COVID-19 and social unrest have dominated the news for the last several weeks, and the result has been an increased awareness of the need to ensure safety and security for people, whether at work or in public places, resulting in an emphasis on technologies such as video surveillance. Since CCTV systems have been used for many decades to monitor high security private areas, and with the availability of infrared cameras, can cameras be deployed to ensure public safety generally and can they even screen for disease?

Up until a few years ago, the answer would have been no, as the solutions did not scale well. For every CCTV camera, one security person was generally required to monitor a screen. Multiple screen implementations in front of one person were little help, as the ability for a single individual to stay focused when presented with multiple moving images was shown to degrade rapidly. When analog cameras became digital and then were connected to the Internet, the situation became completely untenable: too much input, too little human.

Then came smart cameras and video analytics. With embedded analytics, a camera could basically manage its own detection threshold and alert a human when something crossed that threshold. Armed with this technology, a human observer could now manage literally hundreds of cameras, and with an accuracy level that exceeded the old paradigm of one-camera-one human. Increasingly, humans will be the arbiter of last resort when deciding whether a particular event rises to the level of a threat that must be addressed: automation will do most of the work.

Video Surveillance Research at IDC

Here at IDC, we have recognized that physical security will increasingly be a function of technology, using sensors of various kinds, armed with advanced analytics, to automate the security functions of monitoring and detection. To that end, we have consolidated our video surveillance research into a new global practice focused on video surveillance and vision solutions.

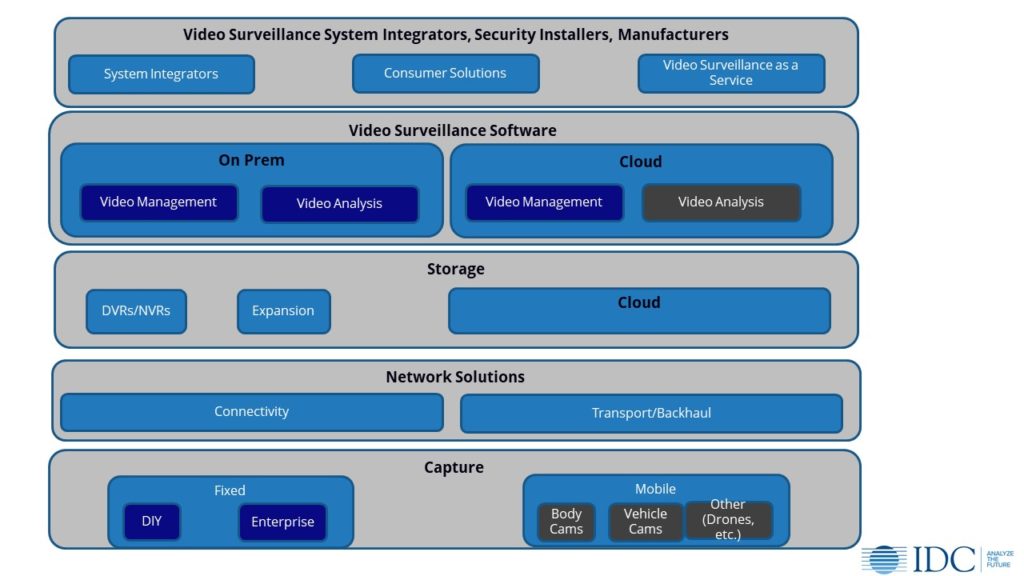

As the following chart shows, we have developed a taxonomy that covers the video surveillance market beginning from the sensors that capture video, continues through the networks that provide transport and backhaul, the storage solutions that support the retention of video data that enable video analysis, and the providers of video services.

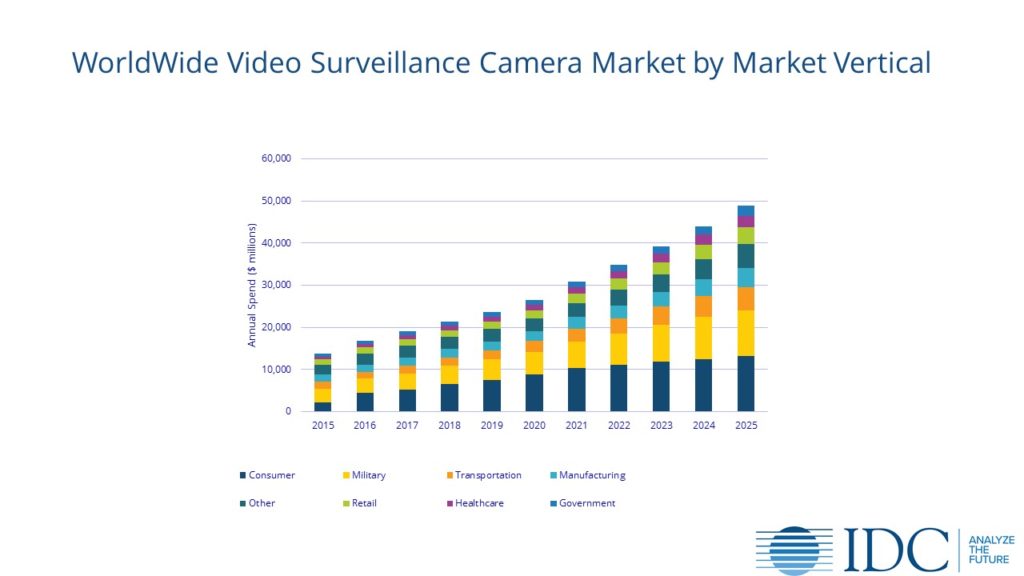

Since it is impossible to look at everything all at once, we began by looking at video capture and have constructed models of that submarket. Not surprisingly, especially with recent news of social unrest, we see significant growth potential. As the following chart shows, through 2025, the market will nearly double. By 2025, the global annual spend for video cameras will be in excess of $48 billion, with a CAGR of 12%. This is in spite of temporary declines due to lock downs associated with pandemic control.

Next on our agenda will be an examination of the video analytics market where we expect to see a similar potential for growth. We have already published a market glance that inventories the primary vendors in the video analytics space. By the end of the year, we expect to have developed a market share and forecast analysis as well.

The bottom line is that video observation technologies are gaining resonance with all the primary market verticals and, in spite of concerns associated with the technology’s potential to intrude on personal privacy rights, IDC does not see any significant slowing in the market over the next five years.

Learn more about the rise of smart surveillance cameras and their effect on the market in IDC’s “The Rise of Smart Video Surveillance Cameras”: