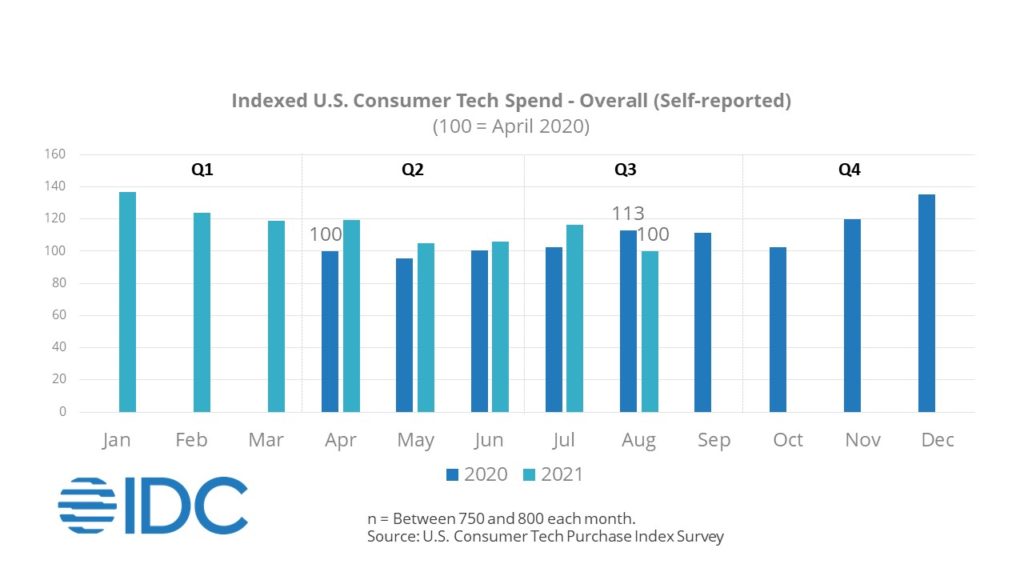

Consumer tech spend dropped drastically in August, falling 17%, returning to the same level as April 2020, when IDC’s U.S. Consumer Tech Purchase Index survey began. This came after four consecutive months of year-over-year same month gains and when this analyst fully expected continued growth fueled by back-to-school and continued engagement with the consumer tech category.

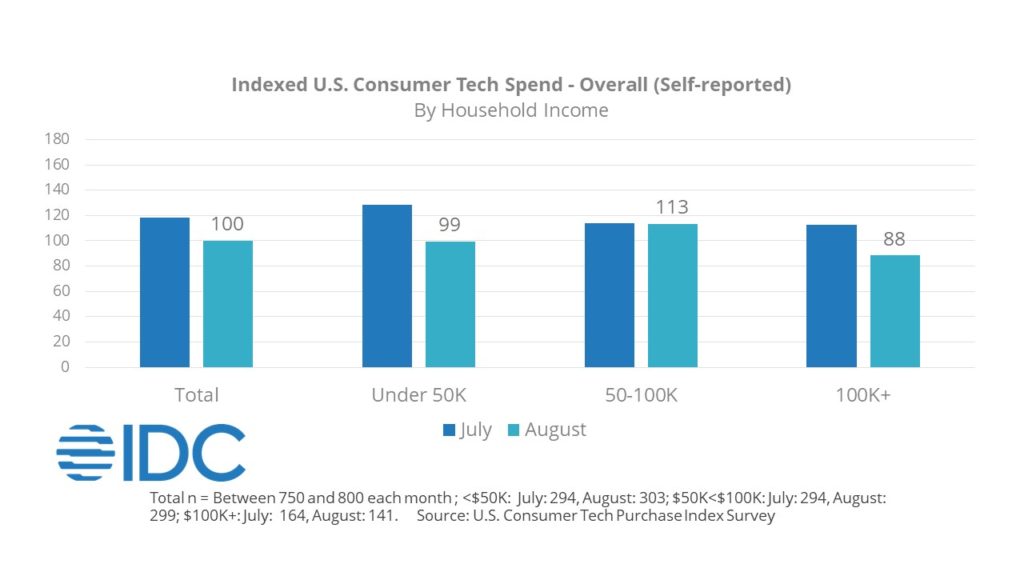

Consumer spend dropped at the top and bottom ends of the marketplace. It was far more resilient among middle income consumers (with incomes between $50K and $100K) where spend remains 13% ahead of the April 2020 benchmark.

Device Spending Was Down Pretty Much Across the Board

Device spending, which drove July’s big result, fell by 25%, giving back July’s gains and then some. Spend on most major devices (including tablets, smartphones, smart TVs, wearables, even gaming consoles) are all down from July, well below last year’s spend. PC spend was up 7% over July but well below last August.

What’s Clear and What’s Not

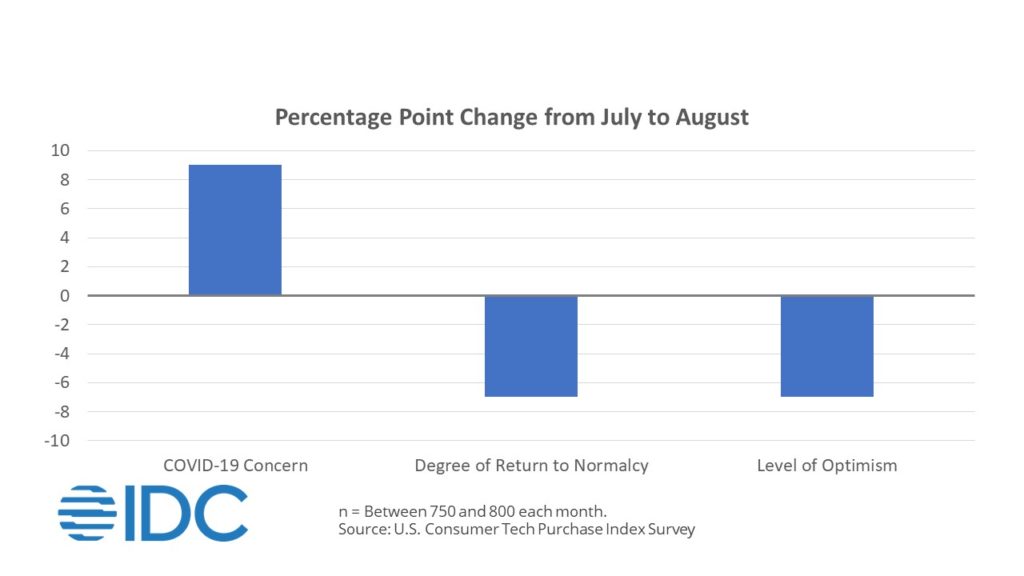

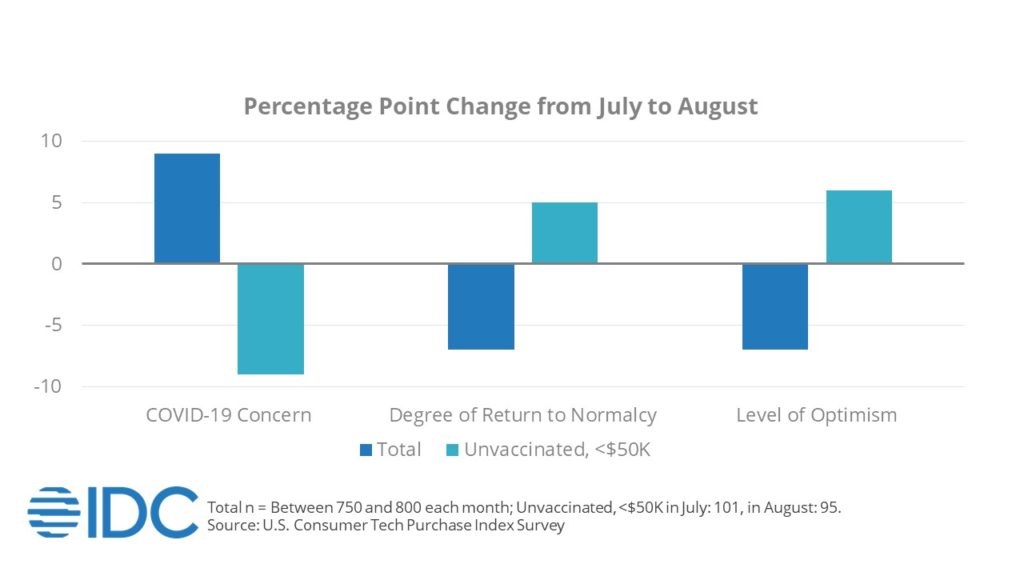

August results are enigmatic in many ways. What’s clear is this: the Delta variant has wreaked havoc, provoking renewed COVID-19 concern and sharp drops in consumer optimism and perceptions of normalcy. Uncertainty has returned with a vengeance.

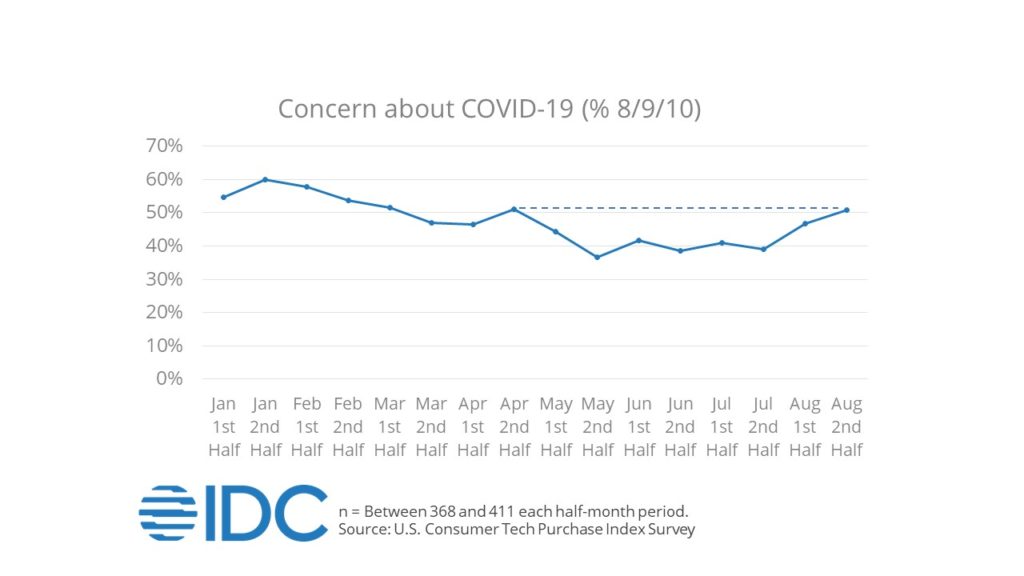

COVID-19 concern has returned to the level last seen in the second half of April.

Since the early days of the pandemic, consumer concern about COVID-19 has corresponded with high levels of tech spending. So why is the most recent level of increased COVID-19 concern associated with a huge drop in tech spend?

Is Spend on Non-Tech Categories Driving the Drop in Tech Spending?

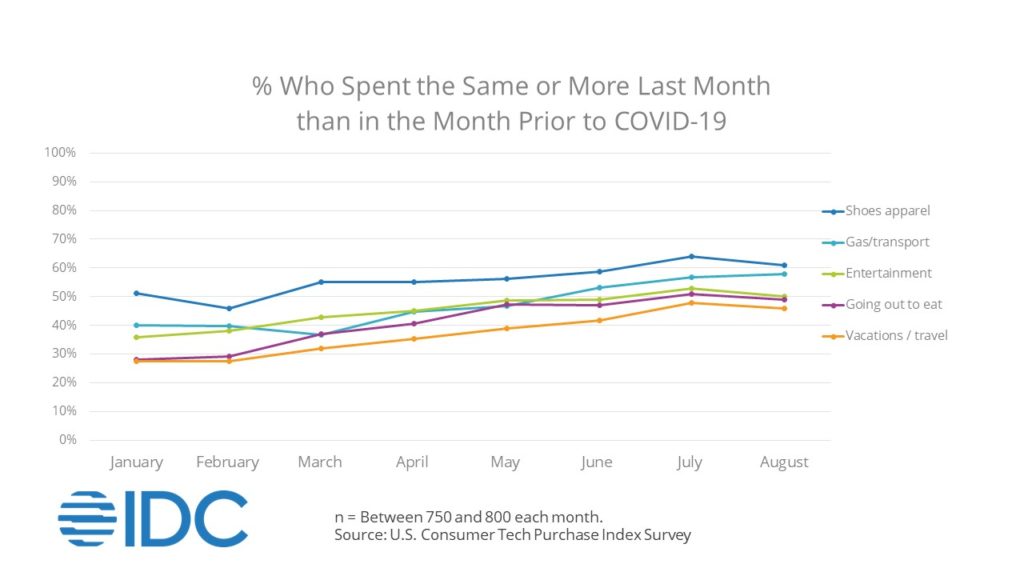

Heading into August, overall, consumers’ resumption of non-tech expenditures had not threatened their tech spending, as the ramp-up had been gradual with little to indicate any direct impact on consumer tech spend. In August, spooked by the growth in COVID-19 cases as the result of the spread of Delta, consumers pulled back their spend on non-tech categories, slightly. Consequently, at the total market level, this does not explain the drop in consumer tech spending.

Vaccination Status & Consumer Spending: Tech & Non-Tech

These total market results belie a much more complex underlying reality. A unique and complex mix of factors is at work. The intersection of household income, COVID-19 vaccination status, and consumer tech spending reveals some interesting realities.

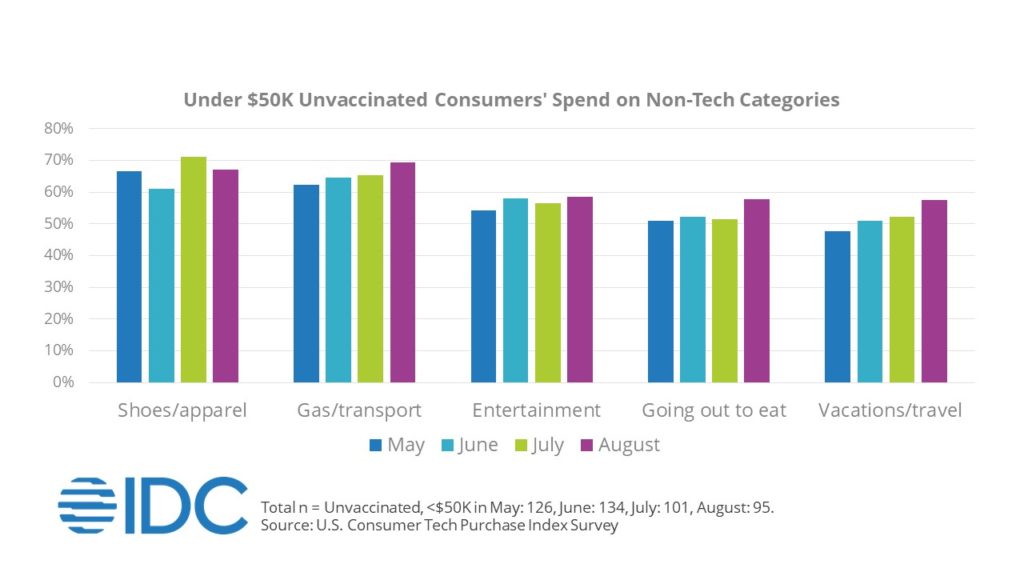

Those with incomes of under $50,000 go against the overall trend, as their expenditures on entertainment and going out to eat continued to grow in August, bucking the overall trend. This is part of a larger trend. When we look at unvaccinated, low-income consumers, the trend is even stronger, with four out of the five categories up in August, including travel.

