As the tech landscape continues to evolve, businesses worldwide are looking for new ways to expand their reach and tap into unexplored markets. For home-grown technology vendors, the opportunity to scale their businesses beyond local borders is vast—but understanding the nuances of global markets is key to navigating this growth.

IDC’s X2G Research focuses on helping home-grown vendors (X) broaden their global (G) market reach by understanding new wallets and tapping into global demand. This research is designed to provide critical insights to succeed in new regions, increase market presence, and build stronger relationships with international stakeholders.

Understanding Tech Buyer Intentions and Vendor Perspectives in Asia

One of the biggest challenges for home-grown vendors is understanding the diverse needs and expectations of tech buyers across the Asia/Pacific region. IDC’s X2G Research gives an overview of Asian tech buyer intentions and vendor perspectives, comparing the experiences and requirements of multinational corporations (MNCs) with those of Asian home-grown tech vendors.

Key Questions Explored:

- What do buyers in Asia/Pacific Japan value most when selecting a tech vendor?

- How do perceptions of MNCs differ from those of local vendors?

- What are the pain points buyers face when working with home-grown vendors, and how can these be addressed?

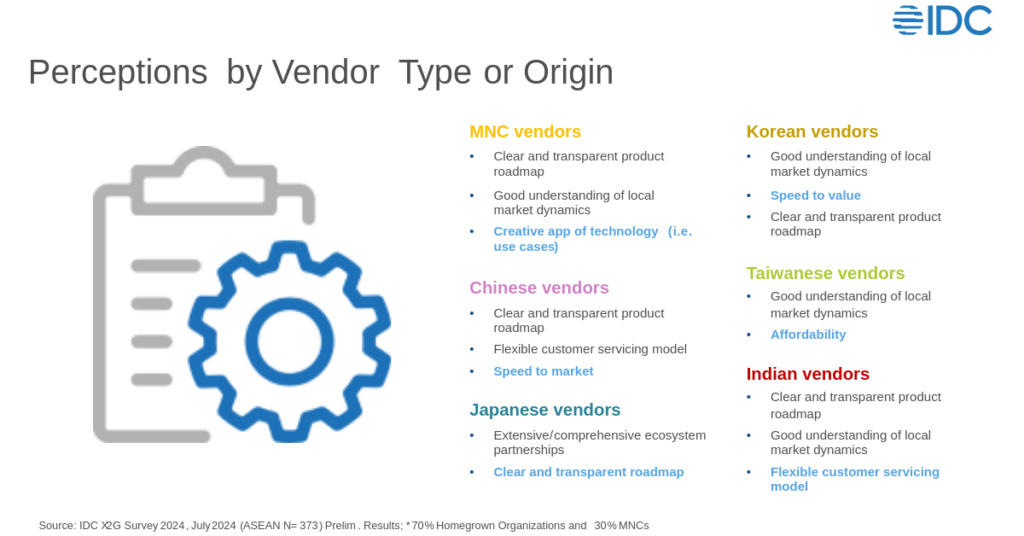

IDC found in its survey of Asian home-grown and MNC vendors that while MNC vendors are valued by the region’s tech buyers for their creative applications of technology (e.g., use cases), Asian home-grown vendors are preferred for their speed to value/market, extensive/comprehensive ecosystem partnerships, affordability and flexible customer servicing models, to name a few.

By uncovering these insights, vendors can tailor their offerings, messaging, and customer engagement strategies to better align with buyer expectations in Asia, ultimately driving higher conversion rates and customer satisfaction.

Crafting Effective Go-to-Market Strategies, Identifying Opportunities and Addressing Challenges

A strong go-to-market (GTM) strategy is critical for any vendor looking to expand its footprint. However, what works in one market may not necessarily work in another. IDC’s X2G Research offers actionable insights into developing GTM strategies that resonate with local audiences while maintaining a global appeal.

Key Considerations:

- Localization: Adapting products, services, and marketing campaigns to suit regional preferences.

- Partnerships: Building alliances with local players to accelerate market penetration.

- Pricing and Packaging: Aligning pricing models with local economic conditions and buyer expectations.

In the same survey IDC found that the top vendor selection criteria used by tech buyers in Asia/Pacific, in order of priority, are product roadmap, product quality and trust, functional expertise (business process), pricing and service delivery, industry knowledge, and innovation.

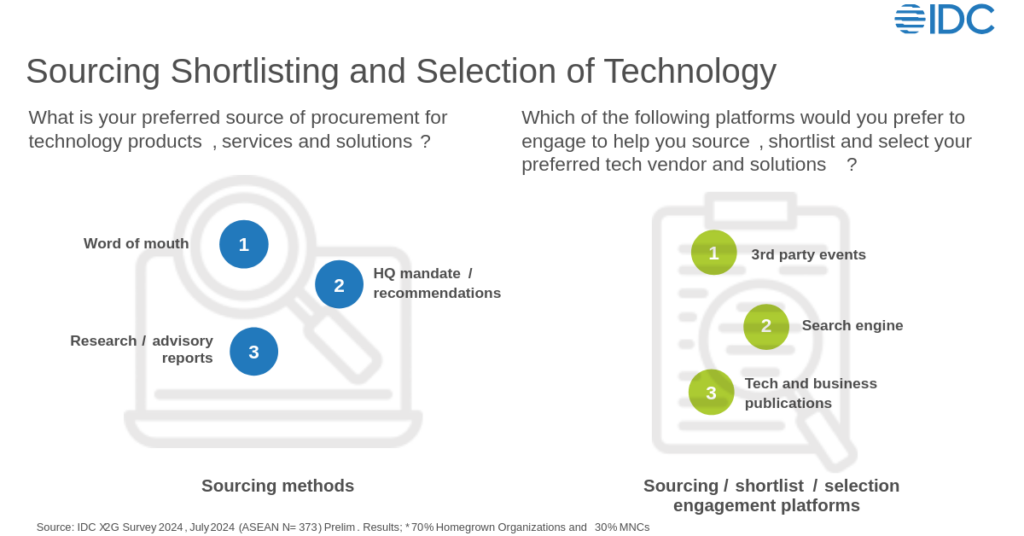

In terms of sourcing method of procurement for technology products, services and solutions, word of mouth comes first, followed by HQ mandate/recommendation and while research/advisory reports. In sourcing, shortlisting and selecting their preferred tech vendor and solutions, the region’s tech buyers prefer engaging the most in third-party events, followed by researching online via search engines and tech/business publications.

By adopting a data-driven approach to GTM planning, vendors can maximize their chances of success in their expansion into new markets.

Doing Business in ASEAN: Success Playbooks for Tech Vendors

Ultimately, the success of home-grown vendors hinges on their ability to identify and capitalize on high-growth opportunities. This research equips vendors with the knowledge and tools needed to target specific industries, segments, and geographies effectively.

Key Insights Provided:

- Emerging trends and opportunities in key industries such as fintech, security, cloud, manufacturing, and more.

- Regional market dynamics and growth potential across Asia/Pacific.

- Best practices for building brand credibility and trust in new markets.

With these insights, vendors can make informed decisions about where to focus their efforts, ensuring they achieve sustainable growth and long-term success.

Why This Matters

The Asia/Pacific region is home to some of the world’s most innovative tech vendors yet many struggle to break into global markets or compete with established MNCs. By addressing the unique challenges these vendors face—from understanding buyer intent to navigating regulatory landscapes—this research aims to level the playing field and unlock new opportunities for growth.

For home-grown vendors, the message is clear: the world is your oyster, but success requires a strategic, informed approach. By leveraging the insights and strategies outlined in this research, Asia’s tech vendors can not only expand their reach but also cement their position as global leaders in the tech industry.

What are your thoughts on the challenges and opportunities for home-grown tech vendors in Asia/Pacific?

Register today for our webinar on ASEAN IT Market Opportunities for Asian Homegrown Tech Vendors to gain critical insights on tech buyers’ intentions and perceptions of Asian tech vendors, the state of the ASEAN IT Market, and winning go-to-market strategies. To learn more about IDC X2G Research, contact us by submitting this form or email Tessa Rago at trago@idc.com.