The Exciting Year Ahead for IDC Spending Guide

IDC’s Spending Guides, standard-bearers for extensive and exhaustive technology market intelligence, are undergoing major updates starting in July 2023 and continuing into 2024. The updates will bring deeper analysis capabilities to market through enhanced visibility into sectors, sub-sectors, and industries—increasing the total number of industries covered from 20 to 28. The update also includes a planned size segmentation refresh which will add additional granularity of insight.

IDC and Spending Guide: Years of Proven Success for Market Intelligence

For decades, IDC has been the tech industry’s standard for consistent, benchmarkable market intelligence in six continents. Designed around a global overarching technology taxonomy that includes detailed segmentation by geography, industry, size, use case, and other metrics, IDC’s market intelligence is one of four integrated “intelligence” domains IDC maintains for the tech world.

Since 2016, IDC’s Spending Guides have delivered this market intelligence in a collection of over 25 market forecast products which detail planned technology spending across a variety of different market scenarios. Created leveraging a combination of demand side and supply side data and validated by our in-country industry and technology analysts, IDC provides the most accurate forecasts available. This intelligence enables tech vendors, investors, and partners, as well as others that serve and observe the tech world, to deeply analyze the size, trajectory, and growth opportunities over time in highly specific markets and segments.

Industry Enhancements Coming July 2023

Starting in July 2023, IDC Spending Guides will become even more powerful with the restructuring of industry coverage within the IDC taxonomy.

Starting with the Enterprise and SMB by Industry and Software and Public Cloud Services Spending Guides, IDC will update industry coverage across the entire product line, adding clarity to segmentation-scope and introducing coverage in eight new industries. At the same time, this update maintains the fundamental methodologies of IDC’s existing taxonomy, keeping companies whole, SIC based, and aggregating sub-industries with similar IT needs or along the same value chain. This major undertaking will eventually expand to all Spending Guide products, including our 3rd platform use case-based guides, with the goal end-date of 2025 H2.

Spending Guide: The Year in Review

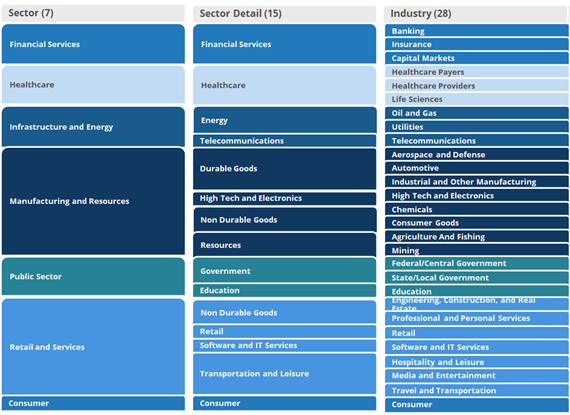

IDC spent a year researching existing industry taxonomies. In this time, we conducted a study of economic standards, client inquiries, tech vendor industry taxonomies, and competitive taxonomies. The conclusion was that a restructuring of the industry segmentation within IDC’s taxonomy was necessary to keep clients informed to the degree expected in the modern world. The resulting update, which is summarized in the figure below, brings more granular industry scope and enhanced industry definition to IDC’s taxonomy.

Figure 1: IDC’s new industry segmentation

While this update impacts all industries to varying degrees, the benefits will be felt most notably in the following industries: Discrete Manufacturing, Process Manufacturing, Professional Services, Wholesale, Personal and Consumer Services, Resource Industries, Retail, Transportation, and Insurance.

Why Updating Industry Coverage Matters

With more thoughtful categorization and granular segmentation, Spending Guide users are better equipped to identify, analyze, validate, and action questions and insights specific to the industries they serve.

From a usability perspective, a more narrowly defined industry scope means less “noise” in the data, increasing the ability to find relevant information while decreasing the time it takes to do so. With less time spent in analysis, there is more time for execution. Analysts and strategists can also track trends across more industries, validating assumptions while understanding nuances of buyer behavior and if / how these change in adjacent segments. Executives and their teams can better inform strategic decisions and justify tactical actions, such as acquisitions, partner selection, resource allocation, territory and campaign planning, and more at granular industry levels.

For example, a leading technology provider targets small to medium size DX technology vendors with specific industry focuses for acquisition. Once acquisition targets are identified by the team, they need a financial case for the acquisition to present to the executive team and the board, thereafter. Using the Worldwide Digital Transformations Spending Guide, the company aligns the offerings of target vendors to specific DX use cases across industries of note. From this vantage, they can narrow down the high-value targets and make their own internal assessment on technology fit and support. With enhanced industry granularity, the acquiring organization can further streamline their process and reduce the time to prioritize high-value targets against those less aligned.

Deploy Spending Guide Industry Insights With Other IDC Solutions to Maximize Impact

When used in combination with other IDC Data & Analytics products, the industry update makes it so Spending Guide can be used to further investigate global assumptions, insights, and trends in granular industry scenarios, including those characterized by different geographic, technological, size, use case, and other segmentations. For instance, total available and serviceable addressable market figures identified IDC Black Book can be refined and clarified at the industry-level in the Spending Guides, helping prioritize product development and acquisition plans. Conversely, Spending Guides can serve as an effective starting point for market sizing that is further validated at global levels in Black Book.

Looking at it from another perspective, industry-related assumptions, insights, and trends identified in Spending Guides can be further refined and actioned with the data in other IDC data products for different purposes, like:

- Tracker®, which provides vendor performance metrics in over 150 markets, driving competitive intelligence and helping to position products and align go-to-market plans.

- Channel Partner Ecosystem, which provides profiles and performance details on technology partners, helping articulate partner go-to-market strategies.

- Wallet and Services Contracts Database, which provide segmentation of individual company budgets and services contracts (including contract value and renewal dates) for technology buyers and vendors, helping craft strategic marketing initiatives and pinpoint sales activity timing.

What’s Next on the Spending Guide Product Roadmap?

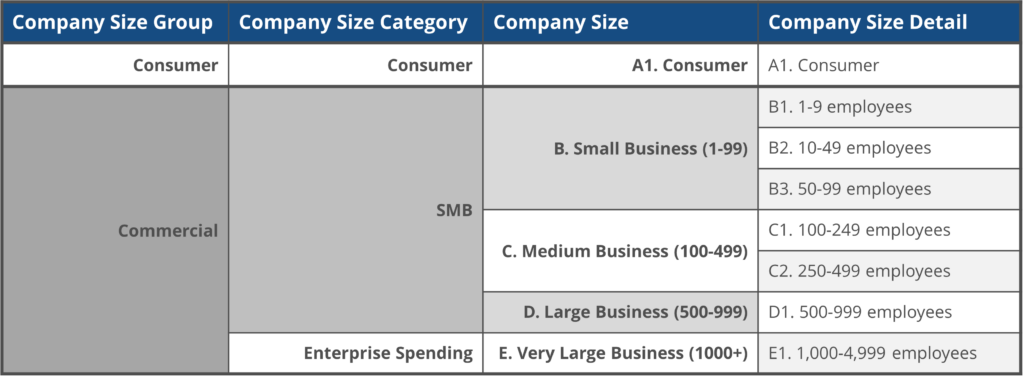

IDC’s Spending Guide products and the Data & Analytics team are dedicated to continuous improvement as part of ongoing operations. While the magnitude of the industry expansion for Spending Guides is evident, IDC remains committed to other areas of improvement in the next 12 months, including the granularity of size segmentation in the taxonomy.

With a target release of January 2024, IDC will introduce new company size details to the Enterprise and SMB ICT Spending Guide taxonomy. The change will result in nine ranges of company size across five size segments which are further categorized and grouped. See the figure below for full details on this size segment update.

Figure 2: IDC’s upcoming size segment refresh

There is a lot of reason to be excited about the product enhancements coming out of IDC Spending Guide in the year ahead. To learn more about the solution, market intelligence generally, or to request a demo please visit the Spending Guide section of IDC’s Data & Analytics Solutions page.