We continue to reside in uncertain economic times. Whether you look at geopolitics, like the situation in Israel and Ukraine, or you consider volatile energy prices, the long-tail effects of the COVID-19 pandemic, higher inflation and its direct impact on the tech industry, or even the quickly approaching 2024 U.S. election, all these factors continue to have an effect on the economy and ultimately on the predictability of services providers’ (SPs’) businesses. However, while market conditions will eventually wane and course-correct, a different challenge facing services providers continues to progress and is unlikely to resolve without decisive action — the erosion of services providers’ strategic value.

Faster. Cheaper. Fewer, and with less influence. These are just a few of the many forces at play in today’s services markets. Services customers want more for less, with less risk, faster proof of value, more risk sharing, and costs that are directly tied to outcomes through value-based pricing. Provider adoption is also consolidating, with companies now using fewer providers for core services.

Companies have become very comfortable utilizing third-party services firms and providers to support many core facets of their business, both business process-based and technology-focused. The approach of utilizing multiple providers to hedge corporate risk is still a critical part of a firm’s sourcing strategy, but there are signs that firms will be reducing the portfolio of vendors on which they rely. As the value and trustworthiness of utilizing external providers for core services have proven increasingly safe and reliable, companies are now shifting their third-party services strategy toward simplicity and cost-effectiveness over and above diversification and redundancy. As companies seek help accelerating digital transformation and building resiliency, they have become markedly more comfortable doing all this with a smaller number of providers.

At the same time, the order in which various types of third-party vendors are engaged is beginning to shift, resulting in services providers slipping backward in their proverbial “place in line.” Services providers have historically led strategic technology discussions and then worked with clients to bring in the technology providers that are needed. The opposite is beginning to occur, which has resulted in customers now turning first to technology firms and public cloud providers. You can read more about this trend in another recently published IDC report found here.

IDC’s Services Path program, an annual global survey of 2,600 companies, has also confirmed this shifting to be true. When companies were asked what sources of information they primarily utilize to select various types of firms, the number 1 source of information was cloud services providers (e.g., AWS, Azure, Google, and IBM), followed in second place by sourcing arms of consultancies (e.g., PwC, Deloitte, EY, and KPMG). In addition, when companies were asked what type of vendors they believe are best suited to help them with digital transformation, the top answer was IT infrastructure providers (e.g., HPE, Dell Technologies, and Cisco), with business or IT consultancy firms (e.g., Accenture, Deloitte, PwC, EY, and McKinsey) placing second.

Public cloud providers and technology vendors are now often taking the lead in strategy discussions, only to then bring in traditional services providers later when needed. This modified approach is further contributing to why traditional pure services providers are becoming viewed as less influential.

How Services Providers Fight Back

IDC has just published a report examining this phenomenon, which includes a deeper discussion of these trends, along with advice for services providers on how they can fight back against this strategic challenge. The full report can be found on our website, but here are a few highlights and findings from the study.

Leveraging AI Everywhere

Just like the long on-prem software implementations of yesteryear were sent by the wayside with the advent of cloud, the same will happen to traditional services delivery models as AI matures and becomes more reliable and accepted. Companies have less patience for long transformation projects and lengthy deployments. As more service offerings become asset-based, self-service, and AI-driven, the days of long, expensive, human capital–intensive service engagements will dwindle.

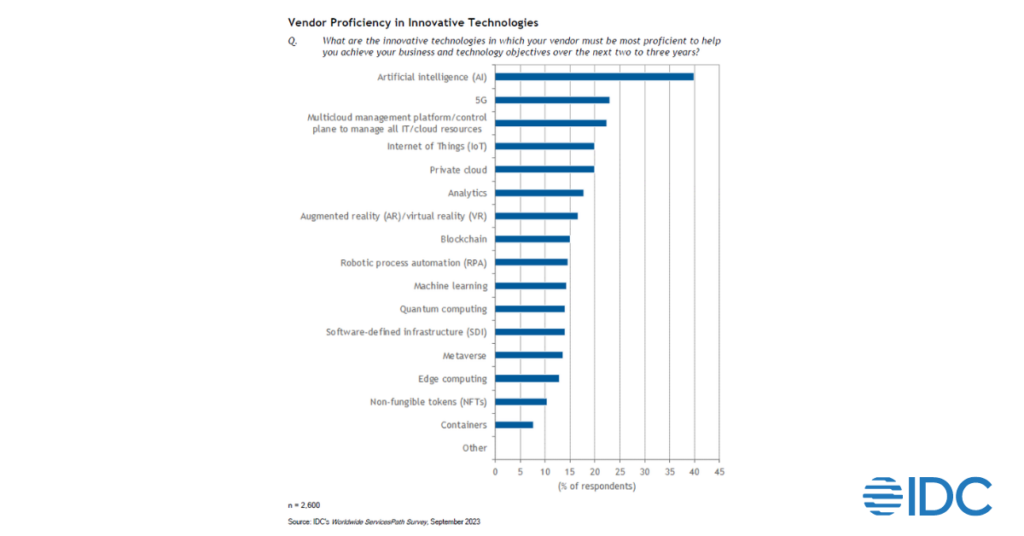

IDC predicts that by 2025, 40% of all services engagements will include GenAI-enabled delivery (see IDC FutureScape: Worldwide Services 2024 Predictions). This is further supported by the results of IDC’s Services Path program, which found the top 3 business priorities for companies today are increasing productivity, improving operational efficiency, and improving talent performance, all of which are expected to be directly enhanced by the adoption and advancement of GenAI. Likewise, businesses are heavily focused on bringing in services providers that excel in AI expertise above and beyond any other new technology. IDC’s Services Path found proficient AI skills to be nearly twice as important as any other new technology skill set when businesses are selecting which services firm they want to engage.

Reducing Barriers To Success

IDC’s Services Path respondents were asked what characteristics their vendors demonstrated that became barriers to success for their organization. The top 3 responses, in order, were “vendor is unable to meet service levels/requirements;” “inability to support more complex needs;” and “vendor can’t adapt quickly enough to changes in requirements.” Part of traditional services providers fighting back against their waning strategic positioning needs to include rapidly recognizing and removing these barriers to success for their customers.

ABC, Talent, Pricing and more

There are several other notable topics that services firms will need to further address to fight back against current market trends, some of which include expanded use of asset-based consulting, developing more flexible pricing structures that are closer aligned with value delivery, counteracting the talent squeeze (both for themselves and their customers), and further optimized and self-service driven managed service offerings.

The full report discusses all these topics in more detail, but there are a few important things for services providers to keep in mind:

- Differentiate based on pricing flexibility and risk sharing. IDC’s Services Path found the most important metrics used by companies to shortlist services vendors are their ability to provide compelling proof of ROI, offer multiple pricing options, and provide flexible pricing terms.

- Partner with technology vendors to utilize their SaaS platforms and co-develop ABC offerings. Not only will this save both upstart time and required investment, but partnering with an already industry-leading company is the fastest way to establish credibility and reduce barriers to entry.

- Reskilling labor will be a vital component of meeting the impeding demand for AI-centric services. For example, IDC predicts that by 2025, 40% of organizations will re-skill their customer care agents to take up different roles to deliver better business value, largely driven by the adoption of GenAI in the contact center.

Companies today are looking for strategic partners that can be utilized broadly across the life cycle from consulting to managed services, can understand the nuances of their business, have deep expertise in their industry, and can provide fast proof of value beyond simply helping cut costs. Ultimately, services providers that can help businesses harness innovative technologies, link them to their business processes, and connect their strategy to their tactical needs to drive top-line growth are the firms that will solidify a long-term seat at the head of their client’s strategy table.