The digital economy is frequently regarded as a beacon of innovation and growth, both influencing and being influenced by ICT spending. Today, there is increasingly more impact on the economy from the digital world. However, the digital economy itself is a complex ecosystem, influenced by countless macroeconomic factors that shape its development and trajectory. There are global economic trends in inflation and overall technology, “background” developments in raw material supply chains that influence technology hardware procurement, and ongoing, fast-paced advancements in emerging technology. Understanding these influences is crucial for uncovering the full picture of the digital economy’s potential and challenges.

Understanding the economic impact of new technologies and quantifying it is not immediate. IDC’s Worldwide Digital Economy Strategies Program, in collaboration with IDC’s Data & Analytics team, developed a Digital Economic Impact model over the years and recently applied that to the key technology of the moment: artificial intelligence (AI). We chose AI, as it is not only on everyone’s mind, but is also a paradigm shift that’s reshaping industries, economies, and societies at an unprecedented pace. As we explore the macroeconomic factors influencing the digital economy it becomes clear that AI is both a product of these factors and a key driver of change within this dynamic landscape.

According to our model we found that Business AI (consumer excluded) will contribute $19.9 trillion to the global economy and account for 3.5% of GDP by 2030. You can read the report or press-release for full details, but how did we calculate this? Our economic impact analysis leveraged data from our Spending Guide and other sources to help understand both the immediate impacts of AI spending and the interaction with broader economic forces at play which we explain below.

Understanding How AI Impacts the Economy: Economic Impact Models

As aforementioned, AI will account for 3.5% of GDP by 2030. To estimate the overall impact of a technology product or service, IDC developed an economic impact methodology that combines IDC’s knowledge of the market and internal data with a standard analytical framework that leverages the most updated countries input-output (I/O) tables.

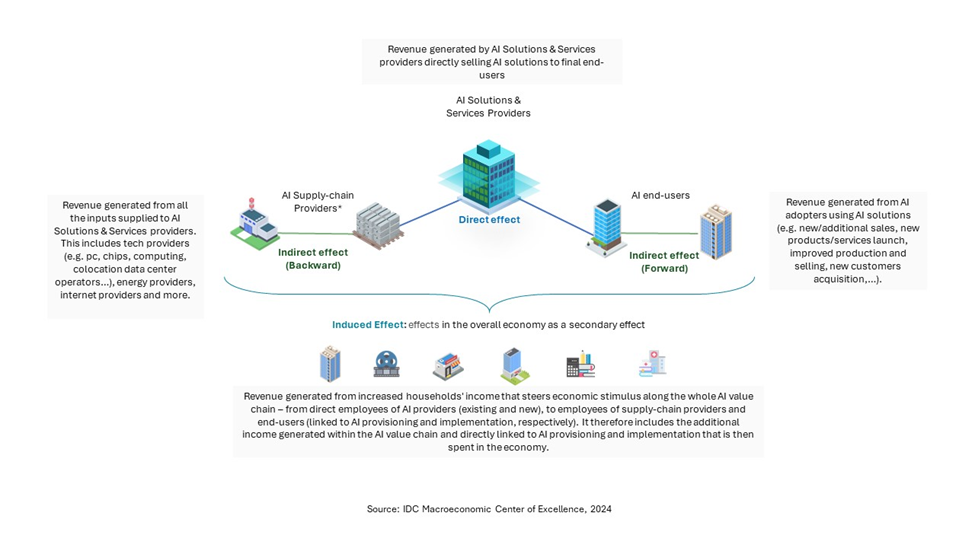

In brief, the economic impact of AI can be sub-categorized into direct, indirect, and induced effects.

Direct Effects

Direct effects refer to the income generated by providers of artificial intelligence solutions or services from their direct sales to customers. In other words, it is the revenue of solutions/services providers when directly selling their products to end users. Essentially it is the revenue of an AI vendor when selling their solutions or services.

As a concrete example let’s take the case of a company that develops and sells AI-driven customer service chatbots. When this company successfully sells its chatbot solutions to online retailers, that revenue generated from these sales represents the direct economic impact of AI.

Indirect Effects

Indirect effects involve the economic impact related to the AI supply chain and the advantages gained by entities that adopt AI, such as enhancements in productivity and revenue growth. This category also includes the influence that organizations or technology providers exert on a regional or national level through their AI-related operations. Indirect effects are further divided into “backward” and “forward” categories. Backward indirect effects refer to the economic effects on supply chains and industries that provide inputs to AI-driven sectors, in other words, revenues generated in local industries impacted by AI. Forward indirect effects refer to effects on AI adopters that benefit from the adoption of AI technology in terms of productivity, revenue growth, and other business parameters.

More concretely, backwards indirect effects include all inputs supplied to AI solutions from the backend: including PCs, chips, computing, colocation datacenter operators, energy providers, internet providers, and more.

On the forward effects side, this includes concretely any increase in revenue coming from different factors such as the introduction of enhanced products or services, improvements in production and sales processes, or gains in customer acquisition that result from the implementation of AI.

Induced Effects

Induced effects stem from increased household income due to AI-related activities, leading to higher consumer spending and broader economic benefits. These are secondary effects, referring to economic stimulus coming from increased household income, including existing and new employees linked to the AI value chain across direct and indirect effects layers. People will spend part of their new wages in the economy, thus generating additional economic impact.

For example, let’s take a manufacturing company with an ambitious AI strategy that has installed a dedicated AI team, hired specialists, etc. This company may pay higher salaries to this AI team due to the increased demand and profitability of AI products. As these engineers receive higher incomes, they have more disposable income to spend on goods and services within their community, perhaps buying a car or dining out more frequently. These purchases inject additional money into the local economy, benefiting various sectors such as the automotive industry, restaurants, and construction businesses. It serves as a “ripple effect” of increased consumer spending stemming from AI-related economic activities.

Things To Watch Out For

These numbers, however, do not mean the journey from investment to monetization and economic impact is straightforward. In the case of AI, many companies are starting to question which use cases truly add value, and we are also seeing that regulation and questions about the ethical use of AI are increasingly important topics. From our Global Future Enterprise Resiliency & Spending Survey, tech decision makers (IT and LoB) reported an overage of 37 GenAI PoCs in the last 12 months, with only 5 making it into production, on average. Out of these 5, they reported a 68% success rate. That means a lot of PoCs failed, a testament to the long road ahead for AI’s real impact. While it is true that AI doesn’t necessarily guarantee immediate returns, AI’s economic impact will play out over time as the market matures. It is also crucial to keep this long-term perspective in sight while making executive decisions on implementation and deployment.

Going Forward

The interplay between AI and the broader macroeconomic factors is reshaping the digital economy in profound ways. Direct, indirect, and induced effects of AI all underscore AI’s role as a transformative force within the global economy. The model we applied here can also be applied to other kinds of transformative technologies.

Contributing Authors:

- Carla La Croce – Research Manager, Data and Analytics, Europe

- Lapo Fioretti – Senior Research Analyst, Emerging Technologies and Macroeconomics

- Andrea Siviero – Senior Research Director, MacroTech, Digital Business, and Future of Work

Discover how IDC’s AI Use Case Discovery Tool can elevate your AI strategy—learn more here.