The Best of Times

For Apple, it is the best of times, thanks to the way it has consolidated its position in its traditional markets and raised its game above that of Android in higher price segments.

In 2023 it became the world’s largest phone maker by volume, surpassing Samsung according to IDC’s Worldwide Quarterly Mobile Phone Tracker.

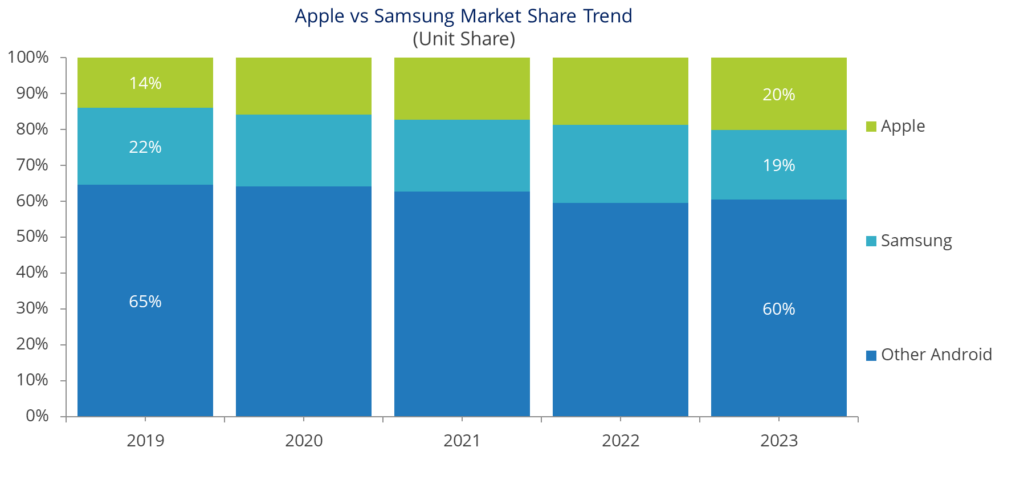

Volumes and unit share have been creeping up since 2019 (Chart 1 below), and the value of iPhone shipments has close to doubled in a decade. Various factors have helped Apple achieve this.

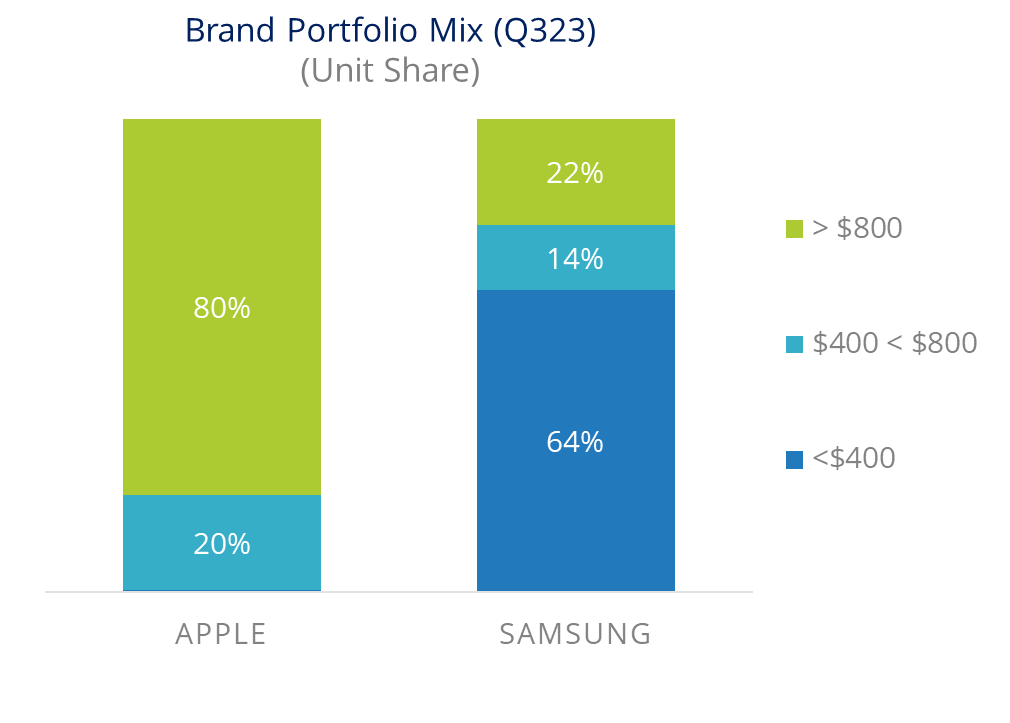

Apple increasingly takes the top of the market, creaming off well-heeled consumers in affluent countries for its premium phones. (Chart 2 below)

More specifically, Apple has ridden a wave of consumers preparing to put more money down for their phones and the iPhone 14 and 15 series have resonated with consumers.

