Earlier this month, GM announced that it will be adopting Google’s Android Automotive operating system, which included Google’s voice assistance (Google Assistant), embedded navigation (Google Maps), and in-vehicle applications (via the Google Play Store), for all of its vehicle brands beginning in 2021. This landmark deal reinforces the importance of developing and delivering a differentiated in-vehicle experience, as well as demonstrates how large horizontal technology platforms and brands are targeting IoT and key verticals (like automotive) for growth.

It also provides insight into the challenges that automotive manufacturers and suppliers face in designing, deploying, and supporting in-vehicle experiences that meet or exceed the expectations vehicle owners have from their consumer devices.

Although this specific announcement was not expected, accelerated changes in vehicle technology adoption and consumer preferences have built a foundation for such an announcement.

Why In-Vehicle Experiences Matter

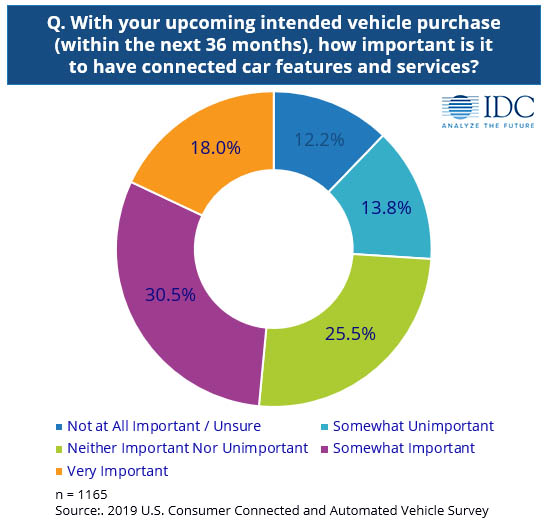

In particular, IDC’s research has shown that vehicle owners are increasingly choosing new vehicles based on the in-vehicle technology and experience. In fact, in IDC’s 2019 U.S. Consumer Connected and Automated Vehicle Survey, 48.5% of vehicle owners intending to purchase a vehicle within 36 months placed importance in connected vehicle features and services. And it is unlikely that this consumer-led push of wanting more and more technology in the vehicle will let up.

Figure 1. Understanding the Importance of Connected Vehicle Features and Services to a Future Vehicle Purchase

However, the need to deliver these increasing consumer technology demands has placed a considerable burden on automotive manufacturers and suppliers, who must juggle all development, manufacturing, sales, and lifecycle aspects of a vehicle, including that in-vehicle experience. But how should they position and consider the priority of these in-vehicle development efforts?

The in-vehicle experience should be a key area of competitive differentiation for all automotive brands. This experience is noticed, utilized, and critiqued every time a driver gets into their vehicle, often before they even leave the parking lot. In addition to helping a driver stay connected to their preferred apps, services, and ecosystem, it serves as the front-line to keep drivers calm, productive, and safe in a world with increasing traffic and commute times.

The in-vehicle experience also makes up a critical input for automakers looking to collect, analyze, and utilize vehicle data for both closed loop product and service innovation, as well as for potential future data monetization. Therefore, it goes without saying that automotive manufacturers and suppliers must make the hardware, software, and integration of their in-vehicle experience a continued area of investment and focus.

Delivering Superior In-Vehicle Experiences is Tougher Than it Looks

Advising manufacturers and suppliers to focus on the in-vehicle experience seems straightforward, but unfortunately hasn’t been as simple to execute. Part of the challenge has been that automotive and manufacturers have not fully adapted to this software driven, consumer-led world. In this way, they have not been able to keep up with the expectations for frequent updates and iterations to be deployed after launch, whether it be to unlock a new feature or support a new 3rd party service or merely to quickly address a known software bug/issue.

Another key challenge includes an inconsistent track record deploying user-interfaces and new technologies. Consumers want interfaces that are intuitive and encourage discovery and adoption. Unfortunately, many early and current versions of these in-vehicle systems leave much to be desired in this area. Further, drivers increasingly complain about the disparity between the look and feel of their smart devices (i.e., tablets and smartphones) and the ones found within the vehicle. This has become a point of frustration, as consumers are unable to understand why there is this drastic difference.

A third challenge is that the support for smartphone projection technologies like Apple CarPlay and Android Auto cedes a manufacturer’s sole control of the in-vehicle experience. These projection systems provided vehicle owners with a low friction way to select a projected smartphone’s user interface, smart assistant, mapping services, and a growing ecosystem of applications over the native experience designed and developed by the manufacturer. And, what began as a means of competitive differentiation by early adopting manufacturers and suppliers five years ago, has since grown into near ubiquitous, commoditized adoption.

Further, vehicle owners have begun to heavily rely on these projection technologies and see them as the bar by which they evaluate native, in-vehicle experiences. This increased adoption has been great for consumers who can now rely on consistent interfaces and experiences across their vehicle and other technologies, but bad for manufacturers and suppliers who must find a way to evolve their in-vehicle experiences to compete with a much-higher bar.

GM Prioritizes In-Vehicle Experience

GM has responded to these challenges and increasing consumer demands by listening to their customer’s feedback. In this way, GM’s in-vehicle experience will leverage the Google ecosystem and brand to harness its innovation and expertise in the latest, near-term battle for competitive differentiation. This decision was definitely not made lightly by GM and is part of a long list of in-vehicle technology procurement and integration decisions the automaker has made as it executes on its evolving strategy.

And this is likely just one of many such decisions that will be made over the course of the next few years by automotive manufacturers and supplier. As these companies look to experiment with different approaches to achieve a desired balance for features, functionality, cost, brand, and control, they must also ensure that they fully understand the impacts of any future partnerships and supplier agreements.

This includes not only executive level buy-in to ensure alignment with strategic priorities, but also careful examination of how these decisions could change in terms of short- and long-term differentiation. A few Google-based cars, like a few Android Auto supported cars, does indeed provide competitive differentiation, but at what level of adoption does the differentiation fade and commoditization rise?

What other elements are vehicle users looking for? Find out in our webcast on Vehicle Ownership, Usage, and Buying preferences from our consumer survey: