With Broadcom’s acquisition of VMware in 2023, the new VMware by Broadcom has undergone an overall program of merger and reorganization, which in turn has led to a restructuring and consolidation of many of the most prominent and popular VMware product offerings.

As a result of some of these changes, many customers are seeing significant cost increases at both purchase and renewal for VMware products, with new more expensive subscription bundles replacing common perpetual software licenses. These changes have caused much consternation and concern for customers, with even Broadcom CEO Hock Tan acknowledging and referenced these post-merger;

“We overhauled our software portfolio, our go-to-market approach and the overall organizational structure. We’ve changed how and through whom we will sell our software. And we’ve completed the software business-model transition that began to accelerate in 2019, from selling perpetual software to subscription licensing only – the industry standard.

Of course, we recognize that this level of change has understandably created some unease among our customers and partners. But all of these moves have been with the goals of innovating faster, meeting our customers’ needs more effectively, and making it easier to do business with us. We also expect these changes to provide greater profitability and improved market opportunities for our partners.”

What is this means for customers

VMware by Broadcom has recently made significant changes which includes the end of sale of perpetual licenses, change of license metrics and announcement of new product bundles.

End of Sale of Perpetual Licenses

Where customers have not already transitioned to Subscription licenses, Broadcom by VMware is mandating subscription transitions at renewals and purchase, with the majority of Perpetual Licenses removed from General Availability. For many customers this shift to subscription increases annual costs with subscription licenses generally being more expensive than equivalent perpetual support and maintenance.

Changes of License Metric

In 2020 VMware amended license metrics for many of its most popular products from per CPU to Per Core, with an entitlement of 32 cores per CPU license/subscription. In 2023 VMware shifted this entitlement to 16 cores per CPU subscription, which for many customers with high core counts effectively doubles their license requirements, thus resulting in further purchasing and increased costs. Furthermore in 2024 with the introduction of the new Subscription bundles, VMware by Broadcom moved to per core licensing overall.

New Product Announcements

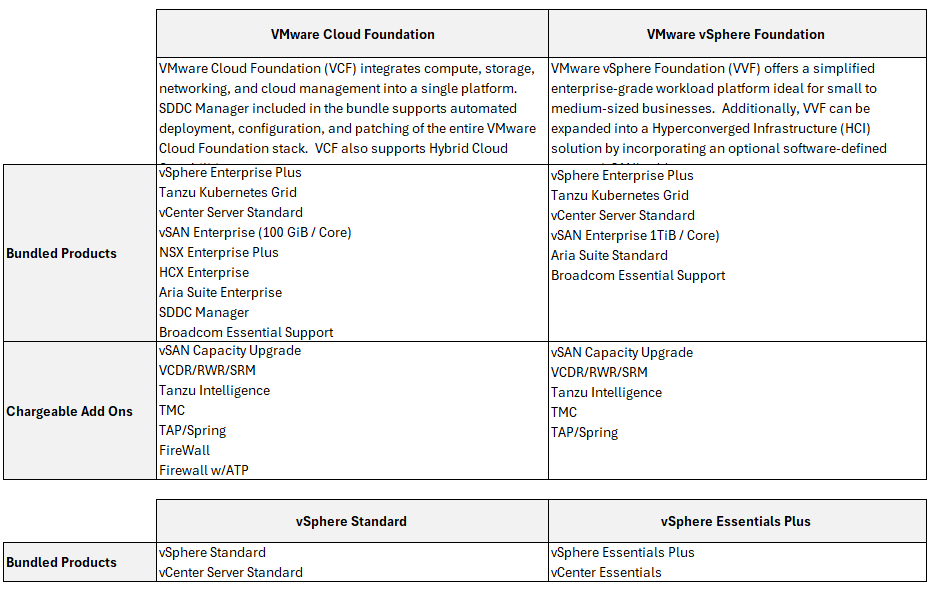

Upon completing the acquisition, VMware by Broadcom moved quickly to consolidate and “simplify” their product offerings, effectively bundling many popular products into a small number of distinct combined product offerings whilst discontinuing individual sales of individual products. Below is the feature comparison of these new offerings:

The key challenge for buyers is that it severely limits flexibility in terms of product choice. As an example, a customer previously purchasing vSphere Enterprise and vCenter Server, at renewal will no longer be able to purchase those licenses individually, instead now having to purchase subscriptions to VMware Cloud Foundation or VMware vSphere Foundation, thus having to purchase the likes of Tanzu and vSAN, regardless of whether that customer requires these products. These bundles come at an increased cost above the previous individual subscription costs, reflecting the extra value they give customers, however are unavoidable for customers regardless of their need or requirement.

Divestment of VMware Products

Further to Broadcom’s acquisition, in February 2024 Broadcom agreed to divest VMware’s End User Computing decision to KKR, which has become a standalone company called Omnissa.

“Workspace ONE and Horizon are best-in-class platforms chosen by many of the world’s leading enterprises to create seamless and secure digital workspaces with interoperability across increasingly complicated technology stacks,” said Bradley Brown, Managing Director at KKR. “We see great potential to grow the EUC Division by empowering this talented team and investing in product innovation, delivering excellence for customers and building strategic partnerships.”

As a standalone company, the EUC Division will continue to be run by its existing management team led by Shankar Iyer”

For some EUC customers, this may dilute the overall Broadcom investment into another company, potentially resulting in lower Broadcom discounts, and therefore, not only extra costs for remaining VMware investments but also for those divested EUC products.

Longer Term Deals

In addition to these changes, we note that Broadcom are incentivizing longer term deals, offering the most optimal pricing for customers considering 3–5 year terms. Where customers opt for short term renewals, pricing per unit is often much higher, effectively disincentivizing these options and limiting short term extensions.

Quotation Delays

As might be expected with such wide-reaching changes to commercials and business structure, customers are reporting that renewal quotations are taking longer than expected to be provided, which in turn gives less time to review and negotiate.

Reseller Restructures

Along with changes to commercial offerings, Broadcom have restructured their channel sales and resellers. For larger companies, Broadcom has chosen to take these accounts direct, which means customers may no longer have the support of their reseller in ascertaining requirements and facilitating negotiations. Negotiating direct can be very different to via a reseller and may require more preparation and potentially leveraging other Broadcom interests, interactions and investments.

What might the cost impact be?

Whilst every customer scenario is different, overall we see that large cost increases are inevitable and indeed crucial to VMware by Broadcom’s growth strategy. Customers exiting and renewing long-term deals may see compounded impact from multiple changes that have as yet not affected them whilst in contract. In real terms customers may see cost increases anywhere from 100% to potentially as high as 800% at renewal

Predominantly the transition to new bundled products is impacting customer costs the most, however these extra bundled entitlements equally bring extra added value which may be beneficial to customers and potentially give opportunity for replacing incumbent products and costs in the technology estate, or optimizing current VMware by Broadcom deployments and operations.

What should customers do?

- Act now to understand potential impact and risk, potentially modelling future cost scenarios to drive visibility internally and gain traction for strategy review and change

- Understand future strategy and requirements, and how these might align to VMware technology and offerings

- Consider the benefits of the new product bundles and whether they represent value and/or opportunity for other vendor displacement and indirect savings

- Review entitlements to understand how the divesture of VMware EUC products to a separate company might impact investments overall

- Review VMware use cases and identify whether other vendors solutions might be feasible and cost effective to migrate to

- Noting the earlier comment regarding long lead times for quotations, push for an early quotation to quantify cost increases and allow as much time as possible for post-proposal negotiations

- Understand the impact of changes to reseller involvement to the purchasing organization and the impact that may have. As a corollary, seek external counsel from market intelligence partners to address any knowledge gaps left by changing resellers

- Benchmark existing BAU deals to establish a baseline and retain a benchmarking partner that can provide accurate data on new products, pricing metrics and license rules

- Note that any previous price protection or fixed renewal costs agreed in contract may likely no longer apply as they are generally centered on like for like renewals, which are no longer available given the product changes

- Create a post-renewal strategy and timeline for any decisions made that may require more time to implement with forward milestones to review progress

- Recognize that any current or future partial reductions in subscription quantities will generally not generate linear savings at renewal and might be modelled prior to ascertain impact.

In Summary

Product changes and cost increases are almost inevitable for customers renewing post Broadcom acquisition, therefore immediate planning for those potential increases and the leverage of Broadcom VMware technologies in both the short and long term is key. IT Buyers should look to highlight these changes to key Stakeholders, Budget Holders and Strategic decision makers at the earliest opportunity to allow as much time as possible to determine the extra value and opportunities in these new bundles and/or where necessary discuss impact mitigation options.

Ascertaining, modelling and benchmarking potential costs may give further impetus and leverage so that these changes are high on the agenda, and where customers maintain internal IT/Technology risk registers, this technology might be added as a commercial risk in order to gain further visibility and traction.

IDC’s Sourcing Advisory Services (SAS) provides you with the industry’s most-recognized price benchmarks, analyst advice and IT optimization insight.

Ateequr Rahim contributed to this blog.