“We’d rather disrupt ourselves first before we get disrupted.” –Gayatri Narayan, Senior Vice President, Digital Products and Services, PepsiCo.

While some enterprises, such as PepsiCo, recognize the competitive imperative when it comes to digital innovation – the ability to develop innovative products and services that differentiate their business, create competitive advantage, or disrupt the market – many are falling short.

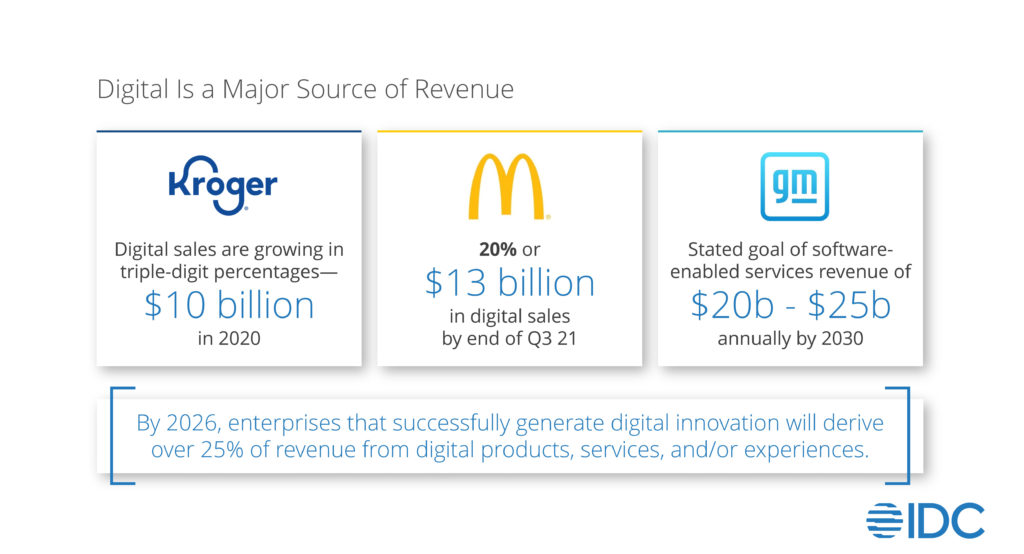

Why should organizations care about digital innovation? Revenue, for one thing. Digital represents a major source of revenue for organizations, as illustrated below.

However, there’s a difference between digital products and services and innovative digital products and services (for more, see IDC’s blog, There’s Digital… And Then There’s Digital Innovation). In fact, IDC is predicting that by 2026, enterprises that successfully deliver on digital innovation initiatives will derive a quarter or more of their revenue from digital products and services.

We asked organizations about their investment in innovation and their spending on maintenance during the pandemic period (2020 and 2021), currently (2022), as well as their planned investment in the next two years. What we found is that we’ve already reached a tipping point in North America. During the pandemic investment tipped towards innovation, with enterprises telling us that they were already spending more of their technology spend on innovation versus maintenance. That will continue to tick up in the next couple of years.

If the revenue potential is so great, and enterprises are already investing, why isn’t everyone successful? Well, because it’s hard. As IDC’s research has identified, there are several areas where enterprises are struggling, and areas where they can learn from the examples set by digital-native companies – younger organizations founded around digital products or services that typically don’t have technical or organizational debt and are more comfortable accepting risk.

What makes Ms. Narayan’s quote so powerful is that it reflects a recognition of – and willingness to accept – risk, which is typically a prerequisite to developing and delivering digital innovation. Many organizations are not willing to accept that risk, or don’t have the expertise to help mitigate it. For technology suppliers, this presents a real opportunity to help their customers recognize that, like it or not, disruption is coming and then provide the tools and expertise necessary to reduce the risks involved with being the disruptor rather than the disrupted.

Enterprises Need to be More Deliberate About Digital Innovation

Most organizations are used to buying and customizing software. Delivering innovative digital products and services, however, requires expertise in generating innovative ideas, developing software, scaling that software and continually iterating on it. When we asked both enterprises and digital natives about their innovation programs or initiatives, we found that, almost across the board, digital native companies are much more likely to adopt various types of programs and initiatives designed to spur and maintain innovation.

