Register for the Future of Industries: Grocery webinar, live on September 22nd at 11 AM/EST, to gain a deeper understanding of what digital transformation means for grocery retailers and how to leverage those innovations to deliver a better consumer experience.

The Pandemic Forces Overnight Transformation

Grocers have had to step up in the last few months to meet consumer needs in a retail environment that was completely impacted by COVID-19. Grocers have exceeded year over year sales on household supplies and food on average by 20%, while more than doubling online business to 10% of sales from less than 5%. This came at a higher cost of operations due to the quite sudden shift to increased online ordering, delivery, and curbside fulfillment. In addition, new operating procedures to maintain the safety and security of employees and customers and wage increases for employees have raised costs. Any retailers that sells grocery is adapting as fast as possible to what is becoming the new normal. As a result, companies including Kroger have stated that their digital (digital transformation) efforts have accelerated by 2 years in two months.

Grocery retailers who were already at the forefront of digital transformation have been in a better position – with more agility, and future-ready omni-channel experiences – to benefit from the upside of the surge in eCommerce business without damaging profitability too much. Retailers that are now implementing curbside delivery or dark stores to supplement fulfillment operations of online commerce have not found it easy or financially beneficial if they did not already have a fleet of stores, warehouses and logistics operations lined up to deliver those services. It is estimated that delivery can shift already low margin grocery businesses into negative territory, with Bain reporting that orders picked in store and picked up curbside carry a -5% operating margin according to a Wall Street Journal article.

The grocery industry is rallying, however, evaluating micro-fulfillment centers beside stores (like Walmart and others) and Dark stores or additional fulfillment facilities in market. For example, Ahold-Delhaize is doing in its Peapod division (or like Ocado is doing with Kroger). Convenience stores are throwing their hat in the ring to capture a piece of the convenience-driven consumer market for prepared foods and grocery as well. Wawa announced plans to build drive-thru Pickup only locations and 7-Eleven announced that it will acquire Speedway, the fuel and convenience shops currently owned by Marathon Oil.

Technology Becomes Imperative for Retailers to Stay Afloat

The new normal for grocery sellers will be underpinned by a digital transformation that makes the consumer experience of doing business with grocers more responsive and more convenient. Changes underway include the customer facing commerce, payments, inventory management and fulfillment capabilities already mentioned, but new ways of working and moving and sourcing goods are also taking place. New processes will be scalable and adaptable so that business can react more efficiently to sudden shifts in demand, and technologies will play a central role. Mobility, robotics, and data enabled automation and workforce engagement will drive costs down and enable speedy order fulfillment. Cloud based applications and platforms coupled with next security and capabilities including computer vision, ESL’s, advanced networks and IoT will keep the infrastructure humming and data moving.

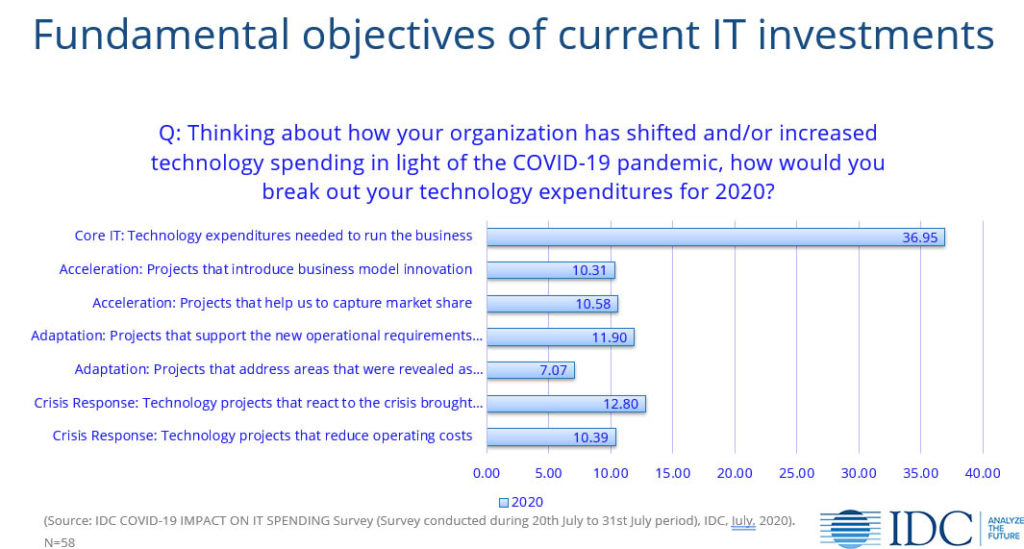

Retailers have adjusted priorities and IT spending plans for the balance of 2020 and into 2021, and the good news is that while in the short term systems are being augmented and apps are being introduced to provide what has become very specific tactical needs (even though they were on the omnichannel / digital transformation roadmap before), next year’s budgets are expected to grow by 44.8% of retail respondents (Source: IDC COVID-19 IMPACT ON IT SPENDING Survey (Survey conducted during 20th July to 31st July period), IDC, July, 2020).

For the rest of 2020, the fundamental focus is on core IT: Technology expenditures needed to run the business. But as you can see in the following chart, retailers are very busy responding and adapting to the current situation and accelerating innovation so that they can continue to lead into the future.

The New “Normal”

In summary, the grocery industry has stepped up in remarkable ways during the COVID-19 pandemic and will now transition into their new normal. Traditional grocery stores, general merchants, warehouse clubs, discount grocers, convenience stores, on-line grocers, cashier-less grocery concepts, and grocery delivery services are all playing important roles in defining and creating how consumers will continue to access the goods and services that they need to support themselves, families and communities into the future.

Stores that sell food and other household necessities have had no choice but to invest in technology to meet the demands of customers, competitors, and operating pressures in the midst of the initial crisis, but now they’ll seek ways to optimize profitability and minimize the impact of future shifts. While consumers continue to integrate on-line commerce into their shopping journeys much more often, Retailers will work on dependable grocery availability and the continued need to provide safe distancing and contactless commerce.

What Technology Should Retailers Invest In?

IDC Retail Insights will explore these and other ideas about the Future of Grocery in the upcoming webinar, Future of Industries: Grocery that looks at trends in the Grocery subsector, what digital transformation means for this subsector, and the technology and innovation strategies that are being applied to meet the needs of the consumer for the next new normal in grocery.

We hope you will join us for the webinar on September 22nd at 11 AM/EST to learn more about the exciting pace of change and innovation in the grocery sector, what is driving this, and what the future of grocery looks like, and what this means for you.