The enterprise software world is rapidly changing. Traditional organizations are increasingly becoming digital innovation factories. In fact, IDC predicts that when it comes to consuming software, the focus will shift from selecting and managing the use of products to assembling a set of internally and externally developed/operated software capabilities. These capabilities, such as micro-services, functions, applets and containers, underpin their own digitally enhanced customer experience, hybrid workforce and intelligent operations services.

Enterprise organizations will be more heavily involved in creating their own software entities and enhancing them with external partners. This transformation means that traditional software partners need to radically rethink their business models to deliver on the promise of the Future Enterprise.

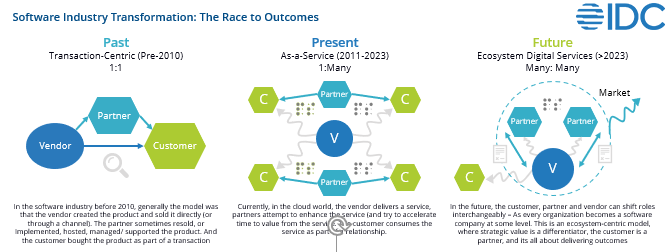

This is a seismic shift, but it is not the first that the software industry has faced. Take a look at the current evolution of the software market, and what it means for the future of enterprise software:

The Past: The Transaction-Centric Model

In the past, the software industry was defined by a transaction-centric model where the software vendor sold a product directly (or via a channel) to a customer. Partners could help with resale, or they provided adjacent services.

The product across almost all vendors was proprietary software; software products were installed via CDs onto client workstations or servers in data centers. Although the client-server (2-tier) model evolved to a 3-tier model with the emergence of web servers and clients – the software was still very much ‘on premise’. These software products were heavily customized to the prevailing mentality at the time – which was – the software must fit my organizational structure and processes (as opposed to the other way around).

The projects to deliver this software were notoriously long – often multiple years – and generally went over budget. This combination led organizations to question the value of the software. Maintenance was charged as a flat rate (normally anywhere between 15-22% – and sometimes higher for premium support), which added significantly to the overall total cost of software investment.

Traditionally, pricing for traditional software sold as a perpetual license was typically set by the product management function, but the science of price setting traditionally has been limited, since most software is sold in a negotiated setting, along with a bundle of maintenance, customization and/or implementation services as part of the deal. Since the software is sold as a perpetual license which may not be repeated, there was great focus within the software vendors to sell at the highest deal size possible, which blurred the value of the actual software.

The Present: The as-a-Service Model

Over the last decade, the industry has transformed to the ‘As-a-Service’ Model, where the vendor delivers a service to many customers while partners look to enhance or accelerate the value of those services. Cloud was a big factor in this shift, as the first major cloud players helped form an entirely new software architecture.

The ‘as-a-service’ business model was developed from the centralized cloud data center that hosted the infrastructure, software platforms, and applications as part of one ‘service’. The design point was multi-tenant in the sense that a common pool of technology resources was created and used by customers ‘on demand’. The operating principle was that economies of scale would drive down the price point, and the cloud service provider would be able to optimize technology resources and ‘flex’ the capacity more effectively for customers.

Due to various latency and regulatory considerations, different flavors of the cloud model were introduced., marking a big shift in product strategy. Private Cloud, Hosted Private Cloud, Public Cloud Single Tenant options were brought to market by the various vendors. One of the key elements of the cloud was the shift from customization to configuration – to prevent the ‘custom code complexity’ created in stage 1. Delivery times for this stage is more in terms of months than years, to customers’ relief.

In terms of product pricing, the current focus is for software to be delivered as a service and sold as a subscription. Since subscriptions are ongoing contracts which enable bundling the license, maintenance, and upgrades into typically a cloud delivered service, the customer value changes, and therefore price must change to capture this value. Subscriptions can be priced in many ways, such as flat rate, tiered, consumption based, or a combination of models. There is greater flexibility and customization to meet customers’ needs – but there is room for even greater improvement.

The Future: The Ecosystem of Digital Services

Organizations are focusing on their digital transformation journeys and striving towards the Future Enterprise state. To enable this transition, IDC believes that the software market will become more of an ecosystem of digital services to support the ‘big picture’ transformation.

In this model, every organization becomes a software organization in some shape or form, so the roles of vendor, partner and customer start to become more fluid. Customer focus will be on outcomes and time to value. Software vendors will need to design their products with these customer objectives in mind.

In the future, the evolution of subscription/service price optimization and usage analytics will combine to enable more outcome-based pricing models. As usage and customer value are analyzed, value metrics will emerge that will enable outcome pricing that scales with value.

Want to know more about the future of enterprise software, and the business model changes that will empower vendors to succeed? Read more in our latest eBook, “Transform Your Enterprise Software Business to Enable the Future Enterprise”: