It has been said before that “proper planning prevents poor performance” and this is particularly important for IT buyers in these uncertain economic times.

The IMF has warned that “Half of the European Union and one-third of the world face recession in 2023”. Global inflation is forecast to rise from 4.7 percent in 2021 to 8.8 percent in 2022 but to decline to 6.5 percent in 2023 and to 4.1 percent by 2024.

Every business needs to understand the impact of inflation and recession from both a demand and supply perspective. This is a very broad topic, so let’s focus this discussion using the persona of the IT managed service buyer.

The IT managed service buyer has (amongst others) the following pain points:

- Understanding current market labor rates – for time & materials projects it’s critical that IT services buyers understand current market labor rates to ensure they are getting value for money from IT service providers.

- Validating IT budgets – for longer term multiyear budgets it’s important for IT service buyers to understand market pricing trends for both labor rates and full scope IT services.

- Forecasting – arguably the most difficult task and a product of the first two is forecasting IT spending over the typical 3- to 5-year horizon, so this is the area that we’ll explore in this blog.

Forecasting

The one true fact about forecasts is that they are always wrong. The more data you have, however, the better the accuracy and it can be compelling for technology buyers when coupled with deep market insights from IDC’s team of subject matter experts, analysts and researchers.

IDC’s benchmarking and sourcing advisory services has market price data from recently signed IT Outsourcing deals in the last 12 to 18 months, which show that inflation has directly impacted the market price for Outsourced IT Services and labor rates.

Annual price reductions in the region of 5% to 10% were commonplace for outsourced IT infrastructure services such as server, storage and network device management, as end clients benefited from economies of scale and automation that service providers offered from offshore delivery locations.

Over the last couple of years, IDC has observed that traditional year on year price reductions have reduced substantially and even reversed for IT services with high direct labor content, such as service desk and deskside support.

IDC research (IDC# EUR149042322, May 2022) has shown that the underlying digital transformation (DX) trend in Europe continues to be strong. Initiatives within digital service development and back-end application and process modernization have increased in priority and size in 2021. The COVID-19 pandemic has resulted in reprioritizing security, workplace transformation and related skills development.

The research emphasized the need for up-to date, evolving skill sets to ensure the resilience and agility needed in rapidly changing environments. Changes in the workplace, due to the pandemic, further increased the demand for cybersecurity and data analysis and uncovered a need to improve skills development and training.

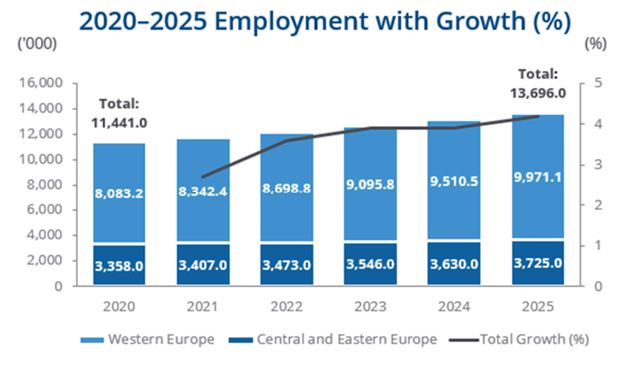

European technology employment grew 2.7% in 2021 with continued demand for DX skills, even though the COVID-19 pandemic put strong constraints on larger implementation projects. 2020 had an essentially flat growth of 0.4%, but growth in employment in 2022 will reach 3.6% as demand continues to grow.

Labor rate inflation

It may be stating the obvious that labor is a key element of any IT managed service deal, however it’s not the only component and other elements like tools and automation are also key as they enable service providers to provide a more cost-efficient solution, using standardized offerings coupled with sheer economies of scale. The benefits of server virtualization and offshoring have plateaued for the majority of existing outsourced infrastructure deals and further cost savings are marginal for many clients.

First-time outsourcing deals can still offer significant savings to clients as offshore labor rates are still significantly lower (up to 30%) than Western Europe rates. This is a relative statement, however, and labor rate inflation is a global reality.

In a related IDC blog Brian Clark explains that the situation has evolved as both buyer and supplier behaviors have adapted to the new reality that inflation is most likely here to stay. The reasons for the price increases may be changing, as well as the areas of IT most impacted, but navigating rising prices for IT supplies, services and talent remains a challenge as we start 2023.

IDC market research has shown that AWS recently raised consulting day rates by 7-8% and Adobe increased pro-serve rates by 20%. Many more examples exist as the cost to deliver professional services continues to rise, due to high demand for this service and a corresponding critical IT skills shortage.

Recent rounds of layoffs within the high-tech community may alleviate labor shortages, but their focus will be on internal operations. The security or Kubernetes expert is expected to remain in high demand.

Inflation in the Euro Area

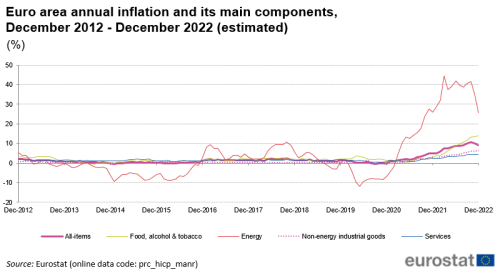

Data from Eurostat (the statistical office of the European Union) shows that Euro area annual inflation is expected to be 9.2% in December 2022, down from 10.1% in November 2022.

Energy is expected to have the highest annual rate in December (25.7%, compared with 34.9% in November), followed by food, alcohol and tobacco (13.8%, compared with 13.6% in November), non-energy industrial goods (6.4%, compared with 6.1% in November).

Services inflation is estimated to be 4.4% in December, and this aligns with IDC’s experience on IT Services Price Inflation, even though the underlying wage inflation is significantly higher.

Conclusion

Technology buyers should expect the price of professional services to continue to rise in the coming 18 to 24 months, as a direct impact of global inflation. The impact on multi-year IT outsourcing agreements will be less pronounced, however, as service providers leverage the benefits of offshoring, automation and efficiencies from standard offerings. That said, end user clients should expect existing service providers to enact their economic price adjustment clauses; the bottom-line impact, however, can be offset with productivity gains and strategic investment to reduce labor intensive business processes and associated services.