The consumer willingness to pay more has pushed Apple even further ahead of its competitors in value terms, and the most expensive Pro models in the new ranges have become the most popular models in its flagship lineup.

Behind Apple’s rising trend are also familiar reasons like the impact of the coronavirus crisis, during which consumers got used to spending more on devices given how much more people use them.

Apple also continues to leverage mobile operators to great advantage.

In Apple’s top 20 markets by share, nearly two-thirds of iPhones are sold through the telco channel, according to IDC data, a figure which has hardly dropped in the last five years.

Their postpaid financing and trade-in deals drive a lot of the iPhone’s volumes. IDC’s Final Tier Mobile Phone Tracker shows that in the US 88% of iPhones are sold through operator postpaid. Generous buyback offers encourage consumers to trade in for the latest iPhone model, knowing that they will get a good price when they repeat the trade in a couple of years.

These deals have helped Apple in those top 20 markets to increase its share in Price bands above $650 to over three quarters.

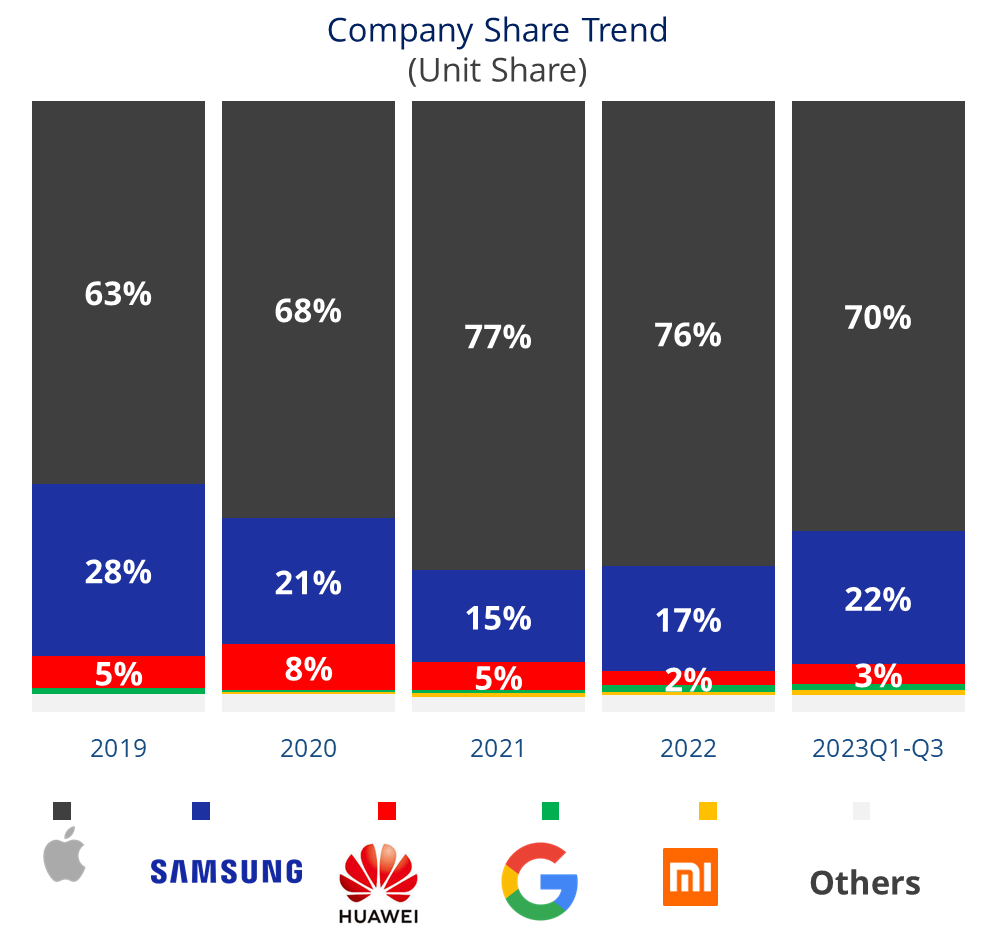

Serendipity has played a role in Apple’s rise too – Apple’s share in China jumped after US sanctions in 2019 stopped Huawei from accessing US components necessary to make 5G smartphones, essentially knocking Huawei out of the smartphone race. Since then, Apple has more than doubled its share in China and became number 1 for the first time ever in 2023.

