Our findings will be presented in greater detail in an IDC Webinar scheduled for March 17th at 11:00 A.M. U.S. Eastern time (16:00 GMT).

The current conflict between Russia and Ukraine has created a critical geopolitical turning point for Europe and the world, and the ITC market is not immune to its initial shock. While there is still uncertainty about the duration of the war, unforeseen development and new sanctions, the tech community must react to this evolving situation with short- and long-term planning, to minimize the spillover effects on their economies and digital markets.

The evolving geopolitical situation will affect global ICT demand in the coming months and years. According to our new IDC Global CIO Quick Pulse Survey, involving more than 60 technology leaders across the globe, 57% of respondents say they are reassessing their tech spending plans for 2022 in the aftermath of the uncertain geopolitical environment, with 10% expecting to make strong adjustments to their ICT investment plans.

“Given the fluid nature of the conflict, IDC recommends that companies identify weak links in their value chain ecosystem, develop agile supply chain strategies, and create action plans that enable them to anticipate and react to a range of disruptive market movements.”

Philip Carter, Group Vice President, Worldwide Thought Leadership Research

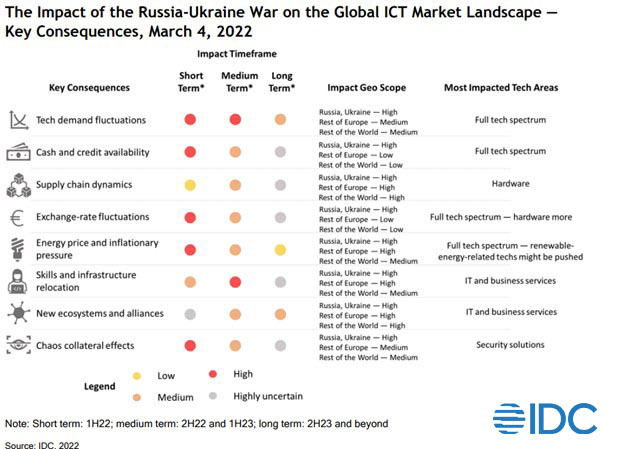

IDC is carefully evaluating the geopolitical situation and its impact on the ICT market, through its broad network of global, regional, and local analysts. Given the characteristics of the conflict and the sanctions currently in place, we have identified the following key consequences for the global ICT market:

Tech Demand Fluctuation: The conflict has halted business operations in Ukraine while the Russian economy is feeling the early impact of Western sanctions. This will strongly affect tech spending in both countries with double-digit contraction of local market demand expected in 2022. Meanwhile, tech spending among Western European countries may increase in part due to expanded defense and security allocations.

Energy Prices and Inflationary Pressure: Tensions over the conflict in Ukraine will have wide ranging consequences on both energy prices and security of supply, particularly for certain European countries where cascading effects on price indices are already being felt. Most countries will need to quickly reassess their near-term energy plans while accelerating efforts to reduce their dependence on carbon-based energy sources.

Skills and Infrastructure Relocation: More than 100 global companies have established subsidiaries in Ukraine and many more have operations in Russia. The conflict has already displaced tens of thousands of developers in Ukraine and led to the relocation of some services in both countries. These relationships, along with the physical assets and personnel associated with them as well as any future expansion plans, will need to be reevaluated in light of the conflict.

Cash & Credit Availability: The financial sanctions imposed to date are presenting serious challenges to foreign credit availability in Russia, while creating potential losses on loans issued by EU countries to Russia. Without access to credit, most organizations will be forced to suspend new technology investments in the near term. The country is also suffering from a severe shortage of cash, which is significantly impacting consumer spending.

Supply Chain Dynamics: Exports of finished products and technology components to Russia will be significantly affected by the sanctions, but the impact to Western companies will relatively small given the size of the market. Imports of tech materials from Russia and Ukraine will also be affected, particularly in the semiconductor sector where supplies of neon gas, palladium, and C4F6 used in chip manufacturing will be greatly reduced. The conflict is also expected to further disrupt global supply chains as cargo is rerouted around the two countries and costs increase.

Exchange Rate Fluctuations: Russia’s currency plunged in value in response to the initial sanctions, making imports of IT equipment and services significantly more expensive. As a result, many companies are refusing to ship orders to Russia even if payment is possible. This also means that Russia’s own manufacturers of PCs, servers, and communications equipment will be unable to operate. Geopolitical tensions are also impacting other currencies throughout the region, including the Euro.

Russia’s invasion of Ukraine on February 24, 2022, and the ensuing escalation of events, is evolving daily. IDC Market Perspective provides a first take on the war’s impact on and implications for the global ICT industry, while providing recommendations to tech providers and buyers to help them rapidly adapt and react to fast-changing market conditions.

“While Ukrainian and Russian ICT markets will be the most affected by the war in the short term, with considerable declines expected in the short term and likely slow future recovery, few countries will be spared. IDC expects other European countries to be hit first and other geographies around the globe to face spillover effects on their economies and digital markets, particularly given the war’s likely impact on trade, supply chains, capital flows, and energy prices.”

Andrea Siviero, Associate Research Director, IDC EMEA

The report’s findings will be presented in greater detail in an IDC Webinar scheduled for March 17th at 11:00 am U.S. Eastern time (16:00 GMT).

Further Reading:

The Impact of the Russia-Ukraine War on the Global ICT Market Landscape — IDC’s March 4, 2022, First Take (IDC #EUR148926122)

This IDC report provides an initial assessment of the implications the crisis presents for the worldwide ICT market, while providing recommendations to tech providers and buyers to rapidly adapt and react to fast-changing market conditions.