What is particularly telling is that 41% of the enterprises said that they were not adopting any of the innovation programs we asked about. In stark contrast, only 1% of the digital natives answered the same way. And, while there is no standard set of activities that enterprises should adopt, doing nothing will certainly not generate innovative digital products or services.

What are digital native organizations doing differently? Well, at a basic level, things like entrepreneurship programs, beta programs, and hackathons are indicative of cultures that foster innovation. These are things that digital natives are doing much more commonly than enterprises.

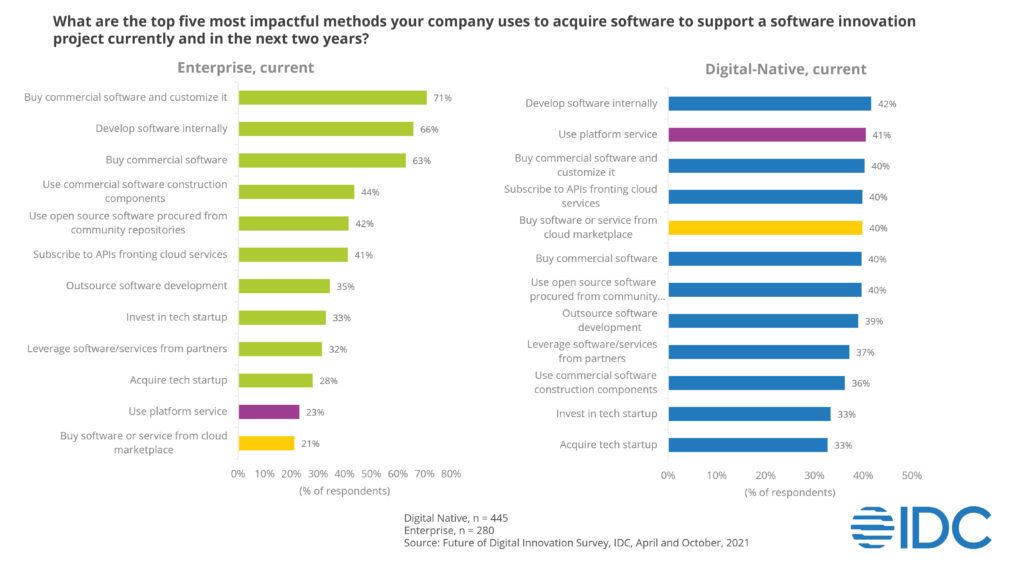

Enterprises Must Reduce Dependence on One or Two Technologies. According to our survey data, digital natives are nearly twice as likely as enterprises to use platform services and buy from cloud marketplaces.

Enterprises concentrate on just a couple of approaches for acquiring software to support software innovation projects – buying commercial software and customizing it or just building custom software. Digital native companies, on the other hand, employ a variety of technologies, which suggests that they are good at matching the technology with the job. And, they’re willing to accept the risk of adopting new technologies, recognizing that it may increase complexity, but that there are also ways to mitigate that complexity.

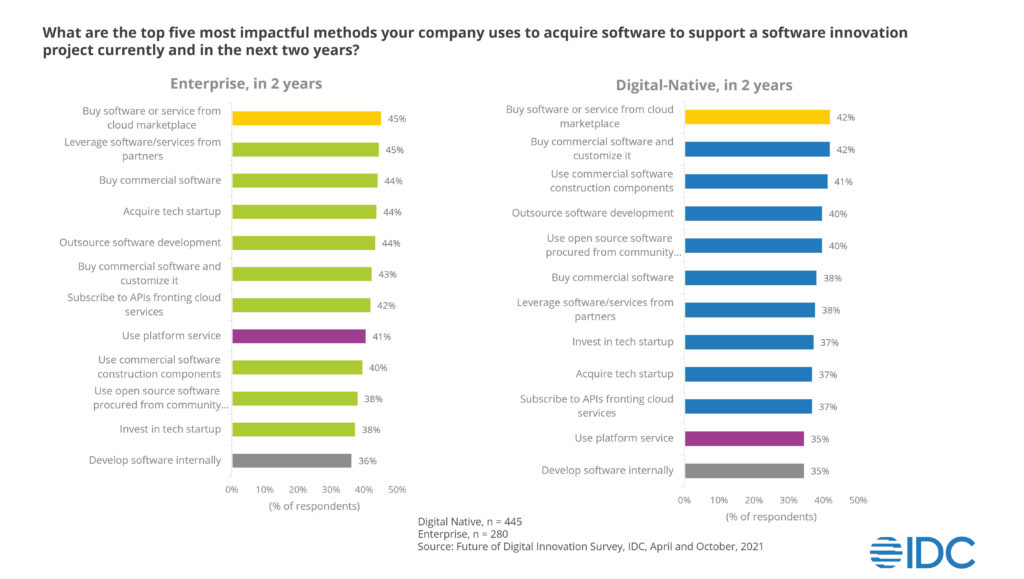

When we asked enterprises and digital natives to look ahead to the next two years, we found convergence between the two groups. Enterprises expect to move away from their dependance on one or two things and source their software from many different places and many different types of technologies.

Perhaps most interestingly, the top response (buying software or services from a cloud marketplace) and the bottom response (developing software internally) are the same for the two groups. It’s not that either type of organization is less interested in developing custom software; it’s more a recognition of some of the challenges of increasing development of custom software, such as skills shortages.

Again, there are take-aways for technology vendors:

- Make sure you are available where your enterprise customers are going to want to buy your products and services. For instance, make your offering available in cloud marketplaces because enterprises expect to buy a lot more from cloud marketplaces.

- As enterprises change their approaches to support digital innovation, they will inevitably face more complexity. Vendors should consider how they can help customers manage that complexity.

Enterprises Must Evolve their Sourcing Strategies

When asked to describe their sourcing strategies, enterprises identified senior leadership mandates as their top answer. Digital natives, on the other hand, said that engineering management makes sourcing decisions on case-by-case bases.

Neither answer is great. Ultimately, organizations should develop sourcing strategies through collaboration between technology and business leaders, and those strategies should be strategic rather than tactical.

Technology vendors should think about how they can guide enterprises toward more mature sourcing strategies.

Enterprises Need Help Making Data-Driven Decisions

We found that the cloud native organizations are much more likely to track KPIs closely. Why? It has much to do with the kinds of tools they are using to track software projects against business KPIs. Digital natives are far more likely to be employing these tools to track KPIs. In contrast, nearly 80% of the enterprises that we surveyed indicated that they were not using any of the tools we asked about to track KPIs.

It’s not that enterprise aren’t tracking KPIs – they are – but they’re doing it manually (using spreadsheets, for instance) and that’s not a recipe for accuracy or success. Technology suppliers that can step in with tools to help track important KPIs related to digital initiatives can capitalize on the opportunity.

Evolving the Business Model to Outcomes as a Service

What is an outcomes-as-a-service model? It’s a focus on selling a desired outcome (improved performance, reduced costs, etc.) not just a product or service. This is a bit forward looking… but, it is worth thinking about, particularly as more digital native companies pivot to this model.

Download: Should Your Organization Adopt an Outcomes-as- a-Service Model?

A good example of this approach is Jotun, a company that sells paint that inhibits growth of barnacles and other substances on the hulls of ships, slowing down the vessels. Shifting the focus from the product (paint) to the outcome (improved efficiency), the paint manufacturer uses data analytics to illustrate how the improved condition of the hull reduces fuel costs and mitigates environmental impact. It now offers a guarantee – if its paint doesn’t produce the expected outcome in terms of reduced fuel costs and environmental impact, the customer receives a refund.

Even for digital natives, this is new – only 4% said that they have already sold an outcome, but 39% indicated that they are working on it… and that is significant.

Learn more about IDC’s Future of Digital Innovation research in our upcoming webinar, Digital Innovation: The Enterprise Journey to Maturity, on May 12.