While it would be an exaggeration to say that the last few years have been a golden age for technology companies, there’s no denying that things have been remarkably calm considering some of the seismic shifts taking place in the way that many organizations consume IT resources. That may be about to change, as a new market landscape begins to emerge at the same time as the global economy shows signs of losing steam. From the impact of a slowdown in China to the growing influence of service providers, here are 3 things you can expect to see in the IT market this year.

1. China slowdown could be a big deal

When Apple recently announced an unexpected shortfall in revenue versus prior guidance, most of the blame was pointed in the direction of slowing sales in China. In turn, it didn’t take long for investors to begin wondering if this was a leading indicator of broadening softness in a market which has become increasingly vital to tech vendors in recent years. The trade war between the US and China is expected to drag on growth in both countries if it continues through 2019, and there are signs that some pockets of the Chinese economy are turning volatile as firms adjust to this changed environment.

Our analysts in China believe the government will use stimulus measures and spending to protect the economy from worst-case scenarios, and in fact many economists think the likelihood of a deepening slowdown in the US is greater over the next 18 months. But it’s also clear that some IT firms will be impacted by the current storm, if it hasn’t happened already.

US vendors may be particularly at risk, if sentiment towards imports from the United States deteriorates (a previous dispute between China and Japan led to plunging sales for Japanese firms in China). China has been an engine of growth for many global technology titans in the past several years, offering up rapid returns which far outpaced their more mature domestic markets, but this in turn has left many of them dependent on China to maintain that pace.

If the trade war is resolved relatively soon, this could be nothing more than a blip. If not, it could have significant repercussions for any firm which has surged on the back of China’s expansion over the past decade. China now represents a much larger share of the global IT market than it did in the past, having doubled its share of worldwide IT spending from 6% in 2008 to almost 12% today.

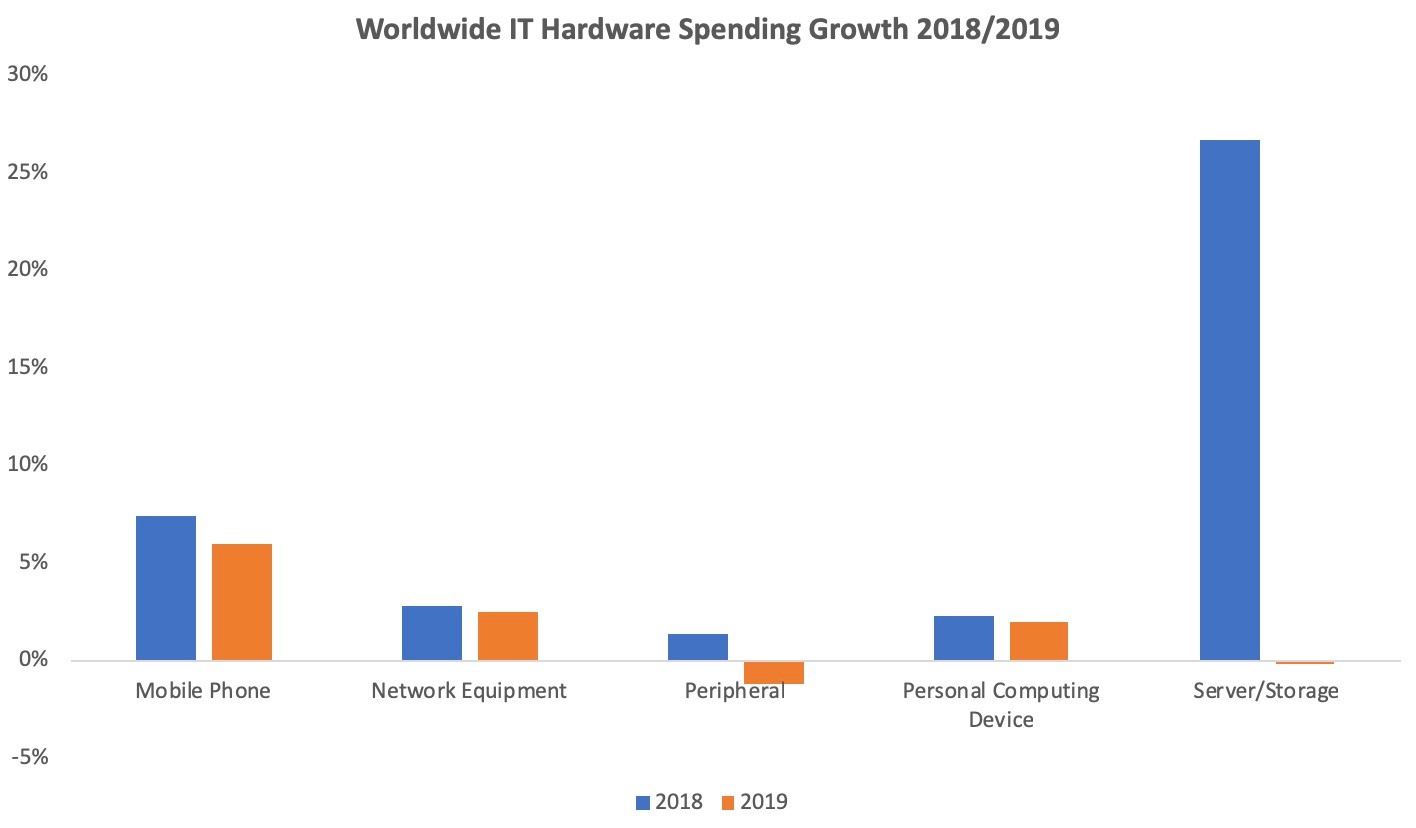

We currently expect worldwide IT spending growth to cool from 7% in 2018 to 5% in 2019, largely due to North America and Europe, and there are now additional signs of softness and inventory build-up in China in the categories where China contributes its largest share of global revenues (smartphones and PCs).

Keep an eye on these leading indicators during the first quarter, for signs that demand for key bellwethers is softening. It could be an early sign of a broadening slowdown which stands to have a significant impact on the global economy. Just as China represents a larger share of ICT spending than 10 years ago, so too does it represent a larger share of trade and GDP growth. If China continues to sneeze, it may not be long before more tech vendors are feeling under the weather.

2. Capital spending boom is coming to an end

The last two years saw hardware markets outperform all expectations, largely due to surging investments by hyperscale service providers in infrastructure capacity and a refresh cycle for traditional datacenters, along with a rebounding PC market and smartphone revenues which, for a while, appeared to defy gravity even as unit shipments declined for the first time.

It’s a fading memory, but ten years ago there was broad consensus across the tech industry that hardware had entered a period of terminal stagnation and decline while software and services represented the future of profitability, growth and expansion. While software has indeed continued to grow at roughly double the rate of overall IT spending and is central to long-term industry stability, it was services rather than hardware which underwent the most rapid process of commoditisation, resulting in a rate of growth which now tends to track or even lag GDP.

The emergence of the cloud and its impact on the traditional IT services business, was a major reason behind this, and it was also the cloud which has driven much of the recent boom in capital spending as service providers rushed to take advantage of surging demand by end-users for everything-as-a-service. Inevitably, there had to come a point where this investment started to cool as supply and demand enter a more normalised relationship, and all signs point towards that point arriving in 2019.

At the same time, an enterprise infrastructure refresh cycle is beginning to wind down, the recent (overdue) PC cycle has peaked, and smartphone vendors may find it more and more difficult to make up for flagging shipments by raising prices. Add all of this together, and we can expect a much slower year for devices and infrastructure spending growth in the next 12 months.

Overall hardware growth will drop from 8% in 2018 to less than 5% this year, mainly due to the slowdown in infrastructure (from 22% last year, to less than 7% in 2019). For context, however, that’s still more than double the rate of IT services growth expected this year (+3%).

3. Service provider power and influence continues to grow

One consequence of the boom in cloud expansion of recent years has been the growing power of service providers when it comes to their dominance of the IT market from a buyer perspective. Cloud IT infrastructure revenues surpassed traditional infrastructure for the first time in the third quarter of 2018, having doubled over the past two years, driven largely by public cloud deployments. Although this pace will inevitably slow in 2019, as supply chains normalise, the long-term shift to cloud deployments will continue and service providers will continue to grow as a share of hardware buyers.

The influence of service providers is not restricted to servers and storage, as the rapid growth and expansion of these companies will see them account for a growing share of other IT market categories from software to telecom services. In addition to cloud service providers, new digital service providers are beginning to emerge, and their expansion will represent both a challenge and an opportunity for vendors of traditional IT products and services.

There is some stability entailed in the service provider model, in that a slowdown in the global economy should in theory have less impact on IT spending than in the past (when end-users tended to slash hardware and software budgets at the first sign of weakness in the bottom line). In this new everything-as-a-service marketplace, many end-users will be able to scale their need for resources up and down in a less volatile manner as we navigate the next economic cycle.

On the other hand, there is also some risk, and new challenges, which come with dependence on a smaller number of customers for traditional IT products, placing more power in the hands of IT buyers to negotiate lower prices while demanding ever-increasing agility and scalability. During this time of tariffs and general supply chain volatility, it may be more difficult than in the past for vendors to pass increased costs on to their customers.

There is some long-term inevitability about this, in the same way that firms in many industries sell to a limited number of service providers. The airline industry is an imperfect example, where the market for jumbo jets is dominated by a relatively small number of buyers. On the other hand, at least the likes of Boeing can be sure that service providers will need to purchase airlines on a rolling basis, whereas there is less certainty attached to some IT market categories.

For many IT service providers, designing and developing their own internal solutions is a strategic goal in order to reduce their dependence on external suppliers. Amazon, for example, has a stated ambition to develop in-house own software for managing much of its business, and has even jumped into the game of shipping AWS hardware directly to buyers of on-premise infrastructure as it attempts to remove the last mile between some IT buyers and the cloud.

Where all this disruption ends, it’s not yet clear, but 2019 already promises to see IT vendors grappling with the growing power of cloud, digital and managed service providers as IT buyers, forcing them to shift their own strategic focus into understanding how to better serve this emerging vertical market. While some may be publicly dismissive of the threat that service providers pose to their traditional core business in the short term, this disruption represents another major transformation in the evolution of the IT market.

Learn more about IDC’s coverage of the IT Market and the growth of service provider influence through our Service Provider Black Book.