At its core, market intelligence helps organizations understand their customers, competitors, and markets better, and allows them to capitalize on changing conditions. As the interplay between these elements becomes more complex, organizations are investing more in aligning the innovation process with market demands. Leveraging market intelligence data, companies can better understand market size and growth opportunities, accelerate innovation, and identify key adjacencies.

Key assets for best-in-class market intelligence organizations are total addressable market (TAM) forecasts and market share data. These tools provide a clear picture of the current state of the markets a company participates including, who key competitors are and their market shares, the expected growth rates of those markets, as well as key adjacent markets that a company considers complementary, competitive, or otherwise ripe for expansion. This forecast and share data is typically customized to:

- Align to the taxonomic lens through which the company chooses to view the market (this may be on a number of axes from technology to geography to vertical and business size segments to unique sales territories and structures)

- Provide the necessary resolution of data (e.g. at the geographic groupings that the company manages to or at the technology market detail that effectively informs product teams and individual product analysis)

- Be delivered with the latest insight at the right time, so it can be fed into yearly or regular strategic planning cycles, sales operations decisions, capital allocation analysis, product management decisions, and other critical data-driven decision processes

Related Resource: IDC’s Custom Data & Research Capabilities

The goal of all of this is to create a single version of market truth that all internal parties including marketing, sales operations, finance, strategy, and senior management can use to inform critical business decisions about investment, product development, sales team focus and allocation, partnering, M&A, and more.

Building, regularly delivering, and continually evolving such a data set is challenging work. However, the payoff is significant:

Market intelligence tools allow you to:

- Focus on a single, credible data set so you can reduce or eliminate internal debate over things like opportunity sizes and expected growth rates

- Build internal consensus and agreement on highest priority target markets for core business and growth opportunities

- Eliminate duplicate work that may be going on in regions/countries or teams evaluating similar opportunities

- Free internal resources to focus on making strategic decisions with the data not assembling it

Without regularly developed, consistent market data, mapped to your business, planning decisions can take longer or be based on ad hoc data or opinion. Market intelligence data provides quantitative analytic support to aid in business and investment management, product and market feasibility and competitive strategy.

Free Download: IDC’s Guide to Market Sizing

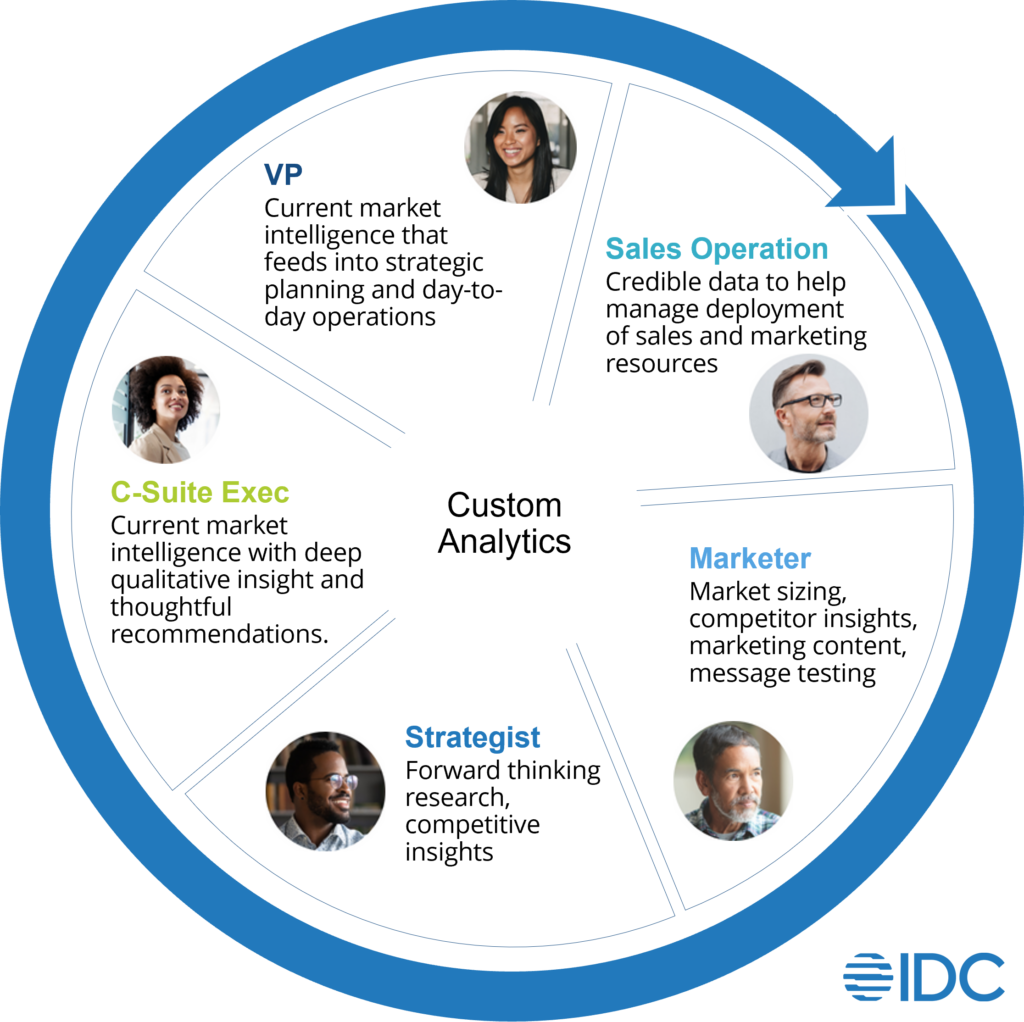

IDC has found the best organizations build this single version of market truth, build consensus that it should be used by all relevant teams, distribute it widely so it is well utilized, and rigorously and regularly revise and update its taxonomies, definitions, and data so it evolves with the company. If this is done, it enables C-Suite executives to identify markets where they can obtain and retain a competitive advantage. (i.e., how to do better in markets they’re currently in and how to identify new market adjacencies they should move into). Sales Operations can use market intelligence tools to incentivize their sales team and resolve conflicting views between, typically, anecdotal sales feedback and central estimates. Marketers benefit from identifying trends early, validating the market for their products and services and crafting messages that are fresh and relevant.

What Goals Can Market Intelligence Achieve?

- Identify business growth opportunities

- Provide quantitative analytic support to aid in business and investment management, product and market feasibility

- Identify performance in existing markets

- Identify compelling market adjacencies that can be entered via organic, acquisitive, or partnering actions

- Confirm market for existing product, how to expand addressable market for current offers, and how to develop new products for existing and new markets

- Target key geographies, verticals, and other segments

- Identify key competitors in existing and planned market, their offers, market share, recent performance

Selecting the Right Market Intelligence Tool

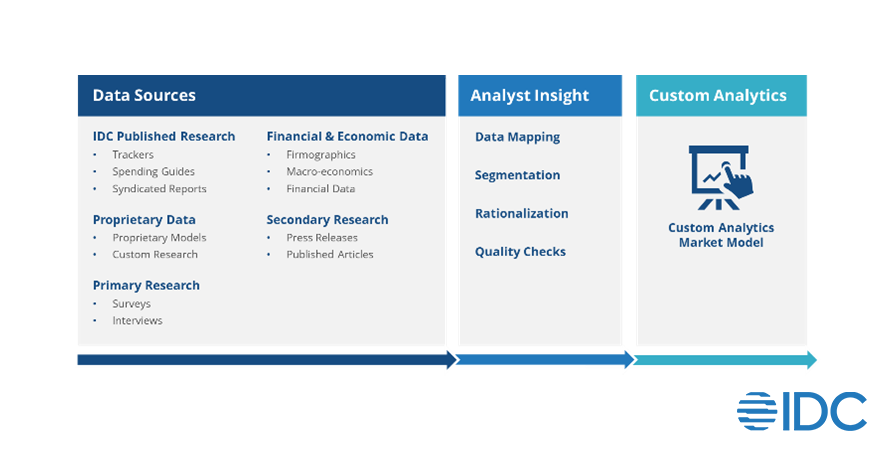

You need to be sure that the tool you use maps the technology world, and creates extensive, insightful data, customizing it to support your critical decision making. To do that, you will want to understand the approach used to develop these custom data sets. What are the sources of data? How is the data validated and rationalized?

IDC maps the world of technology through extensive, well documented taxonomies in technology domains (hardware, software, services) as well as vertical, business size, and use cases. Through this rich set of regularly updated data and taxonomies, methodologies, and tools, as well as a worldwide network of analysts, we deliver these customized market views to the largest, most advanced, and innovative technology driven companies in the world helping them better manage their business.

The right market intelligence data can help you overcome product and market complexities, more accurately forecast revenues and outpace competitive forces by providing current insights that feeds into your strategic planning as well as day-to-day operation of your organization.

IDC’s Custom Analytics practice and how it can help you with reliable market intelligence data.

DOWNLOAD NOW: