That the COVID-19 pandemic is greatly affecting societies is hardly breaking news. The loss of life and the social dislocations that has resulted from the disease is heartbreaking, and we’re certainly all looking forward to the day that an effective vaccine is widely available at low cost. In the meantime, it’s perhaps interesting to assess the pandemic’s effects not just on high tech markets but in the specific corner of it that I mostly cover, gaming.

COVID-19’s effects on gaming are uneven, just as its effect on the broader information and communication technologies (ICT) marketplace is uneven. In this post I’ll outline some of the pandemic’s effects on gaming and wrap it up with a handful of best practice insights that should be actionable in gaming and, hopefully, in the broader ICT market.

COVID-19 and the ICT Market

A colleague of mine recently published this presentation that summarizes how COVID-19 should affect the U.S. ICT market in 2020. It’s an interesting read, and the document notes that while consumer spending has been decimated in several sectors, it isn’t true across the board. ICT spending by U.S. businesses may fall by as much as ~3% this year after generally rapid growth in recent years; smartphones appear to be one of the bigger tech categories on the chopping block while the arrow for security-related goods and services, for example, seems to be pointing up.

Home quarantine and stay at home orders by governments are a big piece of what’s been affecting ICT spending dynamics in recent months, even as the virus outbreak has led to painful contractions in consumer and business spending in many economies. One of the early, bigger impacts on gaming has been the decimation of physical trade shows. As I summarized in this Market Note last month, major 2020 events like the Game Developer’s conference, E3, Gamescom and the Tokyo Game Show have been cancelled or rescheduled as online only affairs. Game-focused retailers like GameStop and physical eSports competitions have been hammered too.

Gaming and COVID-19

The gaming market has generally seen usage spike since COVID-19’s arrival. More home quarantine and shelter in place orders means that hundreds of millions of people have fewer entertainment options, and gaming is one of the bright spots in an otherwise bleak social landscape. Let me break this down more by considering the three main tech branches I use to cover the market – TV-based, PC/Mac and mobile gaming – and serve up some associated morsels.

TV-Based Gaming

In TV-based gaming, the platform titans remain Sony, Nintendo and Microsoft. Everyone who likes game consoles is on pins and needles waiting for more details on the types of experiences Sony’s PlayStation 5 and Microsoft’s Xbox Series X will deliver when they debut this holiday season. Their manufacturing and game development supply chains have been disrupted somewhat by COVID-19, but all indications are these next-gen consoles will launch in 4Q 2020 (although supplies may be constrained). The success of Nintendo Switch has been well-documented. Nintendo’s 1Q 2020 results were incredibly strong compared to 1Q 2019’s results, and part of that delta is due to games like Animal Crossing: New Horizons having “a moment”…that’s lasted from late March to May…as home quarantine orders spiked. Switch has been sold out in many markets in recent months due to rising demand and supply chain dislocations in China traceable to the pandemic.

What’s been overlooked is Sony’s stronger than expected 1Q 2020. Its PlayStation business is in a transition year though, so it’s no surprise that 4Q 2019’s results were lower than 4Q 2018’s results (seasonality means the fourth calendar quarter is always the most important, as this filing makes clear). 2019’s 4Q revenue was down ~20% for PlayStation compared to the prior year, some ¥791 billion compared to ¥632 billion. 1Q 2020 was down 13% compared to 1Q 2019, however (¥498 billion versus ¥433 billion). That 7% difference may not sound like a lot, but it meant an additional ~$280 million for PlayStation! I think a big chunk of that was a COVID-19 effect.

