The raging conflict in Eastern Europe has taken a hit on the global ICT market, and the effects of the Russia-Ukraine war will linger for years to come. According to IDC’s Worldwide Black Book: Live Edition, March 2022, the conflict will generate a loss of worldwide ICT spending worth $5.5 billion in 2022. According to IDC, ICT spending is expected to grow 4% globally, against the 5% expected in the previous update.

European spending will grow slower than expected at 2% in 2022, against 3.7% as previously forecast. The growth slowdown is driven by the impact of the war on Central and Eastern Europe (CEE). CEE spending in ICT will decline 10% compared with our previous forecasts for 2022. ICT spend is driven down by Russia, where spending is expected to drop by 25%, and Ukraine, where the market is now expected to be 54% smaller in 2022.

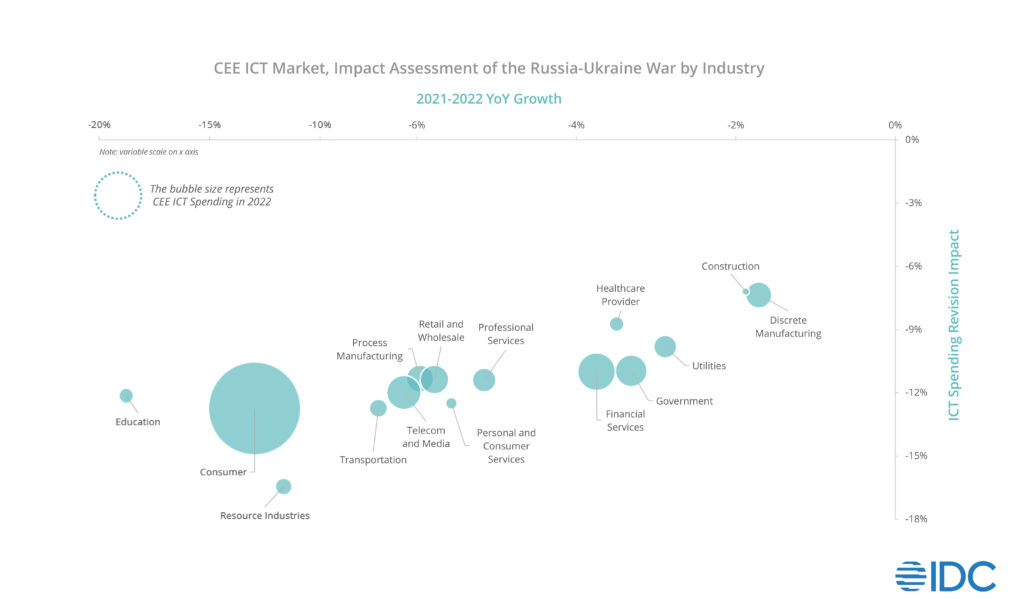

According to the latest update of IDC’s Worldwide ICT Spending Guide Industry and Company Size, V1 April 2022, the conflict will affect 2022 spending across all industries in CEE, but resource industries, consumer, transportation, personal and consumer services, and education will see the largest drops. As outlined in IDC’s Impact of the Russia-Ukraine War on the Global ICT Market Landscape (#EUR148961322), there will be negative effects on energy price levels, boosting inflation (food prices are rising double digits in the region), and thus on organizations’ budgets around Europe.

The impact of sanctions on Russian energy exports, together with supply chain disruption, will hit particularly the resource industries. Reciprocal airspace bans between Russia and the EU, as well as rising fuel prices, put added strain on transportation. Supply chain disruption in the food value chain, base raw materials, and finished products, will impact some manufacturing and distribution segments, while reduced product availability and inflated prices will also reduce spend among consumers, with indirect effects on most B2C industries. Russia and CEE countries will experience disruption of networking and IT supply chains and skilled workforce, which will contribute to a reduction in telecom spending this year. Last but not least, priorities in government budgets have been shifting swiftly towards defense and measures to contain the impact of inflation and resource shortages, leading to cuts in other areas, including education.

The impact of the severe sanctions against Russia, with many international businesses pulling out of the country, is wiping out almost $1.2 billion in ICT spending in the country. Education, personal and consumer services, and telecommunication will be among the most affected sectors in Russia this year.

Supply chain disruptions are affecting Eastern Europe and are leaving Russia troubled with reduced access to partnerships with and distributors in Western countries. Inflation is impacting the Eastern European region and is having a negative impact on both B2B and B2C demand.

Andrea Minonne, Senior Research Analyst, IDC UK

In Russia, software and hardware will be among the most impacted technology groups. The Russian services market will also experience a slowdown, but it will be less impacted thanks to strong reliance on domestic partners. Additional detail by technology can be found in IDC’s recent press release Russia-Ukraine War to Adversely Impact Europe ICT Spending, IDC Says.

IDC expects further impacts to constrain the ICT market in Europe, beyond Russia and Ukraine, which will be reflected in the upcoming forecast releases. IDC’s Worldwide Black Book: Live Edition provides technology forecasts by country and is updated every month. The March 31, 2022 release contains the initial impact assessment of the war and its effect on ICT spending across regions and across technologies. IDC’s Worldwide ICT Spending Guide Industry and Company Size forecasts technology spending across 120 technologies, 20 industries, and 5 company size bands, and it is usually updated twice a year. On April 13th, 2022, IDC issued a special release, reflecting early assessment of the impact of the conflict on ICT spending in Russia and Ukraine. Our industry forecasts for all countries will be refreshed, as planned, in July 2022.