Key Takeaways for IT Vendors

Globally, the risk of a consumer-led recession is increasing as central banks increase interest rates to control inflation. Most economists are coalescing around an expected slowdown in 2023, and a lot will depend upon monitory policy and wildcard events. IDC’s recent poll of 100 CIOs globally indicated that 79% expected a recession[VG1] in their countries or in important buyer countries next year. The majority of them expect it to be a mild or moderate one and not a deep recession.

Inflationary pressure, geopolitical tensions, supply chain disruptions, increasing IT skills shortages, and weakening local currencies all contribute to what IDC refers to as “Storms of Disruption”. Inflation is a significant pain point for Asia Pacific excluding Japan and China (APeJC) economies. Central banks of all major regional economies, namely South Korea, Philippines, Malaysia, Thailand, India, New Zealand, and Australia have increased interest rates in July and August 2022.

Emerging markets face a more pessimistic economic outlook with currency devaluations against the US dollar, making imports costlier. This is a double whammy for countries that import oil and food as weakened local currency means higher imported inflation.

Many APeJC economies were hit due to lockdowns in China, their largest trading partner. Hope is that the Chinese government stimulus will help enterprises, and thus the economy, recover. IDC assumes that the Chinese economy will stabilize and return to growth in 2023. However, the pace of recovery is doubtful with the global economy cooling.

Japan is an interesting case as it is doing the opposite of what the world is doing. The Bank of Japan (BoJ) is not increasing interest rates like other developed economies, thus resulting in a weak Yen, which will impact corporate earnings. Inflation has increased, primarily driven by energy and fresh food prices. The underlying inflation pressures are much softer than in other developed economies, and BoJ predicts inflation to moderate in 2023. There is also an increased risk of rising covid cases.

IDC’s latest survey, Future Enterprise Resiliency & Spending 22 Survey, Wave 3, reveals that IT leaders in APeJC are concerned about inflation (45%) and timely access to products/services due to supply chain disruptions (47%). Chinese IT leaders are increasingly worried about staffing and labor shortages (56%), whereas IT cost increases stemming from inflation (48%) and COVID-related restrictions (46%) are leading concerns of Japanese IT leaders.

IT leaders have started reporting increasing difficulties in filling up vacancies both in line of business and in IT. They have either upskilled existing IT staff or engaged a third-party service provider to resource for the most important technology initiatives. Most IT leaders in the region report extreme difficulty in filling up positions for data management professionals, data scientists/data analysts, followed by software developers and networking engineers.

While the US is “technically” in a recession with a second straight quarterly contraction, Europe is forecasting it to happen in the next six months. APeJC GDP continues to grow in 2022 but at lower levels than predicted earlier. Interestingly, APeJC IT spending growth is holding up well in 2022, with a dip expected in 2023.

For more details on these trends check out IDC’s recent IT Spending & Recession Impact webinar.

Consumer IT spending (related to consumer purchase of mobiles, tablets, PC’s, wearables, and peripherals) slowed in the first half of 2022 because many device purchases have already happened in the last two years to enable WFH or online classes. We expect this to decline further this year and next year.

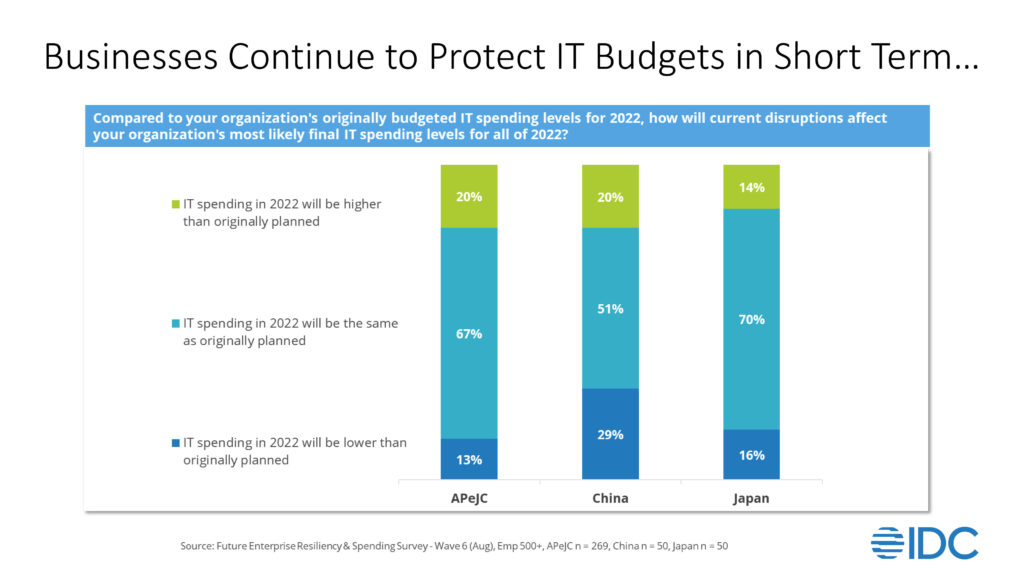

Enterprise IT spending has been stable as businesses continue to protect IT budgets in the short term. Operational budgets account for a larger share of overall spending (cloud, subscription, as a service) and are difficult to pull back at short notice. Cloud spends are still expected to grow strong due to a marked shift from capex to opex operating model.

Expectations are that some capital spending and investments in new projects are vulnerable because the focus will shift to keeping the lights on rather than putting money on new initiatives. Again, the willingness and ability to increase IT budgets in line with rising prices, either due to inflation or currency devaluations, is more uncertain today.

IDC’s survey, Future Enterprise Resiliency & Spending 22 Survey Wave 6, indicates that there are no signs of significant cuts to IT budgets or strategies yet. Instead, businesses are exploring ways of maintaining projects within constraints of existing budgets, which already include planned increases driven by digital transformation and cloud deployments. Enterprises in China have seen their budgets drop due to a decline in economic activity.

However, in this story, regional enterprises are still focused on bringing operational efficiency and business resiliency. Investments in digital infrastructure resiliency programs appear at the top of their priority list. This will involve investments in computing, storage, and network infrastructure and automation across data centers, public clouds, and edge locations to create more responsive, scalable, and resilient platforms for enabling digital business.

To sum up, below are the key takeaways:

- Consumer technology spending hit, expect further declines, followed by reductions in early-stage speculative enterprise projects and capital spending.

- Cloud spends to stay strong as businesses focus on achieving increased business agility and cost optimization post-COVID. However, some spending still correlates with employment so job cuts may negatively impact cloud spending. Employment statistics of enterprises will be an early indicator of any future impact on cloud spending.

- Expect greater scrutiny on technology investments, especially as technology begins to represent a growing portion of spend. Technology investment will increasingly be to support sustainable business growth, and vendor messaging must give it due importance. In short, technology spending will be more strategic.

- Local currency devaluations will negatively impact enterprises’ IT budgets, with imports becoming costly.

- Increasing IT skill availability gap, enterprises turn to third-party service providers to bridge the talent gap.

Understanding the impact of a global recession is essential for market intelligence, strategy, and marketing teams to understand evolving market size, competitor strengths and weaknesses, and optimal pricing approaches. The Black Book Live program serves as the essential tool for these tech supplier teams seeking to map demand for global, regional, and local markets around the world. The Live edition of the Black Book is published monthly and reflects the current optimistic scenario for tech markets. An alternate global IT market view reflecting the latest economic assumptions and indicators across 89 countries, alongside country-level analysis of impact on ICT pricing and demand is also available on request.

For more insights, watch our on-demand webinar: State of the Market – IT Spending & Recession Impact by Industry, click here.

FUTURE ENTERPRISE RESILENCY & SPENDING 22 Survey wave 3: Q5. Overall Impact – Which of the following do you expect will have the greatest impact on your IT spending plans for the rest of 2022?

FUTURE ENTERPRISE RESILENCY & SPENDING 22 Survey wave 6: Q6C. Compared to your organization’s originally budgeted IT spending levels for 2022, how will current disruptions affect your organization’s most likely final IT spending levels for all of 2022?