A less talked about factor is that Apple has reached this position without much change in its geographical focus. Outside of its growth in China, the majority of its sales remain skewed to the richer parts of the world. The Top 20 Apple markets by units share account for more than half of total iPhone shipments, but they account for less than 10% of the global population.

Also, four-fifths of iPhones are priced above $800 (Chart 3 below). Catering to richer markets and more affluent consumers also made Apple more resilient to the current macro crisis. The strength of Apple’s ecosystem, its walled garden of apps, its family of devices, and its well-renowned focus on user experience, also helped maintain demand for Apple during recent challenging years. As did the iPhone’s stronger resale value throughout its life cycle.

Apple has also done well in supply: its superior navigation of the supply chain crisis from Covid-19-related lockdowns enabled its production to escape relatively unscathed, unlike some other industry players.

The Worst of Times

For Samsung on the other hand, it seems like the worst of times in the phone market. It has lost its position as number one in units, a position many in the phone business saw it retaining longer.

As the world’s everything everywhere brand in the phone market, many of Samsung’s difficulties in the last few years have to do with parts of the world, that is most of it, where the iPhone is an aspiration much more frequently than a possession.

It’s not just Samsung which is in the doldrums, it is the global Android market; global Android shipments shrank around 5 percent in 2023 and a total of 20 percent over the last five years.

There were some specific reasons why 2023 was a bad year.

While in the richer world affluence and postpaid deals gave many consumers the choice to ignore the wave of inflation and cost of living pressures, that was far less of an option for vulnerable poorer consumers, who reined in spending on Android smartphones.

So Android sales contracted in many countries, including those of Samsung, since two-thirds of its volume are low-end devices below $400 (Chart 3)

The economic situation in China as it emerged from the coronavirus lockdown dragged down the local market for one and had a knock-on effect on the global market.

But there are more general factors at play.

The motors of the Android market are also much less dynamic than they were. The Chinese 5G boom was over two years ago, and the Indian smartphone market is no longer growing so rapidly or consistently.

The market potential of some emerging markets remains long term, for instance, Africa – where despite smartphone penetration of around 40% according to the GSMA mobile trade body, the market is essentially flat.

Africa has been hit by the global downturn, with falls in several local currencies and new laws imposing import restrictions crashing certain large markets. Emerging markets often suffer badly in a global downturn.

So where has this left Samsung?

In terms of the Android players, it is not doing badly. It has retained its unit market share in Android, in fact it has been level-pegging for several years now.

It has also regained some of the premium smartphone share it lost when it stopped producing its Note series, and it leads in foldable. It has simplified and rationalized its model portfolio, increased its focus on the premium market, and gained 7pts in share from Apple over the last two years (Chart 2).

In the big mid-market economies which are key to the Android market outside China and India – Brazil and Mexico, Thailand and Malaysia – Samsung has in the last couple of years held its own, as it has in larger and poorer Indonesia and the Philippines, and of particular note in India.

Furthermore, Samsung has pushed up its ASP in many of these markets, despite bringing 5G rapidly to lower price points in its portfolio.

So Samsung is not that badly placed if Android-focused markets begin to grow again

These markets are more dependent on the economic cycle than Apple’s key markets, but the economic tide will turn.

Samsung may need to focus its competition in richer Apple markets on foldables, where Apple currently has no product, and reorientate its other flagships towards price brackets affordable in middle-income countries.

Apple meanwhile still faces the challenge of renewed competition from Huawei in China and how to expand into more countries without compromising the premium position of its products.

While Apple has pulled ahead of Samsung in unit sales, for now, they remain close rivals. It is a lopsided contest, in that Apple has the advantage of its own and compelling OS ecosystem while Samsung is limited by Android.

But Samsung is a feisty company, a global consumer electronics player with a worldwide presence, and not about to take playing second fiddle to Apple lightly.