COVID-19 continues to deeply affect the global economy and technology markets around the globe. According to the newest data from IDC’s COVID-19 Tech Index, businesses continue to indicate likely cuts to spending on traditional IT products and services in the near term with deep cuts projected by companies that have been directly impacted by the COVID-19 crisis and the resulting economic shutdown.

While some firms point towards increased spending on specific technologies, all indicators point towards a significant overall contraction in the next few months with the pace of recovery highly dependent on the pace and stability of measures to reopen economies around the world in Q3.

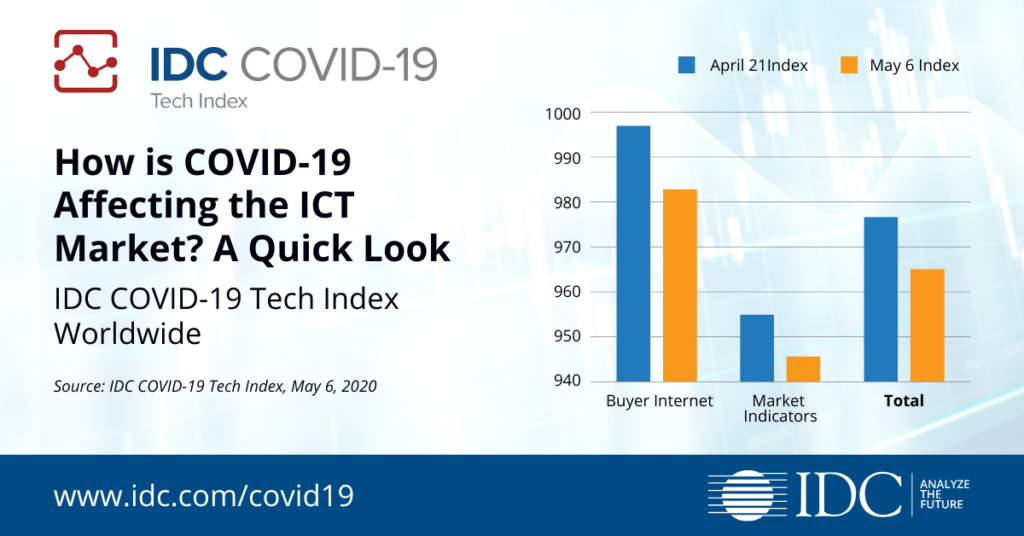

The COVID-19 Tech Index uses a scale of 1000 to provide a directional indicator of changes in the outlook for IT spending and is updated every two weeks. The index is based partly on a global survey of enterprise IT buyers and partly on a composite of market indicators, which are calibrated with country-level analyst inputs relating to medical infection rates, social distancing, travel restrictions, public life and government stimulus. A score above 1000 indicates that IT spending is expected to increase, while a score below 1000 points towards a likely decline.

The COVID-19 Tech Index: Worldwide View

Market indicators are still more negative than buyer intent surveys, with most economists now extremely pessimistic about the near term while restrictions remain in full force across many countries. Early measures to begin relaxing lockdown measures in some European countries will be watched closely by other countries including the US, and any sign of returning strain on health services could lead to a more prolonged period of social distancing.

In this uncertain environment, businesses will continue funding mission-critical IT deployments including cloud services and will seek to support remote workers, but some new projects will inevitably be deferred.

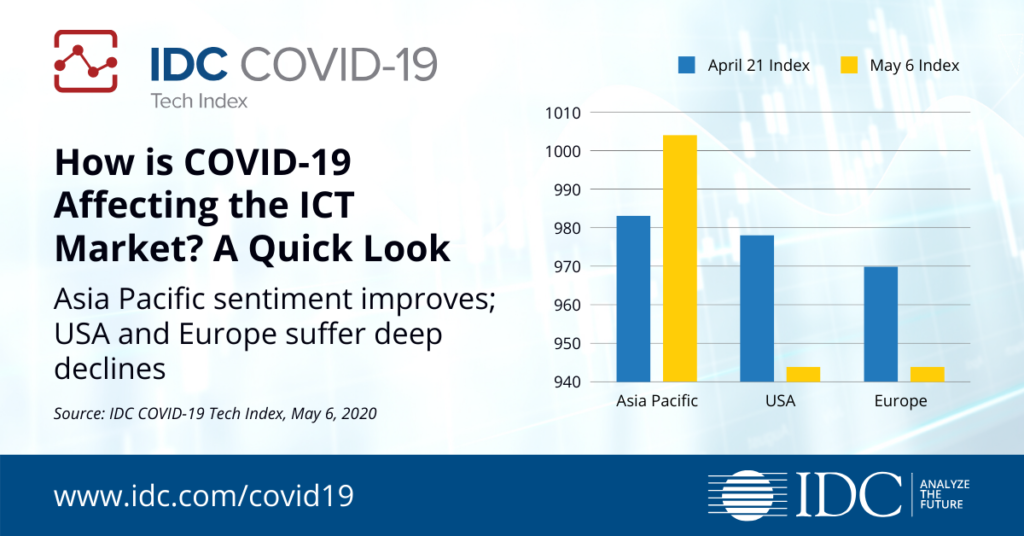

Regional Reactions to COVID-19 Vary

IT buyer confidence in Europe seemed to stabilize in the first half of April, but then dipped again towards the end of the month. This eb and flow in sentiment is likely to continue for a while as businesses react to uncertainty around the pace, effectiveness, and risks associated with scaling down the restrictive measures that have successfully slowed the spread of the virus but also have led to what most economists believe will be a huge GDP downturn in the current quarter.