During the month, unvaccinated low-income consumers stood out from others, becoming less concerned about the pandemic, seeing things as increasingly normal, and becoming more optimistic about the future.

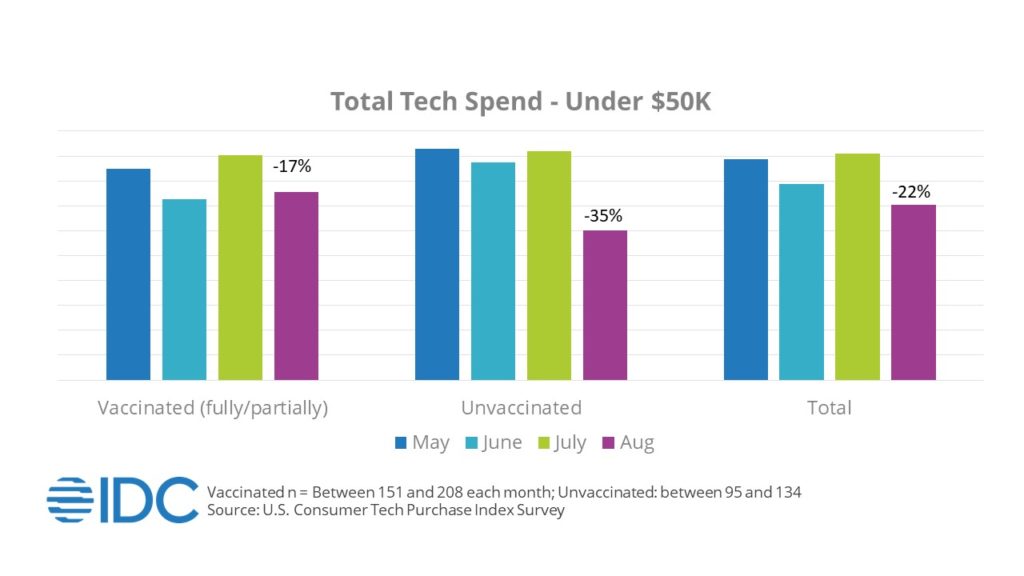

Resigned to “move on” from the pandemic, and resume their “normal” lives, their non-tech spend is impacting their tech spend. They are the single consumer group with the biggest reduction in their overall tech spend. This is significant because, up until August, they had spent more on tech than their vaccinated counterparts.

Now, they’ve pulled back their spend by twice as much as those who have been vaccinated. In August, they spent 20% less than vaccinated consumers with similar incomes.

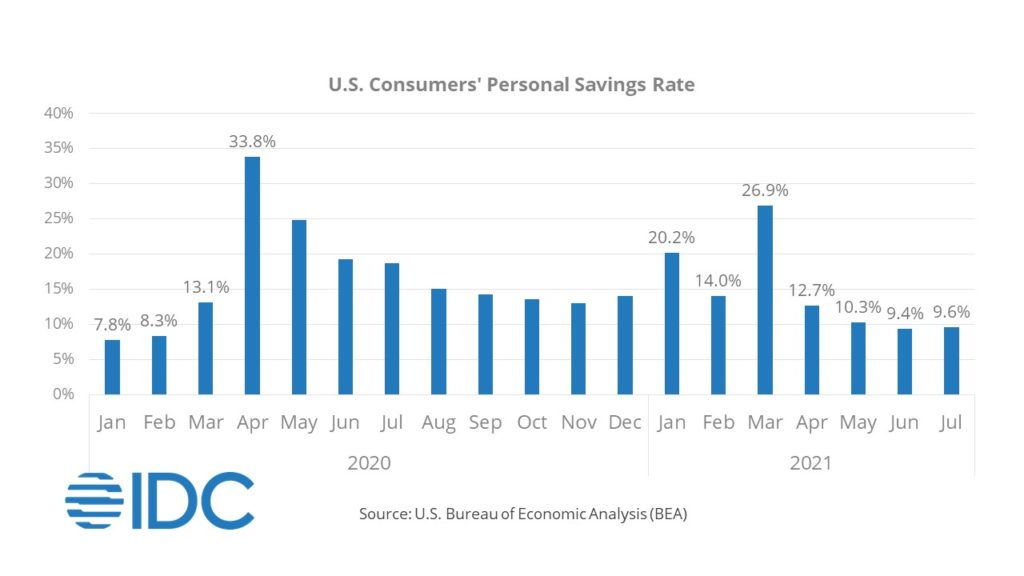

Consumer Savings Level Continues to Stabilize

Consumer savings levels are stabilizing at pre-COVID-19 levels as expected. This naturally impacts low-income consumers the most.

What About the Drop among High Income Consumers?

The drop in tech spending among $100K+ households has more to do with their already having met their needs than constraints on their disposable income or increases in their non-tech expenditures. This is evidenced by an 8% drop in their non-tech outlays (except for their spend on gas/transportation, which was flat).

Continued Uncertainty Around COVID-19 & Vaccines

Data from the highly respected Mayo Clinic shows that 63.5% of the U.S. population had received at least one dose of a COVID-19 vaccine as of September 15, up 3.1 points from August 19th. This represents a slowing in the pace of vaccinations as this is down from 3.8 points over the prior 28-day period.

The virulent nature of the Delta variant appears to have had some impact on unvaccinated consumers, leading some to become less definitive in their decision not to get the vaccine (falling from 56% to 38%). Despite growing slightly from its low in the 2nd half of July, the percentage of “holdout” consumers who definitely plan to get the vaccine is low at 8%.

Recently, President Biden announced vaccine mandates impacting government employees and the private sector. The impact on vaccination levels, control of COVID-19, and ultimately, consumer tech spend, remains uncertain.

Key Takeaways & Actionability for Product Developers, Marketers & Strategists

- Consumer tech spending is most resilient among consumers with middle incomes ($50K<$100K) whose devices and services remains strong.

- Their non-tech expenditures have not impacted their tech spending and they have continued tech needs.

- Marketers would do well to concentrate on this target as we head into the year-end holiday season.

- The end of government stimulus programs continues to contribute to the stabilization of levels of savings and disposable income.

- Low-income consumers are most impacted by this reality and the return to work at jobs requiring their physical presence.

- As a result, the move towards resumption of their non-tech spend has more impact on their tech spend than on other groups.

- This trend is even stronger among those who are unvaccinated and have much more carefree attitudes about COVID-19.

- Value messaging and “buy now, pay later” initiatives may be useful to encourage tech spend among this group.

- Low-income consumers are most impacted by this reality and the return to work at jobs requiring their physical presence.

- With their needs largely met, high income consumers have slowed their spend.

- There is more of a services opportunity with this segment, since their services spending remains stronger (at an index of 105) than their device spend (75).

- Continued uncertainty and volatility will be the reality for the next several months, if not longer.

- It will remain crucial to keep a close eye on consumer sentiment.

IDC’s Consumer Technology Strategy Service (CTSS) utilizes a system of frequent consumer surveys to provide B2C marketers with the full view of the consumer they need to anticipate and meet changing consumer needs and to outperform their competitors. This includes measuring brand trust and helping companies to understand how to cultivate it. In addition to my syndicated service, I work closely with clients on custom research projects and consulting. Find out more here.