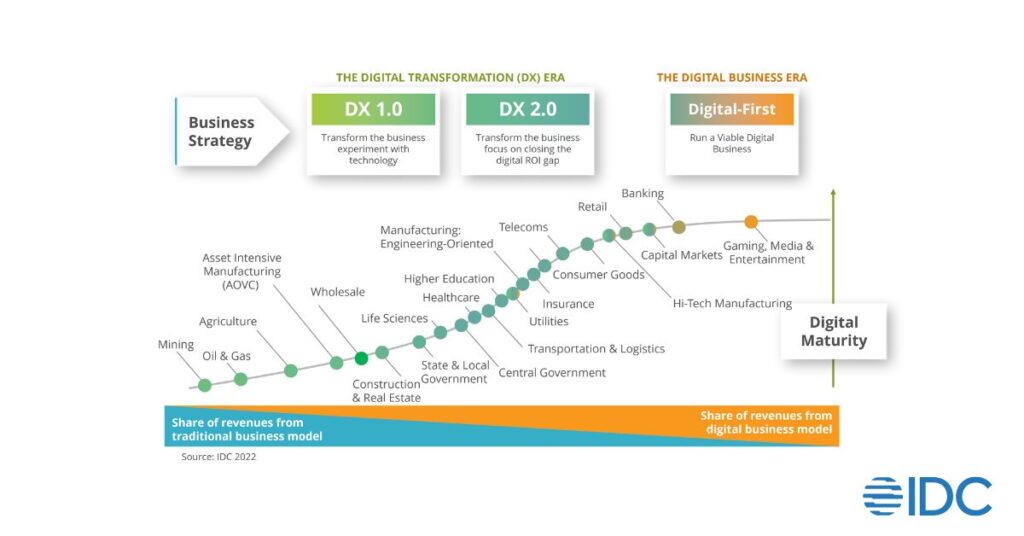

Eight years ago, IDC initiated its research on digital transformation, tracking early enterprise innovation and experimentation that typically focused on solving problems within siloes. Unfortunately, this focus on silos often resulted in disconnected islands of digital innovation where success didn’t always scale, and ROI wasn’t always clear. As digital transformation initiatives matured, enterprises increased their spending on digital technologies and associated services while focusing on achieving positive financial impact.

Now, IDC’s extensive digital transformation research has identified another important milestone – the digital business era. After iterations of transformation, business leaders and investors are now looking for sustainable growth built on digital-first strategies. The C-suite recognizes that at some point, transformation must yield to a bigger and more purposeful long-term goal – business outcomes built on a digital foundation. Our recent survey data reveals that 48% of organizations now consider themselves a digital business; the rest are pretty close behind.

Organizations increasingly recognize that requirements for operating their new digital businesses at scale are different from the digital transformation requirements required to build those digital businesses. Business must figure out how to grow revenue while clamping down on technology, labor, and customer acquisition costs and avoiding delayed decision making associated with new digital sovereignty requirements.

IDC defines a digital business as an organization where value creation is based on the use of digital technologies, including internal and external processes; how an organization engages with customers, citizens, suppliers, and partners; how it attracts, manages, and retains employees; and what products, services, and experiences it provides.

To run their digital businesses at scale, organizations must successfully operate five levers:

Technology Investments

Organizations will need to optimize technology investments, particularly around cloud. IDC estimates that 42% of core IT spending is now related to the cloud.

With cloud as the backbone of their digital businesses, organizations are seeing their cloud costs grow at the same rate as their revenue and utilization – and that’s not good for them. To address that, organizations will pivot their focus from building cloud-first businesses to the economics associated with running a cloud-first business. One area of investment we expect to see is FinOps – still an emerging function in many organizations – as a way to bring together finance, business, and engineering organizations.

As FinOps matures, businesses will move beyond simply forecasting and tagging costs to enforcing cloud expenditure policies and making strategic architecture and workload placement decisions.

Labor Utilization

IDC’s recent survey of tech decision makers reveals that labor shortages still rank as a top three risk factor in 2023. And, while organizations will continue to try and attract and retain talent, they will increasingly recognize that simply throwing bodies at the problem is not scalable. They must pivot to a focus on leveraging their existing talent, which means they will need to leverage more automation.

Whether it’s AIOps, value stream management, or RPA, automation is used in many enterprises today. But it’s still early days for automation. IDC’s data shows that while a third of organizations have automation initiatives, only one out of 10 are mature. There are islands of automation within enterprises, but business will not really be able to solve the labor utilization issue until they harness these efforts under an enterprise automation strategy, presenting opportunities for tech vendors that can help connect and orchestrate activity across the organization.

Customer Acquisition Costs

Despite the pivot toward digital, customer acquisition costs continue to grow because consumers are looking for more personalized, immersive, and real-time experiences across channels and devices, while simultaneously demanding greater data protection. Today, most businesses are not doing a great job of leveraging customer data across the enterprise. IDC’s latest study shows that only 12 percent of organizations connect the data between departments.

Going forward, we expect to see businesses shift their investment focus to customer data management, with the goal of enhancing customer experience. That means we will, in turn, see more investment in customer data platforms, which, to date, have played a minor role. Over the next year, however, IDC predicts they will evolve into enterprise customer data services that use data streams and AI to improve customer interactions

Decision Making

Despite spending $290 billion globally on technology and services to increase decision velocity, 42% of enterprises report that data is underutilized in their organizations.

Why?

Simply put, they are drowning in data. IDC’s Global Data Sphere predicts that by 2026, seven petabytes of data will be created every second. Organizations are trying to harness that data, glean insights, and get it into the hands of frontline decision makers. And, in their efforts to speed that process up, they will shift their investment focus from data generation to decision velocity. They will invest in enterprise data architectures to help reduce the time it takes to turn that data into value generating decisions and they will invest in efforts to bring their business, IT, and data teams together to reduce complexity.

Technology Ecosystems

Trust is at the heart of the digital business – almost 80% of technology decision makers report that trust programs are a priority. However, as more countries put laws and policies in place around digital sovereignty, particularly as it relates to data in the cloud, a new dimension of trust is emerging. An IDC Europe study shows that 71% of decision makers expect digital sovereignty will increase their costs of doing business.

To help address these new trust requirements, organizations will look for additional help from their technology suppliers, essentially “partnering” with them as part of new – and essential – trusted technology ecosystems.

These are the critical business agenda items that businesses must focus on in the coming year. And, technology suppliers must engage with their customers to identify where they can provide additional strategic, technology, and business value. Interested in learning more about the transition to the digital business era? Read IDC’s eBook, Beyond Digital Transformation: What Comes Next?