For the second year, IDC surveyed more than 2,000 U.S. vehicle owners to learn more about how they prefer to buy, use, and pay for connected, automated, and next-generation vehicle technologies. IDC utilizes these surveys to help reinforce and realign the priorities of IDC’s Next-Generation Automotive Strategies’ research practice, as well as to assist automotive and technology suppliers, buyers, and manufacturers understand technology adoption and areas of focus.

Strategic and Rapid Innovation is Critical for Customer Delight

The 2019 survey continues to reaffirm the importance of connected technology and experiences within the vehicle. Consumers are demanding more consistent access to their ecosystems, applications, and connected services within the vehicle. This continued “push” of new requirements like Apple Car Play and Google’s Android Auto into an in-vehicle infotainment system, as well as demands from vehicle owners for real-time services, are forcing automotive suppliers and manufacturers to evaluate how to innovate and adapt to bring the vehicle, front and center, into an always connected world.

This evaluation of improvements may include revisiting a vehicle’s software development to shift from rigid, hard requirements designed and validated well before a vehicle’s release to a flexible, lifecycle management approach of frequent updates and changes post-sale, including the use of an over-the-air (OTA) updating schema. Or this evaluation could include the adoption and use of non-automotive developed, horizontal technologies, including cloud computing and open source software and operating systems to help deliver increased functionality. Regardless, manufacturers and their suppliers need to align at a strategic level on ways that they will independently and cooperatively choose to innovate including balancing key attributes like speed, flexibility, cost, control, complexity, and openness.

Vehicle Owners are Considering Purchasing Electric Vehicles but Reservations Remain

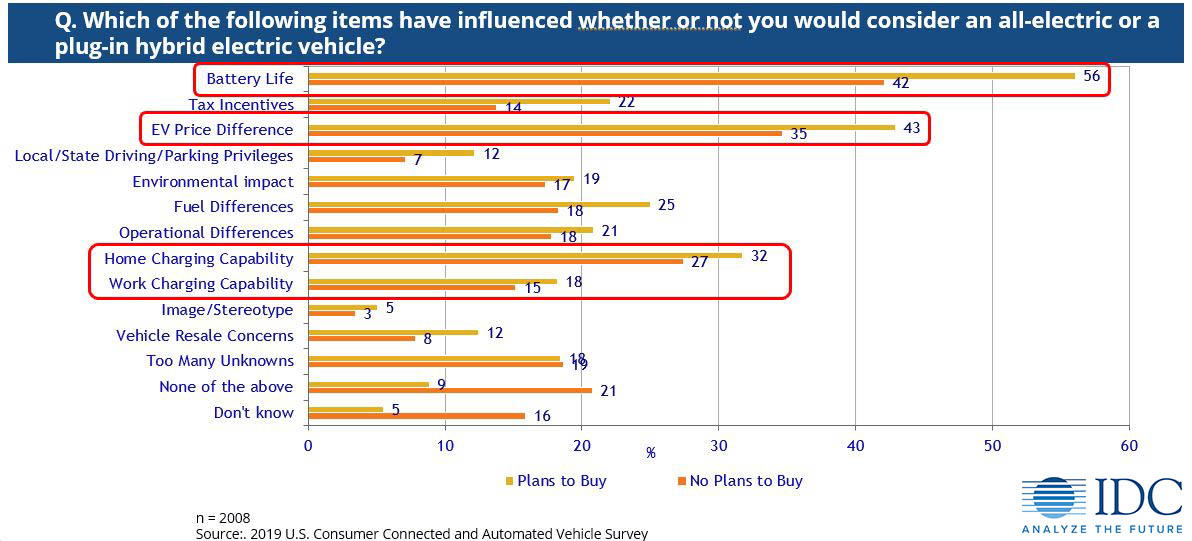

In addition to highlighting the need for automotive innovation, IDC also investigated what influences U.S. vehicle owners’ to consider an all-electric or plug-in hybrid electric vehicle as their next vehicle. The responses, which are broken out based on whether a respondent indicated that they were planning a vehicle purchase within 36 months or not in the IDC survey, are shown in Figure 1.

Figure 1. U.S. Vehicle Owners Influences That Impact All-Electric or Plug-In Hybrid Electric Vehicle Consideration

These results show that there are many different types of influences that U.S. vehicle owners are factoring in when deciding whether or not to consider an EV. The first, and most prominent consideration, is understanding if the vehicle’s battery life is sufficient for their lifestyle and requirements. Although not really a problem for plug-in hybrid electric vehicles (which have access to an internal combustion engine [ICE] in addition to an electric motor), consumers fear all-electric vehicles will not have enough range to support daily driving.

In turn, automotive suppliers and manufacturers have been focusing and investing in methods to increase the size and density of vehicle batteries, as well as techniques to increase the vehicle’s driving efficiency. It is now common, as a result, that new all-electric models are being brought to market to support +200 miles on a single charge. Unfortunately, this additional driving range (i.e., larger batteries) comes at an increased cost, and consumers cite the price differential with ICE vehicles as the second greatest influence.

As manufacturers and suppliers look to deploy their early generation EVs, there will be a cost premium versus ICE (even after applying federal and state tax and registration credits/discounts), but if the ecosystem ramps up efforts towards additional technology advancements, unit economics at scale, pollution and noise mitigation, and increased consumer education (e.g., on areas like reduced operational and maintenance expenditures), the path to cost parity isn’t entirely out of reach.

The third, largest grouping of influences related to EV considerations is how/where vehicle charging at home and work can be supported. This phenomenon of fueling at non-traditional locations is a new, foreign aspect of first-time EV ownership. As such, manufacturers and suppliers need to build an ecosystem of awareness and partnerships to reduce the level of effort to establish and guarantee charging, as well as ease the peace of mind of EV owners (which may be even more important than charging itself). Remember that for a vehicle buyer to consider an EV, they will first need to be comfortable with “charging” well before going to the dealership.

Vehicle Autonomy is Still Not Understood or Desired by Most Vehicle Owners

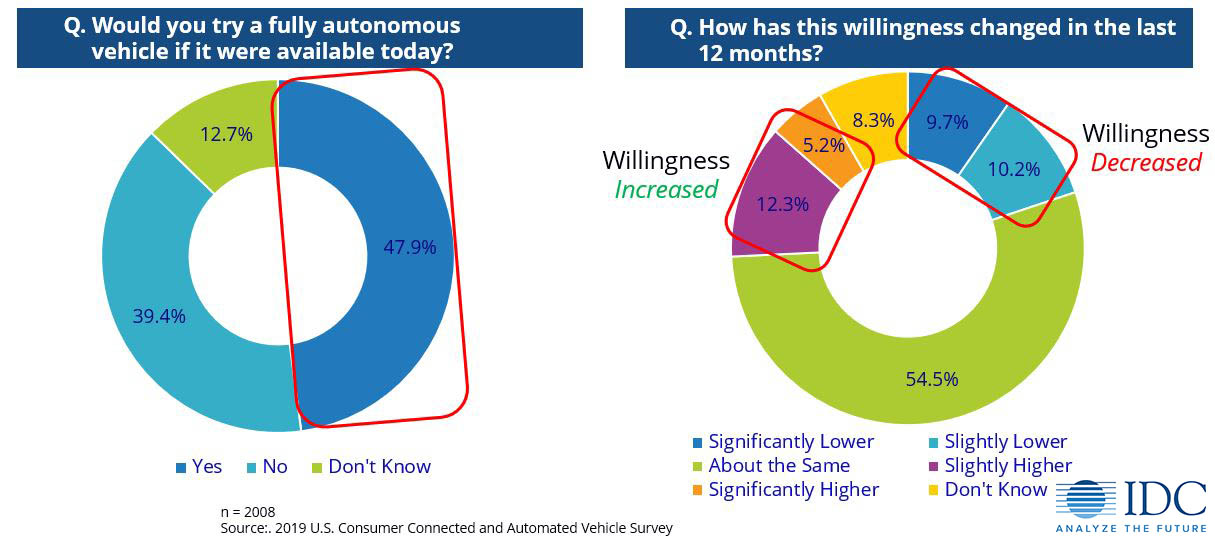

Vehicle autonomy is a topic that generates a lot of interest, but survey results show vehicle owners aren’t convinced in its readiness. In this case, IDC asked respondent’s two related questions. The primary question looked at understanding respondent willingness to try a fully autonomous vehicle. The second, follow-on question, asked about how a respondent’s willingness has changed (or not changed) over the last 12 months. The responses are shown in Figure 2.

Figure 2. Understanding the Willingness of U.S. Vehicle Owners to Try a Fully Autonomous Vehicle

IDC results show that only about half of respondent’s are willing to try a fully autonomous vehicle if available today. This number, which seems reasonable considering the enormity of the self-driving challenge, presents an opportunity for automotive manufacturers and suppliers. These ecosystem members must understand that to reach or approach universal acceptance they must be willing to put aside competition and work together to voluntarily build and reinforce how autonomous vehicles are designed, built, tested, and validated with safety at the core.

This lack of unity in message and approach seems to directly impact the results of the follow up question, focusing on how willingness has changed over the last 12 months. Overall respondents showed that they did not believe the ecosystem “moved the needle” on autonomous technology over the last 12 months even though considerable time, resources, and financial investments had been spent to advance. This doesn’t obviously align with the reality that manufacturers and suppliers have continued to demonstrate advancement in hardware, software, and services, but to vehicle owners, the customer for many of the early generation AV use cases, no significant progress was made.

The ecosystem needs to make a concerted effort to execute disciplined testing and validation while communicating about these efforts with one voice to increase consumer willingness. The industry will then be able to better maximize the potential safety, efficiency, social equity, and environmental benefits of autonomy.

IDC will be publishing three presentations based on this year’s survey findings to the Next-Generation Automotive Strategies research program by the end of July. These presentations have been grouped by topic and include: Part I: Vehicle Ownership, Usage, and Buying Preferences; Part II: Connected Vehicle Feature and Service Usage, Data Sharing, and Payments, and Part III: Mobility as a Service (MaaS), Public Transportation, and Autonomous Vehicles.

Learn more about what we uncovered in our vehicle owner survey; watch webcast on Vehicle Ownership, Usage, and Buying Preferences results: