Typically, a recession brings about conservatism when it comes to technology investments. But like everything else about the COVID-19 Pandemic, we are in new territory.

The pandemic was a wake-up call for the digital resisters. For organizations without a digital presence, they failed to be present in a world where physical locations where shuttered. For organizations without the proper investments in secure cloud, collaboration and communication technologies, they failed to be productive in a world of remote workers. And for organizations without sophisticated data intelligence technologies, they were unable to plan in a world where scenarios changed rapidly.

It did not take long for technology and business leaders to see the link of technology to business operations. Now many are seeking to address the deficiencies uncovered. Over one third of organizations plan to accelerate their digital transformation efforts, according to IDC’s global biweekly survey of tech decision makers.

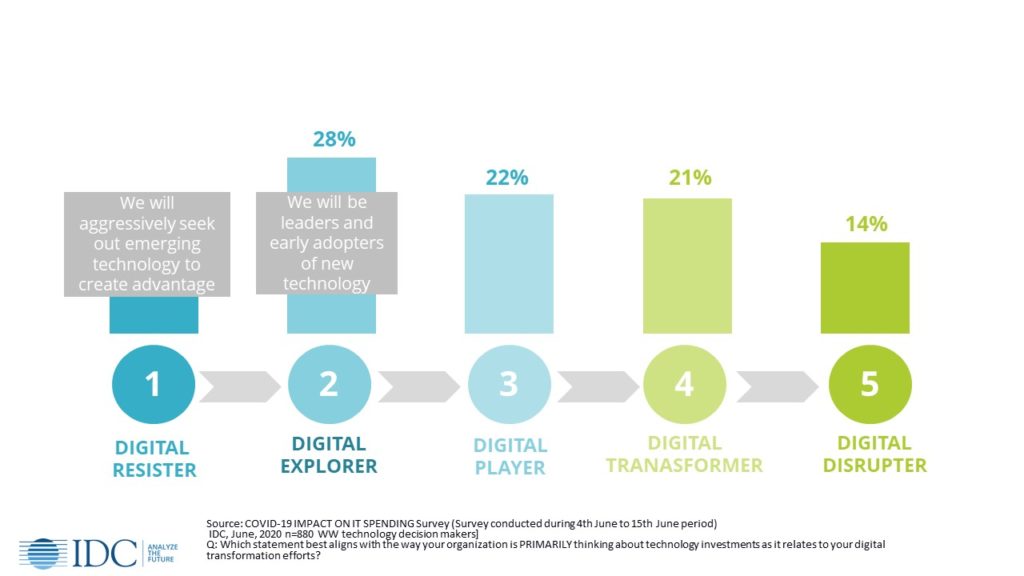

Our study also shows 64% of organizations will either be early adopters of new technology or aggressively seek out emerging technology, a departure from past recessionary behavior. It is the digital laggards who are expected to make the boldest moves as they play catch up.

- 53% of digital resisters, the least digitally mature organizations, are planning to seek out emerging technology compared to the average of 29%.

- 42% of digital explorers (one step more mature than digital resisters) are more likely to be early adopters of new technologies.

Digital Maturity of Organizations Determines Their Technology Risk Attitude

The Best Technology Bets in the Short Term

Leaders tell us the technologies they will be prioritizing fall into three buckets.

- Technology that supports a secure remote work environment. We expect to see increased spending on videoconferencing and virtual workspace, along with the technologies needed to secure those remote work environments – e.g. remote access and secure connectivity technology along with data security.

- Technology that supports a resilient organization. Organizations leaned heavily on cloud during the pandemic. They will continue to do so as they scale their business operations. We will also see organizations lean heavily on technologies that help automate processes. Robotic process automation (RPA) tops that list.

- Technology that supports dynamic decision making. Data analytics proved to be critical during the pandemic as organizations needed visibility into their business operations.

But 65% of organizations reported the pandemic exposed gaps in their analytic, artificial intelligence, and/or machine learning models. Their models were not flexible enough to incorporate contextual business understanding of the situation as it evolved.

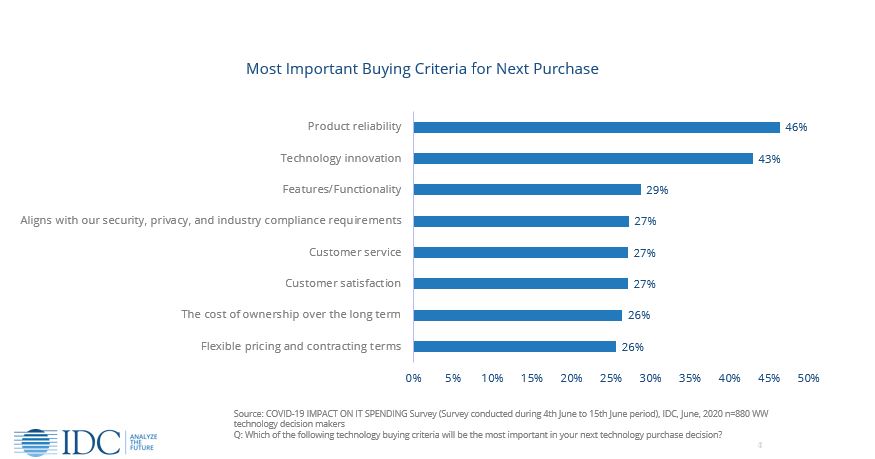

Technology Innovation

For vendors offering emerging technology, there is an opportunity to break into new accounts or new buying centers. Technology innovation is now the second most important buying criteria. 59% of organizations report it is now more or significantly more important because of the pandemic.

Effectively Engaging in a Virtual World

But how does one effectively engage in this virtual world? Like everything else we have seen during the pandemic, an empathetic and engaging digital presence is paramount.

We asked tech buyers whether virtual sales engagement models were problematic, adequate or optimal. In the Exploration Stage, when buyers are determining whether their problem is important enough to invest in a solution, and investigating possible options, 56% found a virtual or digital engagement was the optimal engagement model. Even as buyers got into the Purchase Stage, where they are trying to get answers to final questions, finalize decisions, and negotiate terms and conditions, only 30% found the virtual or digital engagement model was problematic. The others found it adequate or optimal.

Beyond virtual sales calls and proof of concepts, your organization will differentiate itself with buyers if it can do the following:

- Provide tech buyers with robust information online so they can do their own research of offerings

- Provide an interactive benchmark tool to allow tech buyers to understand where gaps need to be addressed

- Provide interactive tools so tech buyers can determine business value for their organization

- Facilitate virtual discussion with experts and customers in their industry so buyers can glean insights into best practices.

The pandemic shined a light on innovative technology. If you can effectively demonstrate in a virtual environment how your offerings address todays enterprise’s business goals, there is an opportunity to establish your offerings in what is the next normal of business.

Looking for the right partner to help position your innovative technology solutions in the market? Learn more about IDC’s customizable Accelerator Program, designed to support disruptive technology vendors in their growth goals: