The latest indicators point towards a further decline in GDP in the second quarter in the US. If that is indeed the case, many in the financial community are ready to declare that the US is already in a recession (given that we saw a decline of -1,6% in US GDP in Q1). However, the select committee of economists tasked with making the call are unlikely to label this a recession in the short term. The reason: very mixed data. 376 000 jobs were added to the US economy during the month of June. In parallel, inflation in May reached its highest level since late 1981. This is a very unique version of stagflation, and economists are expecting interest rate rises throughout the rest of 2022.

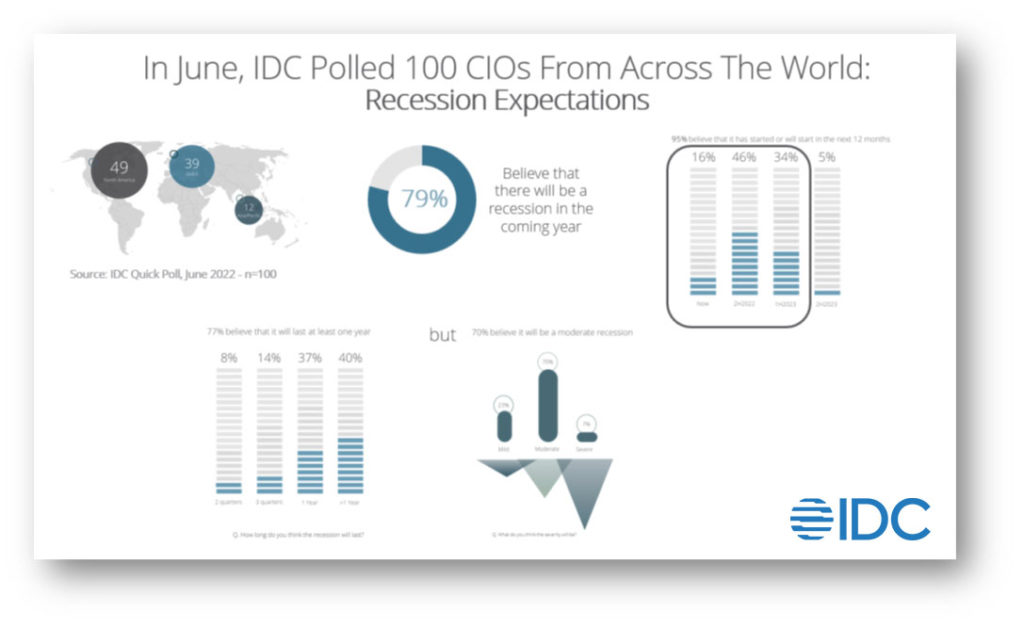

This situation is the latest in the storms of disruption affecting the market right now. The litany of storm keeps growing: ongoing pandemic management challenges, major supply constraints, significant skills shortages in IT and broader technical areas, rapidly increasing cybersecurity threats, evolving climate regulations, and assertions of sovereignty over digital business triggered by the Russia-Ukraine War. With these developments, business leaders are now facing rising inflation, and many are anticipating a significant slowdown in economic activity. The US may be earlier to sound the alarm, but the EU is forecasting a similar situation by early 2023. And while in country recession fears are not a major focus in Asia/Pacific, there are question marks around the potential knock-on effects across the region. IDC’s recent poll of 100 CIOs globally indicated that 79% expected a recession in their own country, or in important buyer countries in the next year. 95% of those believe it either has already started or will hit us in the next 12 months. Of 77% of them think it will last at least a year. Most, however, expect it to be a modest or moderate slowdown, not a deep recession.

As Jamie Dimon (CEO of JP Morgan Chase) explained recently, ‘I said they’re storm clouds. They’re big storm clouds or – it’s a hurricane. That hurricane is right out there down the road coming our way…and you better brace yourself.’

For the technology markets that IDC tracks, this is also a unique situation. This will be the first potential recession in the context of a ‘As-a-Service’ Technology Landscape[1]. Cloud now dominates tech spend across infrastructure, platforms, and applications. In fact, globally the cloud market will represent 40% of WW enterprise IT spend in 2022 (excluding devices and telecom services). An even more telling point is that over 50% of all spending on all software will be as-a-Service by the end of 2022, rising to almost 2/3rds by 2026.

While 63% of the CIOs indicated that they would be either making targeted reductions in IT spend or reduce overall IT budgets, many organizations are continuing to invest in strategic technology projects to support business initiatives (e.g. Analytics, Automation, CX, EX and supply chain transformation) as part of broader digital transformation efforts. In many tech-savy enterprises, up to a third of all spending (not just IT spending) is for technology. Given the focus on cloud when it comes to Tech, IDC expects that the dynamics of that spend will look very different to the past.

Phil Carter and I want to share five key parameters to monitor:

- Consumer vs Enterprise: IDC spending data already shows a significant difference between consumer IT spending (focusing more on devices and media/content services) versus the enterprise, where spend is proving to be much resilient (driven primarily by cloud). For more details on these trends check out IDC’s recent Global Recession Scenario for IT Spending webcast.

- Enterprise CAPEX vs. OPEX spend: In previous economic downturns, IT spend followed GDP trends closely as large-scale CAPEX purchases were put on hold or cancelled altogether. Now, we are dealing with much longer-term multi-year contracts that tech buyers have put in place across the IaaS, PaaS and SaaS layers. Hence overall IT spend will not see the same level of spikiness as in past downturns at a market level. In fact, the real pressure will be on the Cloud Providers themselves as they still need to invest capital in IT hardware and datacenters to support all those long term commitments.

- Cloud Contract Flexibility: IDC is already seeing examples of more flexible cloud contracts being negotiated – minimal short-term pricing increases to drive longer term or larger consumption commitments over longer periods, using reserved cloud instances as a way to get better pricing terms or very favorable licenses and maintenance conversion options in exchange for longer term contracts. The goal for both sides being to reduce cost volatility over an extended period, making capacity planning and cost accounting more predictable.

- Cloud Margins and Cloud Price Increases: For the first time since their inception, many cloud vendors are increasingly under margin pressure. This is linked to increased input costs (infrastructure and energy) and the strong dollar impacting international revenues. As a result, IDC expects the prices of the cloud offerings overall will increase in the range of 5-7% over the next 12 months. This will be an especially important development for major software providers who are at the mid-point of their own journeys to SaaS business models. Managing changing cost expectations for the underlying infrastructure whether owned or “rented” from IaaS providers is now their business challenge, rather than their customers’ operational challenge.

- Cloud Value Realization: Over the past 12-24 months, the pandemic-driven tech spend exuberance has highlighted the cost of cloud. At the platform level, every development decision is a budgeting decision. The focus on FinOps and scrutiny on the ROI has ramped up. The current economic situation will accelerate this trend. One of the key challenges will be to ensure that they aren’t spending on an “As-a-Service in name only” solution that simply alters the financing calculus. The real benefit of an effective As-A-Service offering is that it reduces and even eliminates the long term operational and upgrade costs associated with software and infrastructure lifecycles. Observability will be a critical part of FinOps.

RELATED READING: Enable your sales team to sell value rather than competing on price and features. IDC's new checklist is available now. Start Value Selling Today. Optimizing Customer Value Best Practices.

Looking back at history, the 2007-2008 financial crisis was the trigger for cloud’s to move into the mainstream. However, that was a real market crash. One software executive recently highlighted to IDC how $1 Billion in pipeline evaporated in the matter of days. The current situation is more of a dripping tap than a burst pipe. There is a long run up for policy makers and it’s the inflation vs. growth balancing act – with interest rates being the lever – hence why the market is watching the monetary policy makers very closely.

For the IT market, IDC expects continued resilience in the enterprise space – driven by this ‘As-a-Service’ technology landscape. Cloud vendors new and old will have to think about how to recalibrate their business in an uncertain demand climate. Second quarter earnings will be a early litmus test for the winners versus the losers. And tech buyers will have to find ways to continue delivering accelerated time to value from their cloud spend – or else their investment taps will slowly be turned off.

For more insights, watch our on-demand webinar: State of the Market Special Edition: Global Recession Scenario for IT Spending

- [1] You could argue that the initial impact of the Covid-19 pandemic also fell into this timeframe, but the tech spend spike we saw in that period was unprecedented, and was driven by the need to keep businesses afloat where everything literally was required to be digital. Hence it is very unlikely to be repeated, so it is impossible to use a reference point in this regard.