The oil and gas industry is facing the most significant transformation relative to any other sector driven by the global energy transition. A hydrocarbon producing industry seems the least likely to tackle the emissions and environmental challenges related to climate and energy transition, however, over 90% of companies in the oil and gas industry have already made declarations about their plans for net-zero targets, and many have already deployed capital to pursue an energy transition strategy. Global oil and gas firms across the long value chain are looking beyond maximizing profits and incorporating environmental, social, and governance (ESG) metrics into corporate performance assessments.

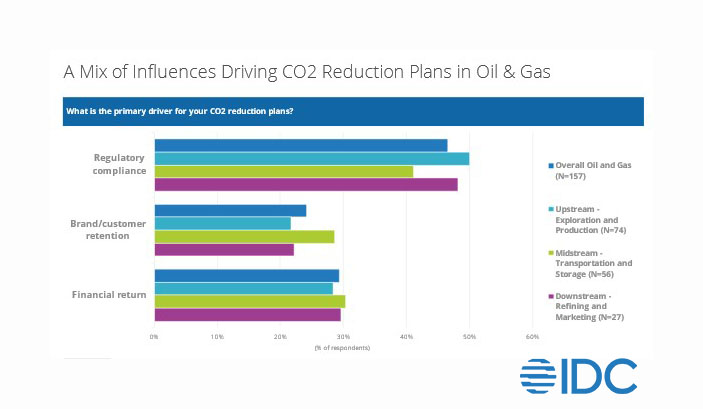

Originally driven by the United Nations, the energy transition and ESG movement has had substantial momentum propelling oil and gas leaders to engage technology partners to meet accepted global standards. In addition, the SEC’s March 2022 directive on climate change disclosures now mandates a quick transition to investor grade reporting. The O&G industry is among the most scrutinized on the planet. As regulators grapple with the competing interests in energy security and climate change, under investment in capital projects in the last many years, ESG is at the front and center of the discussion. Management teams for corporations are getting the message and steering toward ESG-driven values and metrics that are viewed as “sustainable” in the long term rather than strictly focusing on short-term profits. In the oil and gas energy transition survey, industry leaders cited regulations (or impending regulations) as the key driver to CO2 reductions, while financial return and brand considerations were also factors (see figure 1 below).

This ever-changing energy sustainability landscape creates additional complexity to an already sophisticated market global market construct. Investments in clean energy sources such as hydrogen, solar, wind, carbon capture, emissions measuring and reporting technologies, and many others will have a significant impact on the oil and gas business model throughout the industry value chain.

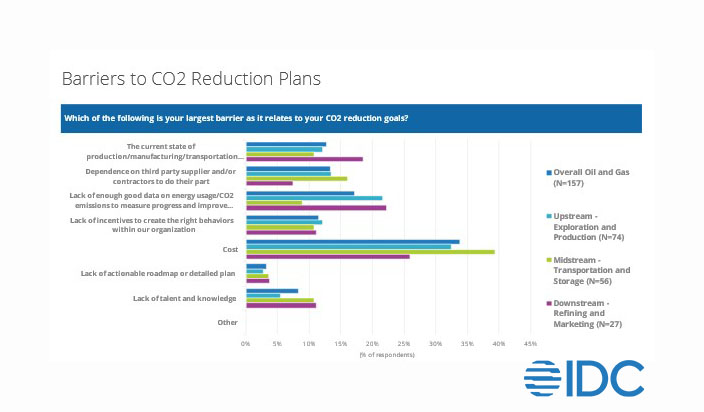

Digital will be a key component to many of the industry objectives. Not surprisingly, cost is viewed as a significant hurdle to CO2 reduction plans. The collective view from the industry is that data access as it relates to energy usage and emissions to measure progress is the second leading barrier (see figure 2 below). The increased complexity of the future oil and gas operating model will significantly boost data volumes and data management requirements. Companies with superior digital competencies are likely to be leaders in energy transition.

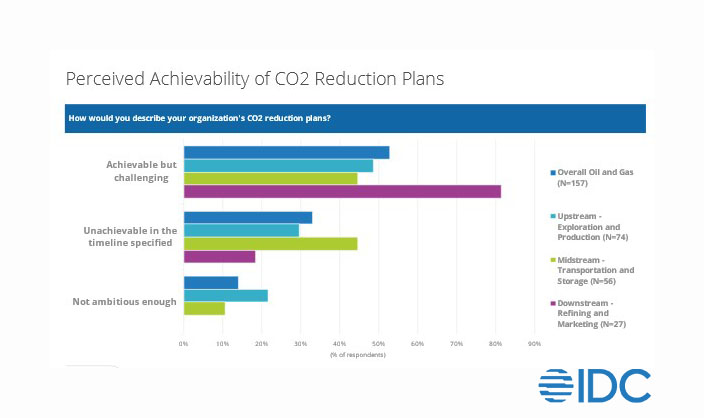

Roadmaps to meet company net-zero and energy transition targets, along with motivations for pursuing certain goals vary widely, and many are still in early days. Many market onlookers, and even some industry insiders, question the achievability of some of the targets. This is an industry transformation that has never been faced at this scope to date. Significant uncertainty remains around economics, regulatory changes, technology advancement and many other variable factors of the energy transition movement. Industry leaders view many of these challenges as achievable, but certainly challenging (see figure 3).

In IDC’s 2022 Oil and Gas Energy Transition survey, we analyze these concepts with oil and gas industry leaders globally. While energy transition is a very broad and complex concept, digital transformation and the advancement of digital technology will be a significant component of the movement. The survey sheds light on the coming changes to the industry business model and significant implications to technology vendors, alike. The future is now for the industry and oil and gas leaders need to embrace the transformation.

To learn more about the Oil and Gas Energy Transition, click the button below to watch a video on the topic. To access the Oil and Gas Energy Transition survey and associated published research, contact your IDC account representative to schedule a 30-minute consultation with me, Andrew Meyers.