PC Gaming

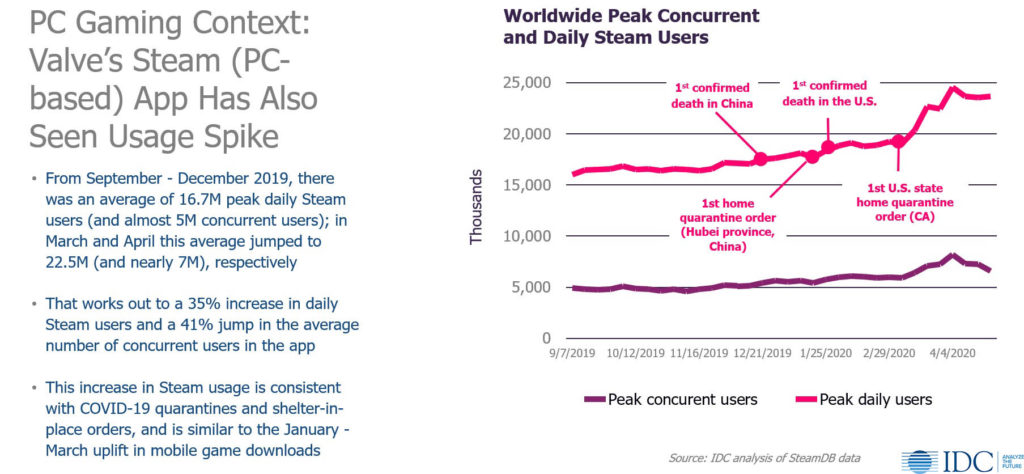

Turning to PC gaming, perhaps nothing illustrates the usage spike better than the Steam app. Steam is the leading global distributor of digital PC games as well as a community hub. As the figure below shows, there’s been a clear a rise in daily use since COVID-19, well, went viral. Steam’s daily users are up 35% in March and April versus the last four months of ’19. Mobile gaming-related apps like Twitch and Discord have seen download spikes as well.

Speaking of Twitch, I’m working on a separate study that will examine how Esports has been affected by COVID-19 and that will be out in June. The widely reported 1Q 2020 spike in hours viewed on Twitch (15-20% worldwide compared to 4Q 2019) was actually higher once you line up the quarantine and stay and home order implementation weeks via the languages Twitch viewers used (and that are generally associated with one country, such as German vs. Korean). It’s clear there was a jump in Twitch livestreamed hours created and unique livestreamers per week as well using this approach.

Mobile Gaming

Finally, there has been a rise in smartphone/tablet game downloads and hours played since COVID-19 hit. I’m working on a joint report with App Annie that will touch on this topic and that should be online shortly.

What Companies Should Takeaway from Gaming Responses to COVID-19

Okay, let me wrap this up with some actionable takeaways:

- Businesses processes need to be virtualized to the extent possible until further notice. If your processes require more than a handful of people to work in close proximity for an extended period, it’s risky and could run afoul of workplace/industry/government guidelines.

- Digital marketing is more important than ever. Some parts of the ad market have seen big pullbacks, but bright spots exist. I’ve seen the rise of “media influencers” and “content creators” on Twitch, YouTube, Facebook and Mixer in recent years, and this channel will get more important – especially for advertisers targeting younger males.

- Move away from supply chain bottleneck countries/companies. The COVID-19 outbreak in several Chinese provinces has revealed bottlenecks that have precipitated big crises. My point isn’t to come down on China, but rather to point out that any time a crucial business process depends on one external party, then you’re vulnerable. Cultivate a more diverse supply chain if feasible.

- Working from home means more virtual collaboration apps/services (and more security). Why not make it sound and look better? Use 4K cameras, which are increasingly common on smartphones. Use headsets with high-quality mics. Good lighting matters too. There are ways of making remote workers feel more tied in with their colleagues. I recently spoke to the CEO of LA’s Bulldog DM, which produces pro-looking live virtual events for popular recording artists, and he’s got a “studio in a box” that more companies might consider.

If insights along these lines sound interesting, follow me on Twitter (@LewisAWard) and check out my Gaming CIS fact sheet. Take care – there’s light at the end of this tunnel yet!

The coronavirus (COVID-19) pandemic is impacting the global economy at nearly every level. Anticipate market challenges, keep business moving, and forsee what recovery could look like with IDC’s extensive COVID-19 research and advice.