High Expectations Collide with Market Realities

Telecom Service Providers are facing historic challenges amidst shifts in both enterprise and consumer demand and challenges transforming from “connectivity providers” to digital platform players.

Historically, telecom service providers have championed connectivity at scale. In past decades, this proved a profitable strategy, with the value of connectivity garnering consistent year-over-year revenue growth and profits. However, recent years have seen telecom providers grapple with a host of challenges including industry competition, commoditization of services, and inflexible IT systems that have made it hard for them to swiftly innovate and compete against new threats.

Further, while network traffic continues to rise, predominantly driven by video apps, service providers have been unable to effectively monetize this traffic growth. The disconnect between revenue growth and network traffic growth remains one of the top challenges globally for service providers as they hunt ways to reinsert themselves and justify connectivity as not just a commodity, but as a value-based service that can be delivered to support a range of use cases and verticals.

In response, many forward-thinking telecom providers have made a purposeful decision to focus their technology offerings and ecosystem partners on targeting digital engagement and new revenue opportunities and rearchitecting their technology stacks to align with hyperscale cloud models as a means to simultaneously control costs and position for service agility longer term.

Even so, third-party entities, including CPaaS, cloud, and other digital platform players, have moved into largely siphon off these digital opportunities while curating vast developer ecosystems, once again relegating many telecom providers to a connectivity-only role.

New Tools in the Arsenal Create New Monetization Opportunities for Telcos

Amidst this push and pull of telecom service provider efforts, a new opportunity has emerged, driven by the promise of SA 5G networks and API exposure capabilities to empower telecom providers to reinsert themselves within the digital landscape by unlocking the ability to more easily sell and scale customized, programmable connectivity designed to be packaged and consumed by application developers.

Unsurprisingly, hyperscale cloud providers, CPaaS companies, and systems integrators have also positioned themselves for this new market opportunity by aligning with industry consortia (e.g., Camara, Open API Gateway) that are championing global standards; however, it remains to be seen where, how, and by whom value will ultimately be created and monetized.

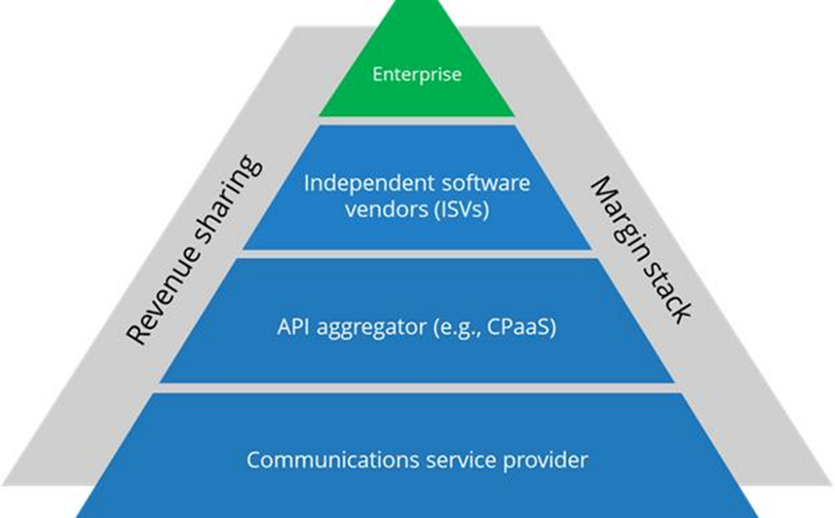

Figure 1: Emerging Telecom and Network API Ecosystem

As part of these market developments, the worldwide IDC team has spent the past couple of years building a methodology to size this opportunity and define ways the telecom API ecosystem can work together to enhance this emerging market.

Telecom Service Providers Can Capitalize on AI and GenAI to Improve Business Results and Potentially Reshape Their Market Role

While APIs represent one-way service providers can capture new monetization opportunities, Artificial Intelligence (AI) presents another avenue to drive business results. More specifically, AI can be inserted into the telecom technology stack to improve TCO, enhance service agility (e.g., AIOps), as well as improve the customer experience (CX) lifecycle.

