Face it, you are paying attention to robotics. Maybe it’s as a curiosity, maybe it’s out of due diligence, or perhaps your interest stems from a realization that robotic technology has become useful in ways well beyond the expected use. Regardless of your interest in robots, the fact is, robotic technology is quickly expanding beyond the realm of industrial automation and has steadily been making its way into new industries and use cases. As this technology expands into new areas, it is important for companies developing business applications, IoT and analytics platforms, and systems integration to pay attention and look for opportunities to capitalize on a new and growing market.

So, what does this growth in the market for commercial service robotics look like? In IDC’s Worldwide Semiannual Robotics and Drones Spending Guide, 1H18 version, November 2018, we are forecasting the total addressable, worldwide market for commercial service robotics to grow with a compound annual growth rate (CAGR) in excess of 20% through 2022, to reach a total worldwide market of over $53 billion.

Keep in mind that this growth and the above graphic represent only one element of the worldwide market for robotics and drones, as it only considers the market for commercial service robotics. This growth is attributable to a robotics market that has matured to a point where users of the technology are achieving significant business value due to the use the technology, which is translating into a buyer market that is increasingly accepting of the technology which is driving buyer investment.

Commercial service robotics is still an early market, as new vendors continue to emerge with robotic applications built for new tasks and directed at new markets. Vendors in the space are developing innovations that are making commercial service robots easier to deploy and use and at a cost and business model that is appealing to markets that have not historically been the target market for robotics vendors.

Breadth of the Robotics Market

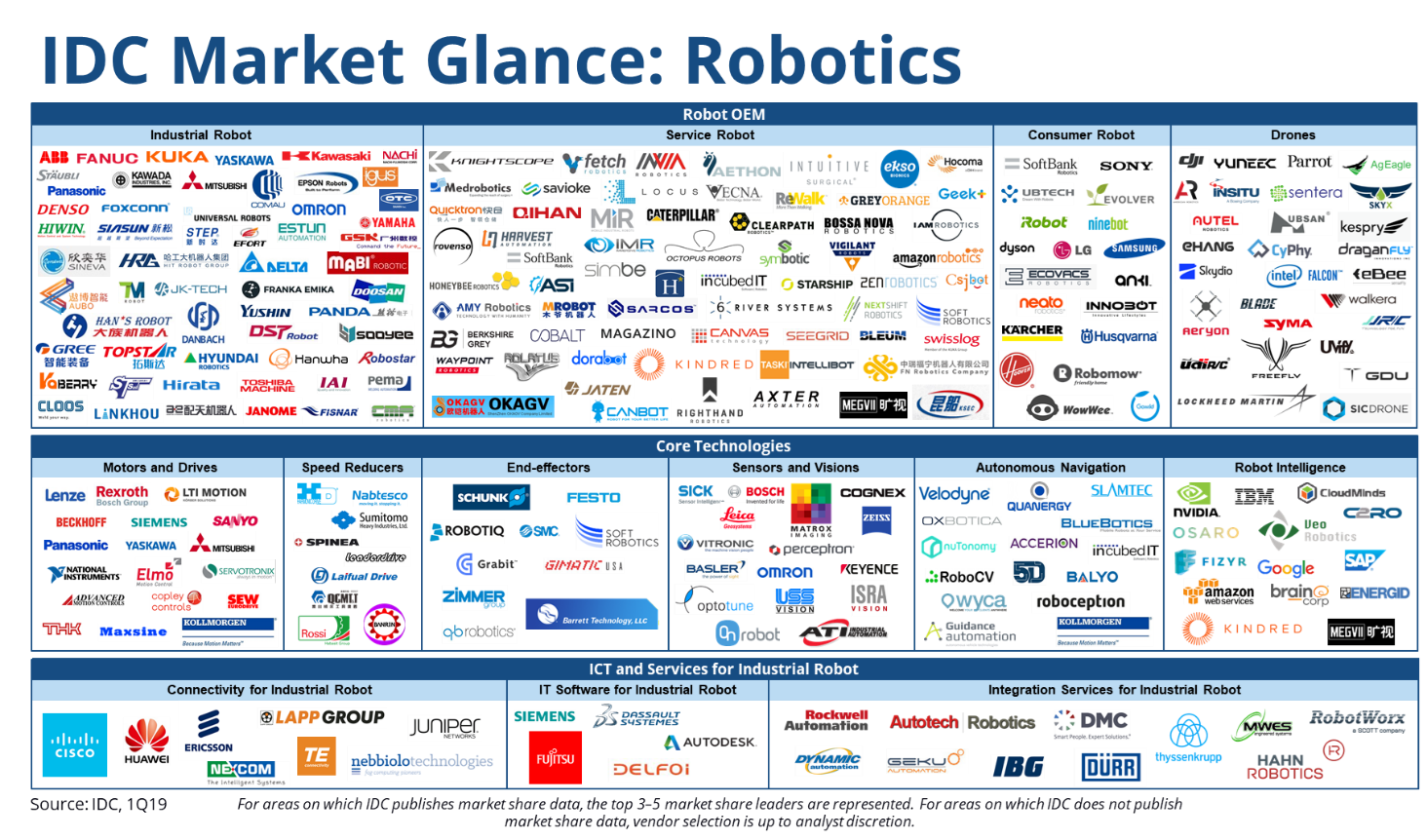

In IDC’s Market Glance: Robotics 1Q19, we identify major players contributing to the growth of the broad robotics market. As the Market Glance graphic points out, there are an abundance of vendors that are contributing to the growth that are supporting the development of robots. These related “core technologies” are elements that are directly related to the development of robotics, across the multiple categories.

The IDC Market Glance is meant to give some perspective around the growth of a market, in this case robotics. So, the greater than 20% growth and $53 billion market forecast for 2022 are relative to the box for service robotics, and the culmination of the boxes below. What does this mean? It means that there is a wide range of vendors in the space for commercial service robotics that are vying for a piece of the pie.

Implications for Tangential Technology and Service Vendors

But, what about the tangential technology categories? As the market for commercial service robotics continues to grow, it is going to deliver new markets and opportunities for technology vendors in tangential technology areas such as:

IoT Platforms and IoT Applications Vendors: Robotics is a technology that is transforming the way in which many industries operate. They are taking over non-value-adding handling and movement of materials, enabling business strategies such as late-stage assembly, and even interacting with consumers. For the vendors building the IoT platforms and IoT applications, it is critical to embrace the world of robotics as this technology is taking on business functions that might otherwise be manually executed yet driven by traditional business software applications.

Partner with the vendors of the robotics to gain a fuller understanding of what these devices are capable of, how the data from these devices must be managed, and how the data from these devices interacts with other business-related data. There is much more here than just asset performance management. Robotics vendors need a mechanism to capture real-time insight from their fleet and provide the ability to access these robots remotely, and the customer is looking to tie together data from the robots and other areas of the business.

Business Application Vendors: The users of traditional business applications are turning to robots as a mechanism to drive productivity and efficiency gains, reduce costs, and ease the pain of the current and future labor challenges. As these companies continue to deploy robotics into their business processes, the need to have robotic systems integrated into the traditional business systems will increase as well. The deployment of robots can indeed deliver the expected value points, but there is much more to be gained through the integration between traditional business systems and robotic technology. As robots take on historically manual processes, it gives companies an opportunity to capture digital data about process execution that has remained elusive when the processes had been conducted manually.

The future of business, as we see it today, relies on digital technology to add value. Robots, while a physical piece of equipment, are able to become networked and therefore deliver digital insight into process execution. In addition to digitizing the data around process execution, a part of the value of robotics is in process automation. Thus, it becomes immensely valuable to be able to automate the process of giving work instruction to a robot that would otherwise come from business execution systems that traditionally direct manual efforts. Not all robotic deployments must be integrated; they can deliver value without integration, but the value grows significantly when integrated because work directives can become automated.

Strategy Consulting and Systems Integration Vendors: For strategy consulting and systems integration organizations, service robotics open-up a new opportunity to add value for their clients. Organizations that are exploring the use of robots will need support in several areas, such as: business process redesign, strategic road mapping, implementations, integrations, aftermarket support, custom design, and more. On the surface, dropping robots into a business process may seem straightforward, but in reality, there are a lot of technological considerations that an organization must take into account to both get such a deployment up and running and, more importantly, ensure that such a deployment delivers on the expected value. This point is true relative to nearly all technology implementations, which is why the strategy consulting and systems integration firms play such a vital role in delivering effective technology-driven projects.

Closing Thoughts

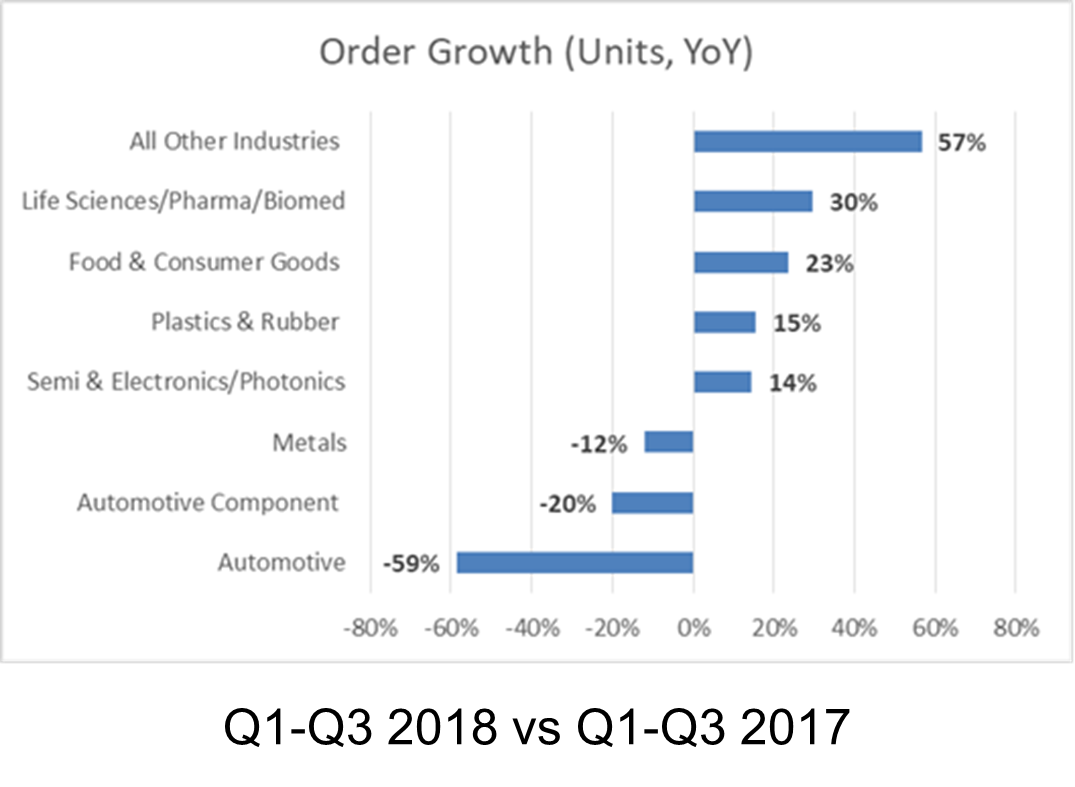

Robotic technology is quickly proliferating outside of the traditional markets for robots. In fact, the Robotics Industry Association (RIA) noted that there was a 59% decrease in YoY orders between Q1-Q3 2017 and the same period in 2018. However, there was also significant growth across “all other industries” where YoY orders of robotic increased by 57%.

Source: Robotics Industry Association, RIA

There can be little doubt that robotic technology is making its way into new industries and across new use cases. As this technology continues to proliferate, there will be an increased need for vendors with products and services that enable business operations to look to create alignment and strategies related to robotics. Indeed, this is especially true for those vendors participating in the IoT Platform and IoT application space. Robots are connected end points, and the value of service robotics goes well beyond task level automation. Even though the use of service robotics is delivering significant business value, the next level values will be delivered through the ability to capture operational data about previously manual tasks and turn that data into actionable intelligence.

While robotics in general is not necessarily a new market, commercial service robotics is a rather new business area. There is a lot of growth occurring and it is happening now because the robotic technologies have advanced and users are achieving significant business value through the use of robotics in non-traditional industries and applications.

Learn more about commercial service robotics business opportunities: read IDC’s worldwide forecast: