Have you noticed how often we reference maps, floor plans or other location and geospatial tools in our everyday lives? Did you monitor the Johns Hopkins COVID-19 map early in the pandemic? Look at photos of the Ever Given ship trapped in the Suez Canal and try to figure out if that was going to impact your supply chain? Start anticipating your delivery when Door Dash showed you your driver’s progress?

No matter what industry you are in, it is time to make location and geospatial intelligence a part of your enterprise strategy so that you can realize the benefits there too. IDC has a growing body of research to show how this capability adds value to software and to the enterprise overall.

Are you capturing ‘place’ with any of your current enterprise sensors and software?

Everything that happens in your enterprise happens somewhere. Whether it is a worker at a certain spot in a manufacturing facility or a data center where you are storing data or an address where a customer’s order is supposed to arrive, that physical context of where the action takes place impacts the action. Any type of IoT sensor is ripe to be analyzed by its placement, and could be analyzed against other factors of that immediate environment such as weather, air quality, or the number of other devices nearby. Maybe you just want to check that physical assets are where they are supposed to be. Your asset inventory probably specifies where each item is, but there’s a lot you can do beyond just basic tracking of whether an asset is in its correct position.

Recent IDC research on data buyers showed that 74% are using location data today, whether they source it internally or externally. Across every industry we studied, at least 25% of enterprises are using more location data than they did just 1-3 years ago. The usage by those in transportation and logistics has soared by nearly 60%; while finance and retail/wholesale upped their already-leading usage of this data type by nearly 50%.

Not every analytical package, developer tool or even database can handle the varied types of location and geospatial data that exist. In order to turn this data into insight, you need fit for purpose tools that can assist with data preparation functions such as geocoding, normalizing and cleansing what can be massive datasets. More and more database vendors are including geospatially compatible structures at no additional cost, even if many of their users are not taking advantage of those features.

Are you using enterprise SaaS that has location and/or geospatial capability?

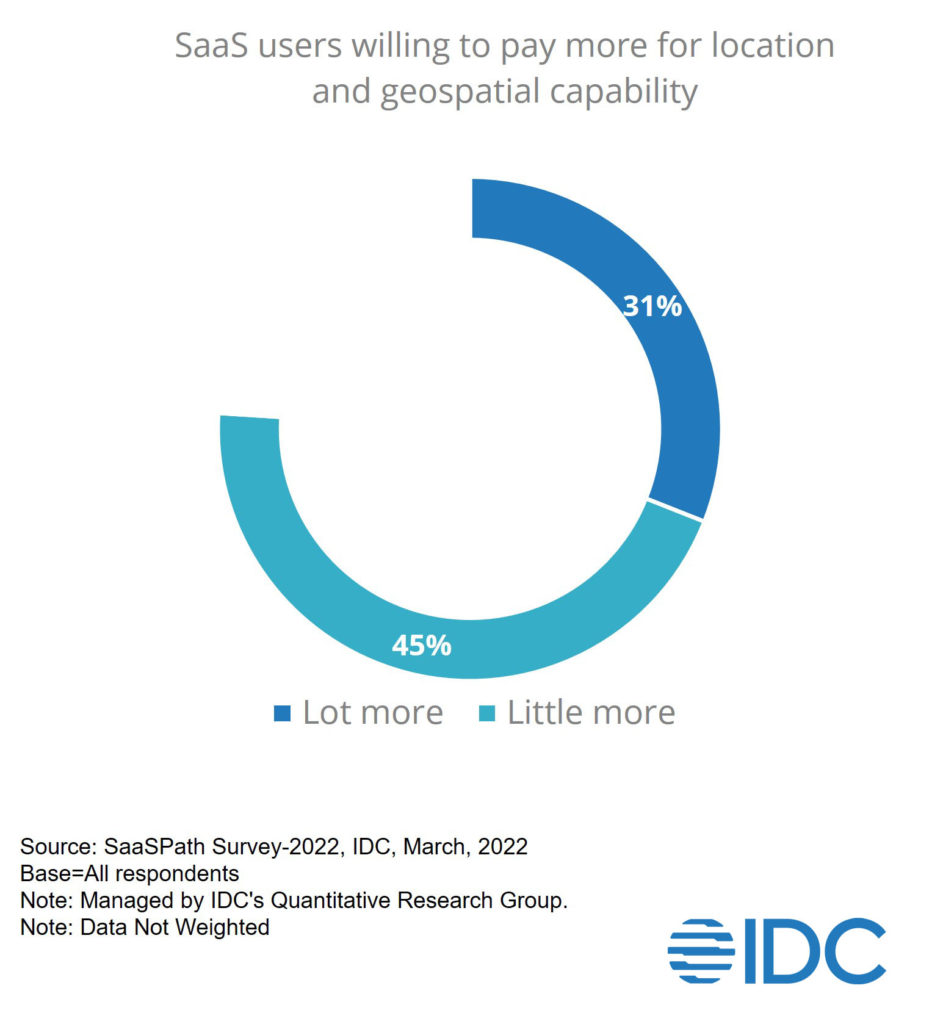

Business process enterprise SaaS has not incorporated location and/or geospatial capabilities to the extent that some database tools have to date. This is likely to be on the horizon though because recent IDC research shows that 76% of SaaS buyers would be willing to pay more for applications that include location and/or geospatial capability. That is huge – and a greater percentage than would be willing to pay extra for almost any possible add-on capability.

There wasn’t huge variance across enterprise applications either. While subscription management was the highest at 86%, the least appealing offer would be with Talent Management, and 73% of SaaS users were willing to pay more for additional location capabilities in that application.

In another study, 40% of external data buyers said that they were sourcing location data from within their enterprise applications. Clearly, there is a lot of draw for enterprise applications that are making use of location and geospatial points to enhance the value to their users.

This doesn’t even touch upon the use of a variety of spatial analytic and data science applications that you may be able to deploy. From traditional GIS (that is moving to the cloud) to open source tools to no-code and low-code platforms, the market has been exploding with new offerings and extended capabilities from more mature vendors. However, the efforts to equip more data scientists and data analysts with spatial skills (and have historical GIS departments partner with a broader range of business functions) have been slow to gain traction.

Are you missing out on opportunities to glean better insight into your processes and assets?

This is a bit of a rhetorical question, since I firmly believe that the context of where something is happening (or should happen, or might happen) unlocks greater value by unlocking meaning that hadn’t been taken into consideration previously. We are finding that enterprises with even a low level of geospatial capability improve their performance across a wide spectrum of metrics – and those at the top of the geospatial maturity scale have a 50% greater benefit. The areas these enterprises can improve are quite diverse, from things that are fairly obvious like managing facilities and routing deliveries, to less expected areas such as developing business plans and pursuing new markets. As just one example, indoor space planning has become much more sophisticated with BIM integration, indoor wayfinding, and applications that helped to register and monitor how space was being used under pandemic restrictions and for ongoing benefits.

Can you really make the best possible decisions and have keen insight to your processes and assets without considering WHERE they are?

As I’ve written elsewhere, I believe that using ‘place’ as a context in business processes and analytics is going to become as commonplace as using ‘time.’ While it is true that your use cases might drive you to new technologies, analytical tools and new people and skills for your organization, adding (or fortifying) location and geospatial as part of your data strategy is an investment that will not take long to pay off.

Want to chat about how you have been using – or getting ready to use – location and geospatial dimensions in your data and applications?