As telcos move toward future network architectures governed by cloud-native architectures, this ushers in a much greater role for automation and orchestration across various physical, virtual, and containerized network functions, as well as AI-informed operations and monetization platforms.

This in turn raises the importance of adopting AIOps within network operations; however, network-related AIOps brings its own unique set of challenges for Telecom Service Providers as well as a vendor community that overlaps but does not entirely match, the more generalized ITOps vendor roster.

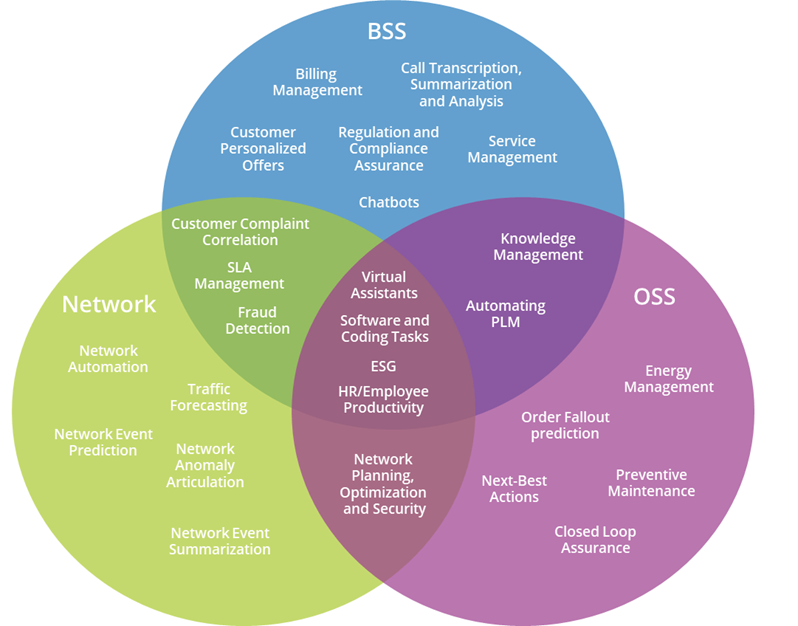

Meanwhile, GenAI has emerged as a powerful tool to enable telcos to embrace some of the benefits of AI while simultaneously investing in the internal skillsets and capabilities required to embrace AI more broadly. The graphic below highlights some of the key use cases IDC envisions for GenAI across telco environments.

Figure 2: GenAI Telco Use Cases Across Telco Environments

While this graphic provides an optimistic outlook for the full set of Gen AI’s impact on telecom service providers, the reality is it will take time, effort, and AI partners for telecom providers to realize gains from AI. Indeed, with AI curators racing to drive AI innovation across multiple environments (e.g., hybrid and multi-cloud, etc.), it is likely multiple models will become prevalent in which telecom service providers serve dual purpose by becoming some of the strongest consumers and distributors of AI and Gen AI going forward.

Further, interest in AI applications is also prompting service providers to build near-term roadmaps clarifying how enterprise customers can leverage their core and edge assets to support emerging use cases (e.g., AI inferencing at the edge) while reinforcing connectivity as the foundation of AI-enabled applications and services. Indeed, while AI is being emphasized by many organizations, it will require a global distribution mechanism to help scale. Hyperscale cloud providers are top-of-mind, but telecom service providers can also play a role in connecting AI apps.

Overall, it is a critical time for telecom providers, and their technology vendors, to synchronize on key priorities and investment strategies, particularly in light of historical struggles to optimally monetize telecom networks. Doing so can enable them to rearchitect a brighter future for telecom monetization and set them up for a key role in a digital, AI-centric world.

For a deeper dive into these topics, watch IDC’s July 10th webinar, “Revenue Enablers for the Future Telco: APIs, AI, and Emerging Tech”.