At IDC, we believe that understanding the consumers’ mindset around technology is vitally important to all tech companies, regardless of whether your business is B2C, B2B, or B2B2C. This is because irrespective of what type of technology you deliver—be it hardware, software, or services—what your end users want and need is increasingly dictated by their experiences as human beings, not employees. In a world where consumers’ experience with new technologies drives the trends impacting IT decision makers, we increasingly expect the consumer tail to wag the enterprise dog. Grasping this distinction is essential, as is the fact that we expect significant disruptions in the way consumers engage with and spend on technology in the coming years.

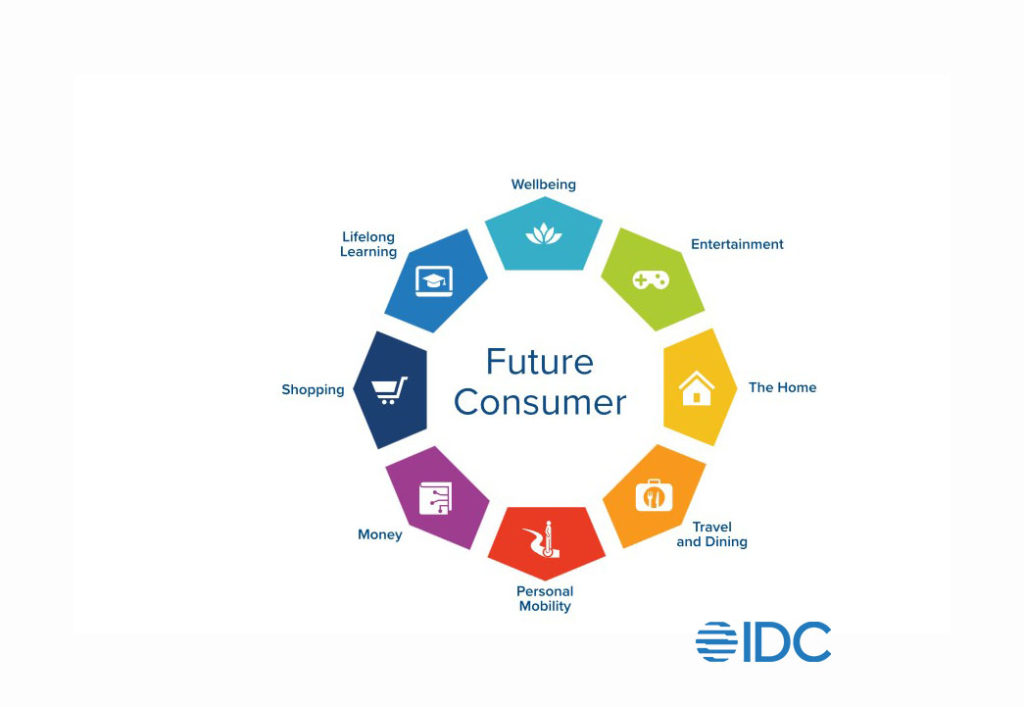

To address these fundamental beliefs, IDC has embarked on a multi-year journey to build out new research to drive a better, more profound understanding of the consumer. At the center of this research is our Future Consumer Framework, which consists of eight primary segments that, when taken together, represent a holistic view of how consumers leverage technology across the many facets of their lives. The eight primary categories of the framework include Entertainment, The Home, Money, Shopping, Personal Mobility, Travel & Dining, Lifelong Learning, and Well-being. For those familiar with IDC’s Future of Enterprise research portfolio, it’s helpful to think of that as the yin to the yang of Future Consumer. See the image below for a view of the Future Consumer Framework.

IDC leverages the framework across three primary research areas: The Consumer Pulse, which surveys consumers in seven countries about their current and near-term attitudes toward the eight segments, with particular attention paid to the concept of brand trust. The Consumer Market Model (CMM) leverages the framework to create five-year forecasts of consumer internet penetration, online activities, eCommerce, and other services spending across 51 countries. Finally, the Future Consumer Agenda seeks to provide a futurist’s view of significant trends and technology shifts across the consumer spectrum.

All three programs leverage data to help guide near- and long-term thinking and endeavor to drive thought leadership across the consumer technology category. They build upon and synthesize data and insights from our existing consumer portfolio of products that include device coverage (PCs, Tablets, Smartphones, Smart Home Devices, AR/VR Headsets, and Wearables) as well as market-specific categories (TV/OTT Video and Gaming and eSports).

Early Consumer Pulse Insights

IDC officially launched the Future Consumer programs in early 2022, and all three programs already drive significant new perspectives. For example, our initial Consumer Pulse Entertainment survey yielded dozens of important insights about consumers’ use of technology to engage with new and evolving content, create content themselves, and even monetize their work. A few essential insights:

- Social media sites now constitute the biggest source of video content watched by consumers, even bigger than linear TV or streaming.

- Each successive generation spends more time on entertainment than the previous, meaning that Gen Z spends demonstrably more time engaged with entertainment than Boomers or older.

- Gaming represents a larger percentage of the time spent on entertainment among younger generations, too, but that number is sizeable across all generations.

- Content creators who say they don’t make money from their work tend to use their smartphones for content creation most of the time. In contrast, those who do earn tend to leverage a wide range of devices more evenly, including smartphones, tablets, PCs, and standalone cameras.

These data points are just the tip of the Consumer Pulse iceberg. Because we’re leveraging a robust survey methodology across seven countries, we’re able to slice and dice our results to surface particularly useful data points that inform both our near-term and long-term views of a category. And remember, this is just one of the eight category-based surveys.

Assessing TAMs with the CMM

Another major launch this year was our Consumer Market Model. Built upon a decade-old service (formerly called the New Media Market Model), the CMM team leveraged brand new IDC survey data, existing IDC device installed base data, and numerous third-party sources to create a massive new dataset that examines total available markets (TAMs) across a range of categories. The CMM aims to be the one-stop shop for consumer-centric forecasts that you can’t find anywhere else, backed by data and analyst insights.

After a year of new research and a taxonomy overhaul, the new CMM has now launched and is driving key insights. A few from the U.S. include:

- Despite predictions that online fitness would fall off fast after the pandemic, the CMM projects a 13.3% CAGR in total spending on online fitness services from 2021 to 2026 in the U.S. spending through mobile and non-mobile devices (PCs, set-to-boxes, etc.) is expected to reach $2.2 B in 2026, an 87% increase from 2021 at the height of the pandemic.

- The CMM now has new line items, such as consumer AR/VR services. The model projects that there will be 8.3 million new AR/VR-related services users in the U.S. by 2026. Spending on mobile and non-mobile devices for those services is expected to hit $1 billion between 2024 and 2025 and will carry a robust CAGR of 16.6% through 2026.

- The CMM projects that sleep-monitoring/tech services total spending in the U.S. will grow by almost $2 billion between now and 2026. This new line item is increasing at a 12.6% CAGR, with the CMM projecting that 22.5 million new users have been added since 2019.

This is just a taste of what the CMM can provide, and the above numbers are all U.S. only. Remember, we have this data across 51 countries and seven regions and can deliver worldwide rollup.

Predicting the Future

Both the Consumer Pulse and the CMM are data-driven products enhanced by our great team of analysts’ insights. The Future Consumer Agenda program looks to leverage these great insights and follows the resulting near-term trends and hypotheses out even further. The goal is to equip tech companies, governments, non-government agencies (NGOs), and others with insights that drive their long-term strategies. A few predictions from our recent Future Consumer FutureScape illustrate the point:

- By the end of 2025, more than 20% of consumers worldwide will have begun using device-as-a-service subscriptions for their personal electronics and smart home needs instead of buying devices outright.

- By 2025, younger diners will help drive 65% of restaurant orders to be for takeout (delivery, pickup, or drive-thru), accelerating the growth of kitchen-only locations and third-party food ordering apps.

- By 2027, 35% of consumer flagship phone buyers will use a Smart Set (smartphone, watch, and earwear) for entertainment and getting around, pushing leading brands to build content for Smart Sets.

It’s early days in the Agenda program, but to drive our thinking further, we recently created a taxonomy document for this program that adds additional granularity to our Future Consumer Framework.

The Coming Disruption

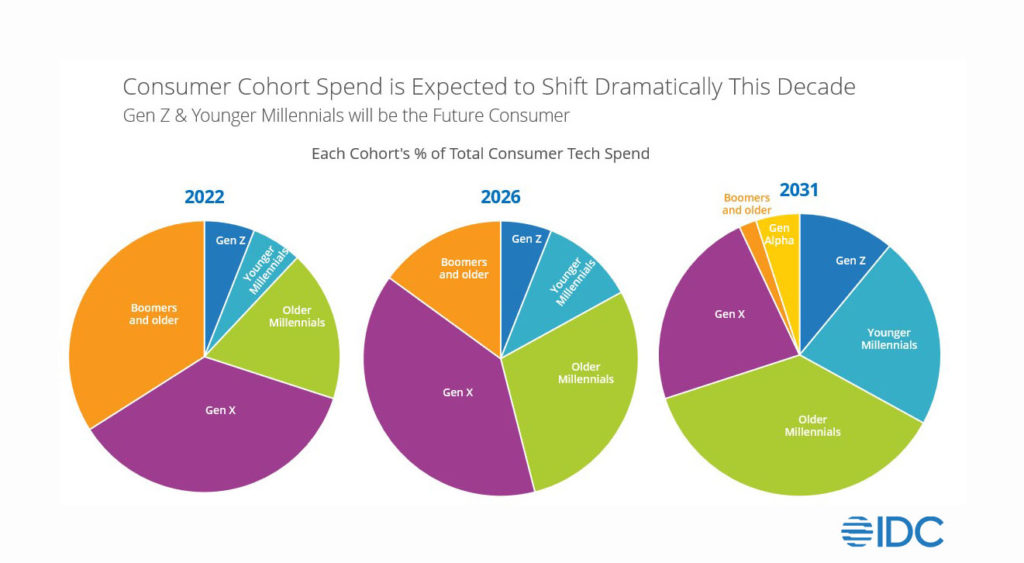

At the top of this post, I alluded to the idea that we see major disruptions in how consumers engage with and buy technology coming down the pipe. This is based on our recognition that younger generations view and use technology in radically different ways than older ones, and they will retain these unique dispositions even as they age. As these cohorts shift to become a majority of consumer spending, they will drive major sea changes in the consumer and commercial technology markets. Once you see it—as illustrated below—you can’t unsee it.

This is why IDC has dedicated research dollars, analyst resources, and a number of upcoming special events to cover the consumer space and the changes we see coming. So regardless of whether you’re a technology company focused on B2C, B2B, or B2B2C, it’s vitally important that you understand the coming wave. One way to begin this education: Contact your IDC salesperson, or Future Consumer Sales Specialist Brad Kennedy (bkennedy@idc.com), to set up a free presentation with the Future Consumer team. Or attend our in-person breakfast briefing at CES called Rise of the Future Consumer: Are You Ready for the Seismic Shift? If you won’t be in Las Vegas in early January, contact Brad, and we’ll follow up with a recorded version of the presentation after the show.