Are we in a recession? Or is it a downturn? Or would it be more apt to call today’s business landscape “economically challenging”? The answer is that there is no single answer —especially when it comes to highly exposed small and medium-sized businesses. Economic conditions and their impact vary dramatically for SMBs based on factors such as their vertical, target market, region, and company size, to name just a few.

However, new IDC survey data makes point one abundantly clear: The recession fear is here for SMBs.

73% of SMBs believe there will be a recession in the coming year

Source: IDC’s January Future Enterprise Resiliency & Spending Survey

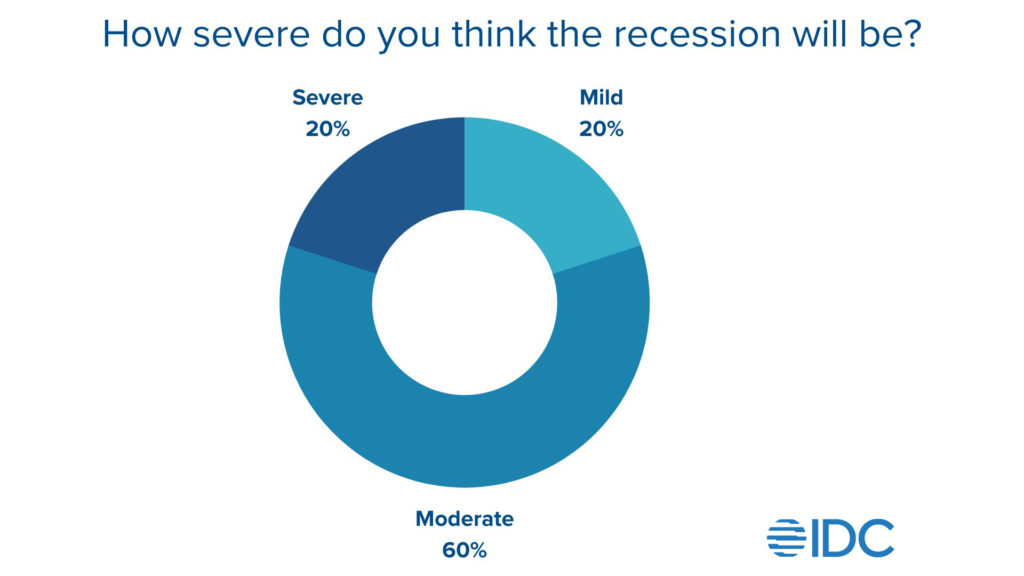

Of those that forecast a recession, nearly 46% answered that they are experiencing a recession right now, 35% estimate one to hit in the first half of 2023 and 20% in the second half of this year. 20% of those SMBs that predict a recession think it will be mild, 60% moderate and another 20% are planning for a severe recession.

A Game Plan to Weather Economic Challenges

In times of uncertainty, it’s essential for SMBs to take emotion out of the equation. One way to do this, and to feel better prepared and organized as a company, is to develop a clear and specific game plan—such as a list of actionable items that will (relatively) quickly deliver measurable results. If executed thoughtfully, this exercise can help SMBs weather today’s economic challenges and put in place strategies to help them operate more efficiently for years to come.

Below are 3 concrete steps SMBs can take now to survive an economic downturn—and thrive once it passes.

Invest in In-House IT Expertise

SMBs need to lean further into digital capabilities during economic downturns to reduce manual work and errors, be more efficient with slimmer staff, and combat rising costs of skilled labor. As a result, SMBs need to hire strong technology leaders who can help them as they invest in digital transformation.

IDC finds that 40% of global SMBs do not employ even one full-time IT staffer, and of those that do have at least one, around 70% only have between 2 and 4. These new in-house IT leaders can get to know an SMB’s inefficiencies more intimately than an outside vendor or consultant and can be technology advocates for the SMB.

High-level IT leaders should be tasked with researching, vetting vendors and technologies, and making technology purchase decisions. When beginning the recruiting process, SMBs should be sure to vet any new IT leaders carefully before hiring. Ensure that they understand a range of IT programs that your business is considering using and that they have experience with similar companies in similar verticals to yours.

These experts should have the capabilities and expertise to ask potential technology suppliers tough questions surrounding details and costs of implementation, integrations, maintenance, and time to ROI.

And finally, these technology executives should be able to carefully evaluate whether it is better to build a technology in-house or use a vendor for it, and also determine if a new technology is necessary and if it will deliver timely cost savings.

Amplify Automation

Inflation is leading to rising costs of skills, and tough economic circumstances are forcing companies to reassess and trim their workforces. This one-two labor punch makes today’s SMB landscape a prime environment for automation. This broad technology comes in many flavors.

Automation technologies can, for example, use ML to learn and improve on their own over time without human intervention. These automation programs could hone marketing and advertising campaigns as they learn what factors lead to a sale or conversion or detect fraudulent transactions by learning typical characteristics of such transactions over time. AI chatbots can take the pressure off customer service staff by solving basic inquiries without human intervention. Robotics in warehouses can save on labor for picking and packing in warehouses while doing these tasks more quickly than humans could. And digital apps and kiosks at restaurants can reduce the number of order takers necessary at quick service restaurants.

Shop Smarter

SMBs should quickly reinstate cost-saving measures that may have fallen by the wayside during healthier economic times. SMBs should seek to become master negotiators. Don’t be afraid to ask for more flexible contract terms and explore any cost savings a vendor might offer, such as volume discounts or bundled savings for when a business buys several offerings from a provider.

Beyond cost savings, this approach also offers the added benefit of reducing integration headaches that can surface when an SMB uses several different point solutions from multiple technology suppliers. This is important as, noted above, SMBs don’t’ typically have large IT staffs. Even if a contract is not yet up for renewal, ask suppliers if there is any room for contract negotiations or to revise fee structures in a way that works better for your business. Use your network of community resources such as a local small business association or chamber of commerce for advice and guidance on the best suppliers for your industry and business size.

Now is also a wise time to diversify your supply chain and sourcing, if possible, to account for global currency fluctuations that can impact energy, component, material, hardware, and outsourced skilled labor prices. And lastly, be vigilant about tracking the ROI of each and every technology in your tech stack. CFOs should also require businesses and IT to perform ROI calculations before approving the budget for new technologies. One person should be held accountable for each project and deliver on those previously forecasted results.

Find more information related to macroeconomic impacts on SMBs, in these related reports that are part of IDC’s Worldwide Small and Medium Business Research practice.