The current economic downturn has had a significant impact on businesses across industries. Digital native businesses (DNBs) are no exception. IDC defines DNBs as companies built based on modern, cloud-native technologies, leveraging data and AI across all aspects of their operations, from logistics to business models to customer engagement. All core value or revenue-generating processes are dependent on digital technology. A DNB leverages its ecosystem of stakeholders (i.e., customers, partners, suppliers, and the community) to drive community-led innovation, dynamically evolve, and co-create offerings.

Related reading: How to Engage with Digital Natives

Market growth for DNBs is heavily influenced by VC funding cycles. And these have seen drastic change over the past 24 months. Comparing deal activity to 2021, each quarter in 2022 showed an increasing decline. Late-stage deal activity is low, and there is a significant lack of exit activity. This has an impact on valuations and results in portfolio triaging from venture capitalists. VCs have warned their portfolio companies to buckle up and ‘prepare for the worst’.

The last two years, however, create the basis for some tough comparisons (due to the pandemic driven spike in VC investments for digital native businesses). To put it into context, it is interesting to note that when compared to pre-pandemic levels (prior to 2020) overall VC investments have actually stayed on par or even showed growth (depending on the segment). Fundraising remained resilient, with most of the funds raised by larger, more experienced funds. Available cumulative dry powder is at an all-time high, just short of $300B, leaving enough money on the table to invest.

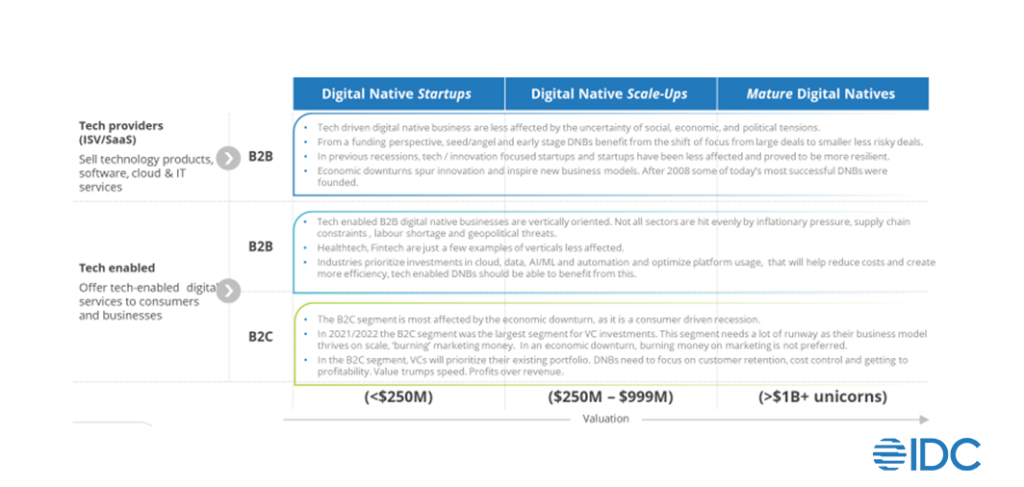

When looking at future market developments, it is important to note though that there is a difference in DNB business models and DNB company size. IDC distinguishes three DNB business models:

- Tech-oriented DNBs, who focus primarily on selling a tech solution

- B2B DNBs who offer tech-enabled digital services to the B2B market

- B2C DNBs, who offer tech-enabled digital services to the B2C market.

The graphic below shows that tech-oriented DNBs are least likely to be affected by the economic downturn. B2B DNBs, in many cases, are vertical-oriented, and not all sectors are hit equally by current market conditions. The B2C market, appears to be hit the hardest. The consumer tech sector showed the largest decline in deals in 2022. In this consumer-driven recession, many of the larger B2C-oriented DNBs have been forced to look at their business model. The adage of profits over revenue and value over speed to market has become dominant in the B2C segment.

The same holds true for the various size classes that we distinguish in the DNB market. Not all size classes are affected to the same extent.

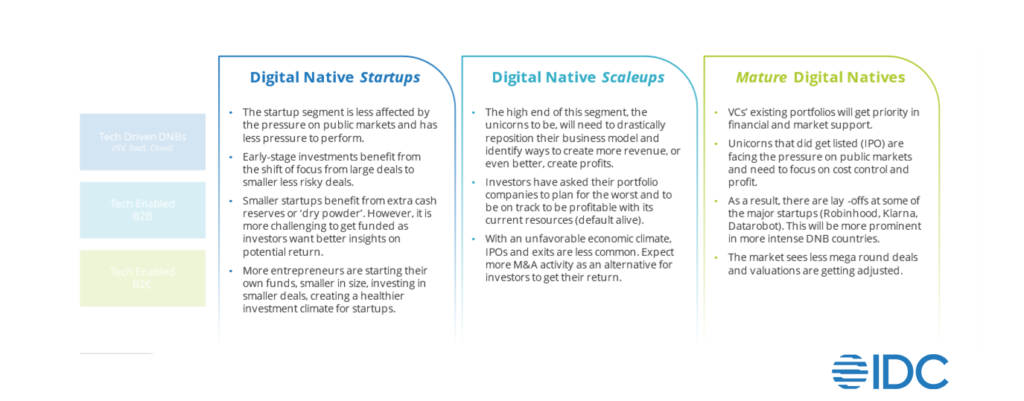

Up until this point, angel and seed deal activity appeared to be resilient to the economic downturn; however, this may change as the drop over the recent quarters has been significant. Deal value did increase, implying that start-ups in this segment are applying for larger funds to extend their runway. Early-stage deal activity also declined compared to 2021, but increased compared to pre-pandemic levels. Valuations remained on par, however, looking at a quarterly trend, they are declining as well.

The more mature digital natives are the most susceptible to economic conditions and public market pressure. Unicorns and mature, publicly listed DNBs face tough public market conditions and many of them have announced layoffs. Those planning an initial public offering are postponing their plans, making it more difficult for investors to cash in on their investments. This creates a hurdle in the venture capital investment cadence and in turn, makes it harder for start-ups and scale-ups to secure additional funding.

While the downturn may present challenges, it also presents opportunities. One area where start-ups and scale-ups can find opportunities is in recession-resilient tech areas such as cybersecurity, AI/ML, robotics and supply chain solutions. Additionally, focusing on industry-specific growth opportunities in the B2B DNB category, such as Fintech, Healthtech, and ClimateTech, remains beneficial.

Looking back, the pandemic has led to an abundance of funds available and the emergence of new business models in various sectors. The following economic downturn increases the need for sophisticated and innovative IT solutions. DNBs who depend on a digital business model are therefore expected to continue to increase their market share. IDC’s latest survey results show that DNBs are not inclined to cut back on their IT expenses*. This survey, of over 1200 DNBs globally further showed that this segment continues to invest more than average in IT and that the majority plans to increase these investments over the next 12 months. Overall IDC expects the worldwide digital native business tech spending to grow with a CAGR of 20.9% to become a $500 Billion Market in 2026.

Related reading: Worldwide Digital-Native Business Tech Spending Opportunity Forecast, 2022–2026: A $500 Billion Market in 2026.

In conclusion, the economic downturn will have its challenges for start-ups, scale-ups and unicorns, but still sees opportunity for growth, especially for the tech sector. By focusing on recession-resilient tech sectors and industry-specific growth opportunities, digital native businesses can navigate the current economic environment and secure the funding they need to grow their businesses.

If you want to learn more about this survey: please reach out to our Digital Native Business Team.