However, businesses in Asia/Pacific showed some signs of improving confidence, which reflects a general sense of optimism that the worst may be over in a few countries, including China. The impact on IT spending will continue to be uncertain for some period, with many firms lacking the visibility to make major strategic decisions or commit to short-term spending increases.

3rd Platform Spending Drops

A month ago, overall spending projections by IT buyers were still positive in a few areas like artificial intelligence (AI) and other digital transformation projects. US companies were especially reluctant to impose delays on strategic IT projects and deployments, but the reality of a major economic contraction in Q2 appears to have caught up with CIOs and IT departments in the last few weeks.

The cloud isn’t going anywhere, all of the data stored in the cloud isn’t going anywhere, and the need for companies to analyze and extract value from all of that information isn’t any less today than it was three months ago. But decisions to fund new deployments will be hard to make for firms experiencing major declines in revenue and spending cycles will be longer while decision makers are spread around the world in remote locations. New tech products will come to market more slowly and upgrades to office networks or equipment are a low priority while offices remain closed. These headwinds will pass, but there are still milestones to clear before IT spending begins to grow again.

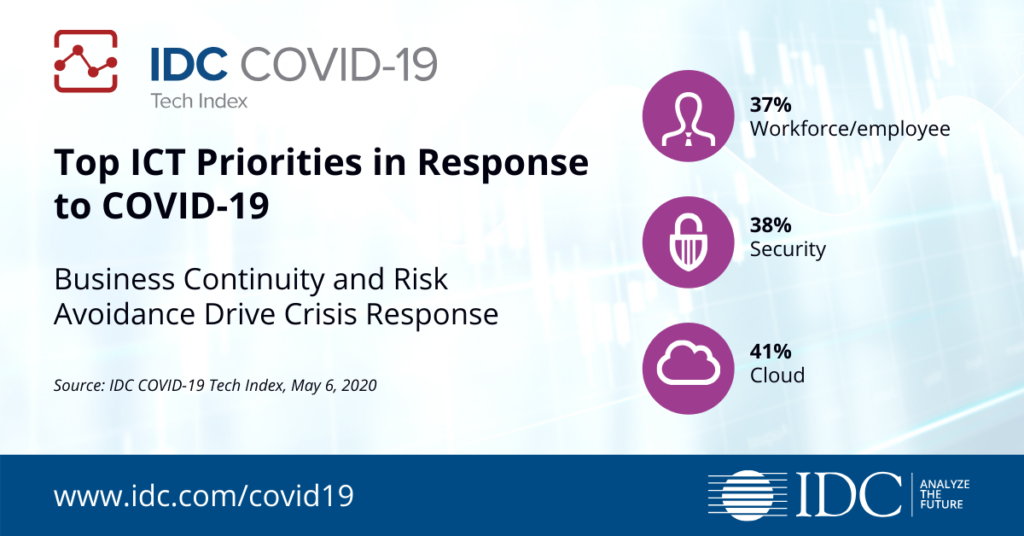

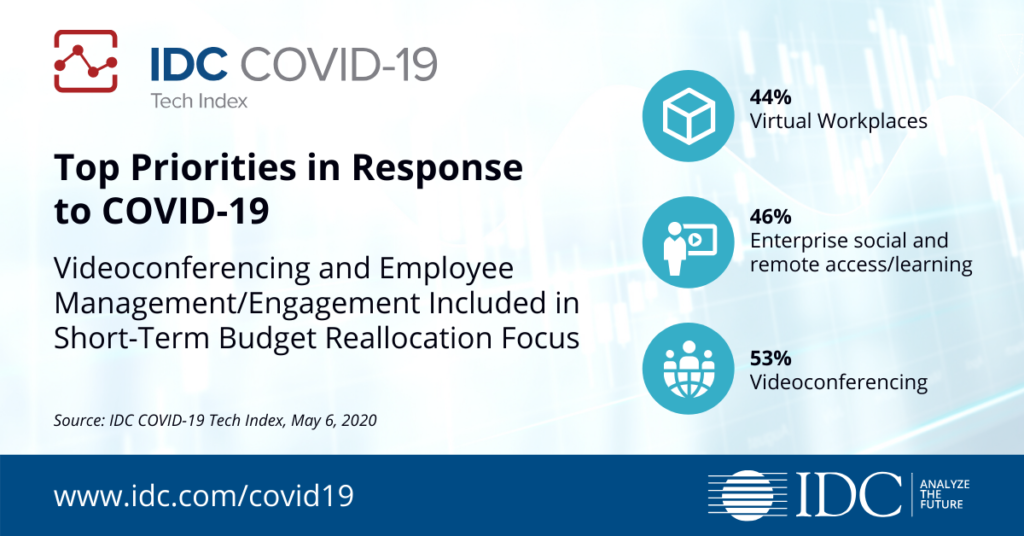

Crisis Response: Where IT Budgets Are Growing

Even with budget cuts, organizations still need to fund projects to keep their business as operational as possible during this uncertain time. Where demand is still increasing, it is increasingly focused on a narrow range of technologies that are critical to support remote workers, such as videoconferencing and remote access solutions.

Further explore the most recent index results, the outlook for technology spending by industry, and how the pandemic is impacting various organizations around the world; listen to our on-demand webinar, “COVID-19: Factoring in the Impact on Industry.”