2020 provided a bit of a wake-up call to retailers that resulted first in a flurry of tactical adjustments, some of which were pulled forward from the list of future projects, with a subsequent realization about how significantly retail business models, processes and tech investments would need to change.

In 2021, retailers are doubling down on these 5 priorities:

- Innovation (and continued resiliency)

- Revenue growth and profitability

- Customer retention (and customer experience)

- Employee productivity

- Operational efficiency

Every retailer, regardless of how digitally mature they are, should be thinking about where they are going next. They will be reimagining how their products and services differentiate and stand out. From a technology perspective they will already be working on investment roadmap updates that are driving towards touch-free customer centric omnichannel retail with a focus on how automation, touch-free, connected, and frictionless processes that improve business outcomes. To learn more about current retail investments, read the IDC report, Customer Engagement and Loyalty Strategies for Touchless Retail.

Retailers with Advanced Digital Maturity Adapted Quickly to Changing Market Dynamics and Flourished in 2020, and they are Still Flourishing!

Target’s 2020 sales growth of more than $15 billion was greater than the Company’s total sales growth over the prior 11 years. Comparable sales grew 19.3 percent, reflecting 7.2 percent growth in store comparable sales, and 145 percent growth in digital comparable sales. Target’s digital sales grew by nearly $10 billion in 2020, driven by 235% growth in the Company’s same-day services. The Company gained approximately $9 billion in market share.

Fashion retailer, Lululemon, also led the sub-segment with strong performance: 2020 YOY net revenue increased 11% to $4.4 billion. Gross profit increased 11% YOY to $2.5 billion.

Strong calendar Q1 2021 results from Target and Walmart validate that customers are continuing to prefer the omnichannel experiences that these retailers offer:

- Walmart reported total U.S. comparable sales, excluding gas, rose 6.2% in the first quarter, slowing from the 10.3% rate in the same period last year, but topping consensus analysts’ estimates for an only 2.03% increase. 37% growth in U.S. Walmart e-commerce sales, 47% growth in U.S. Sam’s Club e-commerce sales and 49% growth in Walmart International e-commerce sales YOY.

- Target sales rose 23%, as investments it made in exclusive brands and services like curbside pickup strengthened customer loyalty and kept them coming back. The company reported overall traffic grew by 17%, basket size grew by 5%, and comparable sales grew 22.9% in the three-month period compared with a year earlier.

Being Truly Customer Centric at the Core Just Got Harder

Every process should be reviewed and optimized to provide a higher level of service and experience. Take a step back and think about how the customer journey has changed, benchmark yourself against best practices, and adapt accordingly.

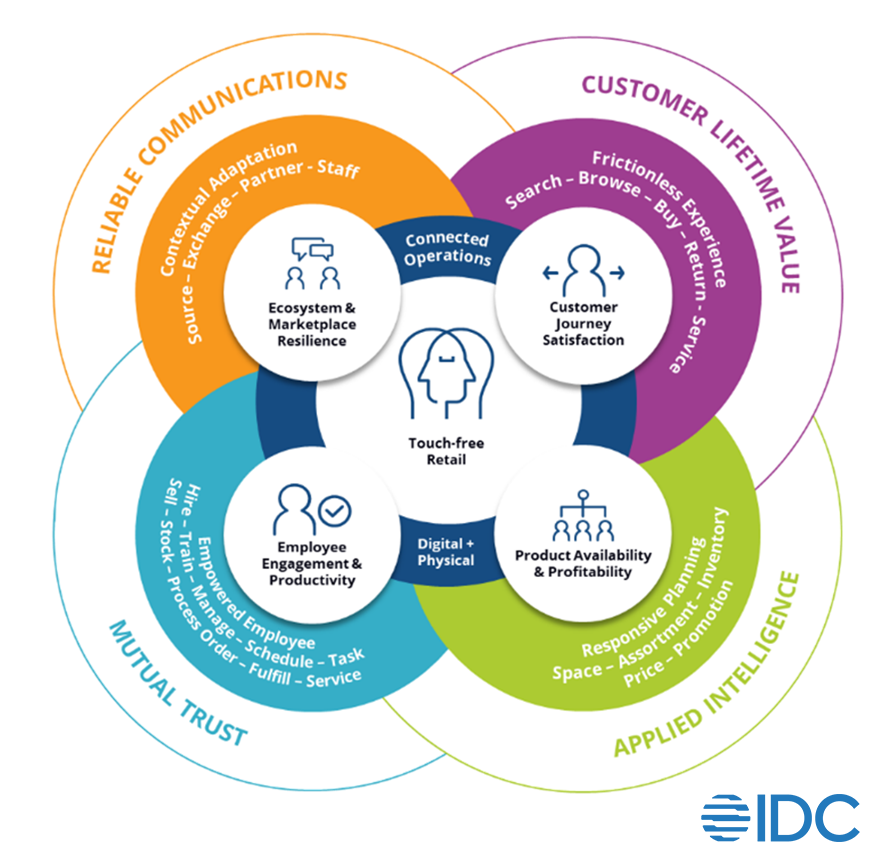

Figure 1: Core Omnichannel Retail Processes 2021

Core Omnichannel retail processes must be customer-centric by design.

When building this integrated platform to support Customer Centric Contactless Retail, retailers must account for four domains of interaction, as follows:

- Know the customer – Drive customer lifetime value. Start with the customer journey itself reflecting on the intention to maximize lifetime value of the customer through every step. This customer-centric approach will require redefining customer satisfaction and understanding that the customer prefers—and now expects—a frictionless experience.

- Sell the Right Products – right products / right place / right time. Put the right products in the right place at the right time by leveraging data, insights and automation driven demand planning, assortments, inventory, pricing, and promotions. Plan more responsively to market demand and have products available where they can best be leveraged to improve growth and profitability.

- Empower employees – Enable mutual trust. Elevate the personalization of work and service that stems from enabling employees to serve customers well. Leverage data and analytics driven training, scheduling, task management and last mile tools. Empower the employee to improve engagement and productivity.

- Communicate and collaborate – Provide reliable communications. Drive the modernization of systems and processes that reflect the way that companies, employees, and customers live and work. Adapt engagement, commerce and relationship management strategies in line with the current reality. Rethink partner and innovation strategies so that the business can adapt as the market changes.

The New Paradigm Requires a Focus on Outcomes

Retailers who offer robust omnichannel experiences, such as Target and Walmart have grown customer loyalty, as 50% of consumers reported that they would only shop at retailers with flexible omnichannel order, fulfillment, and returns processes. Far from disappearing in 2021, these customer needs and expectations have become the norm, with 20-40% of consumers already adopting new retail technologies (such as mobile apps, contactless payments, and interactive kiosks) in response to 2020 conditions.

As a result, retailers have a new set of business priorities driven by consumer behavior and subsequent retail performance / outcomes.

In 2021, the top 6 business process investment priorities are as follows:

- Inventory Visibility. Seeing is believing and available stock drives sales.

- Hub & spoke fulfillment and returns. Every touchpoint adds value – orchestration and automation drives profitability.

- Frequent Product Portfolio Refreshes. Old cycles are old news – fresh product drives more eyes and buys.

- Bespoke customer engagement. Enabling customers to have the experience they choose drives frequency and loyalty.

- Workforce empowerment. An empowered workforce is more productive and improves service and experience satisfaction.

- Self-service as a service. Touchless, automated, and frictionless – less latency & friction improves the time value of process.

In Conclusion

With 2020 in the rear-view mirror, and general consumer and business optimism on the rise, 2021 retail IT budgets are drifting higher – not for everyone of course, but 39% of retailers have reported that IT spending will be higher in 2021 than actual spend in 2020. Compared to other industries, the permanent impacts to the workforce and customer journey are most significant, and budget is being allocated accordingly. For more guidance on refining the technology roadmap, aligning with outcome expectations with future innovation in mind – join us for the webinar, “Retail’s Technology Enabled Leap Forward“, live on July 15th at 11 AM/ET. Click the button below to register.