and transparent choices about their personal data and how it is used, companies can build trust and win out over brands that do not.

- Honor the “default” to not use or share consumer information unless specifically and transparently authorized to do so.

- By providing consumers with clear and transparent choices about their personal data and how it is used, companies can build trust and win out over brands that do not.

- Protecting consumer privacy is an important part of a company’s reputation for integrity and a critical component of brand trust.

- The level of trust in your brand determines your brand’s growth potential and ability to expand into new segments.

- This should not be minimized.

- Invest in the necessary systems and capabilities to deliver this kind of permission-based data usage and privacy.

- The level of trust in your brand determines your brand’s growth potential and ability to expand into new segments.

IDC’s Consumer Technology Strategy Service (CTSS) utilizes a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes measuring brand trust and helping companies to understand how to cultivate it.

In addition to my syndicated service, I work closely with clients on custom research projects and consulting. Find out more here.