Asian banks need technology investment to continue their growth momentum. The industry is robust, with nineteen of the top 50 global banks being Asia-based. If these banks do not continue investing in emerging technologies to drive innovation and productivity, they may face increased resilience risks in the long run.

The Asian banking sector has faced numerous challenges and is rapidly evolving due to geopolitical tensions, rising interest rates, growing needs for inclusion and microfinance, increasing demand for hyper-personalized services, a worsening risk environment, operational efficiency issues, and tighter regulatory oversight.

Each of these challenges require technology investments. In this context, the bank must decide on what its priority investments will be. Let’s take a look at some of the potential winners for 2025 and beyond.

Banks need to be agile in their transformation initiatives. Agility depends on a combination of technology infrastructure and a strategy that supports quick deployment of new capabilities. This could involve a platform strategy, microservices for easy integration, or a mix of adopting and building. Choosing the right approach is both an art and a science.

What is needed is an infrastructure that facilitates innovation. All of us who have struggled with the “Technology Bill of Material” understand that the legacy infrastructure setup processes are in months in an age where innovation, POC, and A/B tests are required within days. That is where cloud computing is important, and it must be in the mix. Cloud computing is also important as more of the enhancements require extensive data computing.

While agility helps build an architecture for fast innovation deployment, banks still need to decide on enhancements. Three factors are coming into play in today’s digital age. These are functionalities that increase revenue, automation opportunities to improve efficiency, and, finally, build trust through resiliency and avoiding financial crime.

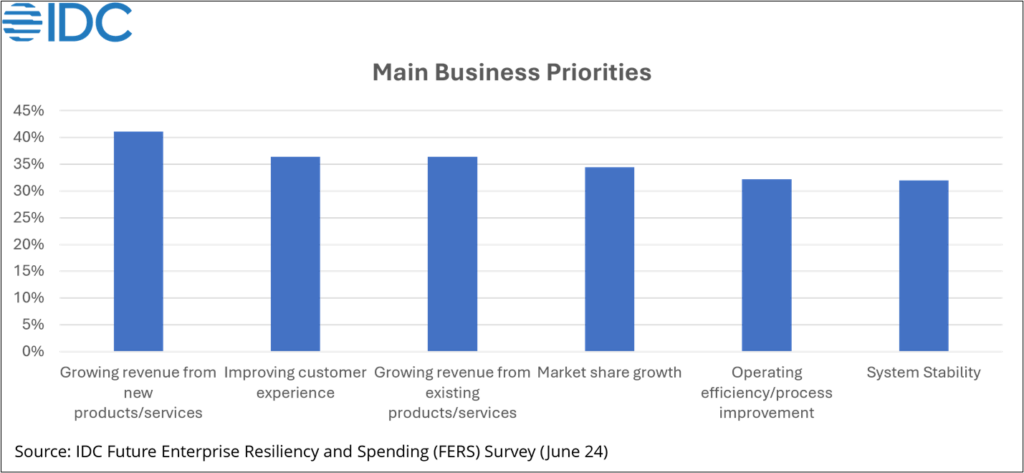

In IDC’s survey (June 2024), 41% of the banks stated that they require new products and services to generate revenues.

Launching any new product requires data, which may comprise of a mix of synthetic data generation and data management techniques. It also requires effort to build the right models, whether that may be techniques like graph and RAG or models such as agentic, generative, predictive, or interpretative. Servicing, operational excellence, and risk management remain the main areas of deployment. Embedded finance and new product development are good use cases for revenue enhancements through AI deployment.

Climate risk is also emerging as a real threat, impacting project risks and worsening personal credit. Extreme weather events affect individuals’ ability and willingness to make payments. Investing in geospatial data-based solutions could be a smart long-term strategy.

Placing these bets could eventually lead to positive leverage for Asian BFSI players.

Join me and my team at our 2025 Financial Services event series happening across Singapore, China, and India from June to August. We’ll explore the latest trends in DX adoption by Asian banks and demonstrate how financial leaders can build holistic ecosystems with technology. Learn how to reap AI benefits through operational efficiency and improved customer experience in a multi-polar world. Also, don’t miss our upcoming webinar on Driving Growth Beyond AI in Banking and Financial Services – register today!