One can be forgiven for their quizzical expression on hearing that we still have a third of the world’s population without internet access.

According to the International Telecommunication Union (ITU), an estimated 2.9 billion people, representing 35% of the world’s population, do not have access to internet. The least developed countries are the least connected, however, these connectivity gaps also extend to developed countries.

For example, approximately 19 million Americans representing 6% of the population still lack access to fixed broadband service at threshold speeds. Global connectivity gaps exist in parts of Europe and Asia, Africa, and South America.

It’s against this backdrop that a challenge to bridge the digital divide creates an opportunity for comms SPs (Communications Service Providers) partnering with LEO (Low Earth Orbit) satellite operators to offer highspeed cost-effective options. This will close the remote and rural connectivity gap, considering terrestrial network deployment has not been financially feasible to develop a robust digital infrastructure.

The pairing of satellite providers’ constellations in LEO with comms SPs’ mobile networks promises to deliver highspeed satellite-to-cellular coverage and broadband internet access to connect the unconnected. Comms SPs have high expectations to derive significant benefits including extended coverage with lower latency, resiliency, access to emerging markets, and the ability to offer new services and applications.

The Surge in LEO Satellite Constellations

Previously, satellites’ success has been hindered by substantial costs and invisible profit margins associated with launching and maintaining a fleet of satellites. This time, satellite companies have a higher chance of success because of several key reasons:

- Building smaller, more capable LEO satellites that are placed in orbit at an altitude of 2,000km or less. The advancement in rocket technology has made reusable rockets a reality. This significantly improves the economics of launching satellites into lower Earth orbit, making the business case more viable.

- Conventional satellite connectivity placed in more distant GEO and MEO orbits have had challenges with cost, signal delay, and high latency for many cases. Whereas LEO satellite services offer lower latency in the range of 20–50ms due to the satellites’ lower orbit, making them a more viable highspeed satellite connectivity option.

- Combined private and public funding in the billions of dollars for LEO satellite ventures. Governments, driven by the desire to establish control in space are diverting resources away from other programs to invest in space-related initiatives. Prominent examples include the U.S., India, China, and the European Union.

- Private companies such as SpaceX are outperforming governments in terms of deployment speed, shaving years off the process. Also, previously struggling companies such as OneWeb and Iridium have been revived out of bankruptcy through public and private funds.

With these factors at play, the current landscape presents a more favorable environment for LEO satellite operators to thrive and overcome previous challenges in addressing a vast untapped market.

Comms SPs Tying the Knot with LEO Satellite Partners

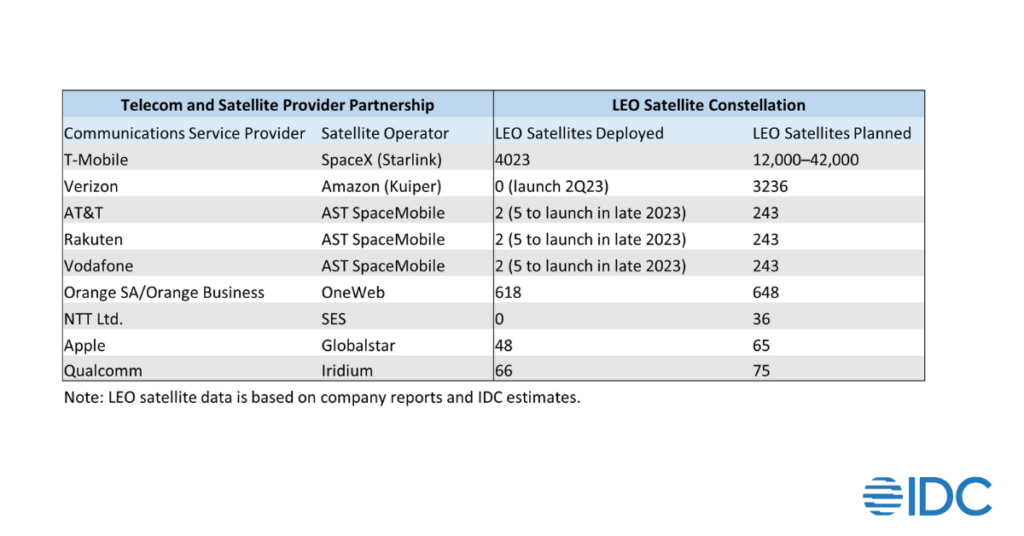

The advent of LEO satellites signals an important new opportunity for comms SPs to extend the reach of their network. Some of these early and notable comms SP and satellite operator partnerships capitalize on this opportunity with first-mover advantage, including:

- T-Mobile announced its technology alliance with SpaceX (Starlink) in August 2022 to develop satellite-to-smartphone connectivity in the United States by pairing the Starlink satellite constellation in LEO with T-Mobile’s wireless network.

- Verizon announced its strategic collaboration with Amazon (Project Kuiper) LEO satellites in October 2021 to extend 4G/LTE and 5G connectivity solutions for both consumers and businesses in rural and remote communities in the United States.

- Orange SA and OneWeb announced their partnership, in March 2023, to expand connectivity services across Europe, Africa, Latin America, and other global regions using LEO satellite communications.

- AT&T, Rakuten, and Vodafone have each separately partnered with AST SpaceMobile to use its LEO satellites to provide direct satellite-to-cellular communications. The partnership, in April 2023, tested the first-ever direct voice connection from space to an everyday cellular device.

- NTT and SES announced in April 2023 a multiyear partnership to use MEO satellites to deliver NTT’s edge as a service to enterprise customers.

- Apple in partnership with Globalstar unveiled satellite connectivity for its iPhone 14 and iPhone 14 Pro models in November 2022 to provide emergency SOS satellite service in remote areas without regular cell phone coverage.

- Qualcomm and Iridium announced their partnership in January 2023 to bring satellite-to-cellular communications to Android smartphones connected to Iridium’s LEO satellite constellation.

It is evident satellite providers who also own the rockets to launch their LEO satellites have an advantage in building out their constellations versus those that rely on third-party rocket providers. IDC expects, due to the increased competition, smaller satellite operators will be either acquired or forced to partner to survive. Also, the right partnerships will be crucial for comms SPs to support their growth plans for satellite-to-cellular coverage as well as future road map development for broadband wireless services.

IDC’s Conclusion

IDC is projecting alliances with long-term implications will increase and become more significant through the pairing of satellite providers’ constellations in LEO with comms SPs. Enabling comms SPs to evolve their network beyond terrestrial cellular with LEO satellite services that include high-speed internet, 4G/LTE and 5G broadband backhaul, and Internet of Things (IoT).

The partnering of terrestrial and satellite communications holds the promise of helping bridge the digital divide and open new economic opportunities for remote areas of the world. It also aligns with the United Nations mandate that by 2030 every person in the world should have safe and affordable access to internet.

The coexistence of satellite and cellular networks will become increasingly prevalent and the continued standardization effort in the 3GPP ensures 5G systems integrate NTNs, such as high-altitude platform systems (e.g., LEO, MEO, and GEO satellites), with terrestrial options.

The new wave of LEO satellite deployments have placed them on the radar of government regulatory bodies. Regulators are taking note of next-generation satellite technologies and government oversight will continue to increase as nations look to establish protective borders in space.

LEO satellite constellations offer a pragmatic and more cost-effective option to close the remote and rural connectivity gap, considering terrestrial wireless network deployment has not been financially feasible to develop a robust digital infrastructure.

The opportunity presented to global comms SPs by integrating LEO satellite connectivity is huge to connect the unconnected and help bridge the digital divide. Hence the right alliances with satellite operators will be critical for comms SPs to support their growth plans for ubiquitous satellite-to-cellular coverage and 5G wireless data and broadband services.

For more insight and information on comms SPs expanding service and revenue opportunities with LEO Satellites please see IDC’s market perspective, “Communication Service Providers Expand Service and Revenue Opportunities with Low Earth Orbit Satellites.”