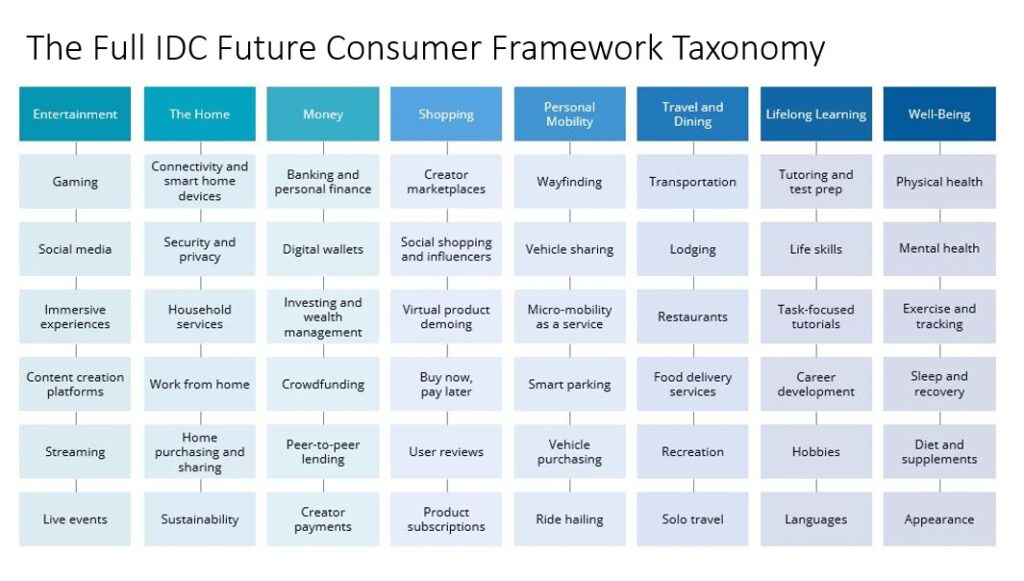

IDC’s Future Consumer research leverages eight primary categories to help paint a picture of a consumer’s whole life and the role that technology plays in it. The eight categories of the Future Consumer Framework include Entertainment, The Home, Travel and Dining, Personal Mobility, Money, Shopping, Lifelong Learning, and Wellbeing. The goal is to go deep and wide to create a holistic view of the Future Consumer; we expect the framework to evolve based on client feedback and market shifts.

Our research includes survey data from seven countries as part of our Consumer Pulse research, internet penetration, online activities, online spending, and other forecasts as part of our 51-country Consumer Market Model (CMM), and thought leadership as part of our Future Consumer Agenda.

These consumer-centric insights will benefit not just companies focused on the consumer but also enterprise companies whose offerings must adapt to fit the demands of commercial entities whose workforce requirements are increasingly influenced by what consumers want. We believe that, increasingly, the consumer is the tail that wags the enterprise dog.

As we’ve built out this research over the past year, one thing has become clear: The data and insights we have in this research stream can help a much broader range of companies than typical technology-specific market research. To that end, we thought it might be helpful to pull an illustrative data point from each of the eight categories and articulate the broad swath of users inside a company that can use this type of data to build their business.

Entertainment

Impact/Data Point: The Future Consumer is more engaged with user-generated content and social media than with traditional linear TV or streaming. This will profoundly impact how future content is created, distributed, and consumed, and the resulting changes and influences carry huge ramifications for technology companies. Moreover, the CMM shows that spending on independent content subscriptions is set to grow at a 12% worldwide five-year Compound Annual Growth Rate (CAGR).

Who can use this type of data? Device OEMs, component vendors, strategy teams, technology marketers, content platforms, content delivery, and infrastructure vendors.

The Home

Impact/Data Point: More than 50% of Gen Z say working from home is better than working in the office, and readiness to work from home is driven by income over the type of work. As companies and employees continue to navigate the challenges associated with hybrid work, consumer attitudes will have an outsize impact on the hardware, software, and services that evolve to serve the home as the center of everything. The CMM shows that smart home-related services are set to grow at a 16% worldwide five-year CAGR.

Who can use it: Peripheral OEMs, smart office vendors, platform vendors, collaboration software developers, home services vendors, and security and privacy-focused software developers.

Travel and Dining

Impact/Data Point: The attitudes and behaviors of Gen Z and Millennials increasingly point to a very different lifestyle from previous generations regarding meals and dining. These two cohorts have a much more positive view of the quality of delivered food and the value of delivery services.

Who can use it: Hospitality, travel, transportation, and tourism executives, technology vendors serving the industry, and online travel service providers.

Personal Mobility

Impact/Data Point: Mobility is multi-mode for most, and 83% of Gen Z use at least two modes of mobility for at least 10% of their mobility time. The largest share of all consumers (45%) uses three mobility modes monthly. The U.S. is the main exception to this pattern, with half of consumers using just one mobility mode. The CMM shows that micro-mobility services are set to grow at a 26% worldwide five-year CAGR.

Who can use it: Automotive executives, micro-mobility startups, technology strategy executives, OS and platform owners, government planners, and map services.

Money

Impact/Data Point: One in six (16%) of consumers report that their primary bank account is an online-only one. Gen Z (22%) and Younger Millennials (20%) stand out for their higher adoption. The latter are also much more likely to use the many different sources of alternative digital payments (peer-to-peer, digital wallets, etc.) over cash. The CMM shows that digital finance services are set to grow at an 11% worldwide five-year CAGR.

Who can use it: Banking and finance companies, fintech vendors, OS vendors, platform owners, device vendors, and security and privacy technology providers.

Shopping

Impact/Data Point: During the pandemic, online transactions became the majority for the first time. Very few consumers buy “only online” or “only in-person.” Among Gen Z, 67% lean toward an online-first mentality, while younger millennials are at 75%. The CMM shows that online grocery services are set to grow at an 8% worldwide five-year CAGR.

Who can use it: Online and traditional retailers, direct-to-consumer vendors, device and accessory OEMs, and technology vendors that service retail clients.

Lifelong Learning

Impact/Data Point: Our research shows that 58% of consumers used online learning last year, and penetration is over 70% among Gen Z and Millennials but just 36% among Boomers and older. Those with a continuous learning mindset embrace it. The CMM shows that broad online services are set to grow at a 15% worldwide five-year CAGR.

Who can use it: Online learning platforms, app stores, OS providers, device vendors, content creation and delivery platforms, and strategy and marketing teams.

Wellbeing

Impact/Data Point: More people are exercising and doing it more frequently than before. Home’s share of workout time is at 44%, up from 36% pre-COVID but down from the 56% COVID peak. Interestingly, this is an area where Gen Z/Younger Millennials underperform the average. The CMM shows that online fitness services will enjoy a 19% worldwide five-year CAGR.

Who can use it: Connected health service providers, disease management firms, OS providers, wearable OEMs, and online health and fitness providers.

Conclusion

The data points above represent just the tip of the iceberg in terms of what IDC has to offer when it comes to consumer insights. Our team is ready to help you navigate an increasingly complex consumer environment with rock-solid survey data, strong forecasts built on well-reasoned assumptions, and thought leadership based on years of experience covering these markets. If any or all these topics interest you, we encourage you to reach out and start a discussion with our team.

If you’re attending West Coast Directions, be sure to register for Tom Mainelli’s Future Consumer breakfast presentation; if you won’t be there, reach out for a copy of the deck.